Picture supply: Getty Photographs

I’ve toyed with the concept of including Fundsmith Fairness to my Shares or Shares ISA or Self-Invested Private Pension (SIPP) for a number of years now. However I’ve by no means invested within the fund.

Ought to I put that proper in 2025? Let’s have a look.

Preserving it easy

At simply over £23bn, Fundsmith’s the most important of its sort within the UK. It goals to ship long-term progress by investing in giant, high-quality firms from around the globe.

Key traits it seems for embody predictable earnings, enduring aggressive benefits, excessive returns on capital, and low debt.

I’ve all the time admired supervisor Terry Smith’s easy funding philosophy, primarily based on three rules:

- Purchase good firms

- Don’t overpay

- Do nothing

Listed here are the highest 10 holdings, as of 29 November.

| High 10 Holdings |

|---|

| Meta Platforms |

| Microsoft |

| Novo Nordisk |

| Stryker |

| Philip Morris |

| Automated Information Processing |

| Visa |

| L’Oréal |

| Waters |

| Marriott |

A handful of high quality firms

The portfolio’s concentrated with simply 26 shares. Personally, I like Smith’s high-conviction technique, as he stands out in a crowd of fund managers hedging their bets with a whole bunch of shares.

But it surely does add threat, significantly if the highest holdings don’t carry out. Or the supervisor fails to spend money on the shares or sectors that drive market returns. Sadly, this has occurred lately.

Underperformance

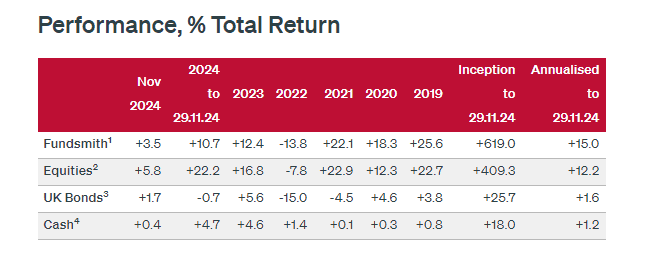

Fundsmith hasn’t crushed the market since 2020, when it returned 18.3% versus 12.3% for the MSCI World index. From the beginning of this yr to November, the return was 10.7%, properly beneath the index’s 22.2%.

As we will see, the long-term outperformance continues to be intact. However the latest poor run’s very disappointing, particularly when the fund has ongoing costs of 0.94% on the large funding platforms.

The primary challenge has been an underweight allocation to among the massive names main the synthetic intelligence (AI) rally. It hasn’t owned AI darling Nvidia, whose shares are up 2,297% in 5 years, or Tesla (up 75% in 2024).

Mistimed Amazon commerce

In 2023, the fund additionally bought Amazon (NASDAQ: AMZN), simply 19 months after investing. That was a mistake, with Amazon shares almost doubling since.

Smith noticed Amazon’s investments within the grocery area as a possible misallocation of capital. He mentioned it had already “stubbed its toe in this sector with the Whole Foods acquisition” a number of years beforehand.

To be truthful, he has a degree. Amazon does take dangers investing in several areas, together with self-driving vehicles and AI tasks. None of those are assured to repay and will weigh on future earnings.

This is the reason I used to be stunned when Smith invested in Amazon (it has unpredictable earnings from one yr to the following). And whereas I’ve by no means owned Amazon inventory, it looks like one the place you “do nothing” after investing, letting tendencies like e-commerce, digital promoting, and cloud computing play out long run. So I used to be a bit confused by the entire thing.

My resolution

Has Smith misplaced the Midas contact? My hunch is that is only a tough patch, although admittedly an prolonged four-year one. I’d desire to have extra confidence earlier than I make investments.

The fund now has simply 12.6% within the Info Know-how sector. If the AI growth continues, that would show pricey. Or maybe considered one of Smith’s most interesting calls.

I’ll have an interest to know which, however not as a Fundsmith investor, as issues stand.