The business was just lately rocked by the catastrophic collapse of $OM, the native token of the Mantra venture, on April 14. In hours, $OM plummeted by over 90%, wiping out billions in market worth and leaving traders reeling.

What started as a promising real-world asset (RWA) tokenization venture rapidly became a cautionary story of market manipulation, questionable practices, and shattered belief. This text delves into the $OM crash, its underlying pink flags, and the broader implications for the crypto house.

Mantra Dump – A Single Candle Wipes Out $6 Billion In a single day

About Mantra

Mantra is a Layer 1 blockchain centered on tokenizing real-world belongings (RWAs) with a security-first strategy, constructed on the Cosmos SDK for institutional use. Its $OM token, launched in 2020, drives governance, staking, and transactions. Centralized exchanges like Gate.io, OKX, and Binance listed $OM, enhancing liquidity via pairs like OM/USDT. The token soared to an all-time excessive of $6.30 in early 2025, skyrocketing 500x from its low, fueled by market hype and FOMO, although later investigations tied its rise to speculative manipulation.

Historic Collapse

On April 14, the $OM token skilled probably the most dramatic crashes in latest crypto historical past, plummeting over 90% in a single day. The token, which had been buying and selling at round $6.30 only a day earlier, collapsed to a low of $0.40, decreasing its market capitalization from almost $6 billion to a mere $683 million. This sudden drop triggered over $74.7 million in liquidations, with some particular person positions dropping greater than $1 million every.

Supply: Coinmarketcap

The crash was so extreme that it erased years of positive aspects for $OM holders, a lot of whom had been drawn in by the token’s meteoric rise of over 500x from its all-time low. Many traders suspected that this was a rug pull and manipulation from Mantra’s staff, which equally occurred within the LUNA case earlier than.

The same case of LUNA’s crash – Supply: TradingView

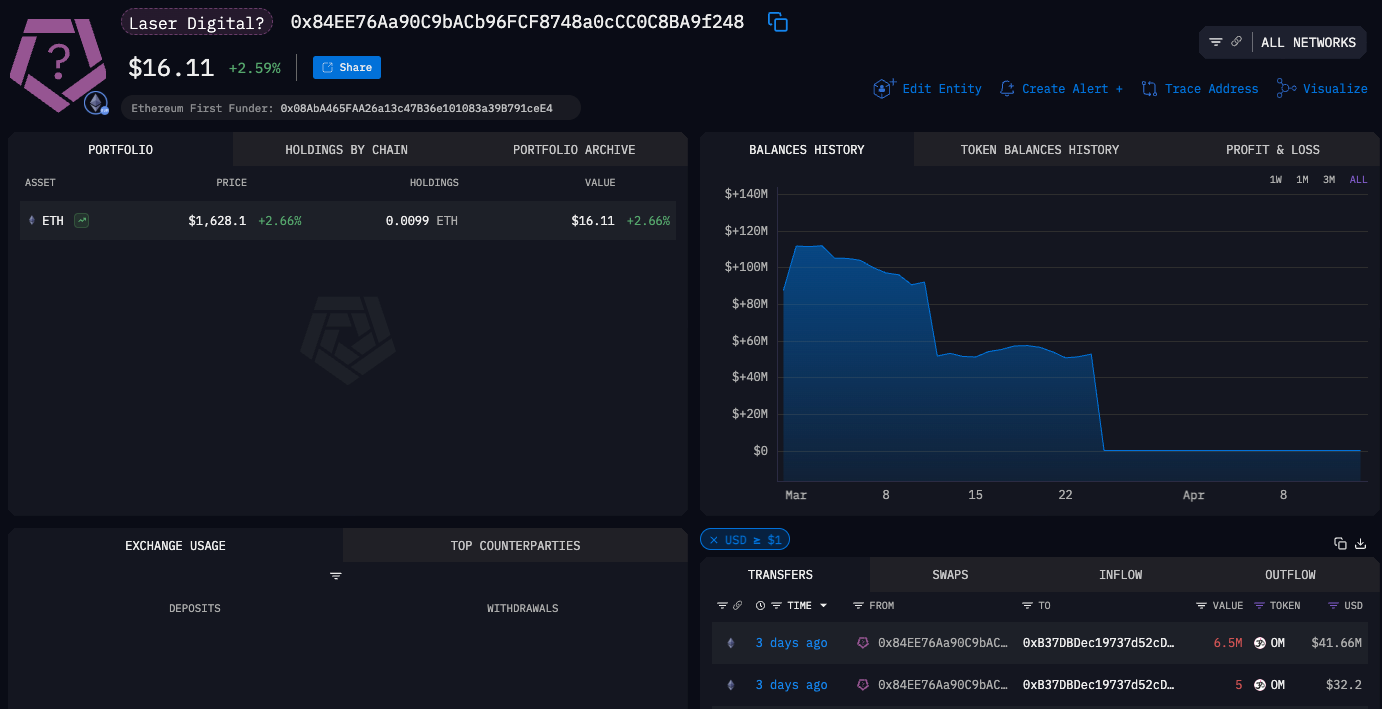

Moreover, the group uncovered a notable connection between the $OM token crash and Laser Digital, which made a strategic funding in Mantra in Could 2024. Two of the 17 wallets linked to the incident have been allegedly tied to Laser Digital. Nonetheless, the group rapidly denied any involvement, refuting claims of interference within the matter.

2-linked pockets deal with from Laser Digital – Supply: Arkham Intelligence

Whispers of a Surprising Rug Pull Scheme

John Patrick Mullin, the co-founder of Mantra, instantly refuted any allegations of inside manipulation or rug pull. He attributed the collapse to “reckless forced closures initiated by centralized exchanges on OM account holders,” claiming that these actions occurred with out enough warning or margin calls. The Mantra staff insisted that their token allocations remained locked and verifiable on-chain, they usually have been actively investigating the incident to uncover the true reason behind the crash.

Sherpas, OMies, and broader crypto group,

First off, the staff and I enormously admire the help that we have now obtained over the previous a number of hours, which we consider is a testomony to the robust help MANTRA has amongst its traders and group.

We have now decided that…

— JP Mullin (🕉, 🏘️) (@jp_mullin888) April 13, 2025

Nonetheless, crypto investigator ZachXBT raised critical doubts in regards to the official narrative. He pointed to 2 people allegedly tied to the Mantra incident: Denko Mancheski, the founding father of Reef Finance, and a person named Fukugo Ryoshu. In line with him, these people had been reaching out to a number of events within the days main up to the crash, searching for huge loans in opposition to their $OM holdings. This revelation fueled hypothesis of coordinated market manipulation, particularly given Reef Finance’s personal historical past of comparable incidents, together with a Binance delisting in October 2024 and an $80 million OTC take care of Alameda in 2021.

Learn extra: Mantra Disastrous Meltdown: $5.5 Billion Vanishes In a single day in Collapse Echoing Luna Catastrophe

The impression on the group and traders was devastating. Many customers lamented the lack of $15 million and declared the business a “scam.” Others accused the Mantra and Binance groups of orchestrating a liquidity exit. The crash obliterated monetary portfolios and eroded belief within the RWA tokenization sector, elevating broader questions on market stability and the integrity of centralized exchanges.

Pink Flag Surrounding the Mantra Undertaking and $OM Token

Whereas some might have perceived the $OM crash as sudden, a better examination of the Mantra venture reveals a sequence of warning indicators that had been constructing for a while. These warning indicators paint a troubling image of a venture that will have been constructed on shaky foundations.

Suspected Group and Mantra Undertaking Itself

First, market analysts found that the Mantra staff managed an alarming 90% of the token’s circulating provide. This excessive focus of possession gave the staff vital management over the token’s price and liquidity, making it extremely inclined to manipulation. Within the crypto house, such a construction usually raises considerations because it allows insiders to orchestrate pumps and dumps, which may negatively impression retail traders.

The staff behind Mantra DAO additionally has a controversial historical past. Reviews have surfaced that some staff members participated in fraudulent Preliminary Coin Choices (ICOs) through the 2017 crypto growth, whereas others have been linked to working a on line casino—a element that raised eyebrows locally. Moreover, Mantra DAO has confronted authorized scrutiny prior to now for failing to supply clear monetary stories, additional eroding belief in its operations.

One other level of concern was Mantra’s dealing with of a deliberate airdrop. The venture had introduced a 50 million $OM airdrop as a part of its Gendrop program, however simply earlier than the distribution, the staff banned 50% of individuals, claiming they have been bots—with out offering a transparent rationalization. The staff subsequently delayed the airdrop, leaving many customers annoyed and suspicious of the staff’s intentions. Compounding this, Mantra quietly altered its tokenomics with out correct communication, a transfer that additional fueled mistrust.

Massively Over-valued and Overhyped $OM Token

Rumors additionally circulated that the venture had bought giant OTC offers to traders at costs 50% under the market fee, a observe that would have allowed insiders to dump tokens whereas artificially inflating the token’s price. This ties into one other obtrusive challenge: the disconnect between $OM’s valuation and its fundamentals.

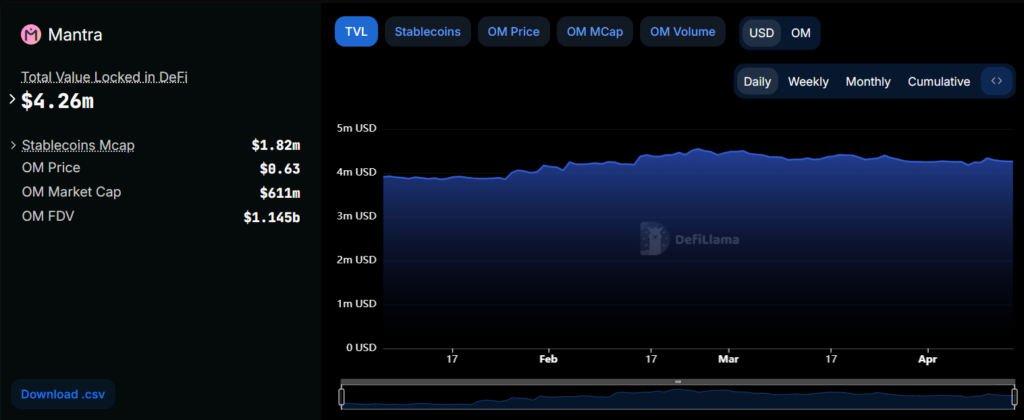

Previous to the crash, $OM had a completely diluted valuation (FDV) of roughly $10 billion, but its complete worth locked (TVL) was a mere $4 million. This stark disparity reveals that market manipulation, FOMO, and speculative narratives massively overhyped the token, slightly than real demand driving its worth. The price, which had surged over 500x from its all-time low, was fragile and susceptible to collapse because of the lack of actual shopping for strain.

Supply: DefilLama

When the crash lastly occurred, $OM’s valuation plummeted by almost $6 billion, however the TVL solely declined by simply over $1 million. This statement raises a essential query: did the TVL in Mantra’s ecosystem genuinely replicate person exercise, or did the venture artificially inflate it? The suspiciously small TVL decline in comparison with the large valuation loss signifies that the staff might have manipulated the ecosystem’s exercise to falsely counsel adoption and worth.

The involvement of figures like Denko Mancheski, who has a historical past of market manipulation with Reef Finance, solely provides to the suspicion. Reef itself skilled an analogous pump-and-dump cycle, surging 650% earlier than crashing 64% after a Binance delisting in 2024. The parallels between Reef and Mantra, coupled with ZachXBT’s findings, counsel that $OM’s rise and fall might have been orchestrated by skilled manipulators who exploited retail traders’ belief and FOMO.

Conclusion

The $OM token crash highlights the dangers in crypto, particularly in hyped tasks missing transparency. Regardless of Mantra’s denials, pink flags like concentrated token possession, a shady staff historical past, and suspicious offers solid doubt. This saga stresses the necessity for investor diligence in a hype-driven market and requires higher regulation and safeguards because the business matures.