Defining Yield in Yield Farming: Mounted vs. Variable

Incomes yield in DeFi includes leveraging decentralized protocols to generate returns on cryptocurrency holdings, sometimes within the type of further cryptocurrency. This apply is broadly categorized underneath phrases like yield farming or liquidity mining, the place members lend or stake their digital property inside DeFi protocols to earn curiosity, tokens, or different incentives.

For extra: A Complete Evaluation of Yield and Cost Stablecoins

Variable Yield in Yield Farming

Variable yield is characterised by its fluctuating nature. Returns are dynamic, altering primarily based on prevailing market situations, the provision and demand for liquidity inside a protocol, and its utilization charges.

Widespread methods for incomes variable yield embrace staking property in a proof-of-stake (PoS) consensus mechanism, using liquid staking tokens (equivalent to Lido’s wstETH or Rocket Pool’s rETH, typically accessed by way of merchandise like Index Coop’s dsETH), collaborating in lending protocols, or offering liquidity to Automated Market Makers (AMMs) like Uniswap or Curve.

Whereas variable yield typically presents the potential for increased returns, it necessitates steady monitoring of charges and energetic adjustment of methods to capitalize on shifting alternatives.

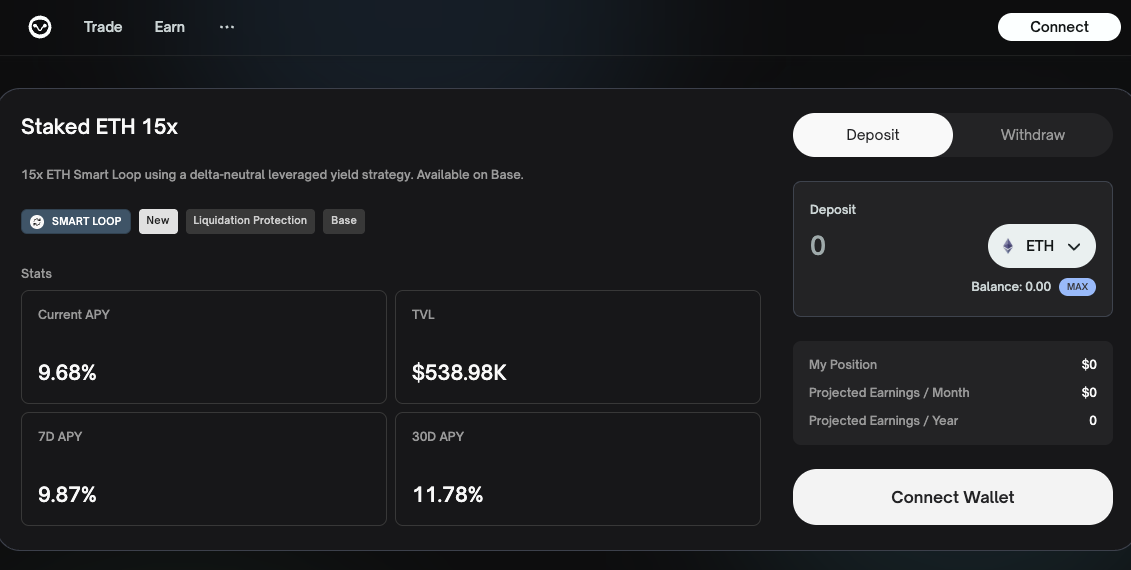

Supply: Index Coop ETH

Mounted Yield in Yield Farming

Mounted yield methods in DeFi provide predictable returns, sustaining a relentless rate of interest all through a specified interval. This predictability considerably advantages monetary planning, accounting, and tax functions, permitting exact revenue assessments. These merchandise typically present “true passive income,” requiring no energetic administration as soon as allotted.

An important distinction exists between Annual Share Price (APR) and Annual Share Yield (APY). APR calculates curiosity solely on the principal, whereas APY accounts for compounding curiosity, usually making it increased. Understanding this distinction is important for correct return analysis.

Mounted yield’s predictability and passive nature characterize a strategic DeFi growth. It attracts a broader spectrum of buyers, significantly risk-averse people and establishments, by lowering cognitive burden and direct market danger publicity. This boosts Complete Worth Locked (TVL) and enhances DeFi’s legitimacy.

Nevertheless, some think about this an “illusion of fixed” inside DeFi’s unstable ecosystem. Whereas the rate of interest itself is mounted, the underlying atmosphere stays inclined to vital dangers, together with good contract vulnerabilities, impermanent loss, and broader market volatility.

The “fixed” yield is contingent on the soundness of good contracts, pool liquidity, and basic market situations, all dynamic. Thus, the mounted price applies to curiosity calculation however doesn’t assure the principal’s fiat worth or immunity from protocol-specific operational dangers. This highlights the essential want for sturdy danger disclosure and complete person schooling for mounted yield merchandise.

For extra: The Rise of Stablecoins: 2025 Market Replace and Key Statistics

| Attribute | Mounted Yield | Variable Yield |

| Predictability | Excessive (price stays fixed) | Low (price fluctuates primarily based on market) |

| Energetic Administration | Low (true passive revenue) | Excessive (requires fixed monitoring and adjustment) |

| Danger Profile | Decrease (however nonetheless topic to DeFi inherent dangers) | Greater (as a result of market dynamics and energetic methods) |

| Typical Return Vary | Average | Probably Excessive |

| Main Use Case | Lengthy-term progress, predictable revenue | Maximizing short-term returns, opportunistic |

| Examples of Methods/Protocols | Mounted-rate lending, Bond-like devices (e.g., Notional Finance, Yield Protocol) | Staking, Liquid Staking, Lending Swimming pools, Liquidity Offering (e.g., Aave, Compound, Uniswap) |

Desk 1: Mounted Yield vs. Variable Yield in DeFi

The Worth Proposition of Mounted Yield in a Unstable Market

Mounted yield in DeFi presents essential predictability and certainty in a unstable market. It gives steady rates of interest over outlined intervals, enabling clear monetary planning, particularly for accounting and tax functions, by making certain minimal revenue margins.

Moreover, mounted yield methods generate “true passive income.” As soon as invested, they require no ongoing administration, in contrast to variable yields demanding steady changes. This hands-off strategy extremely appeals to buyers in search of constant returns with out intensive time commitments.

Given their steady nature, mounted yield methods are conducive to long-term progress inside DeFi. They foster compounding returns, selling a extra sustainable funding strategy over speculative ventures.

Mounted yield attracts direct analogies to conventional fixed-income investments, valued for his or her common, non-varying returns. DeFi enhances this by providing accessible lending/borrowing with out intermediaries, democratizing yield era. Advantages for “accounting and tax purposes” and the comparability to “traditional fixed-income investments” strongly place mounted yield for institutional buyers and company treasuries.

These entities require predictable money flows and clear monetary reporting, which variable crypto yields can’t present. This makes mounted yield a essential enabler for integrating conventional finance capital into DeFi, transferring past speculative retail participation in the direction of structured, enterprise-grade monetary merchandise. This growth signifies a maturing DeFi market, cultivating a brand new class of buyers.

Mechanisms and Protocols Driving Mounted Yield in DeFi

This part explores the particular technical and operational mechanisms that facilitate mounted yield era throughout the DeFi panorama, highlighting key protocols and their revolutionary approaches.

Mounted-Price Lending Protocols

Mounted-rate lending protocols kind the bedrock of predictable yield in DeFi, permitting customers to lend crypto at a hard and fast price for a set time period. Debtors additionally profit from steady prices. These platforms sometimes use over-collateralization to safeguard lenders, with charges influenced by utilization and liquidity.

Notional Finance is a key instance, providing a fixed-rate cash market the place lender returns come immediately from borrower funds. This protocol permits customers to lend or borrow at mounted rates of interest for particular maturities (e.g., 3 months, 6 months, 1 yr).

An investor would possibly lend USDC for six months at a hard and fast 5% Annual Share Yield (APY) on Notional. No matter market fluctuations, they know precisely how a lot curiosity they’ll earn at maturity.

Notional Finance

Yield Protocol pioneered fixed-term lending/borrowing by way of fyTokens, performing like zero-coupon bonds. Whereas fyTokens provide mounted returns, Yield Protocol additionally engages in variable-yield actions (e.g., AMM liquidity swimming pools), that means impermanent loss can happen. Different protocols like 88mph provide direct fixed-rate lending, and main platforms like Aave and Compound would possibly combine such options.

The “fixed” yield itself is a structured monetary product. It both transfers rate of interest danger to debtors or embeds it in a tradable token. Nevertheless, a protocol promoting mounted yield would possibly nonetheless use underlying variable-yield methods to maintain its choices.

This significant complexity means the mounted price provided to the person doesn’t insulate your complete protocol from inherent variable yield dangers or assure the principal’s fiat worth. Subsequently, buyers should look past the marketed price and perceive the protocol’s full operational and danger administration mannequin.

| Protocol Title | Main Mounted Yield Mechanism | Key Options/Notes |

| Notional Finance | Mounted-rate cash market (lender-borrower matching) | Lenders lock yield for up to at least one yr; returns from fixed-rate debtors. |

| Yield Protocol | fyTokens (zero-coupon bond-like) | Pioneered fixed-rate/time period; fyTokens purchased at low cost, redeemed at face worth; fungible fyTokens. Could have underlying variable pool dangers. |

| 88mph | Mounted rate of interest lending | Explicitly presents mounted rates of interest on crypto property. |

| DELV | Buying property at low cost (e.g., Staked Ethereum) maturing to market charges | Explores tokenized Actual-World Belongings (RWAs); presents fixed-rate borrowing (DELV Mounted Borrow). |

Desk 2: Key Mounted-Price DeFi Protocols and Their Mechanisms

Structured Merchandise and Tokenized Debt Devices

Past direct fixed-rate lending, DeFi develops advanced tokenized debt and structured merchandise. Sensible contracts automate debt choices, making certain environment friendly issuance, buying and selling, and administration on DEXs, chopping prices and intermediaries.

Protocols like DELV lead this innovation. Its “Hyperdrive One” permits customers to purchase discounted property like stETH for a hard and fast yield, just like zero-coupon bonds. DELV additionally presents “Fixed Borrow” to cap variable mortgage prices. DeFi’s “money legos” design allows seamless integration of those modular merchandise.

Tokenization waves by asset capitalization.

A serious pattern is RWAs. Protocols are tokenizing tangible property like treasury payments and actual property. This bridges conventional finance with DeFi, bringing steady, much less unstable property on-chain.

Ondo Finance focuses on bringing Actual-World Belongings (RWAs) like US Treasury payments onto the blockchain as tokenized fixed-income merchandise. An institutional investor can subscribe to a fund on Ondo that holds short-term US Treasury payments. Their funding is represented by a token that earns a hard and fast yield (e.g., 4.09% APY) tied to the yield of the underlying Treasury.

This gives a clear, blockchain-based entry to a historically steady asset class, providing the predictability and danger profile that company treasuries and enormous monetary establishments demand for structured, enterprise-grade monetary merchandise throughout the DeFi ecosystem.

Yield from Ondo Finance

This strategic shift leverages blockchain’s effectivity for off-chain property. It considerably will increase DeFi’s TVL by attracting institutional capital, particularly these mandated to carry conventional fixed-income. This convergence blurs TradFi and DeFi traces, suggesting blockchain will underpin a broader monetary product spectrum, driving DeFi’s mainstream adoption and regulatory acceptance.

Core Mechanisms of Mounted Yield in DeFi

Sensible contracts kind the bedrock of all mounted yield mechanisms in DeFi. These self-executing agreements automate each side of yield farming, lending, and debt issuance. They exactly outline reward distribution, set up liquidity pool insurance policies, and guarantee transaction transparency and accuracy with out human intervention.

AMMs like Uniswap and Curve, are essential DeFi infrastructure elements. They facilitate decentralized buying and selling and liquidity provision, letting customers swap tokens by interacting immediately with liquidity swimming pools. Liquidity Suppliers (LPs) deposit token pairs into these swimming pools, incomes a share of buying and selling charges.

Upon offering liquidity, LPs obtain LP tokens, representing their proportional share of the pool. These essential tokens will be staked in different protocols for extra rewards, forming the idea of many advanced yield farming methods.

The rising complexity of DeFi methods has led to yield aggregators and vaults. Protocols equivalent to Yearn Finance optimize yields throughout varied DeFi protocols. These platforms automate funding methods, typically together with auto-compounding, to maximise person returns with minimal handbook effort. They function a simple entry level for DeFi, letting customers make investments with no need to grasp each portfolio part.

Benefits and Disadvantages of Mounted Yield in DeFi

Mounted yield choices in DeFi current a compelling proposition for buyers, but they’re accompanied by a definite set of dangers and challenges that necessitate cautious consideration.

Advantages for Buyers

Mounted yield appeals to buyers as a result of enhanced predictability and passive revenue. A steady rate of interest all through the funding’s time period is invaluable for monetary planning, budgeting, and tax concerns, providing clear anticipated returns regardless of market volatility.

Mounted yield merchandise sometimes demand minimal energetic administration. This “set-it-and-forget-it” function makes them a real supply of passive revenue, liberating buyers from the fixed monitoring wanted for variable yield methods.

In comparison with conventional finance, DeFi mounted yield can provide considerably increased returns. These alternatives additionally enable buyers to diversify portfolios throughout varied protocols and cryptocurrencies, serving to mitigate danger.

Leveraging blockchain and good contracts, DeFi mounted yield platforms provide unparalleled transparency. All transactions are publicly recorded, enabling impartial verification and auditing. Sensible contract automation reduces human error and fraud. Moreover, DeFi platforms are open and permissionless, fostering larger monetary inclusion by offering entry to anybody with an web connection and a digital pockets, no matter credit score historical past or location.

Inherent Dangers and Challenges

Regardless of the advantages, mounted yield in DeFi presents substantial dangers buyers should perceive.

Sensible contract vulnerabilities are a main concern; bugs or exploits can result in vital monetary losses. Whereas the yield price is mounted, many protocols depend on underlying liquidity swimming pools inclined to impermanent loss, the place asset price modifications can scale back the greenback worth of deposited funds. Liquidity danger means buyers would possibly wrestle to exit positions in much less liquid protocols or throughout market stress.

Oracle danger arises if manipulated or incorrect knowledge feeds set off defective contract execution, resulting in losses. Governance danger exists in some protocols the place concentrated energy amongst massive token holders can result in detrimental selections.

Even with a hard and fast rate of interest, market volatility of the underlying crypto property could cause an total loss in fiat phrases. Gasoline charges, particularly on busy networks, will be substantial, impacting income. Rug pulls and scams stay a risk within the nascent DeFi house, the place builders can withdraw all invested capital, leaving buyers with nugatory tokens.

Lastly, regulatory uncertainty varies throughout jurisdictions, posing challenges for DeFi initiatives and creating unpredictable authorized frameworks for buyers. DeFi additionally lacks standardized benchmarks and sturdy hedging devices widespread in conventional finance, making rate of interest danger administration tough in a predominantly floating-rate atmosphere.