NOIDA (CoinChapter.com) — Monero (XMR) price continued its sharp upward trajectory this week, extending its April positive factors amid a broader resurgence within the cryptocurrency market. As of April 28, 2025, XMR price spiked to $328, for the primary time since Aug. 2021.

The privacy-focused cryptocurrency decisively outperformed Bitcoin and Ethereum in April. Each posted extra average positive factors regardless of renewed danger urge for food throughout the digital asset sector.

Bitcoin reclaimed the $95,000 degree earlier this week following better-than-expected GDP development information within the U.S., which eased fears of a extreme slowdown. Ethereum additionally stabilized above $1,800 after a unstable begin to the month. Nonetheless, Monero’s price motion has been notable, with the token surging previous crucial multi-month resistance ranges whereas sustaining sturdy momentum.

Including complexity to the narrative, blockchain investigator ZachXBT flagged a suspicious $330 million Bitcoin switch earlier this week, involving 3,520 BTC reportedly laundered throughout a number of exchanges and swapped into Monero. Whereas the broader influence of this occasion stays beneath assessment, it could have contributed to the sudden demand spike for XMR throughout the identical interval, amplifying its price surge.

In the meantime, bettering macroeconomic situations and softening Treasury yields have fueled risk-on sentiment, benefiting different property corresponding to privateness cash. XMR, usually seen as a hedge in opposition to regulatory scrutiny, seems to have capitalized on these dynamics as technical alerts trace at a deeper bullish shift. A serious multi-year chart sample appears to have triggered, pointing to a possible bigger transfer forward.

Funding Developments and Technical Setup Assist Bullish Case

In line with information from CoinGlass, Monero’s open interest-weighted funding charge turned sharply destructive round mid-April. Merchants appeared to place aggressively for draw back, anticipating a price rejection close to earlier resistance ranges. Nonetheless, the destructive funding charge didn’t cease merchants from seemingly liquidating brief positions beneath stress. The transfer highlights a broader shift in market dynamics favoring consumers somewhat than leverage-driven hypothesis.

Concurrently, XMR futures open curiosity surged, reaching considered one of its highest factors since early 2025. Elevated open curiosity and impartial funding charges verify that spot-driven demand fuels the rally, not extreme leverage.

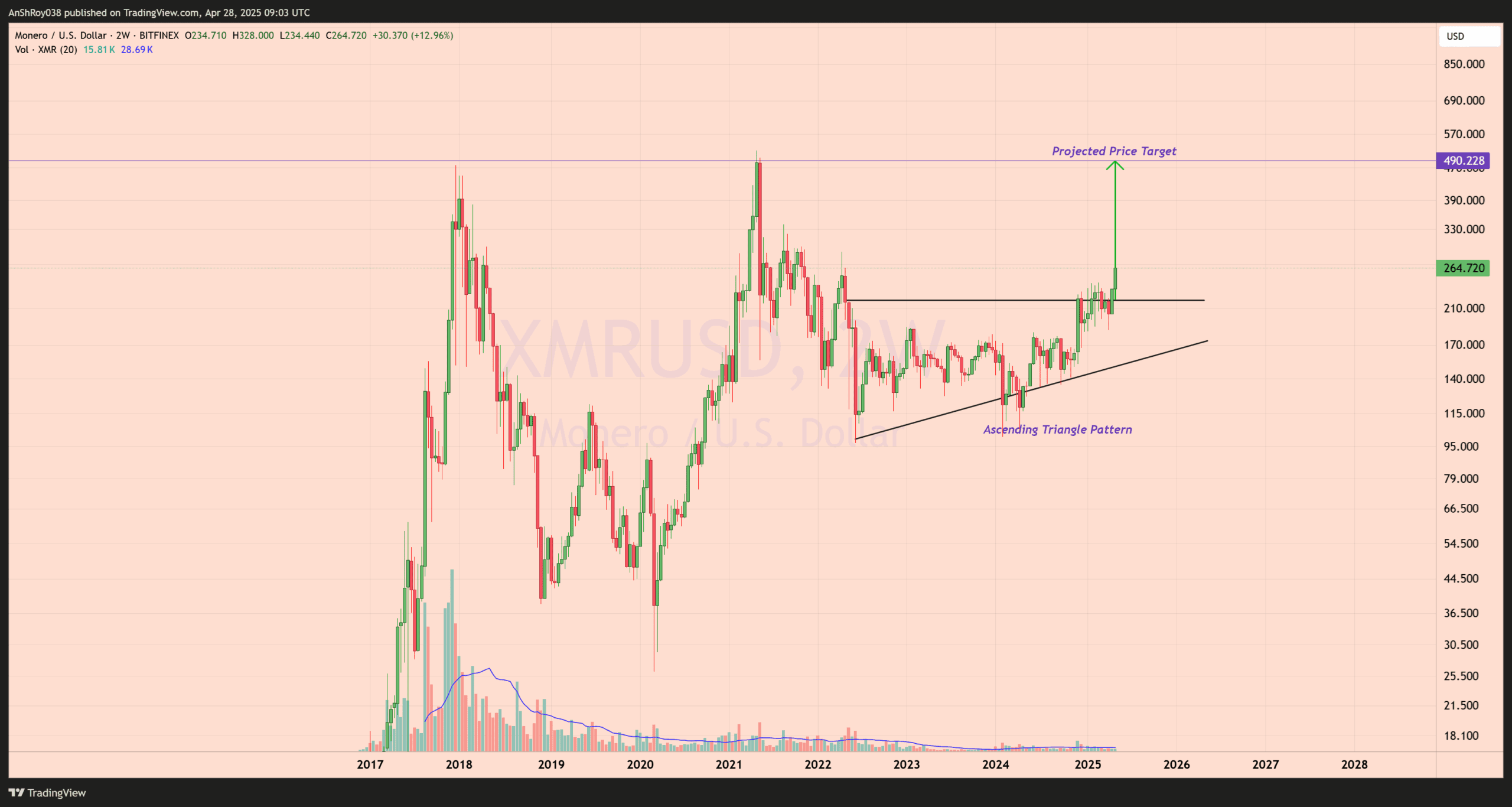

On the spot chart, the XMR price efficiently broke out of a long-standing ascending triangle sample. In technical analysis, ascending triangles usually type throughout consolidation phases. A flat resistance degree and a collection of upper lows characterize the sample.

A breakout from this construction historically alerts bullish continuation, pushed by rising shopping for stress every time sellers try to defend resistance.

Merchants calculated the projected price goal for the breakout by measuring the peak of the triangle formation and projecting that distance upward from the breakout level. Based mostly on this methodology, Monero’s construction suggests vital upside potential if momentum sustains.

Though the breakout has materialized on increased timeframes, full affirmation would require weekly closes above former resistance ranges and wholesome quantity growth. Collectively, funding, open curiosity, and technical construction suggest that Monero might stay a powerful outperformer within the weeks forward, offered that the broader market sentiment stays constructive.

Monero Faces Preliminary Resistance After Sharp Rally

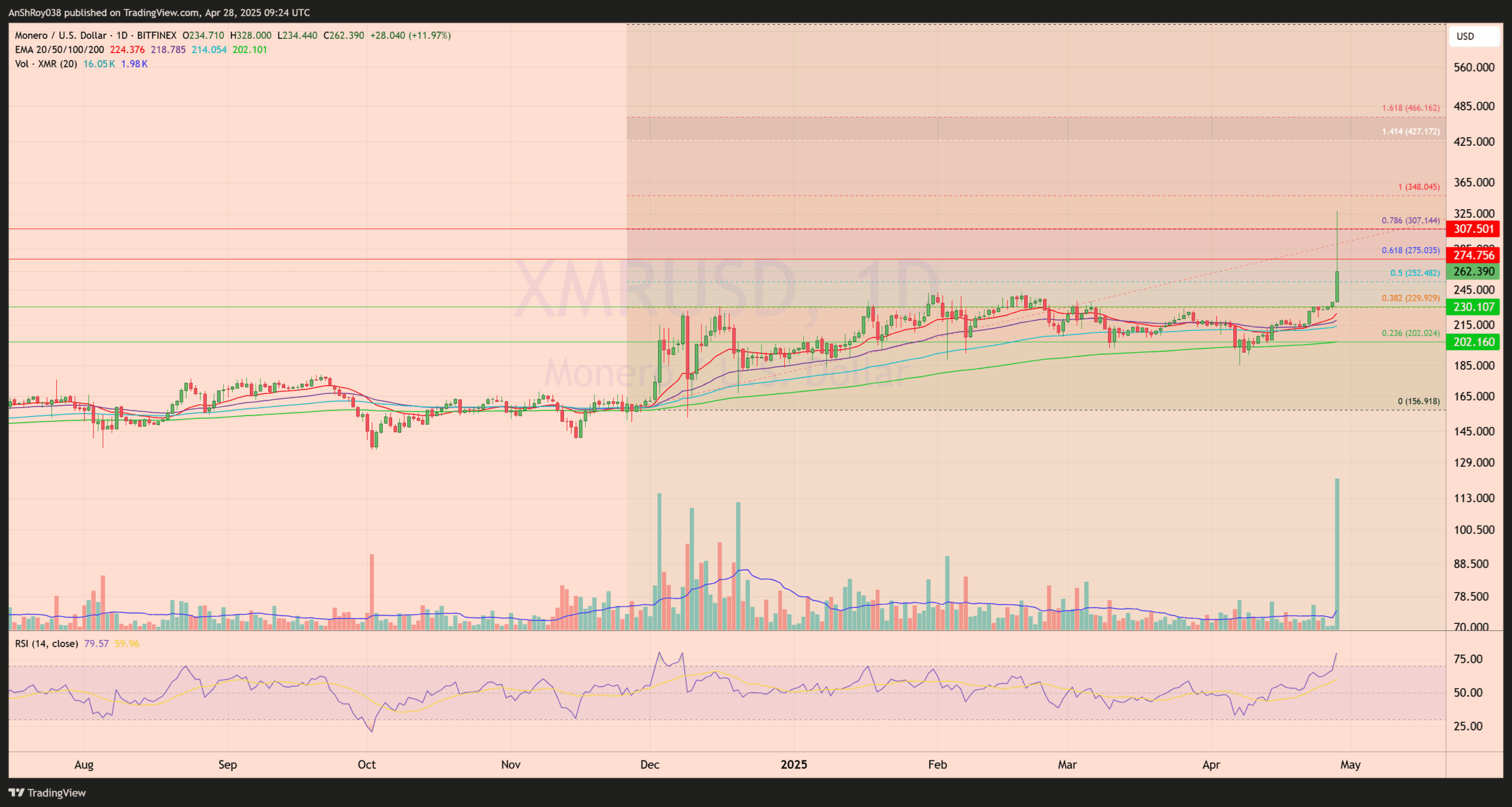

XMR price posted a powerful 40% intraday spike on April 28, briefly hovering towards the $328 mark earlier than profit-taking stress seemingly compelled a pointy retracement. XMR price stabilized close to $263, paring a lot of its earlier positive factors however nonetheless holding considerably above prior consolidation ranges.

The day by day chart highlights clear technical hurdles for XMR price. Rapid resistance emerges close to $275, aligned with the 0.618 Fibonacci retracement degree. Above that, a heavier resistance band looms close to $307, near the 0.786 Fibonacci retracement.

Sustained acceptance above these ranges could be needed for Monero to revisit the higher targets projected in its broader breakout construction.

On the draw back, key assist has shaped close to $245, the place prior horizontal resistance has now flipped into an interim flooring. A deeper pullback would carry the following assist zone close to $230 into focus, corresponding with one other seen horizontal pivot.

The 200-day exponential transferring common (EMA) continues to offer structural assist close to $202. Extra shorter-term EMAs, together with the 50, 100, and 150-day transferring averages, cluster between $215 and $230, including additional power to the underlying uptrend.

The day by day RSI studying close to 80 suggests XMR entered overbought territory through the spike, making the present cooling section a wholesome improvement somewhat than a breakdown. Total, the technical construction stays constructive so long as XMR price holds above the $230–$245 demand zone, protecting the broader bullish breakout prospects alive.