Fast Take

We at the moment are 33 days into the present miner capitulation, with the typical length being 41 days. This means that some miners are nonetheless going through important monetary stress as a result of earlier halving, which has rendered their operations unprofitable. The hash price has dropped over 12% from its peak on Might 26, with the subsequent issue adjustment scheduled for June 20 anticipated to be barely optimistic, in response to Newhedge.

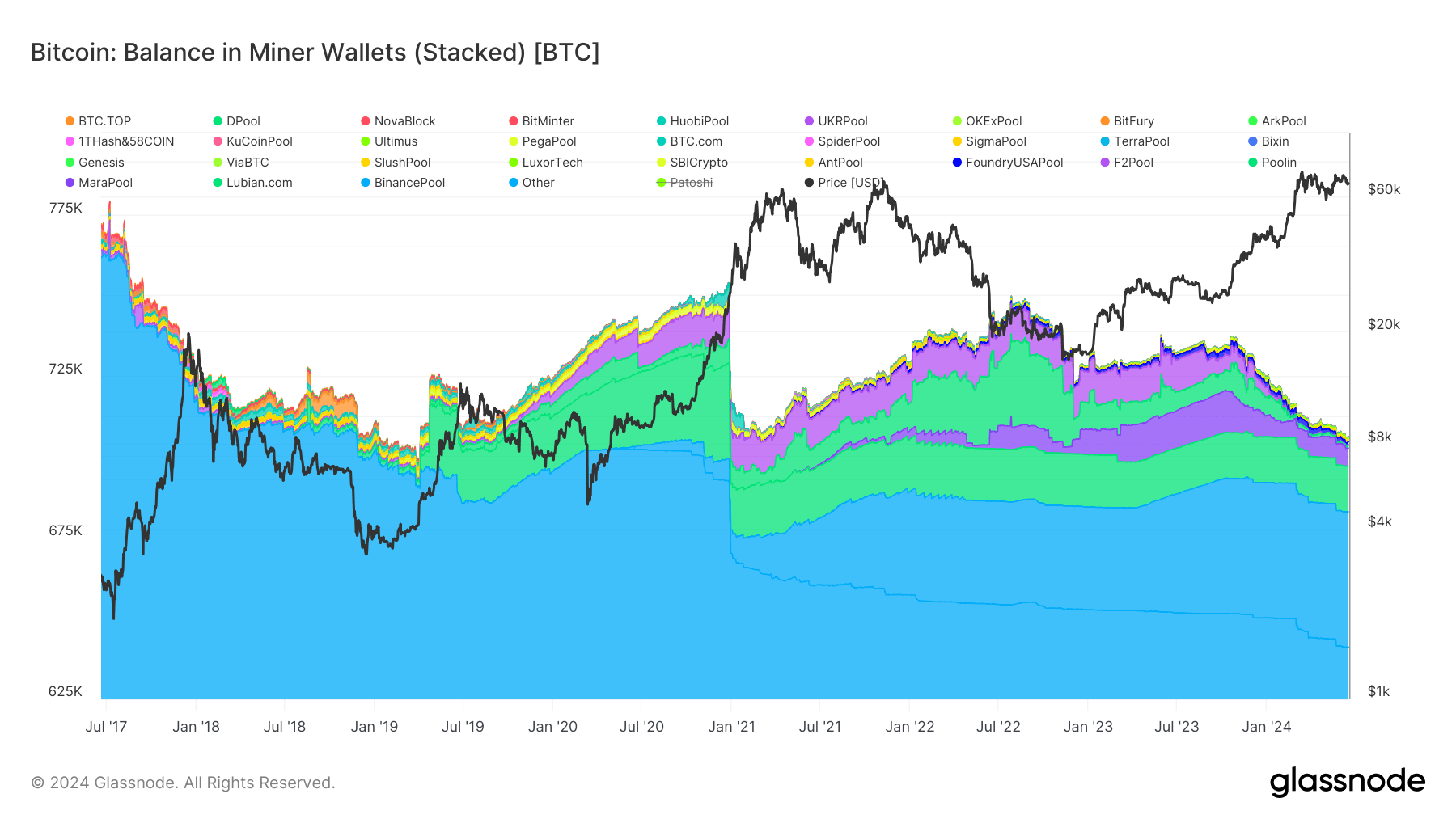

Nonetheless, the hash price’s decline has not reached the anticipated 25% post-halving drop, demonstrating sudden resilience. This resilience will be attributed to 2 components: elevated transaction charges pushed by Runes and Inscriptions and miners’ strategic monetary planning. Miners have constructed up reserves and are offloading Bitcoin to maintain their operations. Over the previous 30 days, greater than 3,000 BTC has been distributed by miners, persevering with a pattern of great distribution since December 2023, unmatched for the reason that 2017-2018 interval, in response to Glassnode knowledge.

Glassnode knowledge reveals that miner balances have decreased by roughly 30,000 BTC since October 2023, now standing at 1.8 million BTC.

This ongoing distribution poses a big headwind for Bitcoin, including promoting stress to the market and affecting its price dynamics.