Picture supply: Getty Photographs

It goes with out saying that Warren Buffett’s investing prowess has lengthy been the topic of monetary discourse. His market knowledge and dedication to long-term investing and monetary self-discipline are second to none. However now the 94-year-old legend has lastly introduced his retirement and might be stepping down as CEO of Berkshire Hathaway on the finish of 2025.

As buyers replicate on his unprecedented profession, consideration turns not simply to his legacy — however shares in the present day which will echo his most profitable picks. Over his lifetime, he reworked a struggling textile firm right into a $1.2trn conglomerate, powered by sensible capital allocation and a deep understanding of enterprise fundamentals.

Let’s check out the shares that cemented his legacy and one that would mimic that success going ahead.

Warren Buffett’s greatest investments

Generally known as the ‘Oracle of Omaha’, Buffett’s easy technique of shopping for high-quality shares and holding them ‘forever’ is admired by many buyers. The businesses he chooses are sometimes these with sturdy aggressive benefits, or ‘economic moats’.

One among his most well-known and enduring inventory picks is Coca-Cola. Berkshire bought $1.3bn price of shares in 1988 — a stake that in the present day is price over $25bn. This comes because of its constant dividends and world model power — two traits that exemplify Buffett’s funding philosophy.

Earlier in his profession, he additionally made a fortune with American Categorical, shopping for throughout a disaster when others have been promoting. This contrarian mindset of specializing in fundamentals over market concern has constantly outlined his success.

So what lesser-known inventory in the present day might be the following Buffett-style win?

Espresso tradition

Dutch Bros (NASDAQ: BROS) is a fast-growing American espresso chain that would ultimately develop to echo traditional investments like Coca-Cola. With a cult-like buyer base and a vibrant, youth-driven model, the corporate is quickly increasing throughout the US. Its drive-thru mannequin, energetic tradition, and constant demand create the sort of client loyalty that would gasoline a long time of success.

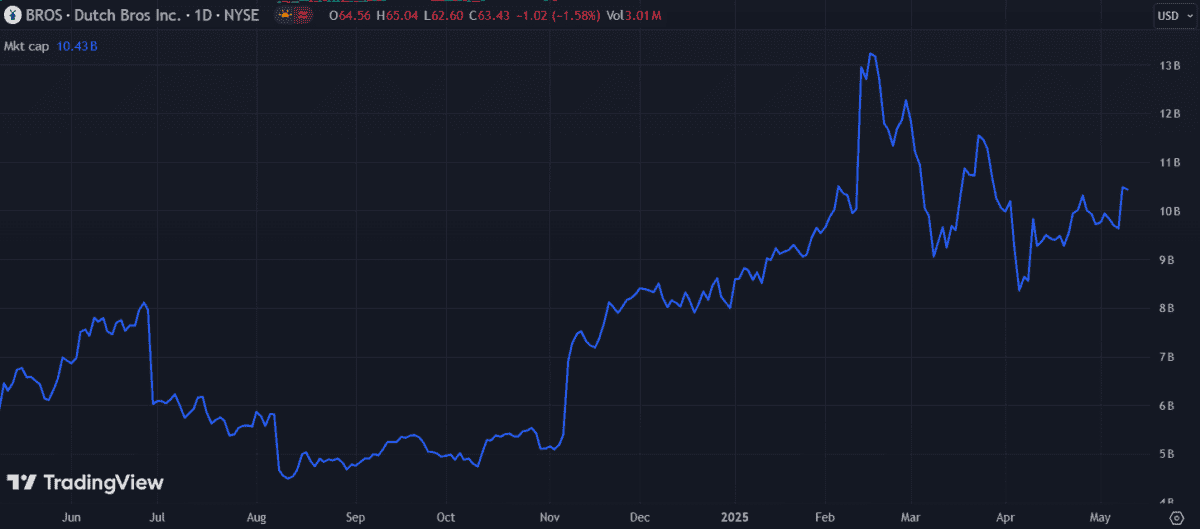

Whereas it’s nonetheless comparatively small in US phrases, its market cap of $10.37bn has nearly doubled up to now yr.

In 2024, it reported a 32.6% income enhance to $1.28bn. And its 2025 first-quarter outcomes, posted final week, present no slowdown. The outcomes revealed a 29.1% enhance in income to $355.2m, with web earnings climbing 38.6% to $22.5m.

The robust efficiency prompted an 8.8% price leap, serving to to spice up its 2025 year-to-date development to 13%. Whereas down since February, its trailing price-to-earnings (P/E) ratio continues to be an eye-watering 164. If upcoming earnings fail to impress, this might result in a notable price drop.

Growth plans

With simply over 1,000 shops at the moment, Dutch Bros estimates a complete addressable market protecting 7,000 areas. This growth potential, paired with robust unit economics and founder-led management, makes it a compelling long-term funding possibility with gradual and sustainable development prospects.

Like Coca-Cola, it markets a high-margin, enticing product with emotional attraction. Positive, competitors within the espresso house is intense, however the model’s differentiation and scalability give it the traits of a high-quality, compoundable inventory. That stated, there nonetheless stays a excessive likelihood of market share loss if it fails to execute its growth technique successfully.

General, I feel Dutch Bros is an early-stage gem that’s nicely price contemplating — significantly for followers of Warren Buffett’s long-term investing strategy.