Picture supply: Getty Photos

Disruptive development shares buying and selling for a couple of {dollars} have the potential to generate life-changing returns. One which’s been getting loads of consideration from traders is Recursion Prescription drugs (NASDAQ: RXRX). Lately, the inventory soared virtually 24% in a single day (14 February).

The corporate is backed by Nvidia, in addition to Scottish Mortgage Funding Belief, and Softbank. So there’s loads of sensible institutional backing right here.

Let’s take a more in-depth have a look at this under-the-radar $10 inventory.

The corporate at a look

Recursion is a clinical-stage biotech agency that’s making an attempt to industrialise drug discovery by utilizing synthetic intelligence (AI) and machine studying to decode biology.

In July 2023, Nvidia introduced a $50m funding within the agency, initiating a partnership aimed toward enhancing Recursion’s AI-powered drug discovery capabilities. With Nvidia’s highly effective chips, Recursion has constructed BioHive-2, the most important supercomputer within the biopharmaceutical business (and thirty fifth on the earth).

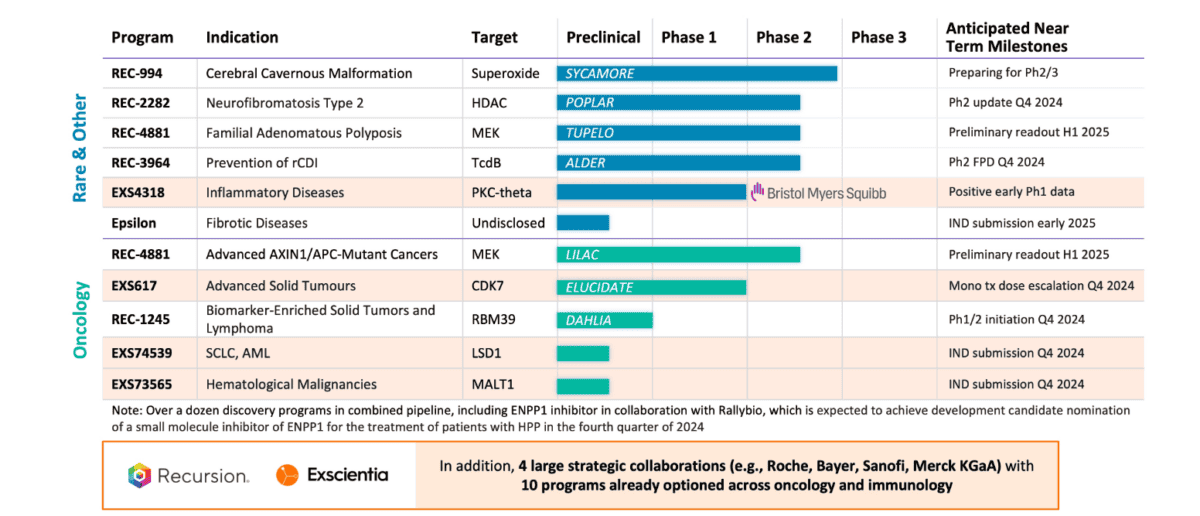

It’s growing a couple of therapies for most cancers and uncommon illnesses, but additionally goals to generate substantial service charges by permitting different biopharma companies to make use of its drug growth platform. Notably, it has signed offers with business heavyweights like Bayer, Roche, and Sanofi.

One other encouraging factor right here is that Nvidia hasn’t bought any of the Recursion shares it purchased regardless that the AI juggernaut did offload a couple of of its positions in This autumn, together with Soundhound AI. This obvious vote of confidence within the agency is what despatched the inventory up practically 24% final week.

Lately, the corporate merged with Oxford-based Exscientia, one other chief within the AI drug discovery house. The mixed entity now has a portfolio of greater than 10 scientific and preclinical programmes, and over 10 partnerships.

Recursion is automating the age-old follow of wanting right into a microscope and is changing human interpretation with AI. That is thrilling as a result of it supplies the chance to profitably pursue extra minor illnesses that won’t have been commercially viable utilizing conventional drug growth processes.

Scottish Mortgage Funding Belief.

Nonetheless early days

As revolutionary as this sounds, the corporate’s pipeline remains to be at an early stage. Meaning it will likely be a minimum of three-to-five years, at greatest, earlier than any of those therapies begin producing gross sales.

Within the meantime, the corporate may signal extra offers and obtain milestone funds for drug growth collaborations. Nevertheless, this can be a very speculative inventory as a result of constant gross sales, not to mention earnings, aren’t anticipated for a few years.

Following the merger, the agency has over $700m in money and equivalents. That’s sufficient to pursue its pipeline for now, however an extra fundraise can’t be dominated out in some unspecified time in the future. Subsequently, the potential of shareholder dilution is a threat right here.

Millionaire-maker?

Nvidia CEO Jensen Huang thinks the following large AI revolution can be in healthcare, which explains the partnership with Recursion. So the inventory is unquestionably value conserving on the radar.

Nevertheless, it’s far too early for me to get bullish as a result of the corporate’s platform isn’t but churning out AI-discovered remedies.

To show £10k into £1m, the inventory would wish to rise 100-fold, assuming fixed change charges. At present, Recursion has a $4.1bn market cap, which implies it will be valued at round $410bn if it achieved that feat – bigger than AstraZeneca right this moment! So extremely unlikely then.

As issues stand, I’m not going to speculate on this dangerous inventory.