Picture supply: Rolls-Royce plc

Final 12 months was one other nice 12 months for shareholders in Rolls-Royce (LSE: RR), identical to the 12 months earlier than. Even when Rolls-Royce shares climb by a far decrease quantity this 12 months – 36% from the place they’re at the moment – they might hit £8.

Provided that the Rolls-Royce share price was in pennies as lately as 2022, that might be an unbelievable return for some buyers.

However how possible may that be to occur (or not) – and ought I to take a position?

Enterprise traits are transferring in the proper course

There’s good cause for the share price to be in a lot better form now than just a few years again, for my part.

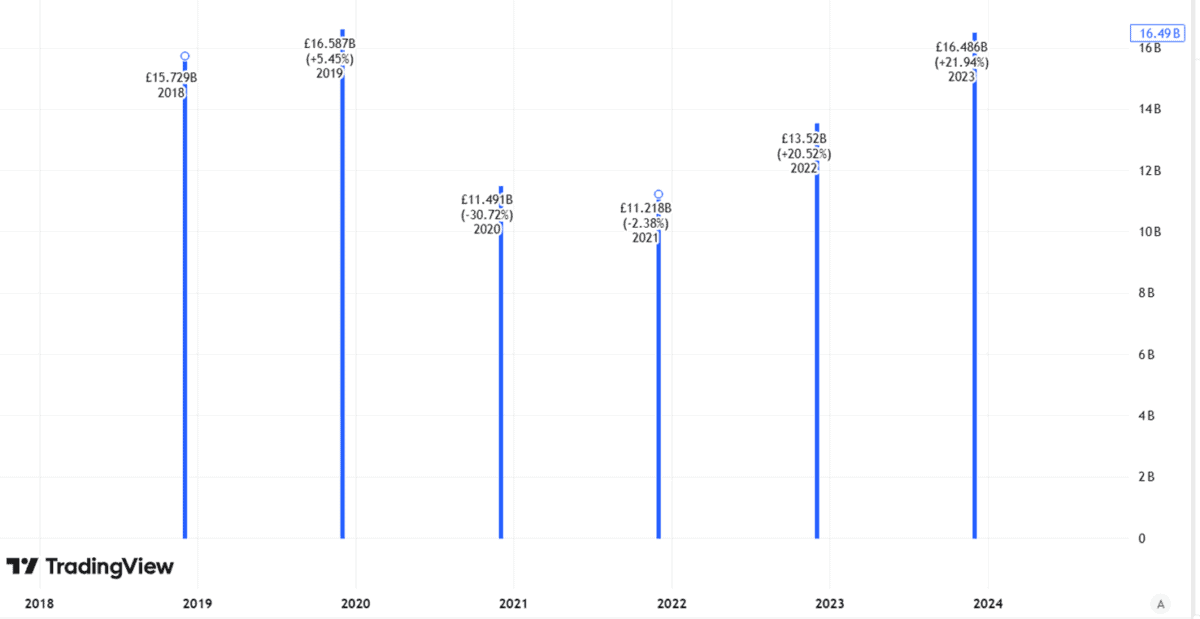

A pointy drop in civil aviation demand throughout the pandemic was an actual take a look at for Rolls. However since then, revenues have come again strongly.

Created utilizing TradingView

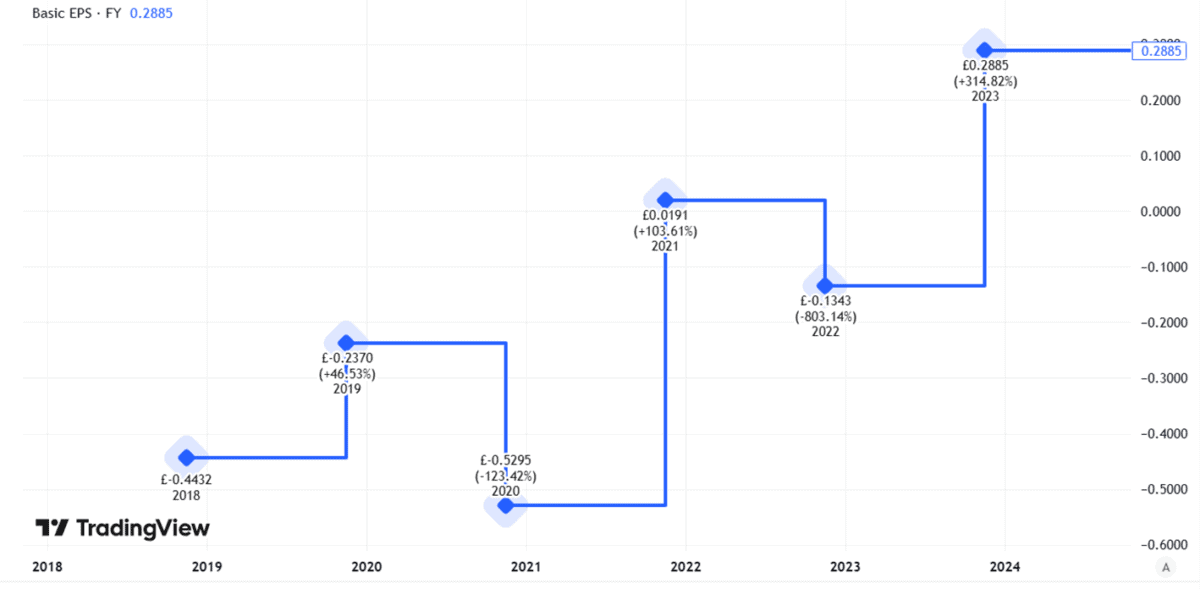

However whereas revenues had been a priority for a number of years, the larger one was earnings. Making and servicing engines is a enterprise that comes with excessive mounted prices. So even pretty modest strikes in income can result in substantial swings within the revenue and loss account.

Taking a look at Rolls-Royce’s fundamental earnings per share that is clear.

Created utilizing TradingView

Rolls has made numerous vital enterprise strikes prior to now a number of years.

It’s got rid of some companies to deal with its strategic core. It has minimize prices. It has additionally carried out an aggressive plan to enhance monetary efficiency.

Mixed with a growth in demand for civil aviation engine gross sales and servicing throughout the business as a complete and it’s a good time for Rolls-Royce.

I’m involved concerning the margin of security

That helps clarify why Rolls-Royce shares have soared.

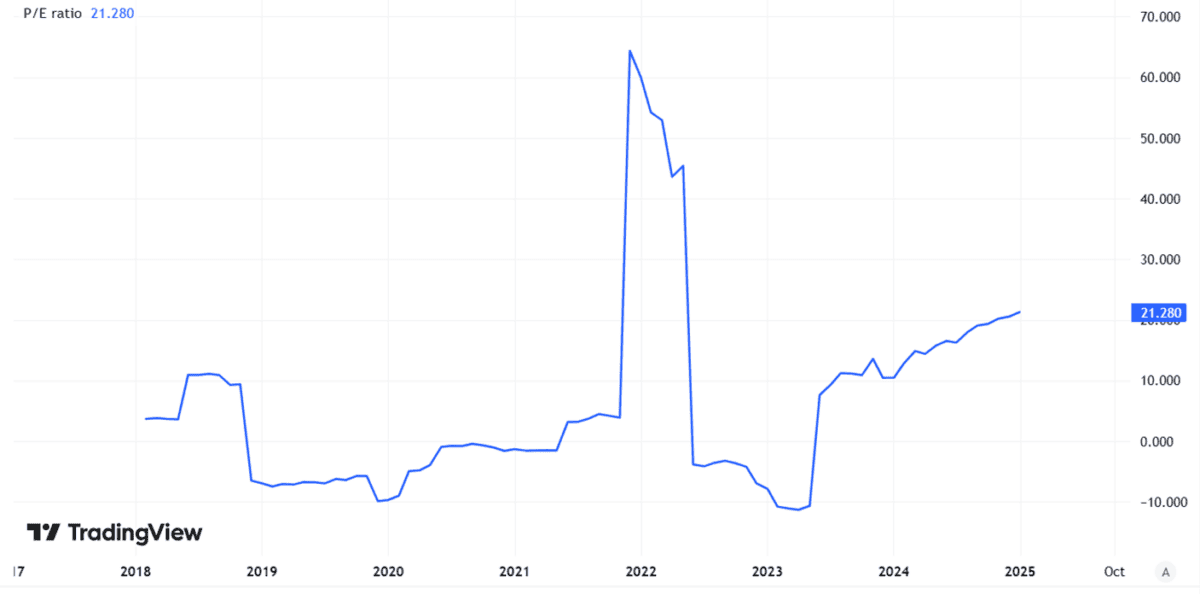

I really suppose they might but go larger from right here, together with doubtlessly hitting the £8 mark. The price-to-earnings ratio of 21 appears a bit pricy to me however not massively overdone. It has been rising however stays nicely beneath its peak of current years.

Created utilizing TradingView

On high of that, the potential ratio may nicely be decrease if Rolls can enhance earnings per share. I anticipate it to have the ability to try this this 12 months and subsequent as a part of its monetary transformation programme – if issues go in accordance with plan.

That, nonetheless, is the place I see potential issues.

Its bold targets imply Rolls already has its palms full delivering on its programme with what it may management.

However what about issues which can be not within the plan, akin to an enormous exterior demand shock pummelling revenues and earnings once more?

We have now seen it within the previous with the pandemic but in addition with terrorist assaults, volcanoes, or a nasty recession sending civil aviation demand sharply downwards.

I see such a danger as a matter of ‘when’ not ‘if’, though it could be a long time sooner or later. Then once more, it might be tomorrow – and I don’t suppose the present Rolls-Royce share price affords me something like an ample margin of security to account for that danger.

So, though I do suppose the shares could transfer larger nonetheless, I’ve no plans to take a position.