YEREVAN (CoinChapter.com) — Metaplanet bought 156 Bitcoin on March 3, spending roughly $13.4 million at a mean price of $85,890 per BTC. This elevated the agency’s complete Bitcoin holdings to 2,391 BTC, in response to its assertion.

The corporate, led by Simon Gerovich, has now invested $196.3 million in Bitcoin because it adopted its Bitcoin technique in April 2023. The typical buy price stands at $82,100 per Bitcoin, and its complete holdings have gained 13% in worth for the reason that first buy.

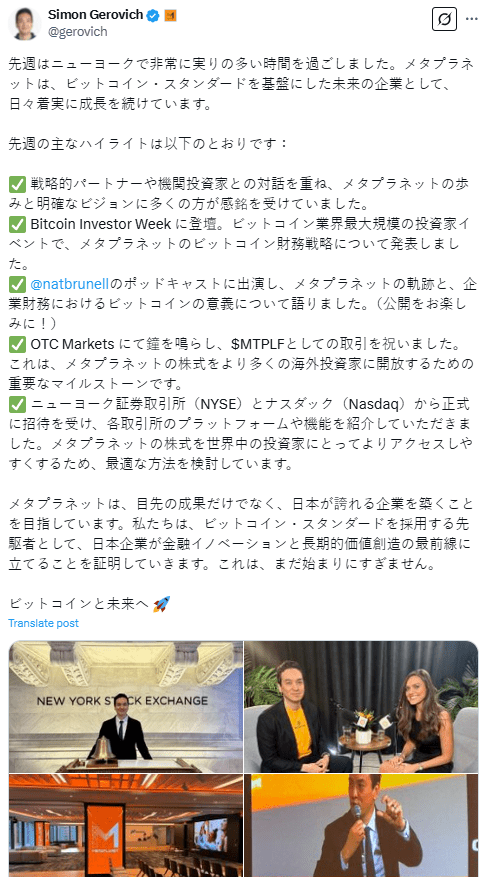

Gerovich just lately met with executives from the New York Inventory Trade (NYSE) and Nasdaq. The corporate mentioned its operations and potential methods to make Metaplanet shares extra accessible.

“We are considering the best way to make Metaplanet shares more accessible to investors around the world,”

Gerovich posted on X on March 3.

A US itemizing is underneath analysis, however no official resolution has been made.

Metaplanet’s inventory, MTPLF, has been buying and selling on OTC Markets since November 2023, permitting extra buyers to entry its shares.

OTC Markets is a monetary platform in the US that gives pricing and liquidity knowledge for round 12,400 securities. Since itemizing, MTPLF shares have climbed 530%, rising from $3 to $18.9.

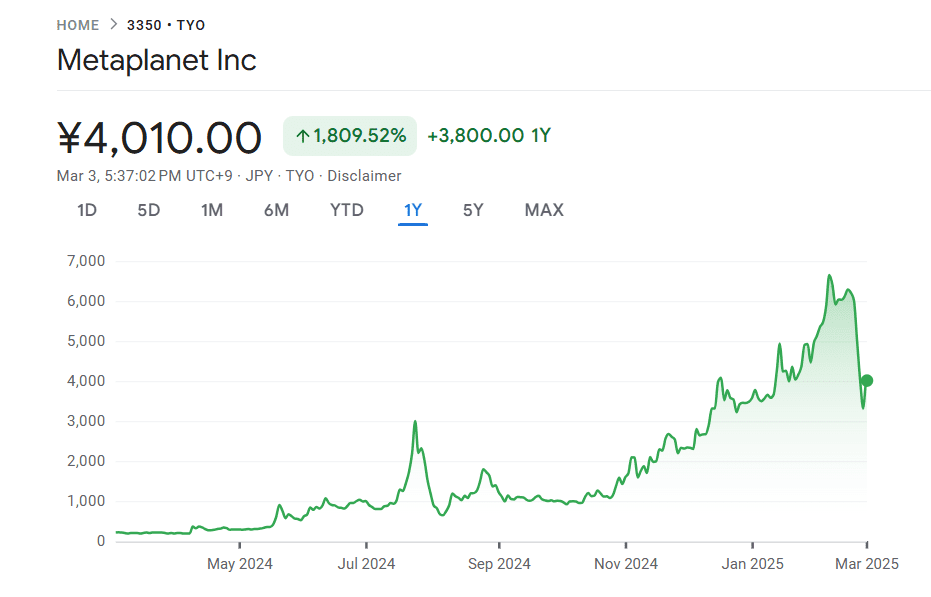

On the Tokyo Inventory Trade, Metaplanet has been one of many top-performing shares over the previous 12 months, gaining 1,800%, in response to Google Finance.

Based on BitBo’s BitcoinTreasuries.NET, Metaplanet is the 14th largest company Bitcoin holder worldwide. The agency has used numerous monetary devices to help its Bitcoin technique.

The corporate goals to build up 21,000 Bitcoin by 2026 as a part of its long-term plan to broaden its Bitcoin reserves.

Regardless of rising curiosity in a US itemizing, Metaplanet has not made any official announcement concerning its plans.

With its Bitcoin holdings growing and inventory gaining momentum, Metaplanet continues to develop its technique however has not confirmed if or when it’s going to pursue a US itemizing.