Picture supply: Video games Workshop plc

Relating to investing, fantasy could be a expensive mindset. That doesn’t imply that pragmatic investing and fantasy worlds don’t go collectively, although. Take Video games Workshop (LSE: GAW) for instance. Video games Workshop shares have been star performers over the long run, greater than doubling in worth over the previous 5 years.

Particularly, they’re up 124% throughout that interval.

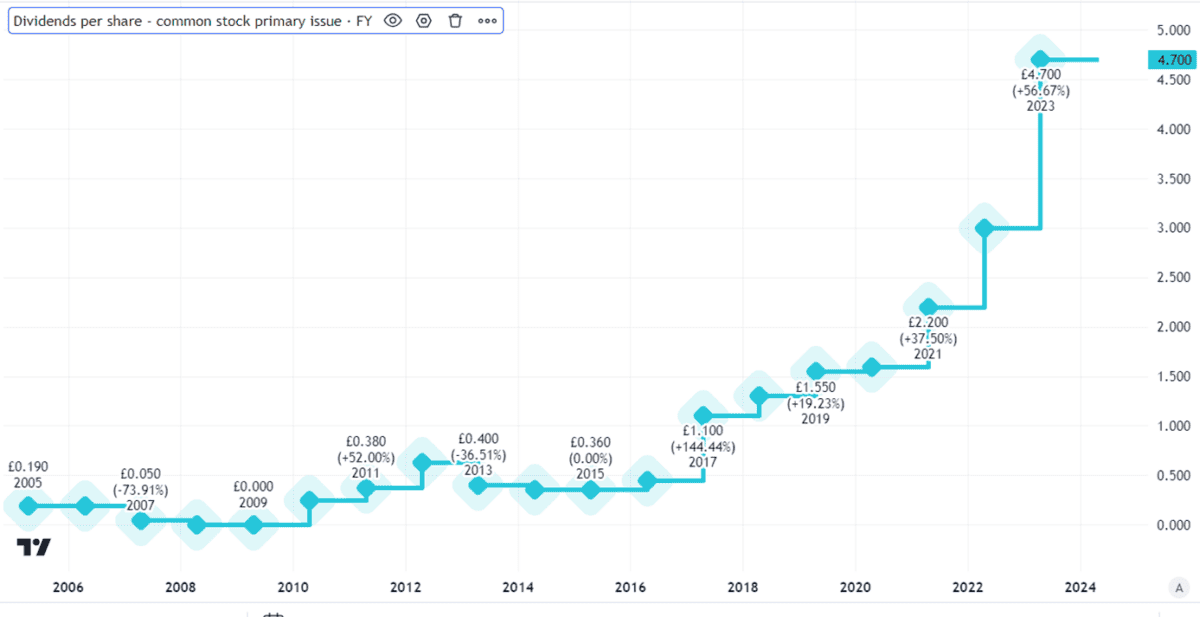

Not solely that, however the FTSE 250 firm has been an everyday dividend payer, with as many as 5 dividends in some years. The present dividend yield is 3.3%.

Created utilizing TradingView

However whereas the dividends entice me, what excites me most in regards to the concept of proudly owning Video games Workshop shares is the potential for additional price positive factors. I feel the shares may double within the coming decade.

Sturdy enterprise mannequin

That’s an formidable expectation. However I feel Video games Workshop has a terrific enterprise mannequin.

A lot of its merchandise are distinctive. By constructing fantasy universes, it might encourage clients to turn into an increasing number of engaged in its merchandise, doubtless which means they turn into much less price delicate over time.

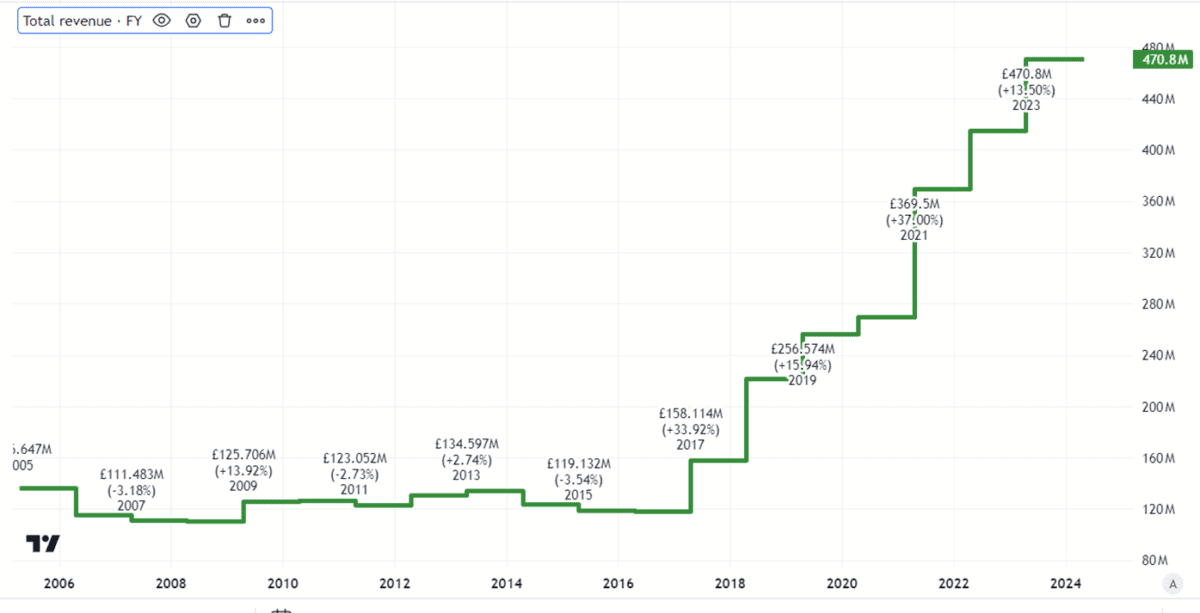

That could be a method for rising gross sales and income. Have a look at how the corporate’s gross sales revenues have soared in recent times.

Created utilizing TradingView

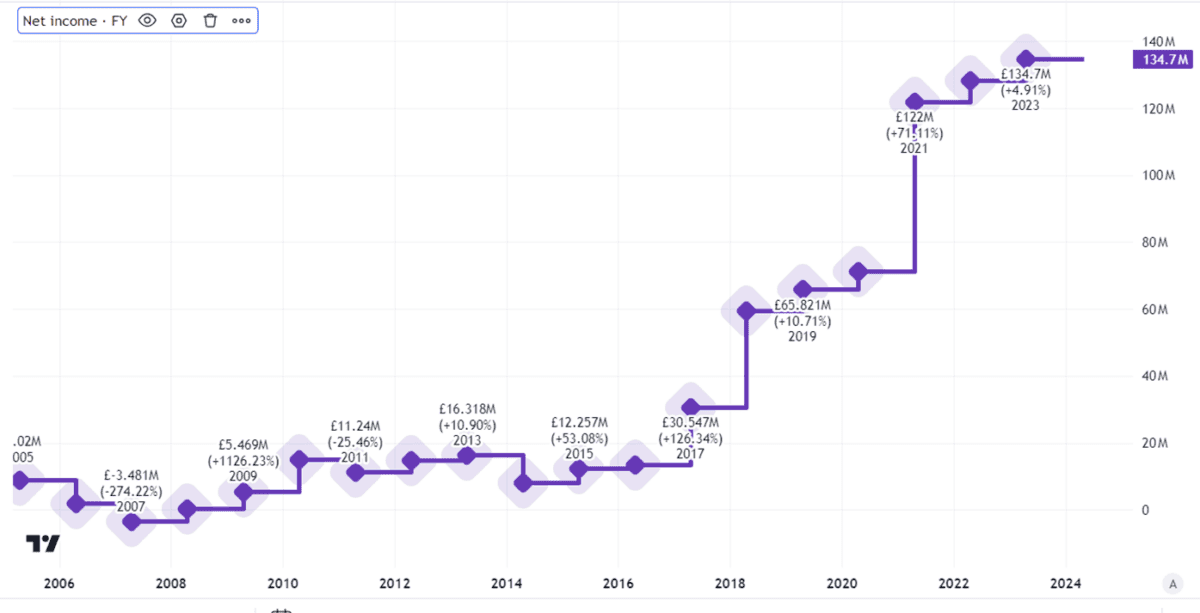

The underside line progress has additionally been spectacular. Internet earnings has additionally jumped in recent times.

Created utilizing TradingView

One thing fascinating in regards to the income isn’t just the expansion trajectory but in addition absolutely the quantity. Final 12 months, the corporate made post-tax income of £135m on gross sales of £471m. That exhibits simply how worthwhile the enterprise mannequin is, with a internet revenue margin of 29%.

Valuing the shares

The Metropolis is clearly alert to the chances right here.

Video games Workshop shares presently commerce on a price-to-earnings ratio of 24. That could be a bit pricier than I wish to pay and certainly is the rationale I don’t presently personal Video games Workshop shares. In the event that they have been low cost sufficient I might snap them up in a heartbeat.

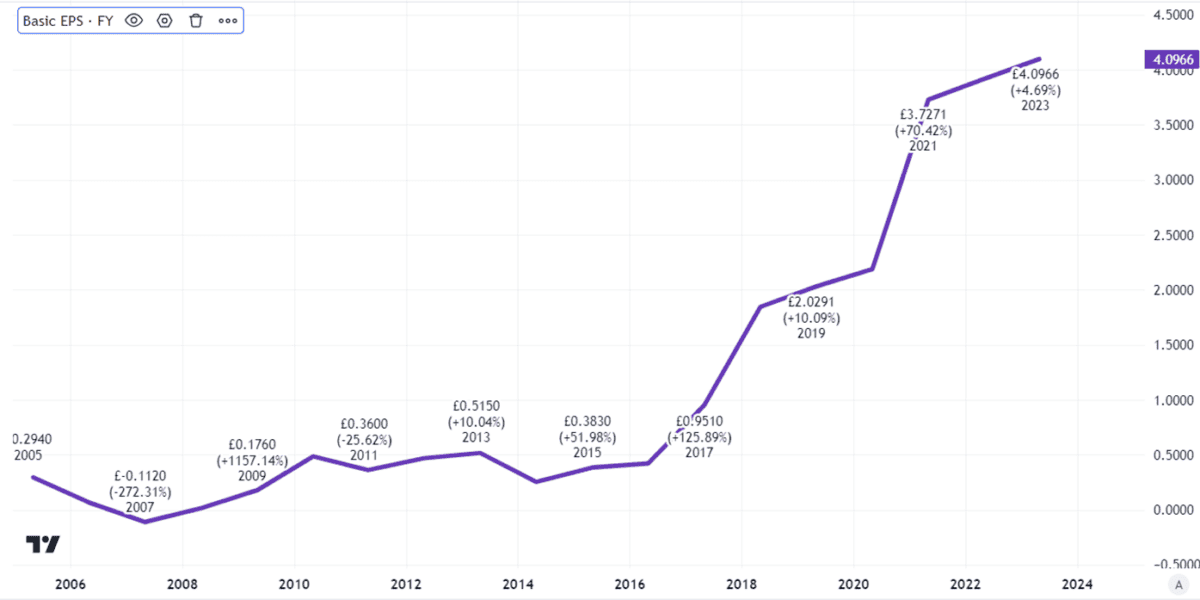

However that ratio relies on present earnings. Not solely have complete earnings grown handily on the firm, so too have earnings per share.

Created utilizing TradingView

If earnings per share continue to grow, I count on the share price to do the identical.

What would it not take for them to double within the coming decade? For my part, principally simply extra of the identical. Video games Workshop has a confirmed enterprise mannequin that’s buzzing alongside lucratively. I count on that to proceed. New income streams like movie licensing rights may add much more progress drivers for the enterprise.

Will it occur?

Though the corporate is working with Amazon to deliver its fantasy world to each large and small display, it stays to be seen whether or not that can in actual fact be a cash spinner.

Video games Workshop’s concentrated manufacturing footprint may be a danger if, for any purpose, its primary manufacturing website has to cease working for a interval.

However I feel this confirmed enterprise can run and run. If it efficiently navigates hurdles alongside the way in which, I reckon Video games Workshop shares may certainly double over the approaching decade.