Geopolitical tensions and financial uncertainties have been inflicting vital volatility within the monetary markets lately. Just lately, President Donald Trump stepped into the highlight once more with remarks about U.S.-China relations and the Federal Reserve. Recognized for his skill to sway markets, Trump’s newest remarks have triggered a wave of inexperienced throughout buying and selling screens, even boosting cryptocurrencies.

Trump’s Newest Strikes

The U.S.-China commerce battle has escalated sharply, with President Trump imposing a hefty 145% import tax on Chinese language items. China swiftly responded by imposing 125% tariffs on American merchandise, thereby intensifying the financial battle. In consequence, inventory costs have faltered, and rates of interest on U.S. debt have risen, pushed by investor issues over sluggish financial development and mounting inflationary pressures.

Be taught extra: Trump Tariffs Drive Miners Out of the U.S.

In a latest interview, President Trump acknowledged, “We’re doing fine with China,” signaling a optimistic outlook on the state of affairs. He additionally instructed the opportunity of adjusting the import tariffs on Chinese language items, clarifying that whereas tariffs wouldn’t be decreased to 0%, they’d be considerably decrease than the 145% price that had beforehand alarmed the market.

In accordance with The Guardian, the President additionally acknowledged that he has no plans to dismiss Federal Reserve Chairman Jerome Powell. His remarks come simply days after he posted on social media that Powell must be eliminated for not chopping rates of interest extra shortly.

Supply: The Guardian

Bitcoin’s Rally: The Trump Impact

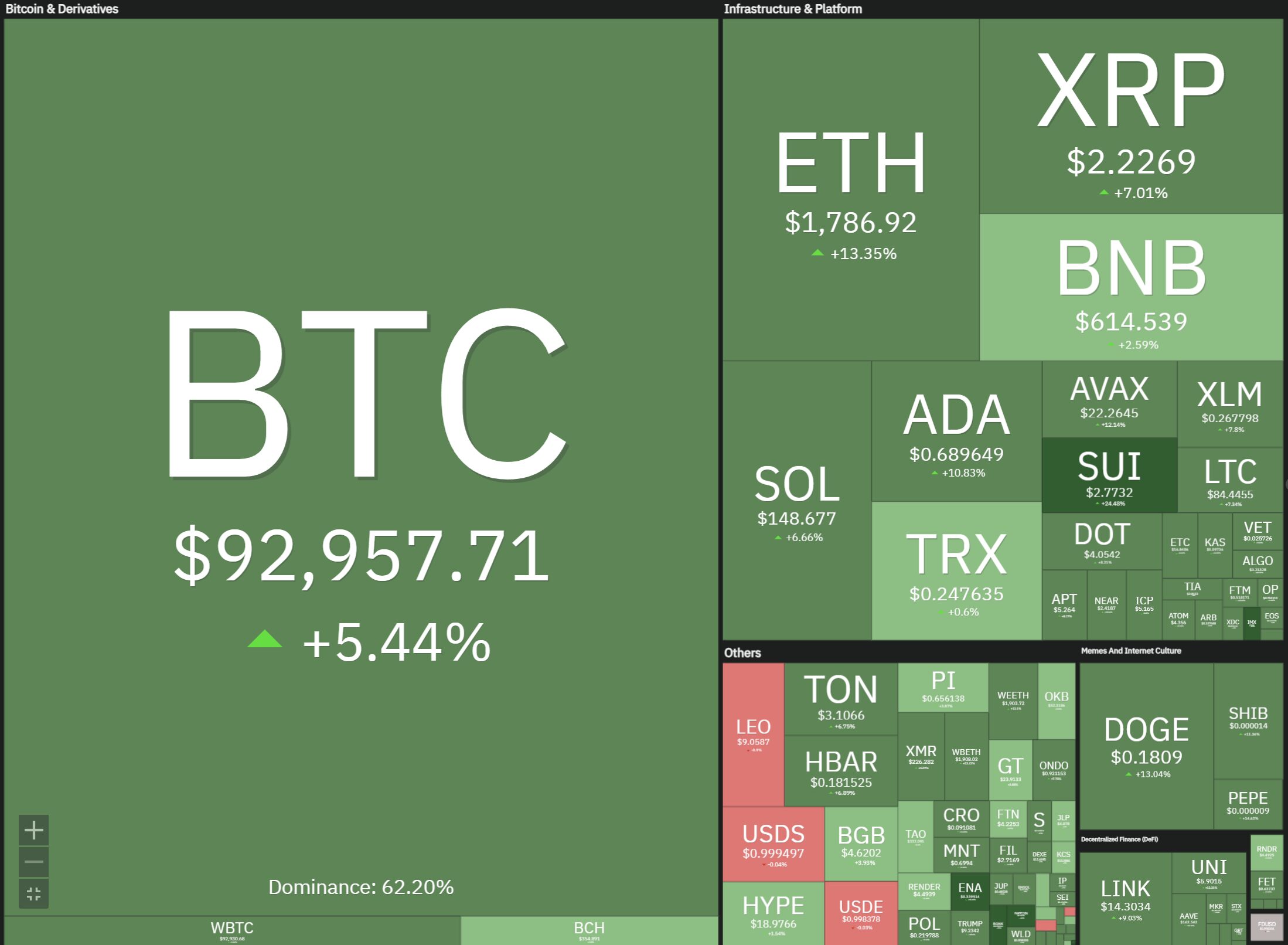

Trump’s remarks have ignited a rally within the crypto market, with Bitcoin surging to $93,000. Ethereum and different altcoins have additionally jumped on the optimism wave. The general crypto market capitalization has elevated by almost 5.9%, surpassing $$2.91 trillion, as investor confidence rebounds on the again of Trump’s optimistic indicators.

Supply: COIN360

Additionally, document inflows into Bitcoin ETFs from institutional heavyweights, recording an unprecedented internet influx of $911.20 million, the very best because the Trump inauguration, in line with Dealer T. Notable inflows embody an enormous $267.10 million influx to Ark Make investments’s ARKB, adopted by Constancy’s Smart Origin Bitcoin Fund (FBTC) with $253.82 million, and BlackRock’s iShares Bitcoin Belief (IBIT) with $192.08 million.

4/22 Bitcoin ETF Complete Web Circulation: $911.20 million

(HIGHEST INFLOW SINCE TRUMP INAUGURATION)$IBIT (BlackRock): $192.08 million$FBTC (Constancy): $253.82 million$BITB (Bitwise): $76.71 million$ARKB (Ark Make investments): $267.10 million$BTCO (Invesco): $18.27 million$EZBC (Franklin):… https://t.co/dXaa4M6Lew pic.twitter.com/Nm7G5c1MpE— Dealer T (@thepfund) April 23, 2025

This institutional shopping for spree has slashed Bitcoin’s circulating provide, fueling its price rally. With extra ETFs seemingly on the horizon, Bitcoin’s upward trajectory may proceed, solidifying its position as a world monetary asset.

Nevertheless, with commerce coverage particulars clashing and the long run unsure, it’s not all easy crusing. Buyers ought to preserve their eyes peeled for shifts with China or the Fed may flip the script quick. For now, the outlook’s shiny, however the lengthy recreation’s nonetheless up within the air. Diversifying and staying tuned to the headlines would possibly simply be the neatest play on this wild journey.