peepo

The month of June hasn’t been type to Bitcoin (BTC-USD) because the world’s largest cryptocurrency is down practically 16% for the reason that starting of June, dropping beneath the $59 thousand mark within the course of. Regardless of that, the biggest public Bitcoin miner Marathon Digital Holdings, Inc. (NASDAQ:MARA) has remained regular over the identical interval with its inventory up 2% for the reason that starting of June.

Earlier this week, Marathon, in addition to its opponents Riot (RIOT) and CleanSpark (CLSK), launched their June Bitcoin manufacturing updates. All of these firms have seen their manufacturing decline YoY because of the halving occasion that occurred final April. Nonetheless, Marathon’s replace had some promising updates because it mined probably the most Bitcoin amongst its friends, elevated its business main HODL stash, and had the most effective mining effectivity when it comes to its revenues per exahash.

In my earlier coverages on Marathon titled “Marathon Digital: The Bitcoin Miner To Own Before Halving And Elections” and “Marathon Digital: A Potential Key Cog In Post Halving Bitcoin Mining”, I used to be bullish on the inventory attributable to its excessive publicity to Bitcoin price in gentle of its HODL stash and its efforts to diversify its enterprise mannequin by promoting its expertise to different Bitcoin miners. My bullish thesis stays in place as Marathon continued its diversification efforts by venturing into mining Kaspa (KAS-USD). I imagine this new enterprise may have substantial advantages to Marathon’s future monetary efficiency because of the excessive margins related to mining Kaspa.

In the meantime, the present divergence within the price motion of each Marathon and Bitcoin may sign a major run within the close to time period. Such a run in each Bitcoin and Marathon could possibly be fueled by the upcoming presidential elections, as I shared in my first protection on Marathon, in addition to a possible decline in mining issue attributable to hashprices being at an all-time low. As such, I’m reiterating my purchase score for Marathon.

Enhancing Mining Effectivity

Final June, Marathon mined 590 Bitcoin at a manufacturing charge of 19.7 BTC/day. Compared, Riot mined 255 Bitcoin at a charge of 8.5 BTC/day and CleanSpark mined 445 Bitcoin at a charge of 14.8 BTC/day. On a YoY foundation, Marathon’s manufacturing declined 40%, Riot’s manufacturing declined 45%, whereas CleanSpark’s manufacturing solely declined by 9%.

|

Firm |

Mined BTC June 2024 |

Mined BTC June 2023 |

Change |

|

MARA |

590 |

979 |

-40% |

|

RIOT |

255 |

460 |

-45% |

|

CLSK |

445 |

491 |

-9% |

At first look, the halving occasion’s influence on CleanSpark seems to be minimal in comparison with Marathon and Riot. Nonetheless, the minimal 9% decline in CleanSpark’s manufacturing is principally attributed to its hashrate’s exponential progress from June 2023. In comparison with June 2023 ranges, Marathon’s operational hashrate elevated 102% from 13 EH/s to 26.3 EH/s, Riot’s operational hashrate elevated 90% from 6 EH/s to 11.4 EH/s, whereas CleanSpark’s operational hashrate elevated a whooping 204% from 6.7 EH/s to twenty.4 EH/s.

|

Firm |

Operational Hash Price June 2024 |

Operational Hash Price June 2023 |

Change |

|

MARA |

26.3 |

13.0 |

102% |

|

RIOT |

11.4 |

6.0 |

90% |

|

CLSK |

20.4 |

6.7 |

204% |

On the finish of June, Marathon held 18,536 Bitcoin, Riot held 9,334 Bitcoin, and CleanSpark held 6,591 Bitcoin. On the similar time, Marathon had a money steadiness of $268 million on the finish of June, whereas Riot and CleanSpark had money balances of $688.5 million and $323 million, respectively, as of March thirty first. Accordingly, every firm’s money steadiness along with their respective Bitcoin stashes have the next values at 1 BTC = $58,889.71.

| MARA | RIOT | CLSK | |

| BTC Held | 18,536 | 9,334 | 6,591 |

| BTC Worth | $1,091,579,665 | $549,676,553 | $388,142,079 |

| Money | $268,000,000 | $688,497,000 | $323,052,000 |

| HODL+Money | $1,359,579,665 | $1,238,173,553 | $711,194,079 |

What caught my consideration in Marathon’s month-to-month replace was its mining effectivity when it comes to its income/EH charge. In June, Bitcoin had a median price of $65,899, a slight improve from $65,266 in Could. Accordingly, Marathon’s revenues in June could possibly be round $38.9 million in comparison with Riot’s $16.8 million and CleanSpark’s $29.3 million. On this manner, Marathon, Riot, and CleanSpark, generated $1.48 million, 1.47 million, and $1.44 million respectively per every operational hashrate as the next desk exhibits.

|

MARA |

RIOT |

CLSK |

|

|

Income |

$38,880,685 |

$16,804,364 |

$29,325,263 |

|

Operational Hash Price |

26.3 |

11.4 |

20.4 |

|

Rev/EH |

$1,478,353 |

$1,474,067 |

$1,437,513 |

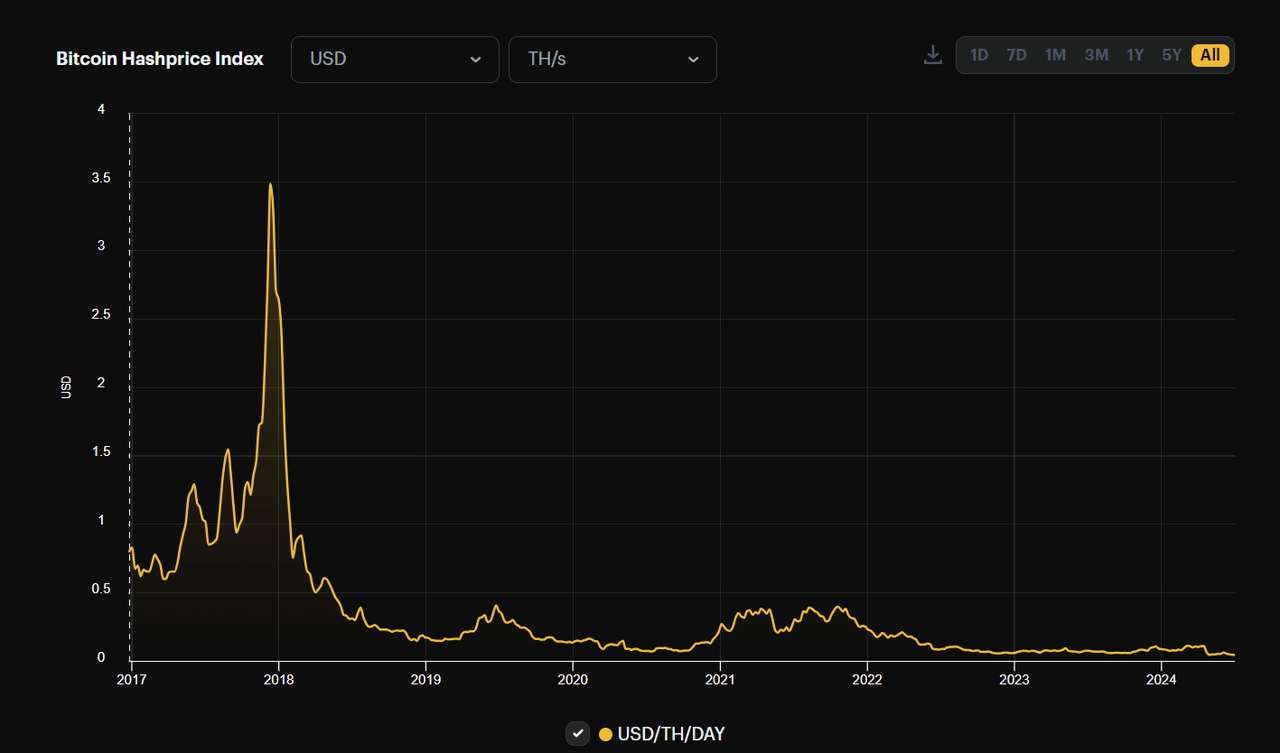

In my view, Marathon’s higher mining effectivity in comparison with its friends is particularly promising because of the document low hashprice of $0.04 per TH/s that has led Bitcoin’s common hashrate to say no over the previous few weeks. Because of this, small, unprofitable miners have unplugged from the Bitcoin community, paving the way in which for big, environment friendly miners to develop their manufacturing with much less competitors within the community. Primarily based on this, it’s anticipated that mining issue may lower by 5% this week, which may enhance hashprice within the coming weeks.

Hashrate Index

Diversification Efforts

On June twenty sixth, Marathon introduced a brand new enterprise to additional diversify its enterprise mannequin after making its expertise out there for different Bitcoin miners. The corporate introduced that it’s mining Kaspa, the fifth largest proof-of-work digital asset with a market cap of $4.14 billion, as of July 4th.

Marathon has already bought 60 petahashes of miners to mine Kaspa, and these miners can generate margins of up to 95% based mostly on Kaspa’s community issue charge and price. Presently, the corporate has 30 petahashes deployed and plans to deploy the remaining petahashes in Q3 2024. As of June twenty fifth, Marathon had mined 93 million Kaspa valued at $15 million, implying a median price of $0.1613.

In my view, this new enterprise will enhance Marathon’s topline in addition to its backside line because of the excessive margins of mining Kaspa. In keeping with Minerstat, Marathon may mine round 1,441,635 Kaspa per day as soon as all 60 petahashes are deployed, in comparison with 720,834 on the present 30 petahashes.

On condition that Marathon anticipates the complete deployment of all 60 petahashes in Q3, I count on it to mine round 99,473,587 Kaspa in the course of the quarter. My forecast relies on 92 days in Q3 and a 30 PH/s run charge for half of the quarter and 60 PH/s for the opposite half of the quarter.

|

Q3 Manufacturing |

|

|

Half at 30 PH |

33,158,368 |

|

Half at 60 PH |

66,315,220 |

|

Whole Q3 Prod |

99,473,587 |

At Kaspa’s present price of $0.1661, Marathon may generate revenues of $16.5 million in Q3 from mining Kaspa. In the meantime, the corporate may generate $22 million in This autumn from mining 132,630,439 Kaspa at 92 days within the quarter and Kaspa’s present price.

Assuming that Q1 usually has 90 days, Q2 has 91 days, and Q3 and This autumn have 92 days, Marathon’s 60 PH/s run charge may see it mine 526,196,852 Kaspa subsequent 12 months on the present mining issue.

|

KAS Manufacturing/Day |

1,441,635 |

|

KAS Q1 Manufacturing |

129,747,169 |

|

KAS Q2 Manufacturing |

131,188,804 |

|

KAS Q3 Manufacturing |

132,630,439 |

|

KAS This autumn Manufacturing |

132,630,439 |

|

KAS Prod/12 months |

526,196,852 |

Subsequently, at Kaspa’s present price, Marathon may generate $87.4 million in revenues from this endeavor alone.

|

KAS Rev/Day |

$239,428 |

|

Kas Q1 Rev |

$11,677,245,201 |

|

Kas Q2 Rev |

$11,938,181,174 |

|

Kas Q3 Rev |

$12,202,000,417 |

|

Kas This autumn Rev |

$12,202,000,417 |

|

KAS Annual Rev |

$87,391,299 |

It ought to be famous that these figures differ from precise outcomes relying on Kaspa’s price motion.

Bitcoin Worth Motion

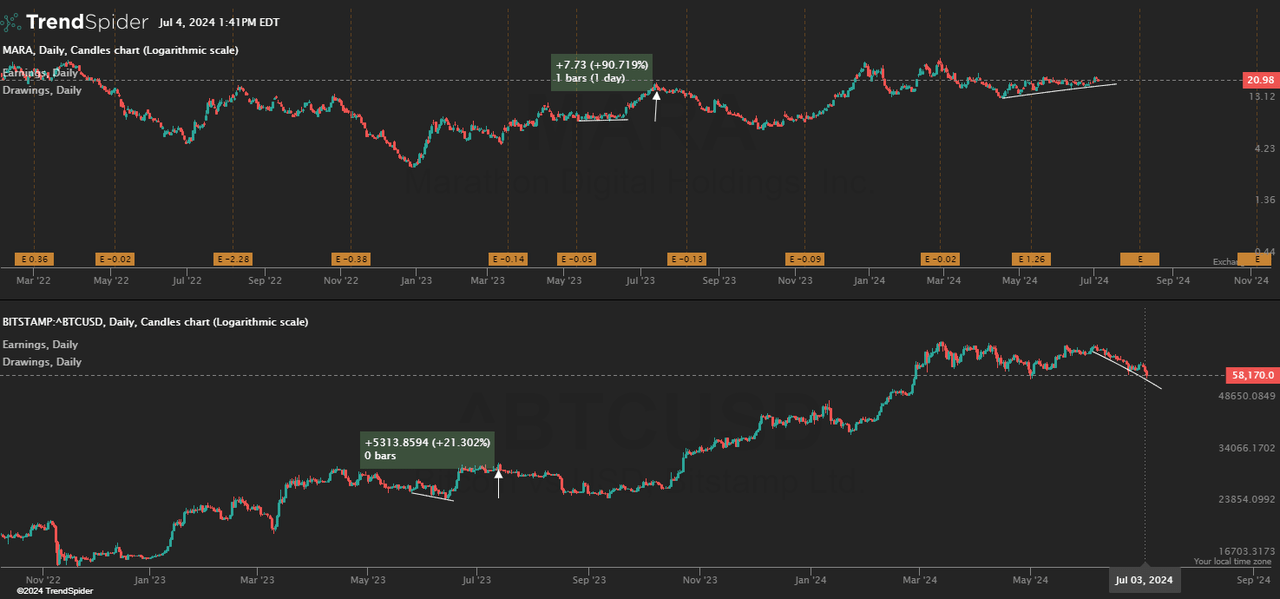

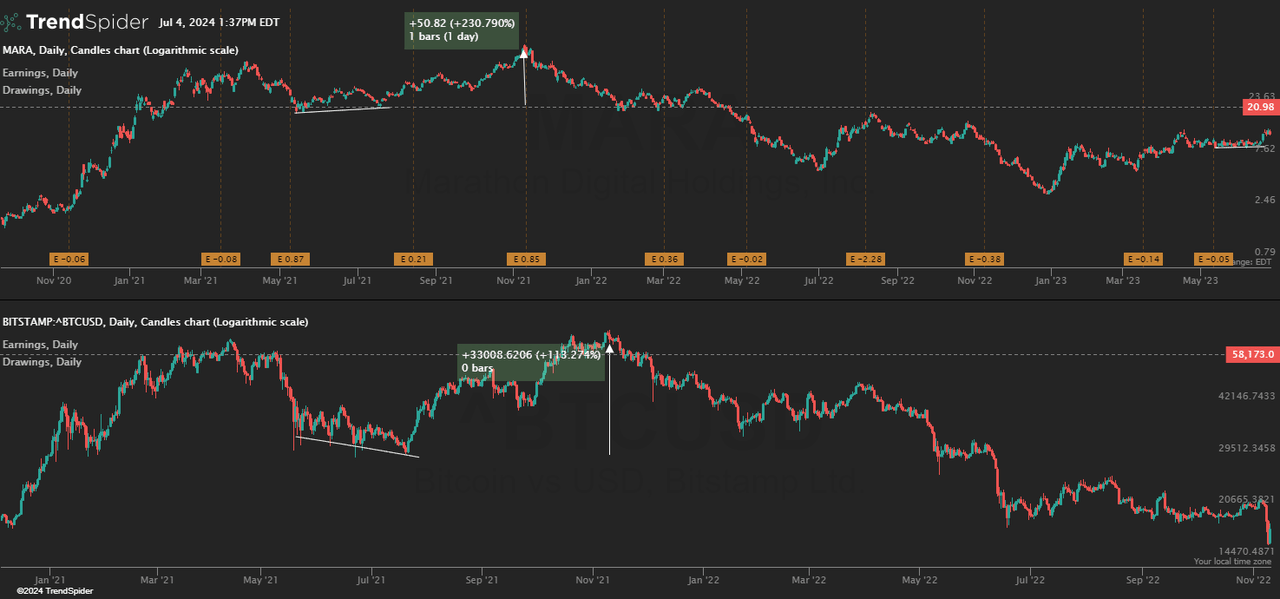

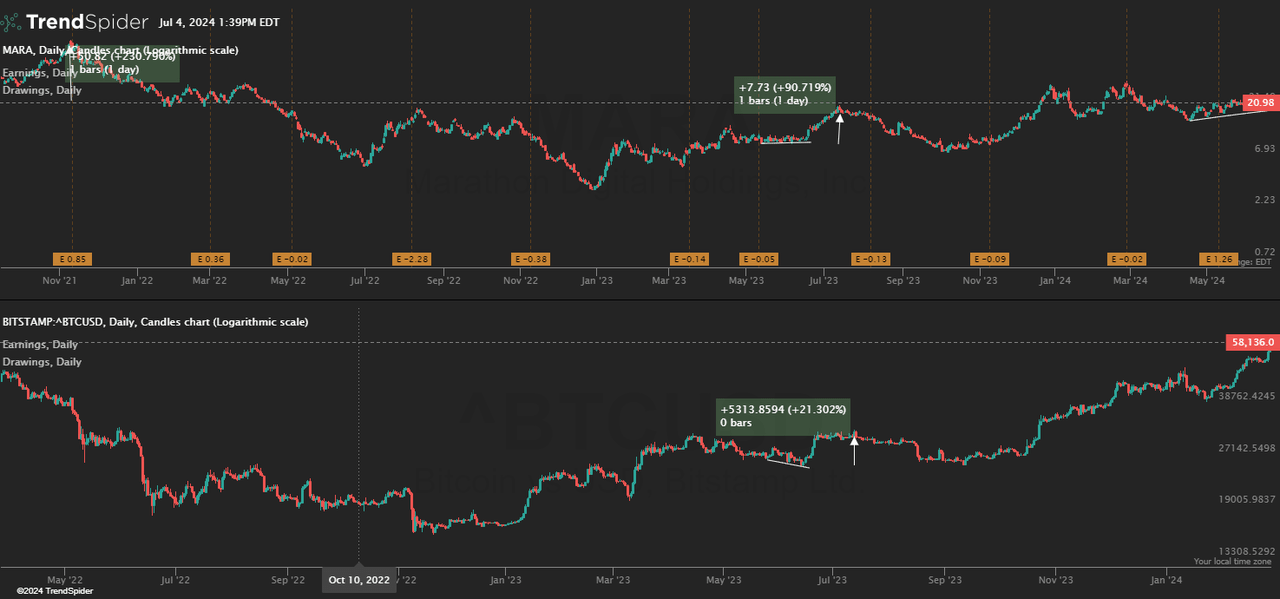

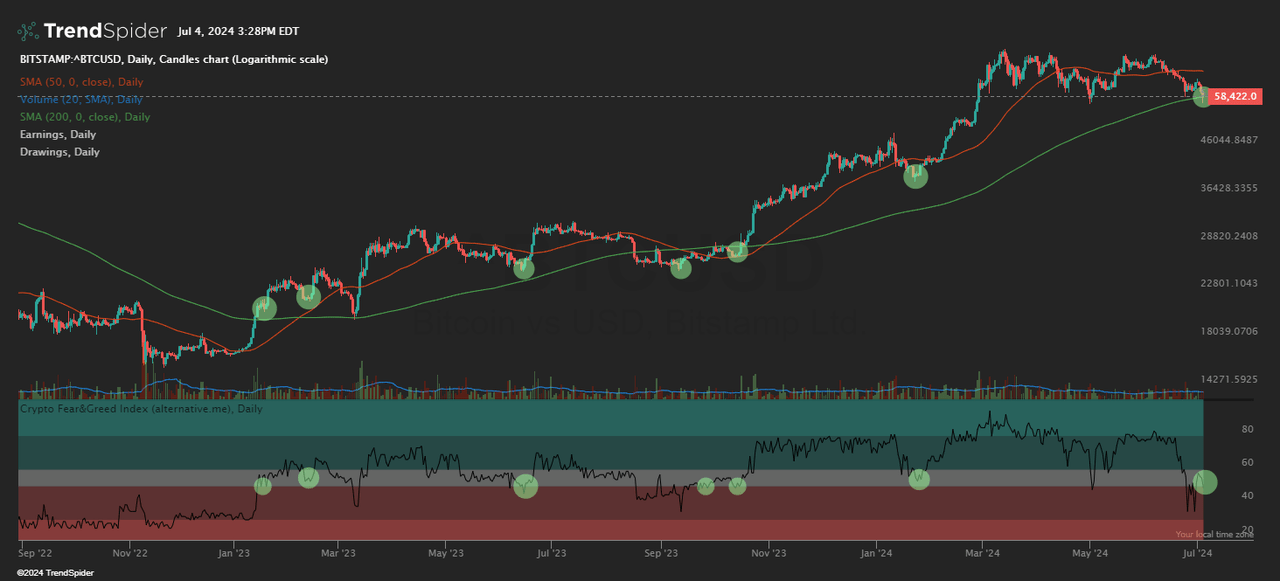

Along with the basics, taking a look at Marathon’s and Bitcoin’s respective charts, it seems that each the inventory and Bitcoin may witness a powerful upward motion within the coming weeks. Very first thing to have a look at in each charts is that at any time when Bitcoin shaped decrease highs and decrease lows, whereas Marathon maintained its development, a powerful rally in each Bitcoin and Marathon’s inventory occurred as proven within the following charts.

TrendSpider

Notice that Bitcoin is at the moment forming decrease highs and decrease lows on the every day timeframe, whereas Marathon is sustaining its impartial development.

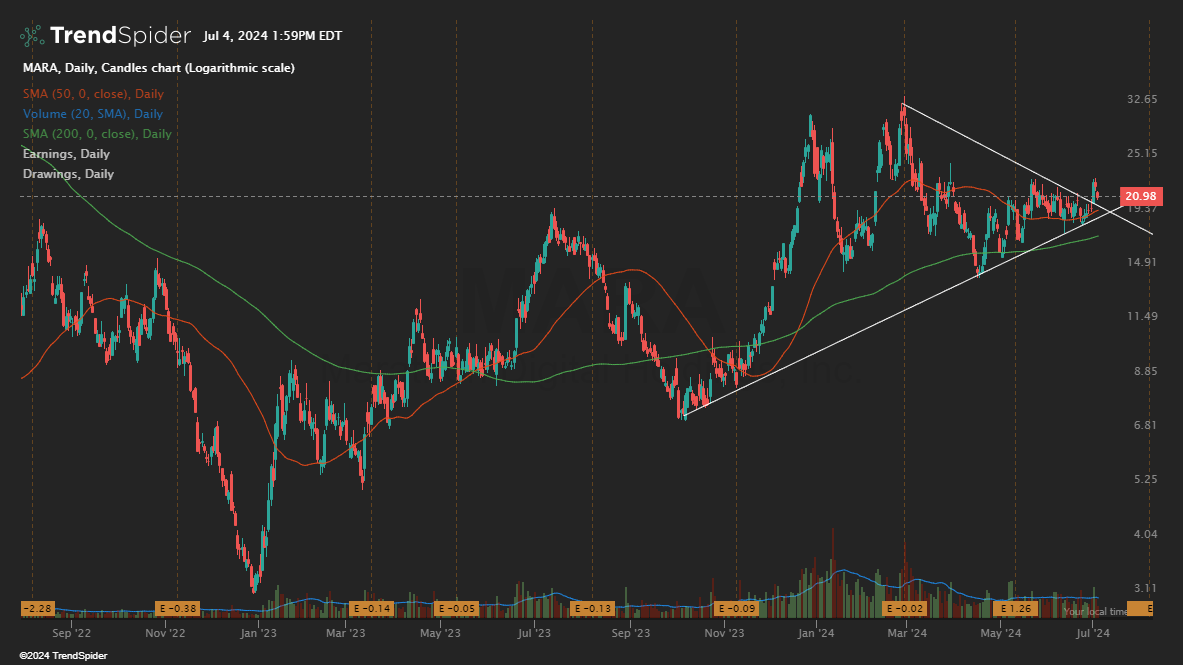

TrendSpider

The identical might be seen in 2021 when Bitcoin was shifting in a downward development whereas Marathon maintained its development. Within the following weeks, each Bitcoin and Marathon’s inventory climbed 113% and 230%, respectively, from their ranges when Bitcoin broke its downward development.

TrendSpider

The identical occurred once more in mid-2023 when Bitcoin shaped decrease highs and decrease lows, whereas Marathon maintained its sideway channel. Within the following weeks, Bitcoin and Marathon’s inventory climbed 21% and 90% respectively from their ranges when Bitcoin broke its downward development.

TrendSpider

A possible Bitcoin rally could possibly be supported by the TrendSpider chart above exhibiting the correlation between Bitcoin’s price motion and the crypto worry and greed index. The inexperienced circles on the chart above spotlight that at any time when the worry and greed index assessments the impartial zone, Bitcoin rallies, which is the case for the time being.

TrendSpider

In the meantime, the chart above exhibits that Marathon has efficiently damaged out of a symmetrical triangle sample with a retest of the trendline. This could possibly be an indication of a powerful upward motion within the close to time period.

Dangers

The principle threat to my thesis is Bitcoin’s price motion. Whereas the technicals and the expectations of decrease mining issue because of the document low hashprices may sign an upward motion within the cryptocurrency’s price within the coming weeks, Bitcoin may proceed its downward development, particularly if June’s non-farm payroll information, scheduled for July fifth, are damaging as this might lower the probabilities of the Fed chopping rates of interest this 12 months. Furthermore, Marathon’s enterprise into mining Kaspa might not present the forecasted outcomes if the cryptocurrency performs poorly.

Conclusion

In abstract, I stay bullish on Marathon following its June Bitcoin manufacturing replace that highlighted its effectivity when it comes to its revenues/EH, which was higher than its largest opponents Riot and CleanSpark. This could possibly be a promising signal for Marathon’s future monetary efficiency due to the expectations of mining issue declining by 5% in gentle of the document low hashprices that has pushed out inefficient miners.

Marathon’s new enterprise into mining Kaspa to diversify its digital property may additionally result in excessive returns thanks because it may generate round $87.4 million in annual revenues at extraordinarily excessive margins of up to 95%. In the meantime, the divergence between Marathon and Bitcoin’s price actions may sign a powerful rally for each Bitcoin and Marathon’s inventory, contemplating the historic information. Such a possible run is additional supported by Bitcoin’s price motion relative to the worry and greed index, in addition to Marathon breaking out of its symmetrical triangle chart sample. In gentle of those elements, I’m reiterating my purchase score for Marathon.

Editor’s Notice: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.