Litecoin (LTC), as soon as often known as the “silver to Bitcoin’s gold,” has badly underperformed the broader altcoin market for the reason that 2018 backside. Whereas LTC is up over 300% prior to now seven years, that pales in comparison with Ethereum and XRP, which gained greater than 3,300% and 750%, respectively, in the identical interval.

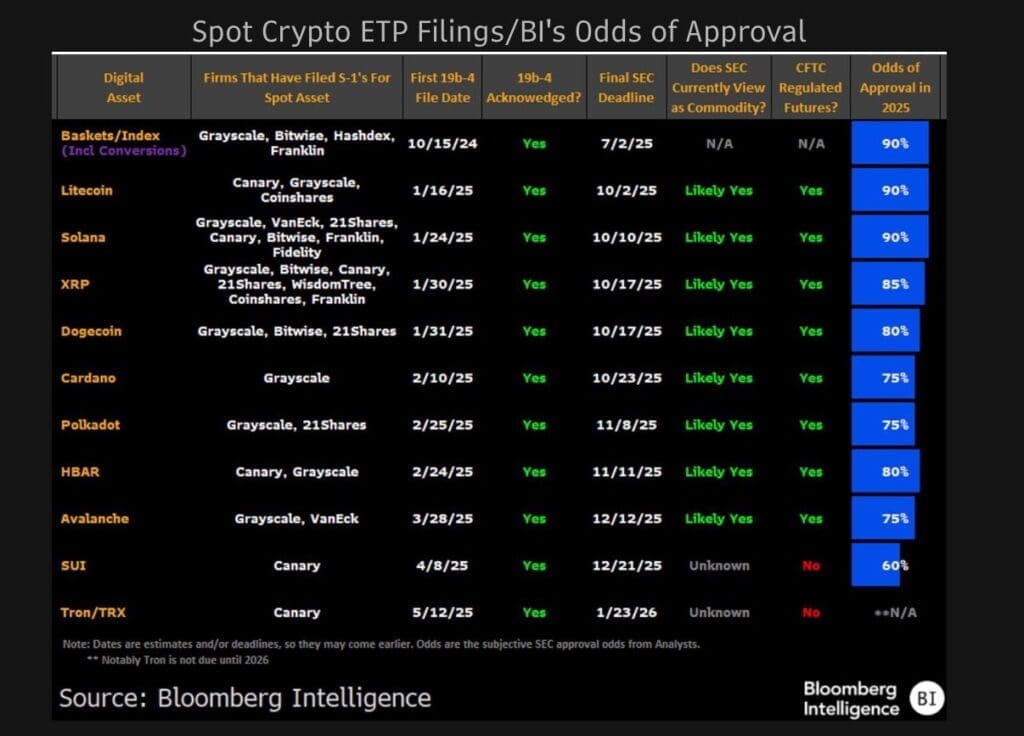

Now, which may be set to alter. A brand new Bloomberg Intelligence replace reveals Litecoin has the best odds of profitable spot ETF approval amongst main altcoins — doubtlessly reviving curiosity in one in every of crypto’s longest-standing belongings.

Litecoin is Main Altcoin ETF Race with 90% Approval Odds

LTC, alongside the layer-1 blockchain, Solana (SOL), holds a 90% likelihood of gaining spot ETF approval within the US by the top of 2025, in keeping with Bloomberg Intelligence’s crypto ETF dashboard. That locations them forward of XRP (85%), Dogecoin (80%), Cardano (75%), and Polkadot (75%).

Litecoin enjoys a regulatory edge. The SEC doubtless classifies it as a commodity resulting from a proof-of-work consensus mechanism like Bitcoin, and the CFTC already regulates its futures. These key elements simplify the trail to a spot ETF.

Grayscale, Canary, and CoinShares have all filed purposes, with the SEC set to resolve by Oct. 2, 2025.

Solana, though it shares the identical 90% approval odds, faces a extra difficult course of. It lacks CFTC-regulated futures and hasn’t obtained a transparent commodity designation from the SEC.

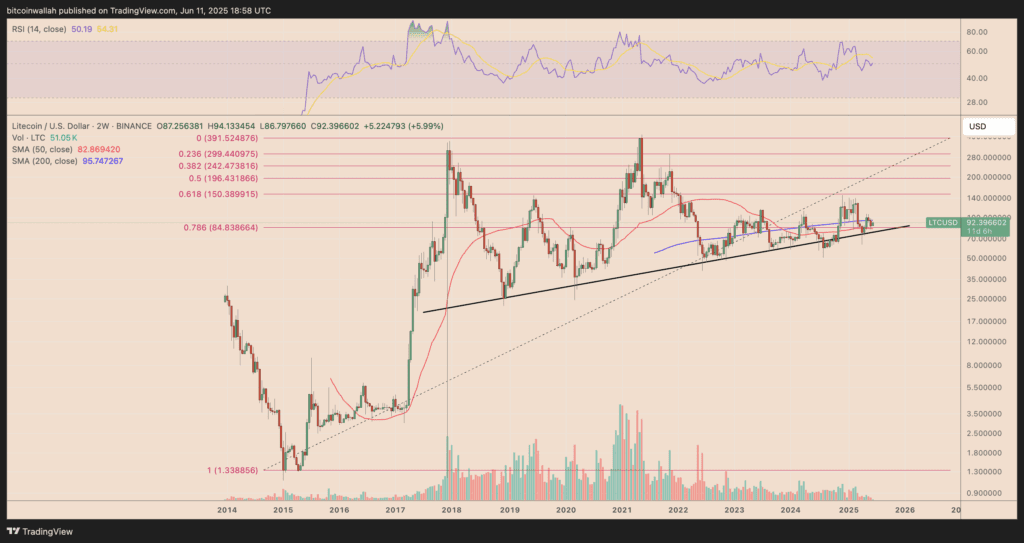

LTC Worth Holds Key Help, Eyes $150 as Subsequent Goal

Litecoin is exhibiting early indicators of a bullish reversal after defending a vital multiyear ascending trendline help. The most recent bounce additionally got here simply above the 0.786 Fibonacci retracement stage (~$84.83), reinforcing this zone as a robust accumulation space.

If the trendline holds, LTC could possibly be setting up for a transfer towards the 0.618 Fib stage close to $150, which additionally coincides with a earlier resistance vary from mid-2023. This is able to mark a roughly 60% acquire from present price ranges close to $92.

The 50-week and 200-week transferring averages — at present close to $83 and $95, respectively — are converging, forming a long-term determination level. A decisive breakout above this compression zone might gasoline a bigger upside push, particularly if ETF hypothesis intensifies in Q3.

The relative energy index (RSI) on the two-week chart stays impartial round 50, suggesting room for price growth with out triggering overbought situations.