YEREVAN (CoinChapter.com) — Kraken IPO plans are shifting ahead because the crypto trade explores a debt elevate of up to $1 billion. In line with a March 24 Bloomberg report, the trade is in discussions about securing funds starting from $200 million to $1 billion.

Goldman Sachs and JPMorgan Chase are among the many banks concerned within the Kraken fundraising talks. The funds will assist enlargement efforts, not each day operations, the report added.

Bloomberg has reported on Kraken IPO ambitions for almost a 12 months. Following the election of Donald Trump, discussions about Kraken going public have intensified. The potential IPO may happen within the first quarter of 2026, Bloomberg said.

Kraken Income and Trading Quantity Surge

Kraken financials present important progress in 2024. The trade reported $1.5 billion in income, a rise of 128% from the earlier 12 months. The corporate additionally recorded $380 million in adjusted earnings, reflecting its monetary efficiency.

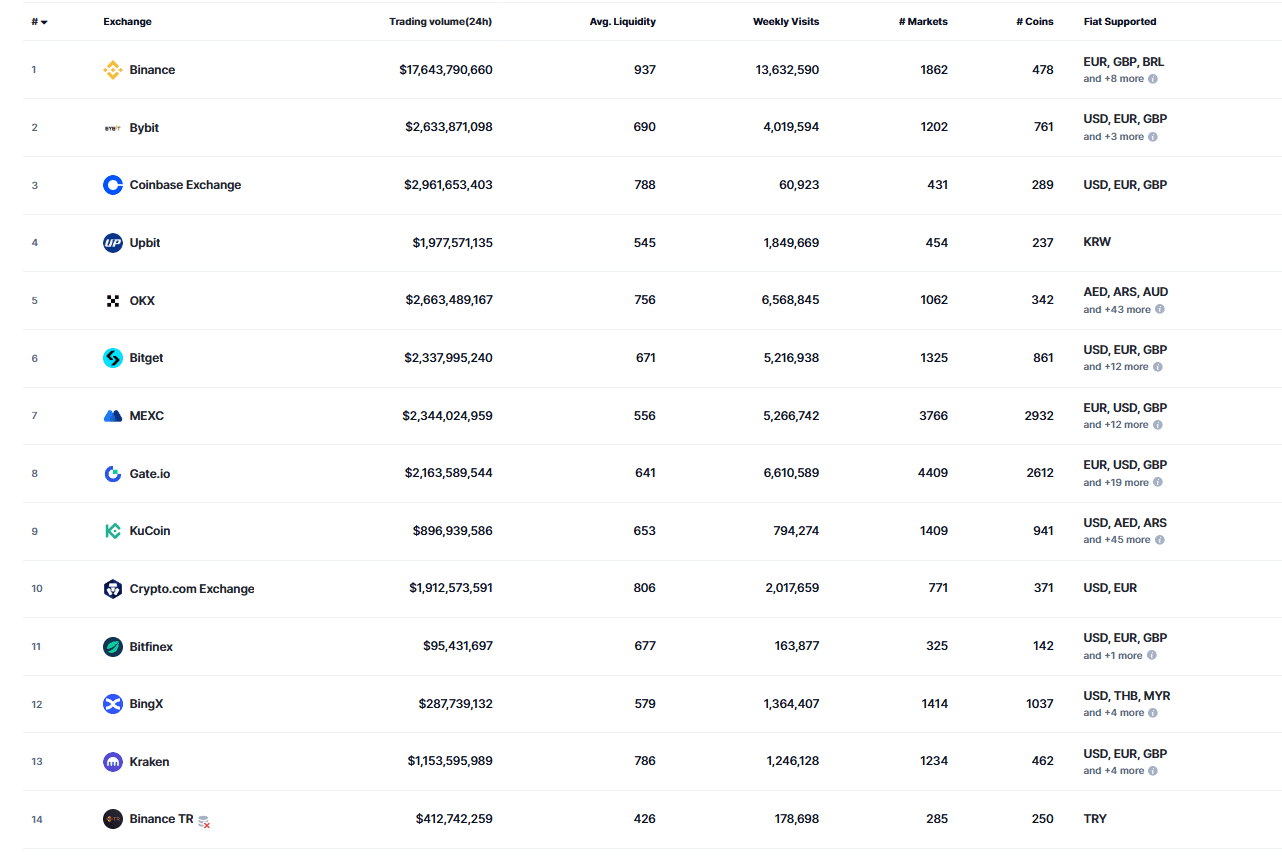

Every day Kraken buying and selling quantity reached $1.1 billion, in response to CoinMarketCap information. This positions Kraken as one of many largest cryptocurrency exchanges available in the market.

Kraken Expands With $1.5 Billion Acquisition

Kraken acquisition efforts proceed because the trade bought NinjaTrader for $1.5 billion. The brokerage service, based in 2003, focuses on futures contracts and operates beneath US Commodity Futures Trading Fee (CFTC) rules.

The Kraken acquisition is a part of its technique to develop within the derivatives market and develop into multi-asset companies comparable to equities and funds.

Kraken Staking Providers Resume within the US

Following adjustments in US rules, Kraken staking companies can be found once more after a two-year suspension. Customers in 37 states can now stake 17 cryptocurrencies, together with Ethereum (ETH) and Solana (SOL).

Regulatory developments have additionally affected Kraken SEC issues. Current studies point out that Kraken was amongst a number of crypto exchanges that averted SEC enforcement actions. This shift could affect the trade’s capability to maneuver ahead with its Kraken public itemizing.

With robust Kraken financials, rising buying and selling quantity, and main acquisitions, the trade is getting ready for a potential public debut in 2026.