Put up-halving, Bitcoin (BTC) miners face a squeeze as rewards drop and prices soar. Can progressive methods and market dynamics assist them keep worthwhile?

The Bitcoin halving is an occasion constructed into the Bitcoin protocol that happens roughly each 4 years. It ends in the discount within the reward miners obtain for including new blocks to the blockchain. The newest halving, which happened in April 2024, slashed the block reward from 6.25 BTC to three.125 BTC.

This occasion, central to Bitcoin’s deflationary nature, impacts the provision of recent Bitcoins and reverberates all through the Bitcoin mining trade and the broader crypto market, introducing a mixture of challenges and alternatives.

This text will study the post-halving world and the way the Bitcoin mining sector can adapt.

Squeeze on miners: understanding the challenges

Diminished rewards

One of many quick impacts of the halving was the slicing down of revenue margins for miners. By slashing miners’ block rewards, the halving immediately impacted their earnings since they began receiving fewer cash for his or her efforts.

On the time of writing, the greenback worth of Bitcoin’s block reward was about $215,000, with the cryptocurrency priced at about $68,800 per coin. Nonetheless, earlier than that, Bitcoin principally traded across the $60,000 stage, that means a typical block reward would have been value lower than $200,000.

In a dialog with crypto.information, Manthan Dave, co-founder of Ripple-backed crypto custody platform Palisade, said that the lowered rewards might trigger smaller and fewer worthwhile mining operations to shut store or drive them to affix up with others.

In his opinion, such a state of affairs might result in a higher centralization of the Bitcoin community since fewer and far bigger individuals could be concerned in working it.

“Everyone is feeling the squeeze post halving…We will see smaller, less efficient mining setups struggle or collapse. Consolidation will continue, sparking fears about centralization.”

Manthan Dave, Palisade co-founder

Bitcoin price dynamics: influence on the mining ecosystem

Put up-halving, miners wanted Bitcoin costs to be excessive for the potential earnings to justify the numerous vitality prices related to mining. In such a case, new miners could be inspired to affix the community, whereas current ones could also be motivated to develop their operations and improve vitality effectivity.

Then again, dropping Bitcoin costs might rapidly push miners into losses, a scenario that would drive much less environment friendly miners out of the market and reshape the mining sector within the course of.

The newest figures from market analyst agency MacroMicro present a snapshot of the generally unsustainable mining prices. Their knowledge exhibits that as of June 3, the common Bitcoin mining price was about $78,115, towards a Bitcoin price of $68,804.

It implies that the common mining prices to Bitcoin price ratio was about 1.14, which can have translated into slim pickings for a lot of BTC mining operations.

In line with a current CoinShare survey, a portion of much less worthwhile mining machines are anticipated to be shut down. Moreover, some miners are anticipated to relocate to areas the place they’ll entry cheaper electrical energy.

As an illustration, a Feb. 7 Bloomberg report indicated that about 21 BTC miners had struck offers with the Ethiopian authorities to maneuver their operations to the East African nation.

Elevated competitors

Following a halving occasion, competitors amongst miners usually intensifies as they vie for a smaller pool of rewards. This implies miners with extra environment friendly operations, entry to cheaper vitality sources, or economies of scale could have a aggressive benefit over their counterparts.

This heightened competitors might stress much less environment friendly miners to optimize their operations or exit the market altogether.

Nonetheless, Manthan Dave believes that gamers within the Bitcoin mining house affected by elevated competitors wouldn’t essentially depart the sector altogether. He thinks they may refocus their vitality on mining and minting different cryptocurrencies.

“Miners that are exiting the Bitcoin ecosystem due to cost reasons are unlikely to exit crypto itself,” Dave famous. “They are likely to reuse their hardware and switch to mining on other chains or redeploy capital into other operations such as staking.”

Community hashrate and mining problem adjustment

When revenue margins drop and drive some mining operations to close down or readjust, it invariably impacts Bitcoin’s community hashrate. The community hashrate is the full computational energy devoted to mining and processing Bitcoin transactions.

Usually, when Bitcoin’s price rises, the hashrate additionally will increase as mining turns into extra worthwhile, drawing in additional individuals and boosting computational energy. Conversely, if the hashrate falls, miners shut down their gear as a result of they’ll not make earnings.

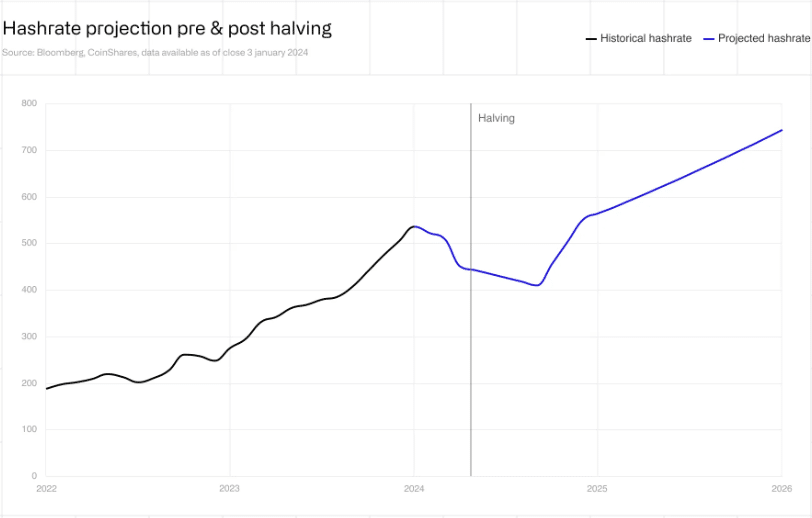

In line with Blockchain.com, the present hashrate is 612.99 EH/s, which remains to be under the all-time excessive seven-day shifting common of 629.75 EH/s recorded in April, 2024.

Nonetheless, the CoinShare report we quoted earlier predicted that the Bitcoin hashrate might attain 700 EH/s by 2025.

The Bitcoin protocol additionally has a built-in problem adjustment mechanism that often kicks in to both make it more durable or simpler to mine BTC, relying on the prevailing scenario.

This adjustment happens roughly each two weeks and is predicated on the time it took to mine the earlier 2016 blocks. It goals to take care of a mean block time of about 10 minutes always.

Potential treatments

Jurisdictional arbitrage

Consultants imagine that jurisdictional arbitrage, which is the follow of profiting from variations in rules, legal guidelines, and prices between totally different international locations or areas, might be a viable technique for miners looking for to optimize their operations.

Palisade co-founder Manthan Dave notes that jurisdictional arbitrage may be a big lever for brand new entrants into the Bitcoin mining sector, given the appreciable problem and capital depth concerned in beginning such operations.

“Jurisdictional arbitrage is a strong lever to pull for new entrants, considering it is already quite difficult and capital intensive to get started,” Dave identified. “Regulatory clarity in a jurisdiction where electricity costs are low can open up opportunities for new companies to launch mining operations.”

Completely different areas supply various ranges of regulatory readability and incentives, which might affect the place miners select to set up their operations. As an illustration, international locations with low electrical energy prices and favorable regulatory environments ought to develop into engaging hubs for mining actions after the halving.

Regulatory readability may present a big benefit, decreasing uncertainties and permitting miners to plan long-term investments.

There was a noticeable inflow of mining operations in areas like Texas, Kazakhstan, and the aforementioned Ethiopia, the place electrical energy is comparatively low cost and regulatory frameworks are conducive to mining.

Conversely, trade watchers anticipate strict rules and excessive vitality prices in different areas to drive miners to relocate and, within the course of, reshape the worldwide distribution of mining energy.

Diversification and adaptation

Within the face of halving-induced pressures, analysts additionally anticipate diversification to develop into a pivotal technique for miners.

It could take a number of varieties, from increasing into different cryptocurrencies to integrating further income streams, corresponding to providing cloud mining providers or leveraging extra warmth from mining operations for different industrial functions.

As an illustration, some miners, corresponding to Texas-based Lancium, have ventured into renewable vitality tasks, remodeling extra vitality into Bitcoin.

Others, like Bitfarms, are exploring vertical integration, encompassing every little thing from mining {hardware} manufacturing to setting up devoted vitality amenities.

The underside line with all these methods is to not solely improve profitability but additionally presumably contribute to the resilience of mining operations.

Spot Bitcoin ETFs: a game-changer in market dynamics

Market watchers additionally view the introduction of spot Bitcoin ETFs as having the potential to affect the dynamics round Bitcoin considerably. The merchandise supply a brand new avenue for funding and have attracted institutional traders, who could finish up offering a stabilizing impact on the Bitcoin market.

“Spot Bitcoin ETFs are a game-changer; they make it easy for institutions and investors to hold Bitcoin for the long term without the need for managing private keys. This consistent buy pressure will counteract the sell pressure from miners, leading to a more stable and bullish Bitcoin market.”

Manthan Dave, Palisade co-founder

Moreover, the elevated accessibility and legitimacy introduced by ETFs might result in lowered volatility, a long-standing challenge throughout the crypto market. A extra stabilized market might imply higher costs and, inevitably, higher revenue margins for miners.

Analysts have additionally advised that ETFs can doubtlessly influence investor sentiment, instilling higher confidence and inspiring extra substantial capital flows into Bitcoin. This inflow of institutional cash can present the liquidity wanted to help market stability, benefiting not simply traders however miners as nicely.

Sharing his perception on the subject, Manthan Dave famous that in the long run, ETFs will increase confidence in crypto and scale back the general market’s volatility. He talked about that the launch of an Ethereum ETF stays to be seen, which will definitely convey new capital because of Ethereum being extra ecologically viable than Bitcoin due to its a lot decrease vitality consumption. Nonetheless, he cautioned that it’s also doubtless to attract capital out of the Bitcoin ETF as traders search to diversify.

Runes to the rescue?

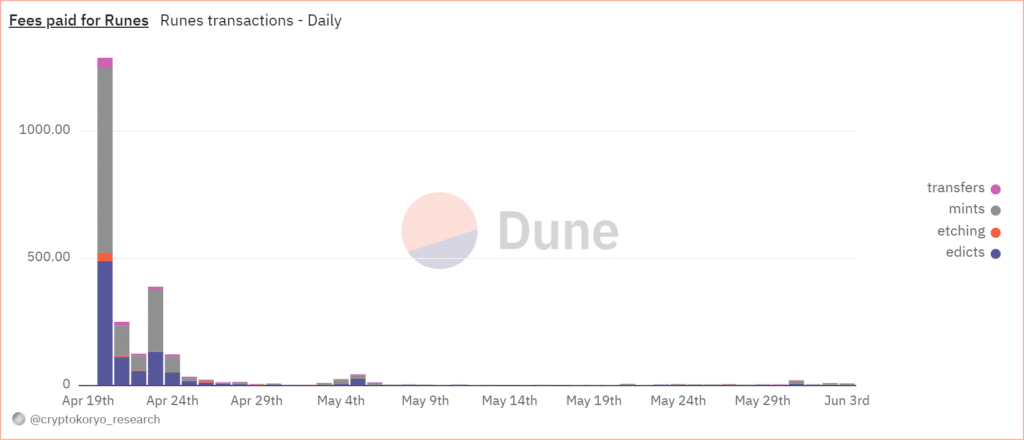

One other attention-grabbing case for BTC miners post-halving has been the launch of the Runes protocol on the Bitcoin community. The protocol, whose introduction coincided with the fourth Bitcoin halving occasion, helps create fungible tokens on the Bitcoin community through the use of its block areas extra effectively than the BRC-20 protocol.

It got here as a blessing of types for BTC miners. The elevated transaction quantity from Runes etchings helped keep miner income for some time, with miners raking in a complete of two,253 BTC in charges in simply the primary two weeks following the Runes launch.

Information from Dune Analytics from round that point confirmed that greater than 80% of transactions on the Bitcoin community have been Runes-related, with precise BTC transactions dropping to lower than 20% of the full.

The elevated variety of transactions meant elevated community charges, which translated to extra money for miners. Nonetheless, the windfall appears to have been short-lived, with subsequent figures from Dune indicating that the variety of Runes transactions has been persistently dwindling.

Forecasting the longer term: Bitcoin’s trajectory

Predicting Bitcoin’s price trajectory post-halving includes analyzing varied market tendencies and components. Traditionally, Bitcoin’s price has skilled vital appreciation following halvings, pushed by lowered provide and elevated demand.

Nonetheless, the present panorama presents distinctive challenges, together with macroeconomic components and evolving regulatory environments. Business consultants have provided a spread of views on Bitcoin’s future.

Some foresee continued development fueled by rising adoption and technological developments. Others have cautioned towards potential pitfalls, corresponding to regulatory crackdowns and market saturation.

Regardless, the long-term outlook for Bitcoin and the mining ecosystem stays optimistic, with consultants like Manthan Dave anticipating the price of BTC to get near the $100,000 mark earlier than 2025.

“Looking at what’s on the horizon, it is likely that we will see Bitcoin teasing $100,000 by the end of this year,” predicted the Palisade co-founder.