As we method mid-2025, a confluence of macroeconomic indicators, institutional involvement, and technical indicators is stirring optimism amongst market observers. Might we be on the cusp of the subsequent vital crypto uptrend?

Macroeconomic Components Shaping Market Sentiment

One of many essential drivers behind the potential shift to an upward pattern is the evolving macroeconomic panorama. Latest indicators from america Federal Reserve counsel a possible pause or discount in rates of interest, aiming to stabilize an financial system grappling with excessive inflation and risky development patterns.

Decrease rates of interest historically incentivize buyers to hunt higher-risk belongings, together with cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), pushing liquidity into these markets.

Additional amplifying optimistic sentiment is the shift in regulatory attitudes globally. Notably, regulatory readability in main economies akin to america and Europe has progressively improved.

Latest developments, akin to clearer crypto asset tips by the U.S. Securities and Alternate Fee (SEC) and the EU’s Markets in Crypto-assets (MiCA) framework implementation, present stronger foundations for institutional capital inflows, decreasing uncertainty and fostering confidence amongst retail buyers.

Institutional Curiosity: A Catalyst for Uptrend

Institutional funding has repeatedly confirmed to be a big indicator of impending market traits. The primary half of 2025 has seen substantial institutional curiosity development, characterised by elevated investments from asset administration giants like BlackRock, Constancy, and Vanguard.

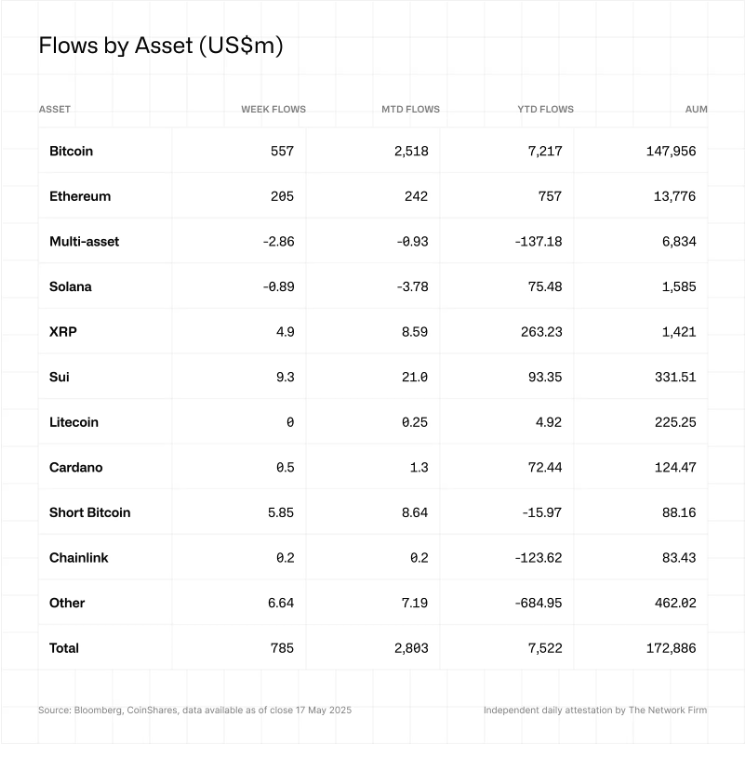

Latest information from CoinShares signifies institutional crypto merchandise have attracted inflows of over $4 billion within the first half of 2025 alone, reflecting confidence within the long-term viability of cryptocurrencies as hedging devices and strategic portfolio belongings.

Supply: CoinShares

Moreover, the approval of a number of Bitcoin spot exchange-traded funds (ETFs) globally has boosted market confidence. In america, the long-awaited approval of the Bitcoin spot ETF by outstanding monetary establishments, together with BlackRock and Constancy, marks a crucial inflection level.

Following the approval, belongings beneath administration (AUM) in these ETFs shortly surpassed $10 billion inside the preliminary month, underscoring robust institutional demand. The ETF launch has considerably lowered the obstacles to entry for conventional buyers, offering direct, regulated publicity to Bitcoin’s price actions, thereby increasing potential market participation considerably.

Cash is Quietly Returning – However Not Everybody Sees It

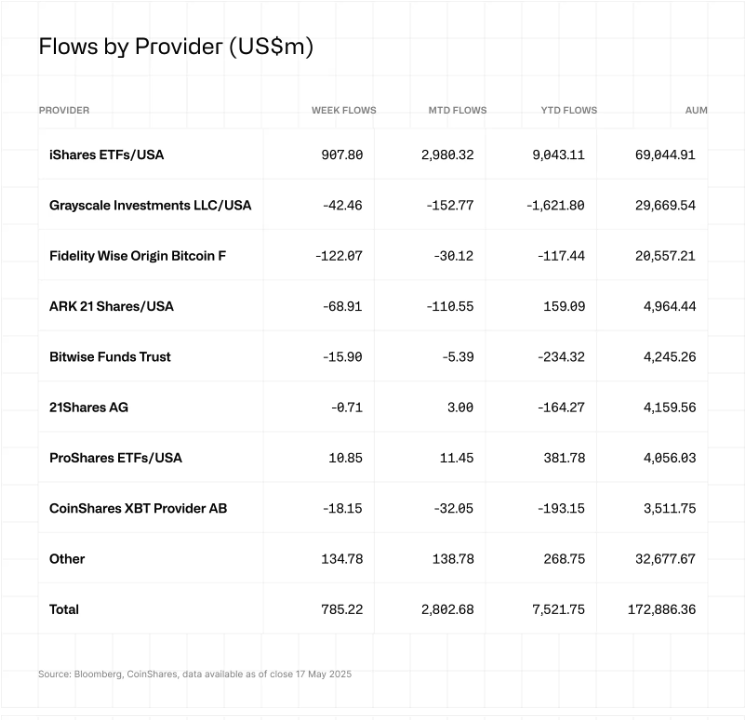

Curiously, regardless of ongoing cautious rhetoric from the Fed relating to financial easing, delicate indicators point out that liquidity is quietly returning to world markets. Within the U.S., the Treasury Basic Account (TGA) has seen over $500 billion circulate again into industrial banks, a consequence of Treasury spending in the course of the debt ceiling negotiations.

This oblique liquidity injection, even with out specific quantitative easing (QE), has considerably boosted market liquidity.

Supply: MacroMicro

China has additionally stealthily boosted liquidity by decreasing reserve requirement ratios, increasing company credit score strains, and subtly devaluing the Yuan towards gold.

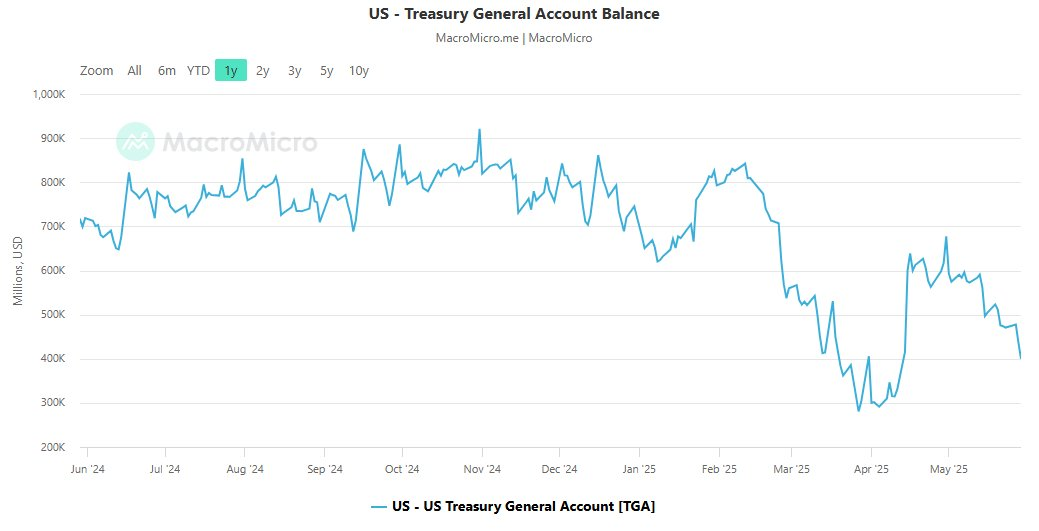

Equally, Europe and Japan, constrained by rising bond yields, have quietly intervened in bond and foreign money markets by way of repo operations and bond repurchases, not directly restoring market liquidity.

Supply: LSEG

In accordance with Michael Howell, CEO of Crossborder Capital, this shift is structural fairly than cyclical, pointing in direction of sustained liquidity flows. Historic patterns point out such liquidity initially targets lower-risk belongings like Bitcoin, earlier than ultimately trickling down into higher-risk altcoins, repeating patterns from earlier market cycles.

Market Sentiment and Investor Confidence

Investor sentiment typically serves as a worthwhile precursor to pattern reversals or continuations. Latest information from blockchain analytics platforms akin to Glassnode and Santiment have highlighted a big uptick in accumulation behaviors by whales and institutional addresses, notably noticeable in Bitcoin and Ethereum holdings.

Massive buyers accumulating during times of price stabilization counsel rising confidence in potential upside actions.

Supply: Glassnode

Nonetheless, market sentiment stays blended. Whereas bullish indicators are evident, warning persists amongst retail buyers on account of current volatility and historic priority of speedy reversals.

Social sentiment indicators illustrate rising however cautious optimism, suggesting that retail buyers await extra decisive bullish confirmations earlier than committing additional capital.

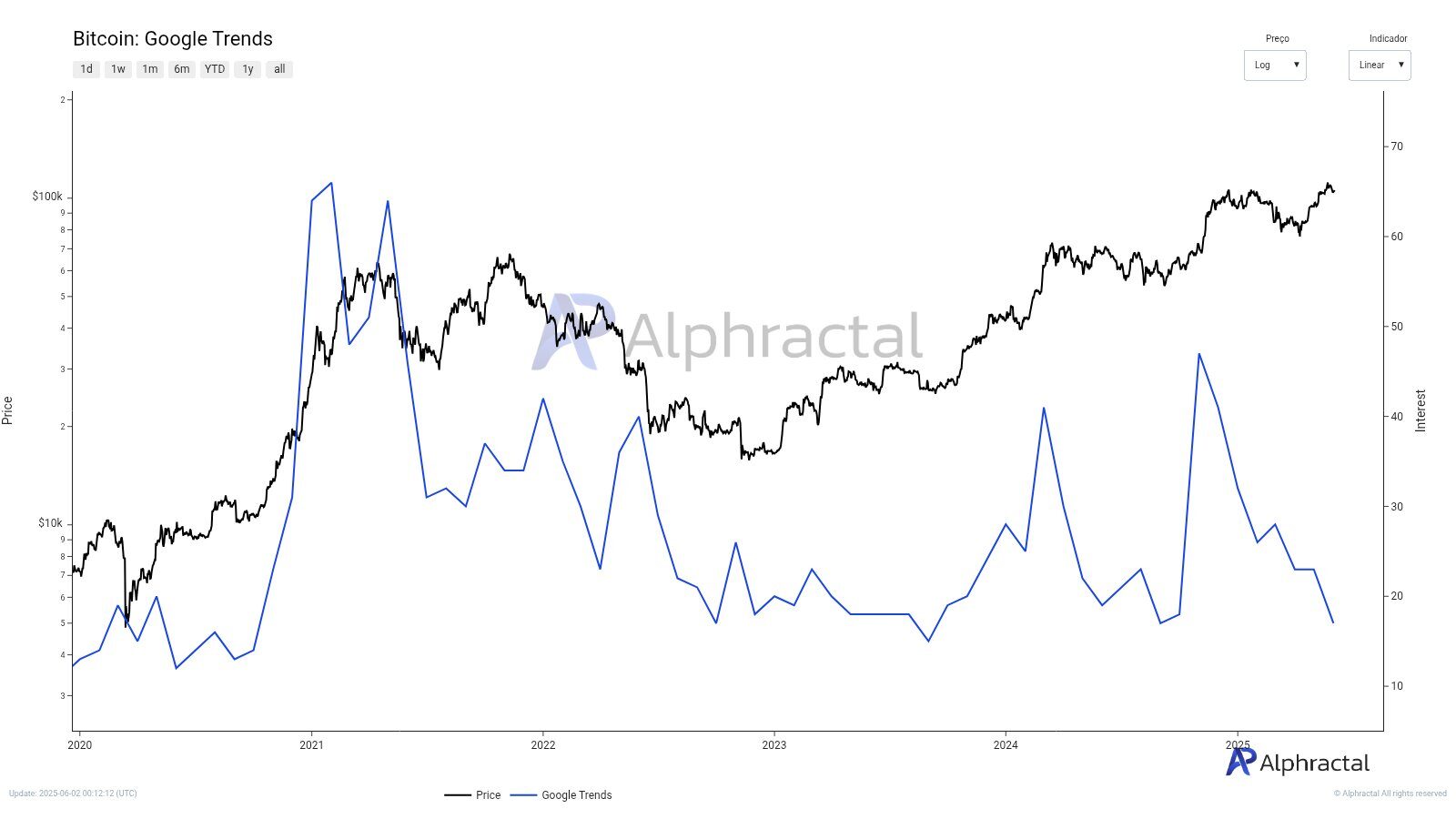

Curiously, current information from Google Traits gives further insights into present market engagement ranges. Google searches for Bitcoin have dropped to 17 factors – ranges noticed beforehand when Bitcoin traded at $54,000 (September 2024) and $26,000 (August 2023).

Supply: Alphractal

This matches curiosity ranges from the market backside in late 2022, regardless of Bitcoin presently buying and selling above $100,000. The comparatively low public search curiosity signifies a scarcity of ample engagement and implies the market may have vital volatility within the coming weeks to reignite widespread investor curiosity and curiosity.

Conclusion

Contemplating the present mix of macroeconomic elements, rising institutional adoption, technical indicators, and measured investor sentiment, there’s compelling proof supporting the potential onset of a cryptocurrency market uptrend. Nonetheless, prudence stays advisable given historic market volatility and protracted exterior dangers.

Traders are inspired to intently monitor key indicators, akin to regulatory developments, institutional funding flows, and technical help and resistance ranges, to make knowledgeable selections. Whereas optimism is warranted, complete threat evaluation stays crucial to navigating the complexities of crypto market cycles successfully.

Learn extra: Trading with Free Crypto Indicators in Night Dealer Channel