Picture supply: Getty Pictures

The S&P 500 jumped 23.3% final yr, the second consecutive annual rise above 20%. And it’s already round 2% increased in 2025.

However is the surging index heading in the direction of a correction (that’s, a ten% fall)? Listed here are my ideas.

Arguments for

Extremely, the S&P 500 has delivered a return above 20% in 4 out of the previous six years. On a complete return foundation (together with dividends), it has been above 25% for 4 of these years, with a Covid-struck 2020 producing ‘just’ 18.4%.

| Yr | Value return | Whole return |

|---|---|---|

| 2019 | 28.88% | 31.49% |

| 2020 | 16.26% | 18.40% |

| 2021 | 26.89% | 28.71% |

| 2022 | −19.44% | −18.11% |

| 2023 | 24.23% | 26.29% |

| 2024 | 23.31% | 25.02% |

Traditionally although, these returns are far increased than traditional for the index. Certainly, the final interval there have been such monster returns clumped collectively was within the late Nineties. And we all know what adopted that increase…

| Yr | Value return | Whole return |

|---|---|---|

| 1995 | 34.11% | 37.58% |

| 1996 | 20.26% | 22.96% |

| 1997 | 31.01% | 33.36% |

| 1998 | 26.67% | 28.58% |

| 1999 | 19.53% | 21.04% |

| 2000 | −10.14% | −9.10% |

| 2001 | −13.04% | −11.89% |

| 2002 | −23.37% | −22.10% |

After all, this doesn’t assure that one thing related will occur this time round. However each then and now, there was the daybreak of a revolutionary new know-how that was getting traders excited (the web and synthetic intelligence (AI), respectively). Would possibly historical past be rhyming right here? It’s doable.

Furthermore, Donald Trump has promised/threatened widespread tariffs, which many economists predict can be inflationary. In that case, this might be a hindrance to rate of interest cuts.

Lastly, the index is extraordinarily richly valued, with a ahead price-to-earnings (P/E) ratio of 21.6. This excessive start line makes it tougher for company earnings to develop at a fee that justifies the valuation.

The index carried out very strongly the final time Trump was in command of the US economic system. Nevertheless, the a number of is at the moment round 27% increased than it was when he took workplace in early 2017. Subsequently, a correction might be on the playing cards.

Arguments in opposition to

Yesterday (20 January), the brand new President was sworn in. In his speech, he promised to spice up client spending energy by reducing vitality payments, taxes, and inflation, thereby making the economic system stronger within the course of. He even talked about placing the American flag on Mars.

Given this optimism, it might be argued 2025 can be yet one more constructive yr for the S&P 5OO. Speak about a US recession has pale, animal spirits are sturdy, and rates of interest nonetheless look set to maneuver decrease.

How I’m responding

The temper within the US proper now’s extremely bullish. My hunch then is that the index will chug increased this yr, however that it gained’t ship a 3rd straight double-digit return. Naturally, I might be completely improper.

What I’m extra sure about although is that particular S&P 500 shares seem grossly overvalued. One is Palantir Applied sciences (NASDAQ: PLTR), whose share price has exploded 1,017% because the begin of 2023.

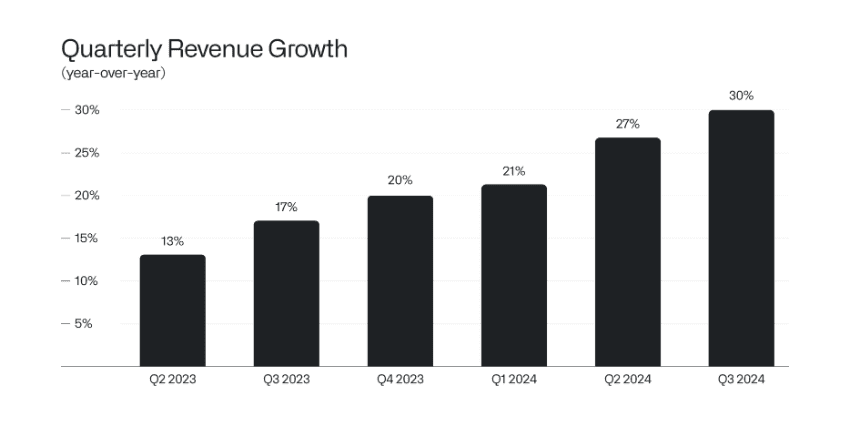

Palantir gives AI options to each authorities organisations and firms. It has been rising like wildfire, with third-quarter income up 30% yr on yr to $725m.

Income has truly accelerated for six straight quarters!

Palantir additionally generated a document $144m in internet revenue. And CEO Alex Karp struck an extremely bullish tone: “A juggernaut is emerging. This is the software century, and we intend to take the entire market.”

Clearly then, there’s so much to love about this AI firm. Nevertheless, the inventory is buying and selling at an eye-watering price-to-sales (P/S) a number of of 66. The ahead P/E ratio is above 150. If development normalises, these valuations are seemingly unsustainable.

Palantir is the kind of overvalued S&P 500 inventory that I’m avoiding proper now.