Picture supply: Rolls-Royce Holdings plc

During the last 5 years, the Rolls-Royce (LSE:RR) share price has gone from 98p to £9.38. In different phrases, it’s up 859% and has left the remainder of the FTSE 100 within the mud.

A few of that is clearly the results of Covid-19 challenges subsiding, however the inventory is now over 100% above the place it was earlier than 2019. So have buyers missed their alternative?

Progress drivers

Basically, there are two the explanation why share costs go up. One is the enterprise begins making more cash and the opposite is buyers change into extra optimistic about its future prospects.

Over the previous couple of years, Rolls-Royce has benefitted from each. Disruption throughout the pandemic has made earnings unusually risky, however a take a look at the agency’s gross sales provides illustration.

The corporate’s whole revenues have elevated by round 65% since 2020. However this alone isn’t sufficient to account for a bounce of over 850% within the inventory.

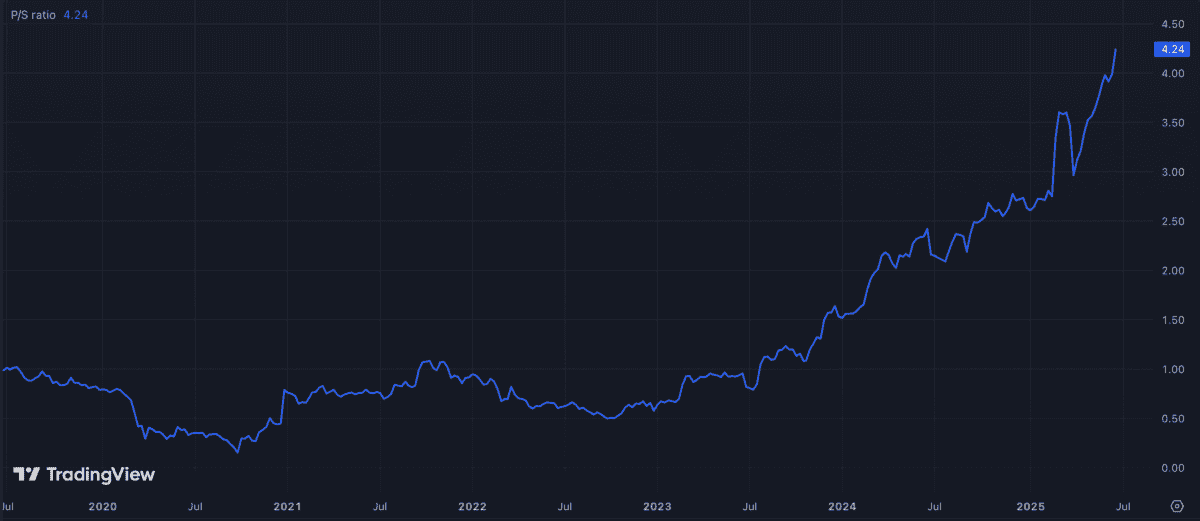

The massive change is within the price-to-sales (P/S) a number of the inventory trades at. This has gone from just under 1 in 2020 to 4.22 – a rise of 322%.

Rolls-Royce P/S ratio 2020-25

In different phrases, there’s little doubt Rolls-Royce has produced some excellent outcomes over the past 5 years. However the greatest cause for the rising share price has been a number of enlargement.

Essentially, meaning expectations for the corporate are larger than they had been. And this implies buyers want to think twice about whether or not or not it could meet these.

Expectations

Analyst expectations for the agency are for revenues to succeed in round £23.5bn by 2028. Based mostly on the corporate’s present market worth, that means a future price-to-sales a number of of just below 3.5, which is unusually excessive.

Excessive multiples aren’t normally signal, however there’s extra to see right here. Rolls-Royce has comparatively excessive fastened prices, which means larger gross sales usually lead to wider margins and earnings that develop at a sooner fee.

This will lower each methods – when issues go incorrect (reminiscent of throughout a pandemic) a comparatively small hit to gross sales can have an outsized impact on income. However excessive fastened prices could be a highly effective power when issues go nicely.

Analysts are certainly anticipating earnings per share to develop extra rapidly, reaching 36p in 2028. At at present’s costs, that’s a price-to earnings (P/E) a number of of 26.

There are plenty of potential alternatives forward of Rolls-Royce. These embrace increasing into narrow-body plane, small modular nuclear reactors, and a shift to sustainable aviation fuels.

All or any of those might increase revenues and income over the following few years. However the present share price appears to think about plenty of optimism and small disruptions can have giant results.

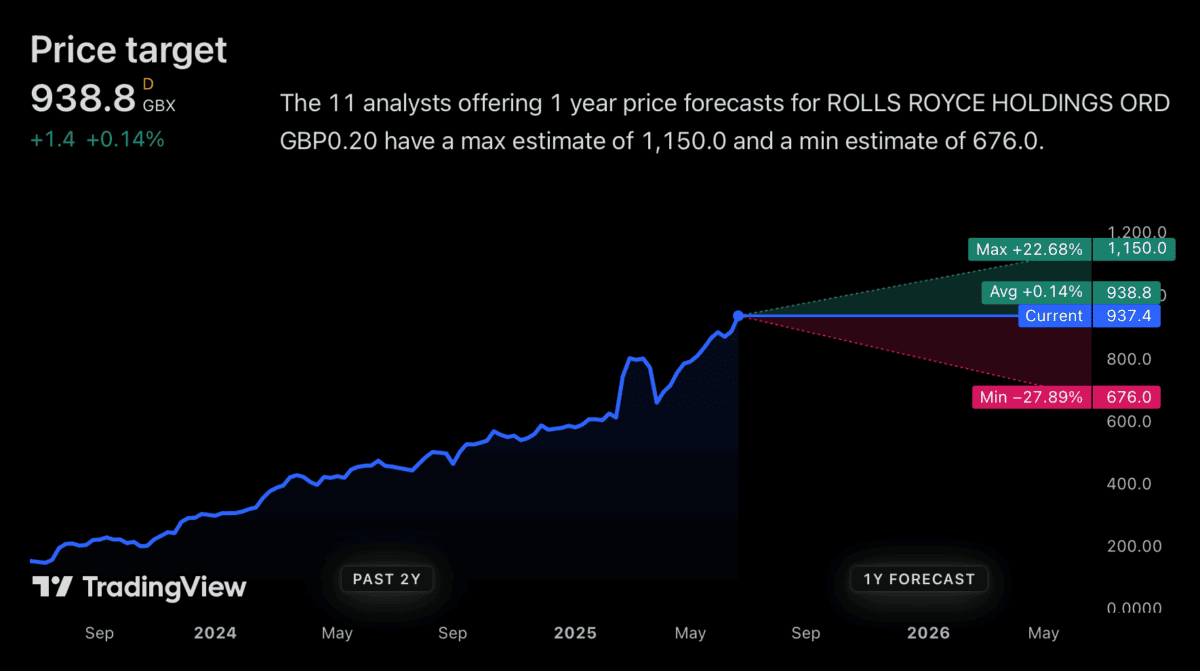

Worth targets

Regardless of the optimistic progress assumptions, analysts don’t have large expectations for the Rolls-Royce share price. The typical price goal is nearly precisely the inventory’s present stage.

My sense is the analysts have this one proper. The present price displays some excessive expectations and whereas the corporate might exceed these, I don’t assume it’s particularly probably.

I’m subsequently not anticipating the Rolls-Royce share price to do in addition to it has performed over the previous couple of years. I’ve obtained my eye on different FTSE 100 alternatives in the meanwhile.