Picture supply: Getty Photos

Broadly talking, the UK’s large- and mid-cap shares have staged a formidable rebound of late. But even after this restoration, the valuations on FTSE 100 and FTSE 250 shares are nonetheless remarkably low by world requirements, providing what could also be a uncommon alternative for buyers to construct long-term wealth.

Proper now, the price-to-earnings (P/E) ratios for the Footsie and the FTSE 250 are 16.2 instances and 12.6 instances, respectively. That’s an enormous low cost to the S&P 500, whose ratio is 23.8 instances, and the Nikkei 225, which has a a number of of 19.3.

This means there may very well be vital scope for capital development, although valuations aren’t the one motive I’m bullish right now. Historic market tendencies additionally counsel UK shares may expertise a considerable upswing.

FTSE 100 in focus

Let’s take the FTSE 100 for instance. In accordance with knowledge from Curvo, buyers have usually loved their strongest returns within the months following a market correction.

The UK’s premier share index slumped 11.8% in September 2002, earlier than bouncing 8.7% the next month. And in March 2020, it dropped 13.4% — its worst month-to-month efficiency on report — earlier than hovering 12.7% the next November, its best-ever month-to-month rise.

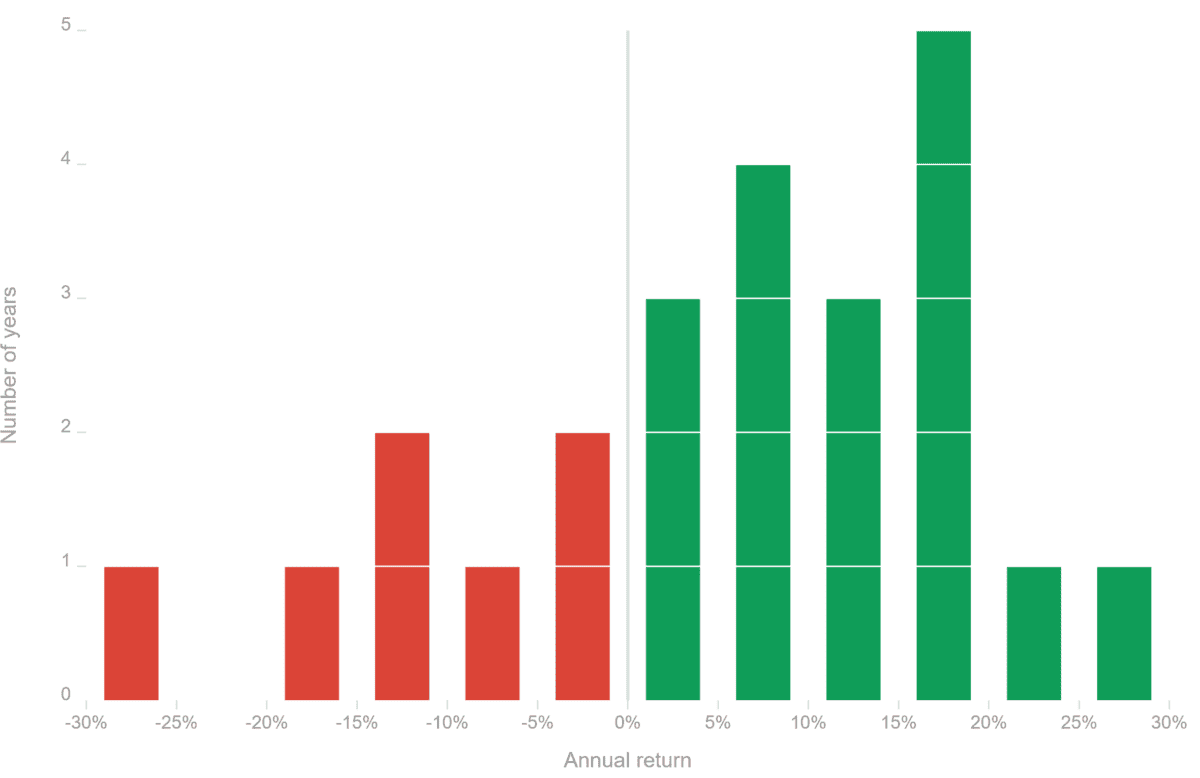

Curvo’s research additionally reveals that market downturns in that point have continuously been adopted by extended rallies. Because the chart beneath reveals, the FTSE 100 has delivered a optimistic return in 17 (71%) of the final 24 years.

The index has recovered from a worldwide pandemic, banking sector collapse, struggle, AND a debt disaster in Europe to provide buyers a fats return. Certainly, somebody who parked £10,000 in FTSE 100 shares in April 2000 would have seen the worth of their funding swell to £34,169 by February simply handed.

A UK inventory fund

In fact previous efficiency shouldn’t be all the time a dependable information to the longer term. However Curvo’s knowledge actually suggests now may very well be an excellent time to think about shopping for Footsie shares.

As I say, the cheapness of FTSE 100 and FTSE 250 firms gives room for UK shares to maintain rebounding. And particularly in order uncertainty over US financial and overseas coverage supercharges investor curiosity in European shares.

Given the high-risk atmosphere in the meanwhile, buying an exchange-traded fund (ETF) may very well be value contemplating to unfold threat and goal giant returns. The SPDR FTSE UK All-Share ETF (LSE:FTAL) is one such fund alone watchlist right now.

This ETF provides nice diversification, with 371 holdings spanning the London inventory market. It additionally gives sturdy publicity to secure UK blue chips and mid-cap development shares, with present weightings of:

- 81% in FTSE 100 shares

- 16% in FTSE 250 shares

As you possibly can see, this fund can also be effectively diversified by sector, offering energy in case of underperformance in a single or two areas. As well as, it holds a broad vary of multinational firms (together with HSBC, Unilever, and Rolls-Royce), which means it additionally provides geographic diversification.

Since 2012, the FTSE 100 All-Share Index has delivered a median annual return of seven%. That’s strong moderately than spectacular, however I feel it may enhance sharply from this level for the explanations I’ve described, giving a considerable increase to buyers’ wealth.