China’s central financial institution added 5 tonnes of gold in March 2025, hitting a document 2,292 tonnes, whereas secretly shopping for 50 tonnes in February, per Goldman Sachs. As China dumps U.S. Treasuries and stockpiles gold, whispers of a looming commerce battle develop louder. May these developments shake the worldwide monetary order—and the place does crypto match within the chaos?

Surprising Indicators China’s Bracing for a Commerce Struggle Explosion

China’s monetary maneuvers lately counsel a strategic preparation for financial turbulence, probably within the type of a commerce battle.

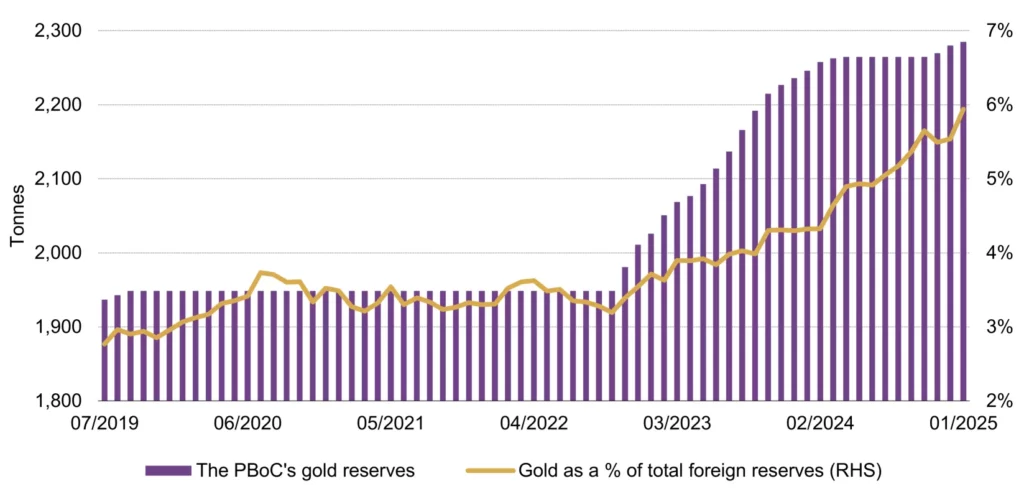

One of many clearest indicators is the nation’s systematic discount of U.S. Treasury holdings. In line with FXStreet, China offloaded $22.7 billion in U.S. Treasuries in February alone, a transfer that raises questions on who will fund the U.S. authorities’s borrowing spree as overseas buyers like China step again. On the similar time, China has been aggressively accumulating gold, with the central financial institution PBoC (Individuals’s Financial institution of China) including over 300 tonnes to its reserves since October 2022.

This pattern of promoting U.S. debt whereas stockpiling gold signifies a deliberate shift away from reliance on the U.S.-dominated monetary system, probably in anticipation of commerce tariffs, sanctions, or different financial retaliations.

The PBoC reported its third consecutive month-to-month gold buy in January – Supply: State Administration of International Trade, World Gold Council

One other telling signal is China’s obvious effort to undermine the greenback’s world hegemony by way of gold. By accumulating gold, an asset that can’t be frozen or devalued by overseas powers, China is positioning itself to climate potential monetary sanctions, much like these imposed on Russia following the Ukraine battle.

Furthermore, there are discussions of a gold-backed BRICS forex, which may problem the greenback’s dominance in world commerce. These actions counsel that China is making ready for a commerce battle and laying the groundwork for a broader restructuring of the worldwide monetary order.

What China’s Daring Strikes Actually Imply for the World

China’s actions communicate to a multifaceted technique aimed toward each protection and offense within the world financial enviornment. Defensively, gold serves as a hedge towards inflation, forex devaluation, and geopolitical dangers.

China’s gold accumulation helps defend its reserves from the eroding results of a weakening U.S. greenback, which may end result from escalating commerce conflicts or broader financial instability. Offensively, China seems to be positioning the yuan as a viable various to the greenback.

By rising its gold reserves and probably re-pegging the yuan to gold (even symbolically), China may make its forex extra enticing to the World South and BRICS nations.

Moreover, China’s latest coverage modifications, similar to permitting insurance coverage firms to spend money on gold, sign a home push to bolster gold demand. If expanded, this might result in a further 500 tonnes of gold demand, additional solidifying China’s grip on the worldwide gold market.

Crypto Caught within the Crossfire—Will Bitcoin Soar or Crash?

The crypto market, particularly Bitcoin, is going through a important juncture amidst this financial turmoil. In line with Swan Bitcoin, world financial uncertainties, similar to extreme debt ranges, forex devaluation, and geopolitical tensions, create a positive atmosphere for Bitcoin.

As China and different nations scale back their reliance on the greenback, buyers could more and more flip to decentralized belongings like Bitcoin as a hedge towards fiat forex dangers. Max Keiser’s prediction of Bitcoin reaching $200,000 in 2024 could appear optimistic, however the underlying logic holds: as belief in conventional monetary programs wavers, capital may circulation into cryptocurrencies.

BTC has seen constructive indicators lately – Supply: TradingView

Nonetheless, the crypto market’s response will not be uniformly constructive. Bitcoin, usually dubbed “digital gold,” may see elevated demand as a safe-haven asset. However, smaller altcoins would possibly face volatility. Regulatory uncertainties may result in panic promoting if governments crack down on crypto in response to shifting monetary energy dynamics.

Moreover, if a commerce battle escalates, risk-off sentiment would possibly initially drive buyers away from speculative belongings, together with altcoins, whereas favoring extra established cryptocurrencies like Bitcoin.

Learn extra: JP Morgan: Traders Want Gold Over Bitcoin as a Secure-Haven

In the long run, the circulation of capital into crypto may surge as nations and people search alternate options to the dollar-based system. A gold-backed BRICS forex would possibly even encourage the creation of gold-backed stablecoins, bridging conventional and digital finance. For now, the crypto market continues to be a speculative battleground, with Bitcoin more likely to profit most from the uncertainty fueled by China’s actions, whereas smaller tokens navigate by way of extra turbulent waters.