Avalanche’s AVAX token reveals indicators of resilience because it navigates via the cooling crypto market circumstances. On Might 30, 2025, AVAX traded close to $21.45 after dropping over 13% from Might 29’s excessive close to $24.34. The downtrend probably resulted from the broader market cooling down, with Bitcoin (BTC) dropping under $106,000 and the Ethereum (ETH) price barely holding above $2,600.

The token’s price drop got here amid a surge in community exercise. Every day transactions not too long ago jumped to almost 12.9 million, pushed by the launch of MapleStory N, a blockchain-based MMORPG by Nexon. The sport has drawn greater than 590,000 energetic wallets, positioning Avalanche as a key participant in Web3 gaming infrastructure.

In the meantime, Avalanche has made inroads into real-world asset tokenization. Avalanche has additionally made different partnerships that might assist the token develop into one of many merchants’ favorites within the coming month.

Moreover, AVAX price technicals assist a bullish future for the Avalanche token’s price in June 2025.

Ecosystem Progress and Mainstream Adoption

Avalanche’s ecosystem is present process an accelerated growth section, positioning it as a viable contender for breakout efficiency in June 2025. The momentum stems from a mixture of retail engagement and institutional onboarding, which continues to validate the community’s infrastructure in real-world purposes.

The mixing of MapleStory N on Might 15 sparked an explosion in on-chain exercise. Avalanche’s every day transactions surged previous 12 million on Might 27, surpassing its Q1 2025 common of three.8 million. The MapleStory market alone recorded over $4 million in quantity, supported by 590,000 energetic wallets and three.5 million particular person transactions.

Excessive-value trades, such because the Fafnir Guardian Hammer promoting for $6,500, spotlight Avalanche’s power in processing tokenized digital belongings at scale. For a community dealing with each asset safety and transaction throughput, this degree of exercise underlines its technical maturity.

Past gaming, Avalanche is deepening its footprint in real-world asset tokenization. Bergen County, New Jersey, has launched a five-year program to put 370,000 property data, valued at practically $240 billion, on Avalanche’s blockchain.

The initiative streamlines documentation throughout 70 municipalities and nearly 1 million residents, bringing effectivity to historically opaque actual property registries. Furthermore, it reinforces the Layer-1 community’s attraction in enterprise-grade purposes, echoing comparable strikes seen in India’s land digitization efforts and state-level token initiatives within the U.S.

The ecosystem growth coincides with a pointy rise in energetic community utilization. Avalanche reported an 81% quarter-over-quarter bounce in every day energetic addresses in Q1, rising from 92,300 to 167,400. With MapleStory’s launch alone pulling in over half one million wallets in Q2, the community’s addressable person base continues to scale aggressively.

Strategic Community Growth

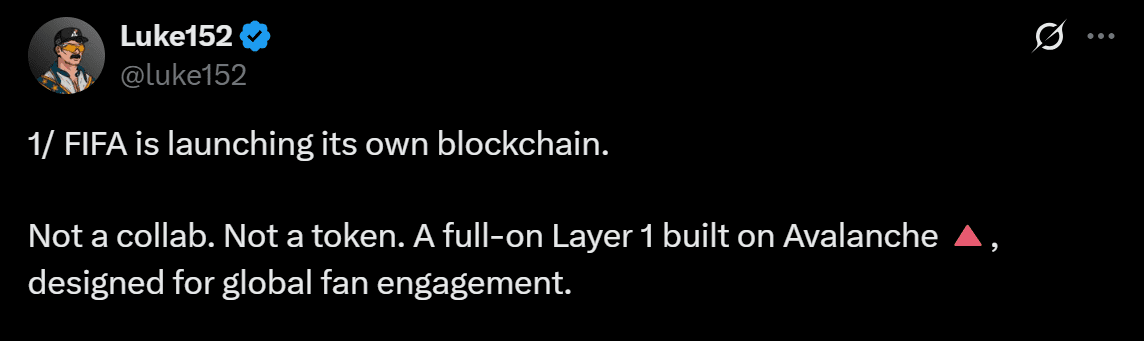

In the meantime, essentially the most pivotal sign of Avalanche’s institutional credibility got here via its latest collaboration with FIFA, which is able to leverage Avalanche’s infrastructure to energy a standalone Layer 1 blockchain.

Not like prior NFT-focused offers, this partnership introduces a sovereign blockchain inside the Avalanche ecosystem, designed to host digital collectibles, tokenized ticketing, and fan engagement instruments. It additionally validates Avalanche’s shift from subnet-based customizations towards full-fledged, devoted Layer 1 deployments.

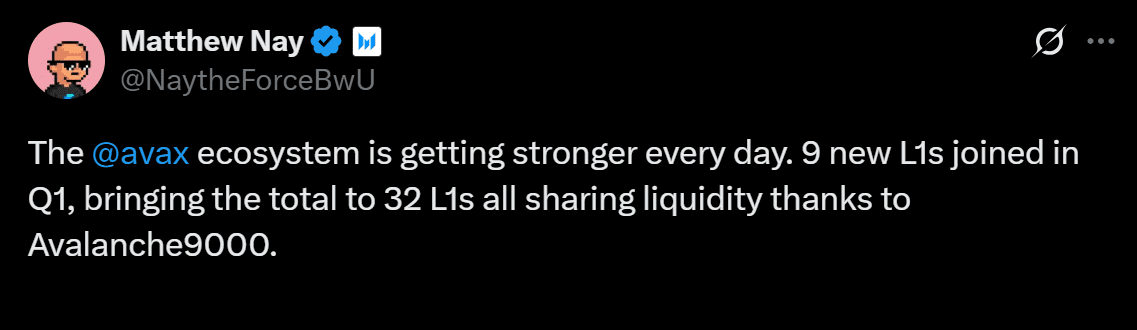

The evolution aligns with developments noticed in Q1 2025, when enterprise-grade initiatives like Wyoming’s WYST and Brass Knuckle Movies turned to Avalanche for specialised, purpose-built chains. The eight new Layer 1s launched in that quarter—together with verticals in gaming, media, and finance—strengthened Avalanche’s attraction as a modular platform. FIFA’s entry may speed up this momentum, opening the door to hundreds of thousands of customers throughout sports activities, leisure, and fintech sectors.

To assist this development, Avalanche has upgraded its technical basis. The Avalanche9000 protocol replace, which raised $250 million in a personal token spherical, slashed C-Chain base charges by 96%. This price discount proved vital in absorbing the Might surge in exercise, significantly throughout MapleStory’s peak utilization days.

In the meantime, the Durango improve launched native message-passing between Avalanche-based chains, enabling cross-chain interoperability with out bottlenecks.

The Codebase accelerator program complemented the infrastructure features. It provided monetary and technical assist to early-stage builders, enhancing Avalanche’s developer pipeline. These compounded enhancements mark a decisive shift in Avalanche’s maturity—away from speculative narratives and towards scalable, institutional-grade deployment.

AVAX may transition from an underappreciated Layer 1 to one of many quarter’s greatest gainers if these developments acquire market traction, with the bull run prone to begin in June.

AVAX Technical Construction Factors to Potential Upside Continuation

In the meantime, the Avalanche price continues to commerce inside an ascending parallel channel, a bullish continuation sample outlined by two upward-sloping, parallel trendlines connecting a collection of upper highs and better lows. The construction usually displays organized accumulation, the place market individuals step by step push the price larger whereas respecting well-defined assist and resistance boundaries.

As of Might 30, the price hovers close to the underside of the channel, following a pointy pullback from latest native highs. If bulls defend the channel’s decrease trendline, AVAX may resume its upward trajectory towards the sample’s higher boundary. Utilizing the usual technical methodology for ascending channels, the potential price goal sits close to the resistance marked round $29.2, a spike of over 36% from present ranges

Earlier than reaching that projected zone, AVAX faces intermediate resistance ranges. Speedy overhead resistance is positioned close to $24.1, with the subsequent degree forming round $26.7. A break above these thresholds would probably affirm bullish continuation towards the sample’s full extension, probably serving to Avalanche price prediction in June.

Conversely, if the channel assist breaks down, the construction turns into invalid. Such a transfer would expose AVAX to draw back strain, with the subsequent assist check close to $20.5. A deeper rejection may drag price towards the decrease marked assist close to $18.34, the place bulls should regain management to keep away from additional deterioration.

Total, the channel stays intact for now, and so long as price holds above the decrease boundary, AVAX retains a constructive technical posture heading into Jun