da-kuk/iStock through Getty Pictures

The hazard to our monetary future doesn’t come from crypto, it comes from Washington D.C.

That quote is from former (and probably future) President Donald Trump from the Bitcoin 2024 convention in Nashville, TN. Amongst a handful of very fascinating quotes from that convention, this one actually stands out to me as vital. Trump’s presence at Bitcoin Journal’s convention this yr marks the primary time a former US President has spoken on the annual gathering since its inception in 2019.

On this article, I will go over a few of my prime takeaways from the occasion, dive into the present standing of nation-state held Bitcoin (BTC-USD), and tackle a few of the long-term issues I nonetheless have for the community.

Takeaway 1: Trump’s Keynote

Throughout roughly 45 minutes on the podium, former President Donald Trump weaved out and in of unrelated marketing campaign speaking factors and Bitcoin-related guarantees. Among the many latter, Trump pledged the next if elected:

- The Day 1 firing of US Securities and Change Fee Chair Gary Gensler and the appointment of somebody extra industry-friendly – this garnered a loud standing ovation

- The shutdown of what has been dubbed within the {industry} as “Operation Choke Point 2.0”

- The formation of an advisory council consisting of {industry} leaders to assist kind pro-crypto coverage

- A protection of the proper to self-custody digital belongings

- A stablecoin-friendly administration

- No central financial institution digital forex

- An order to stop the promoting of the almost 214k BTC presently held by the US authorities

Merely on the deserves of Trump’s commentary particularly pertaining to Bitcoin and the cryptocurrency {industry} in the US, it is troublesome to think about digital asset traders needing way more than what they obtained from that speech to be excited for the long run, in my view. Wanting calling BTC authorized tender, as Salvadoran President Nayib Bukele did in 2021, Trump’s keynote in Nashville was a monumental second in Bitcoin’s historical past. If elected, I believe most of what he laid is definitely considerably possible politically.

Takeaway 2: RFK Jr’s Government Orders

To not be outdone by former President Trump, fellow presidential hopeful Robert F. Kennedy Jr. was much more aggressive in his plan for government-held Bitcoin. RFK Jr. stated that if elected to the workplace, he’d signal, not one, however two Bitcoin-related government orders on Day 1 as President:

- Government Order #1: the US DOJ can be instructed to switch the BTC that it acquired by way of asset seizures to the US Treasury Division the place it could be saved as a strategic asset

- Government order #2: moreover, the US Treasury Division can be required to purchase 550 BTC every day till a 4 million BTC reserve had been amassed

Order no 1 appears lifelike from the place I sit. Government order quantity 2 is much much less possible with out hyperinflating the greenback, in my view. For starters, at a charge of 550 BTC per day, it could take 20 years to construct a stockpile of 4 million BTC. Because the forex is capped at 21 million, 4 million can be 19% of the overall provide. Kennedy famous this could put the nation’s share of BTC provide in step with its share of world Gold provide. Whereas this could be good, the truth is BTC’s emission charge declining each 4 years makes such a proposition mathematically doubtful to say the least.

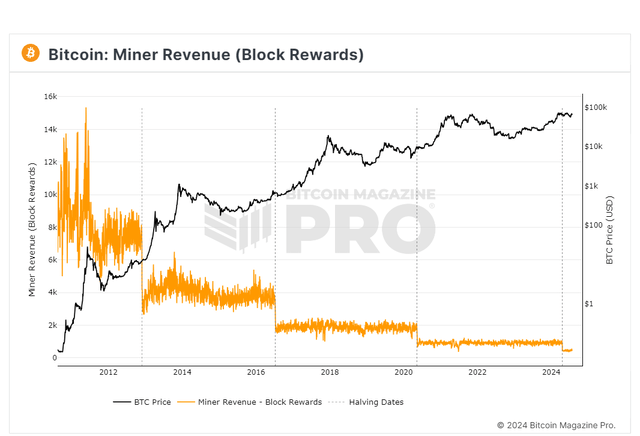

Miner Income (Bitcoin Journal PRO)

At present block reward charges, there are roughly 475 new BTC coming into existence every day. This implies proper off the bat, we’d have already got a 75 BTC provide deficit if the US Treasury put a 550 every day BTC bid into motion early subsequent yr. This BTC deficit would proceed all the best way to a every day deficit of 535 BTC, given 5 further block reward halvings over the subsequent 20 years. Kennedy acknowledges this technique would lead to a multi-hundred trillion valuation for Bitcoin. If we take a $200 trillion market cap as a base case and divide that valuation by 21 million whole cash, we get a BTC price projection of over $9.5 million per coin.

Past his plans to aggressively create a BTC stockpile, RFK Jr shared what I view as a principled tackle Bitcoin, and it is function on the earth. He alluded to how Bitcoin is a permission-less financial asset. An actual-world utility for Bitcoin is when nation-states weaponize banking methods towards their very own residents, as we just lately noticed in Canada through the COVID-era trucker protest. Kennedy appears to ‘get it’ on the ethos of the community and its early adopters.

Takeaway 3: Lummis’ Treasury Invoice

Making lots of the similar factors as each Trump and Kennedy, Wyoming Senator Cynthia Lummis took it a step additional and introduced her plan to introduce a brand new invoice that may direct the US Treasury division to construct a “stockpile” of 1 million BTC over the subsequent 5 years. At present costs, a stockpile of 1 million BTC can be valued at about $68 billion. A 5-year, 1 million BTC plan would escape to a virtually equivalent every day BTC bid from the US Treasury as what Kennedy would suggest. Which I nonetheless view as mathematically doubtful given what it could value taxpayers. Lummis acknowledged that her Bitcoin treasury invoice is unlikely to go this yr, and that consideration probably will not come till after the election in November.

Takeaway 4: Echoes From Saylor

Arguably taking the Bitcoin as a strategic reserve momentum even additional than the audio system already talked about, MicroStrategy (MSTR) Chairman Michael Saylor made what could possibly be seen as a reasonably outlandish assertion exterior of his podium tackle. In an interview format portion of the convention, Saylor stated the next:

The USA authorities owns the vast majority of the Gold on the earth. The US federal authorities owns 28% of the land in the US. The US Authorities ought to personal the vast majority of the Bitcoin on the earth.

The daring above is my emphasis. To anybody who has championed Bitcoin for greater than 6 or 7 years, this assertion might be regarding. I may be beating a lifeless horse at this level, as I’ve introduced this up in earlier articles for In search of Alpha a number of occasions, however the unique meant function of Bitcoin was to be a peer to look medium of trade. Bitcoin was not purported to be an asset that’s hoarded or one which requires intermediaries to personal and switch. It actually wasn’t meant to be an asset that’s owned and managed by the state-run financial methods that it was initially created to disrupt.

Authorities Holdings

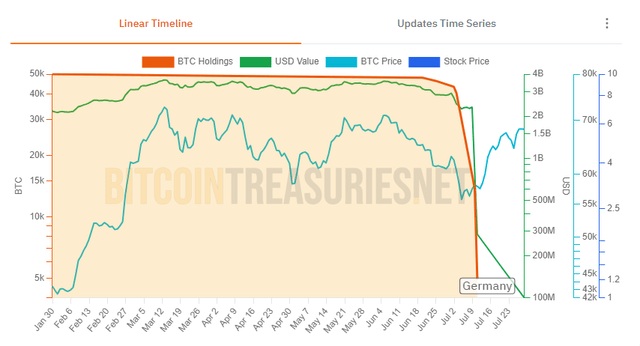

However given the aforementioned feedback at Bitcoin 2024, government-controlled provide could be very clearly the path a few of Bitcoin’s most notable promoters want to see. I feel that could be a troublesome capsule for a lot of very long time Bitcoin supporters to swallow. Nonetheless, authorities holdings of Bitcoin are nothing new. One of many causes Bitcoin endured some price weak spot in late June and in early July was as a result of German authorities promoting roughly 48k BTC in lower than a month:

Germany BTC Steadiness (BitcoinTreasuries.Web)

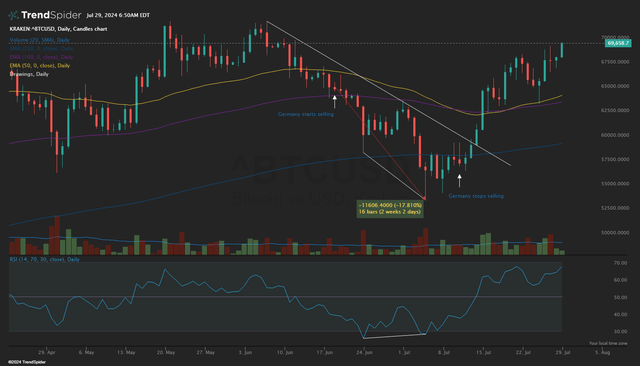

The vast majority of these gross sales came visiting a three-day interval between July 9 by way of the eleventh. By that time, the worst within the promoting stress was over. However between the time Germany started promoting BTC to the time it was completed, the price of the coin had corrected by almost 18% in a bit over two weeks:

BTC Day by day Chart (TrendSpider)

Regardless of Germany promoting in another country’s BTC place totally, there are nonetheless 9 different international locations which have management of Bitcoin provide. Although the US and China personal essentially the most out of that group by far:

| Authorities | BTC | Valuation (m$) | % Of Provide |

|---|---|---|---|

| United States | 213,246 | $14,647 | 1.01% |

| China | 190,000 | $13,051 | 0.90% |

| United Kingdom | 61,000 | $4,190 | 0.29% |

| Ukraine | 46,351 | $3,183 | 0.22% |

| El Salvador | 5,800 | $398 | 0.03% |

| Bhutan | 621 | $43 | 0.00% |

| Venezuela | 240 | $16 | 0.00% |

| Finland | 90 | $6 | 0.00% |

| Georgia | 66 | $5 | 0.00% |

Supply: BitcoinTreasuries.Web

At the moment, governments make up 2.46% of BTC provide. When factoring within the 5.2% of provide held by ETFs and different funding merchandise, the 1.5% held by public corporations, and the two.8% held by personal corporations and/or DeFi protocols, greater than 12% of BTC’s whole provide is held by centralized entities. Massive possession of this nature can have a major influence on price, each to the upside and to the draw back. Simultaneous to the Germany gross sales, there was concern available in the market that Mt Gox Bitcoin holdings would discover their strategy to the market as properly. Time will nonetheless inform on that one.

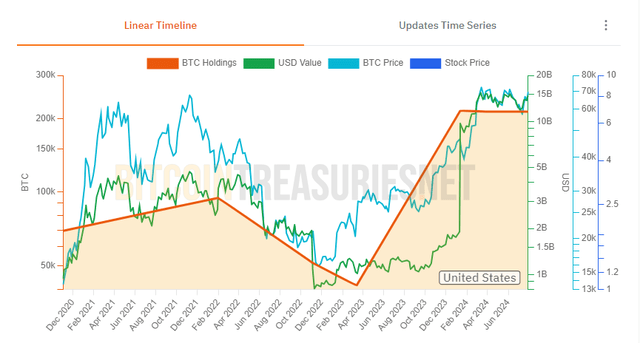

No matter whether or not or not the US flips to an aggressive BTC buying plan in step with what RFK Jr or Senator Lummis have described on this yr’s convention, even when the federal government merely dedicated to not promoting the BTC that it already holds, it could take a big ask off the desk:

United States Bitcoin Holdings (BitcoinTreasuries.Web)

At 213k BTC with a market worth of $14.6 billion, the US authorities already has one of many largest BTC positions on file. If authorities holdings have been an ETF, it would be the third largest after iShares Bitcoin Belief ETF (IBIT) and the Constancy Clever Origin Bitcoin Fund (FBTC).

Closing Ideas

There may be actually a bigger dialog that could possibly be had about simply how a lot Bitcoin anybody authorities or a number of governments ought to personal. For an asset that was designed for use and held in self-custody, I am unsure that is the observe the unique Bitcoiners need to be on. That stated, within the sport of ‘quantity go up,’ the power to bid with the participant who owns the cash printer is theoretically an advantageous place to be in. One might even argue the cash printer itself is the bull thesis for BTC, whether or not the federal government scales 1,000,000 coin place or not. For my part, there are likely simpler methods for the US authorities to construct a Bitcoin stockpile if it have been inclined to take action; one such technique can be to just accept BTC as cost for earnings or capital good points taxes.

I will shut by saying, Bitcoin goes to go the place it goes, no matter what I or any analyst or speaker might imagine. In some methods, Bitcoin is just like the indie band that makes it large however loses a few of what made it particular to start with through the technique of turning into mainstream. For me, Bitcoin 2024 might be remembered because the convention when Bitcoin turned an necessary a part of home politics. We now have presidential candidates, one in all whom is the favourite in November, brazenly speaking a few Bitcoin reserve technique. We’re both on the prime already or the journey is simply getting began. For my part, the very cause these ideas are even catching on is as a result of the present financial system is so inherently flawed. Within the period of economic nihilism, Bitcoin remains to be the most effective meme.