Picture supply: Getty Pictures

Looking for prime shares to purchase in a Shares and Shares ISA? Listed here are a pair from the FTSE 100 and FTSE 250 to contemplate proper now.

Babcock Worldwide

A shiny outlook for the European defence sector suggests Babcock Worldwide (LSE:BAB) might stay one of many FTSE 100’s star performers.

Up 64% over the previous 12 months, the enterprise — which supplies engineering, assist and coaching companies to international armed forces — was promoted to the Footsie in March.

But I consider it stays undervalued at at this time’s price of 833.5p per share. With a price-to-earnings (P/E) ratio of 17.4 occasions, it stays far cheaper than different heavyweight UK defence shares like BAE Methods (22.2 occasions), Rolls-Royce (32.2 occasions) and Chemring (20.6 occasions).

Its sub-1 price-to-earnings progress (PEG) ratio of 0.3 occasions additionally suggests its shares are critically low cost. This supplies scope for extra vital share price positive factors given the tempo at which weapons spending is hovering.

Babcock’s capitalising successfully on this fertile panorama because of its sturdy international relationships and experience in key areas (its duties embody sustaining the UK’s fleet of nuclear submarines, for example). Revenues rose 11% within the 12 months to February 2026, whereas working revenue leapt 17%.

On the detrimental facet, persistent provide chain points within the defence sector might compromise future earnings progress. But I believe that is greater than mirrored in its low valuation.

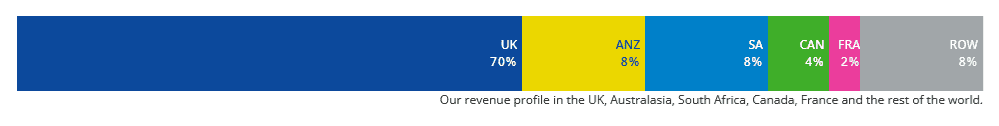

Babcock could possibly be fascinating due to its restricted publicity to the US. As a consequence of this, income are much less depending on Stateside defence spending, which might fall dramatically within the coming years.

Hochschild Mining

Silver producer Hochschild Mining (LSE:HOC) has additionally soared during the last yr, on this case pushed by growing treasured metals costs. At 278.9p per share, the FTSE 250 firm’s up 77% since this level in 2024.

The corporate primarily produces silver from its mines in The Americas. Nonetheless, it additionally produces not-insignificant quantities of gold, permitting it to capitalise on the yellow steel’s surge to repeated highs.

Trying forward, I believe Hochschild might ship superior share price positive factors than pure-play gold shares. That is due to silver’s present cheapness relative to gold, leaving ample room for the gray steel to outperform its treasured cousin.

The gold/silver ratio — which measures the worth of as soon as silver ounce relative to certainly one of gold — is presently at 1:99, which is excessive by historic requirements. Bullion seller Sharps Pixley notes that the ratio peaked at 1:128 throughout the pandemic when gold costs peaked earlier than toppling to 1:70 within the months following.

It says that “with gold at $3,200 per ounce, a 1:70 ratio would put silver at $45.70.” That probably supplies substantial upside from present ranges of $32.88 (gold was just lately altering arms at $3,247.20).

In fact there’s no assure that silver costs will rise. And even when they do, manufacturing issues could hamper Hochschild’s potential to take advantage of this, a continuing threat within the mining business.

However on stability, I believe the corporate’s value critical consideration from ISA traders, and particularly at present costs. It trades on a ahead P/E ratio of simply 8.4 occasions, and carries a PEG of 0.1.