Picture supply: Getty Photographs

FTSE 100 shares have a fame for being regular dividend payers. But the UK’s premier index can also be dwelling to some thrilling shares with long-term progress potential.

If I got £5k to speculate, I’d snap up this pair in August.

An oncology heavyweight

First up is AstraZeneca (LSE: AZN), the biggest Footsie agency by market cap (£195bn). The shares are up 17% in 2024 and 72% over 5 years, which far outpaces the returns from the broader FTSE 100 (even after dividends).

The pharma large additionally pays a dividend, although the yield is modest at 1.8%.

AstraZeneca’s strengths are in oncology, biopharmaceuticals, and uncommon ailments. The previous makes up a couple of third of total gross sales and in H1 this phase grew 22% 12 months on 12 months to $10.4bn.

After all, most cancers remedies are extremely complicated and dear, that means main medical setbacks are an unavoidable threat. However Astra has a fantastic hit price and a really deep pipeline, giving it a number of pictures on aim.

In the meantime, the limitations to entry within the trade are very excessive. Few corporations have the size and wherewithal to compete efficiently on research and improvement.

Just lately, the agency unveiled a lofty aim of reaching $80bn in gross sales by 2030, up from $46bn in 2023. It’s additionally concentrating on a mid-30s core working margin, up from 30% in 2022.

Unsurprisingly, the shares aren’t low-cost, however neither are they grossly overvalued. They’re buying and selling at round 20 instances ahead earnings versus a 10-year common of 18.2.

Long run, there are some highly effective progress drivers working within the firm’s favour. Chief amongst these is a quickly ageing world inhabitants, notably in China the place the agency has a rising presence.

A celebrity progress portfolio

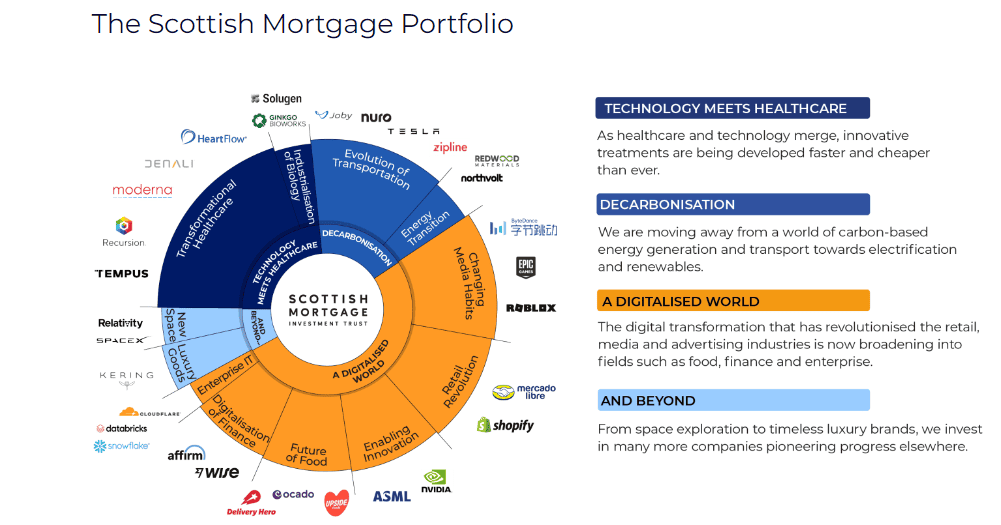

Subsequent, now we have Scottish Mortgage Funding Belief (LSE: SMT), which invests in each private and non-private progress firms.

The shares have been extremely unstable in recent times, greater than doubling in worth in 2020 earlier than plunging by almost 50% in 2022.

12 months so far, they’re up simply 2.2%, lagging the FTSE 100’s return. That’s disappointing contemplating how effectively a number of the belief’s largest holdings have completed, together with Nvidia (up 111%) and Ferrari (up 24%).

One purpose I’m nonetheless bullish is that there’s been sturdy progress reported at lots of the corporations held within the portfolio. Amazon, Shopify and MercadoLibre are all benefitting massively from the continuing progress of e-commerce, regardless of weak total client spending.

One more reason to be optimistic is that the belief has been concentrating on dominant corporations buying and selling at enticing valuations. This bodes effectively for future returns.

For instance, it purchased again into Taiwan Semiconductor Manufacturing (TSMC) after a 10-year hole earlier this 12 months. It stated “TSMC is a key enabler of AI applications” and its scale means “few others can compete” in opposition to it.

This agency is making many of the world’s superior AI chips on behalf of shoppers, together with Nvidia. And the managers seem to have invested when TSMC shares have been buying and selling under 18 instances ahead earnings (very low-cost for a world-class tech inventory). They’re already up 28% in six months.

One threat right here can be one other massive sell-off in tech shares, notably Nvidia, the belief’s largest place.

Nevertheless, with Scottish Mortgage shares buying and selling at a 9.3% low cost to underlying web asset worth, I’d embrace the chance.