On June 1, 2025, the one-hour chart for HYPEHUSD (Hyperliquid to U.S. Greenback) reveals the formation of a bearish pennant sample.

A bearish pennant varieties after a pointy downward transfer referred to as a flagpole. On this chart, the preliminary drop began on Could 27 and ended round Could 29. After that, the price consolidated between converging trendlines, forming the pennant form. The 50-period Exponential Shifting Common (EMA), marked in blue, now hovers close to $32.693, simply above the present price of $32.581.

A pennant sample sometimes seems throughout a pause within the pattern. The sample has two key elements: the flagpole (the steep drop) and the pennant (a small triangle created by converging trendlines). When the price breaks under the decrease trendline, it confirms the sample and suggests additional draw back.

If this bearish pennant confirms, the price might fall by the identical size because the flagpole. Primarily based on the present price of $32.581, a 27% drop would ship the asset down to round $23.78, which can also be marked on the chart as a doable help stage.

At the moment, the price is struggling to interrupt above the higher pink trendline. It stays under the 50-period EMA, signaling weak momentum. If sellers push it under the decrease pink boundary, it will seemingly set off the bearish breakdown.

The price construction aligns with bearish continuation alerts. Till HYPEHUSD strikes again above the pennant’s higher trendline and the EMA, the sample stays legitimate. If breakdown stress continues, the projected goal of $23.78 stays lively.

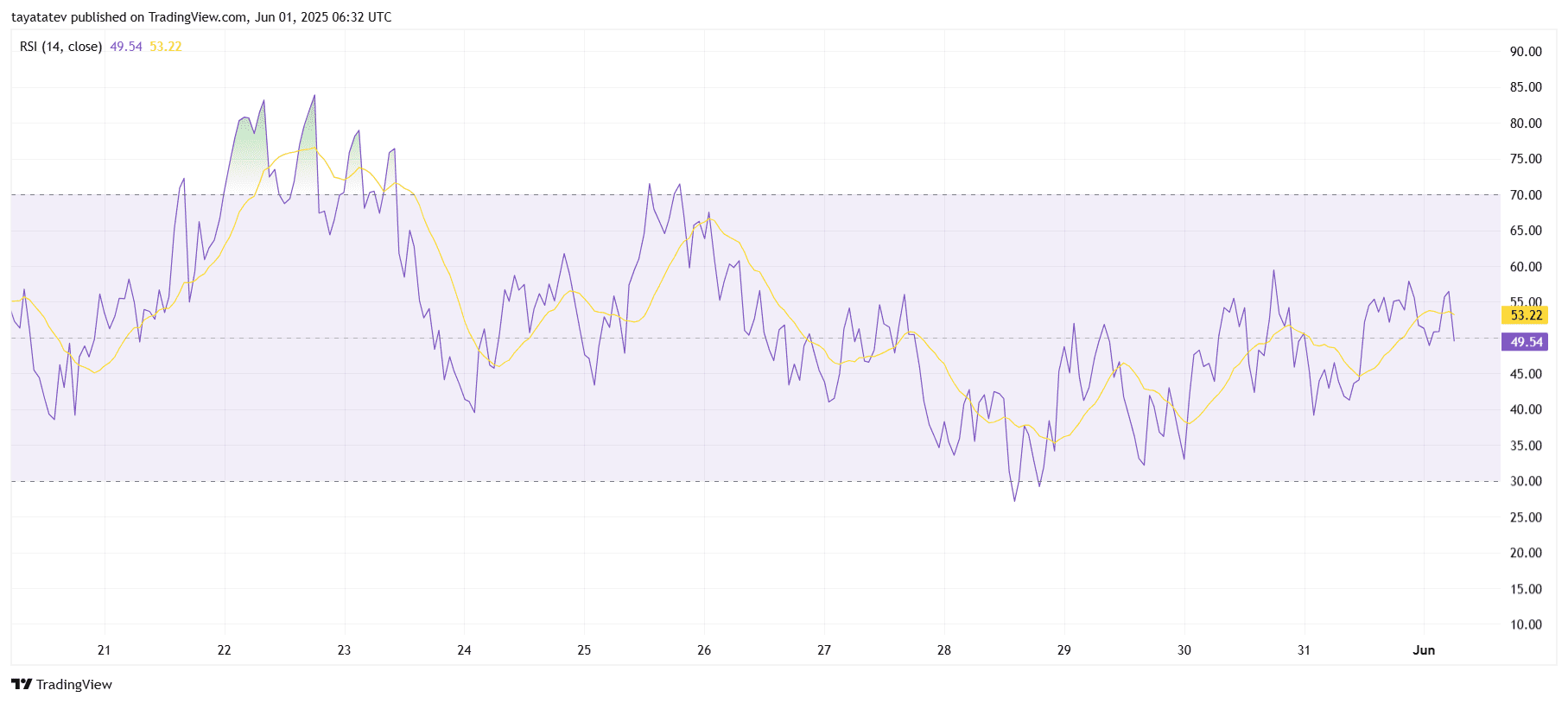

HYPEHUSD RSI Reveals Impartial Momentum Earlier than Doable Breakdown

On June 1, 2025, the Relative Energy Index (RSI) chart for HYPEHUSD (Hyperliquid to U.S. Greenback) reveals impartial situations. The RSI (14, shut) stands at 49.54, whereas the 14-period Easy Shifting Common of RSI is at 53.22. Each values stay throughout the mid-range, between 30 and 70, suggesting neither overbought nor oversold stress dominates.

The RSI has moved under its sign line (yellow), which alerts weakening momentum. As the worth dropped underneath the transferring common, bearish stress might construct if the present pattern continues. RSI readings between 40 and 50 typically act as early warnings throughout consolidation earlier than a breakout or breakdown.

In earlier classes, RSI briefly crossed above 70, exhibiting momentary overbought situations round Could 22. Nonetheless, it failed to carry above that zone. The chart has since fashioned a decrease excessive, confirming a downtrend in momentum. Furthermore, RSI stayed largely underneath the midline since Could 26, matching the bearish pennant formation seen in the principle price chart.

Until RSI reverses and climbs again above 55, the indicator suggests restricted upside energy. If the price breaks under the pennant’s decrease boundary, RSI might fall under 40, confirming bearish continuation.

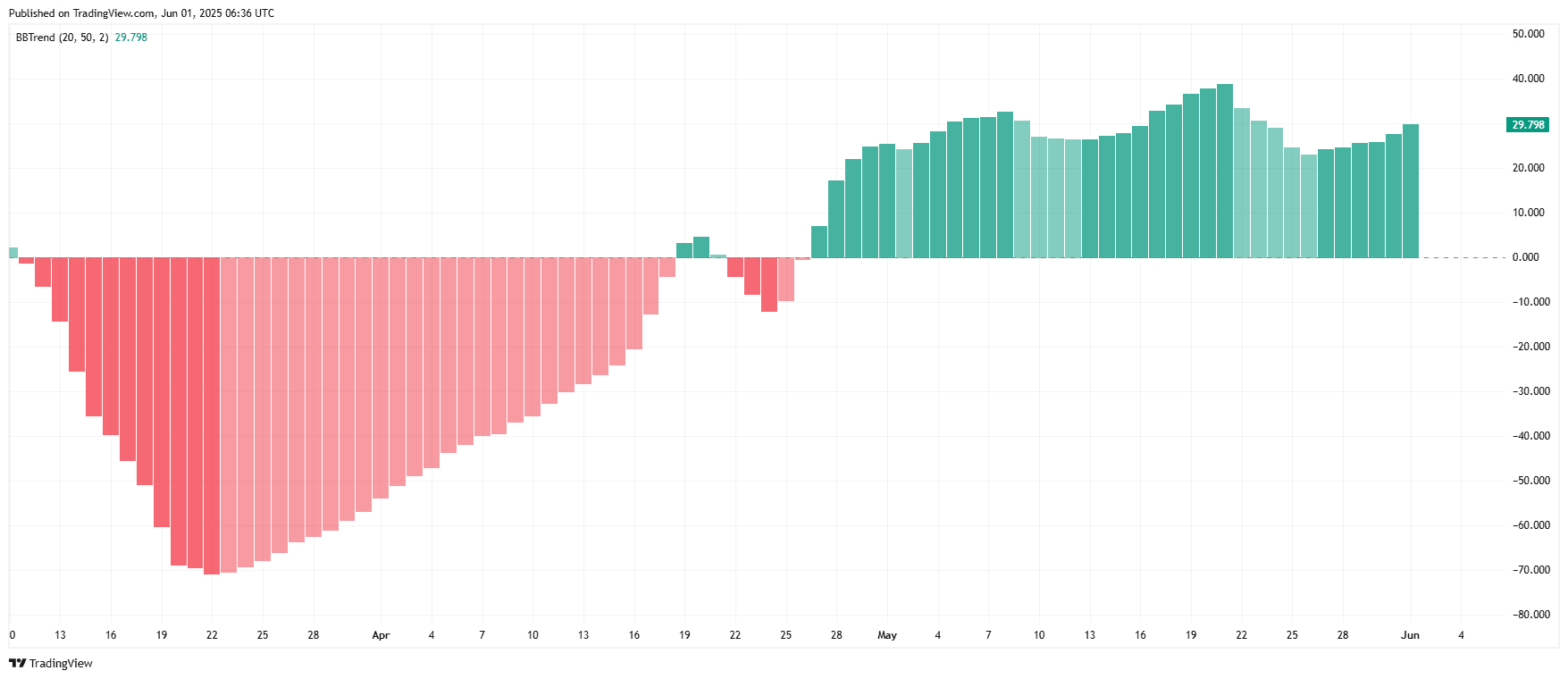

HYPEHUSD BBTrend Indicator Alerts Weakening Momentum

The BBTrend (Bollinger Band Development) indicator for HYPEHUSD (Hyperliquid to U.S. Greenback) printed a worth of 29.798. The BBTrend makes use of durations of 20, 50, and a couple of to trace the energy and route of traits. It shifted inexperienced throughout mid-April and continued rising into Could, signaling a bullish pattern.

Nonetheless, after peaking close to 45 in late Could, the bars began flattening. The current sideways transfer signifies fading bullish energy. Whereas the worth stays in optimistic territory, the slope suggests slowing momentum.

Earlier in March and April, the BBTrend stayed deeply adverse—reaching under –75—which confirmed a powerful bearish section. That pattern reversed in late April as inexperienced bars appeared, exhibiting a transition from bearish to bullish territory.

Now, regardless of staying above zero, the inexperienced bars present little growth. If this indicator turns pink once more within the coming classes, it will affirm bearish management and align with the bearish pennant sample on the price chart.

The present BBTrend sign reveals indecision. Until the worth climbs above its earlier highs, patrons threat shedding energy, and the pattern might flip again to adverse.

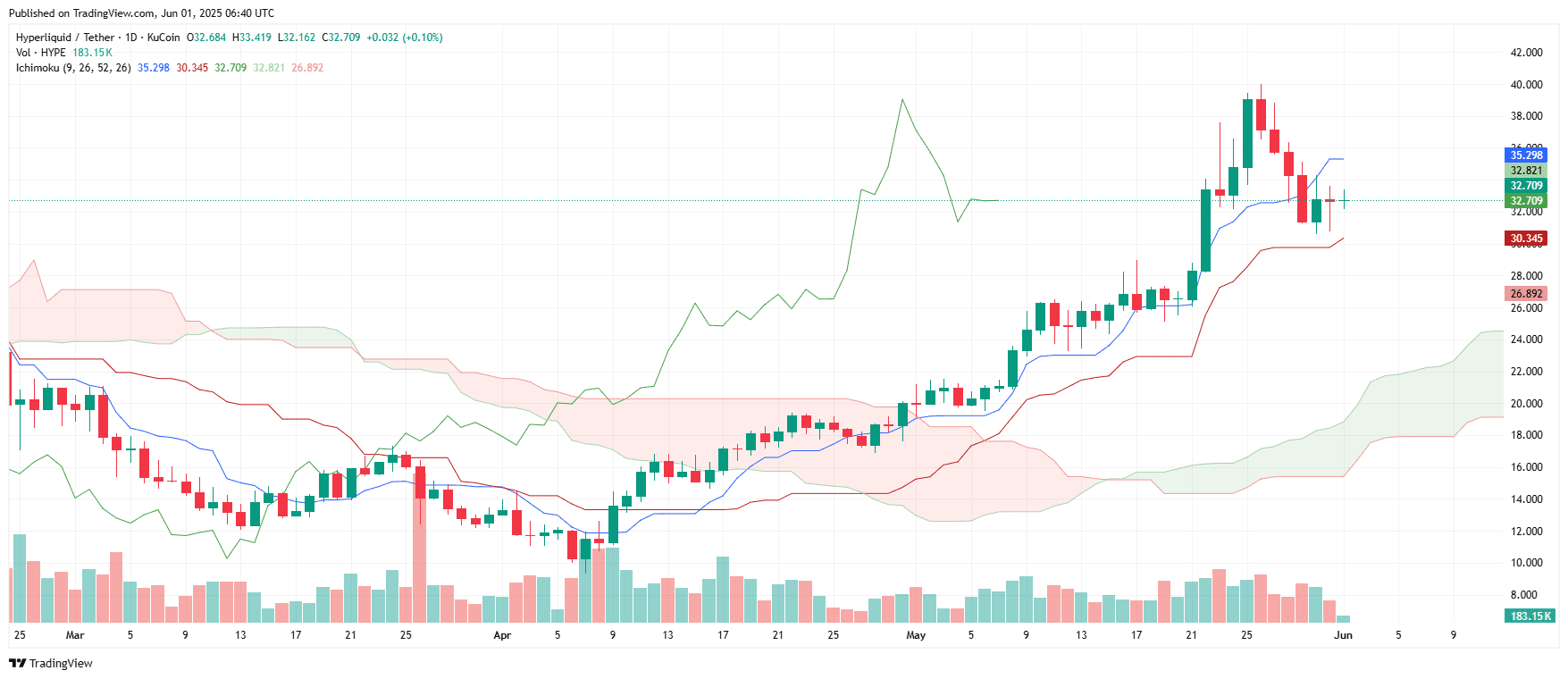

HYPEHUSD Holds Ichimoku Cloud Help However Faces Resistance

In the meantime, he day by day chart for HYPEHUSD (Hyperliquid to U.S. Greenback) reveals combined alerts on the Ichimoku Cloud indicator.

The price at present trades at $32.709, sitting instantly on the Kijun-sen (Base Line), which additionally reads $32.709. The Tenkan-sen (Conversion Line) is barely greater at $32.821, exhibiting gentle short-term resistance. Above each strains, the Senkou Span A stands at $30.345 and Senkou Span B at $26.892, forming the inexperienced Ichimoku cloud under the present price. This implies a bullish help zone stays intact.

Nonetheless, the Chikou Span (Lagging Span) has began turning sideways, exhibiting a possible momentum slowdown. On the identical time, the price lately pulled again from a neighborhood excessive close to $42. This retracement coincides with decrease quantity and a weak follow-through above the Tenkan-sen.

For now, HYPEHUSD holds contained in the bullish construction, with the cloud offering help between $30.345 and $26.892. If the price closes under each the Kijun-sen and the cloud, the pattern would shift bearish. Till that occurs, the Ichimoku setup stays technically optimistic however fragile.

If bulls regain energy and push the price above the Tenkan-sen, short-term upside momentum might resume. In any other case, a deeper pullback towards the highest of the cloud stays doable.

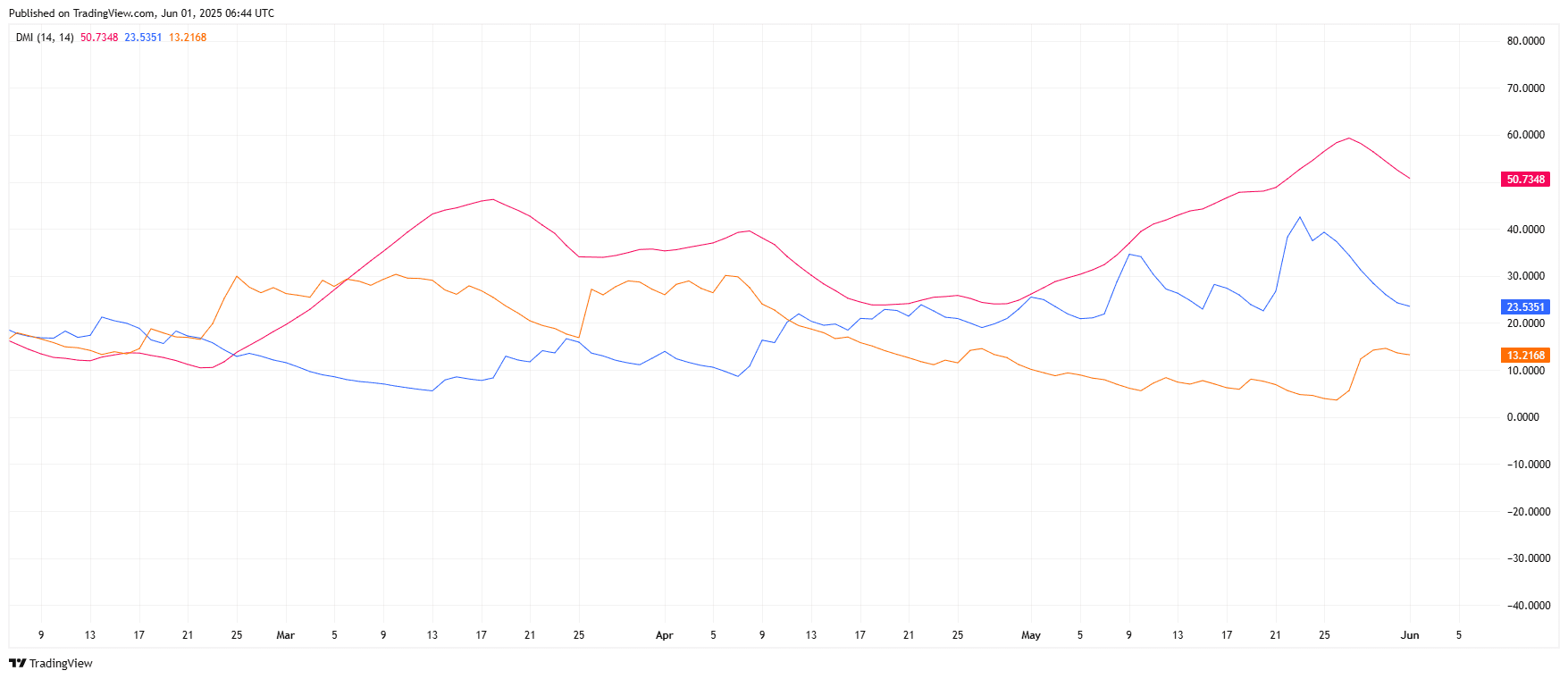

HYPEHUSD Directional Motion Index Reveals Declining Development Energy

On June 1, 2025, the Directional Motion Index (DMI) for HYPEHUSD (Hyperliquid to U.S. Greenback) displays weakening bullish stress. The DMI indicator contains three key elements:

-

ADX (Common Directional Index) – proven in pink, stands at 50.7348

-

+DI (Constructive Directional Indicator) – in blue, measures 23.5351

-

–DI (Destructive Directional Indicator) – in orange, at 13.2168

The ADX worth above 50 confirms a powerful pattern, but it surely has began to slope downward from current highs. This alerts that the pattern, though nonetheless sturdy, is shedding energy. In the meantime, the +DI stays considerably greater than the –DI, exhibiting that bulls nonetheless dominate, however with decreased momentum.

In late Could, the +DI line peaked above 40, whereas the –DI stayed under 15. That hole indicated sturdy bullish management. Now, the unfold between the 2 strains is narrowing. The ADX can also be pulling again, which frequently suggests consolidation or an upcoming reversal.

If +DI continues falling and –DI begins rising, this is able to affirm a shift in management towards sellers. For now, the market stays in a bullish construction, however DMI alerts that energy is fading. A bearish crossover between the 2 DI strains would help the bearish pennant situation seen on the price chart.