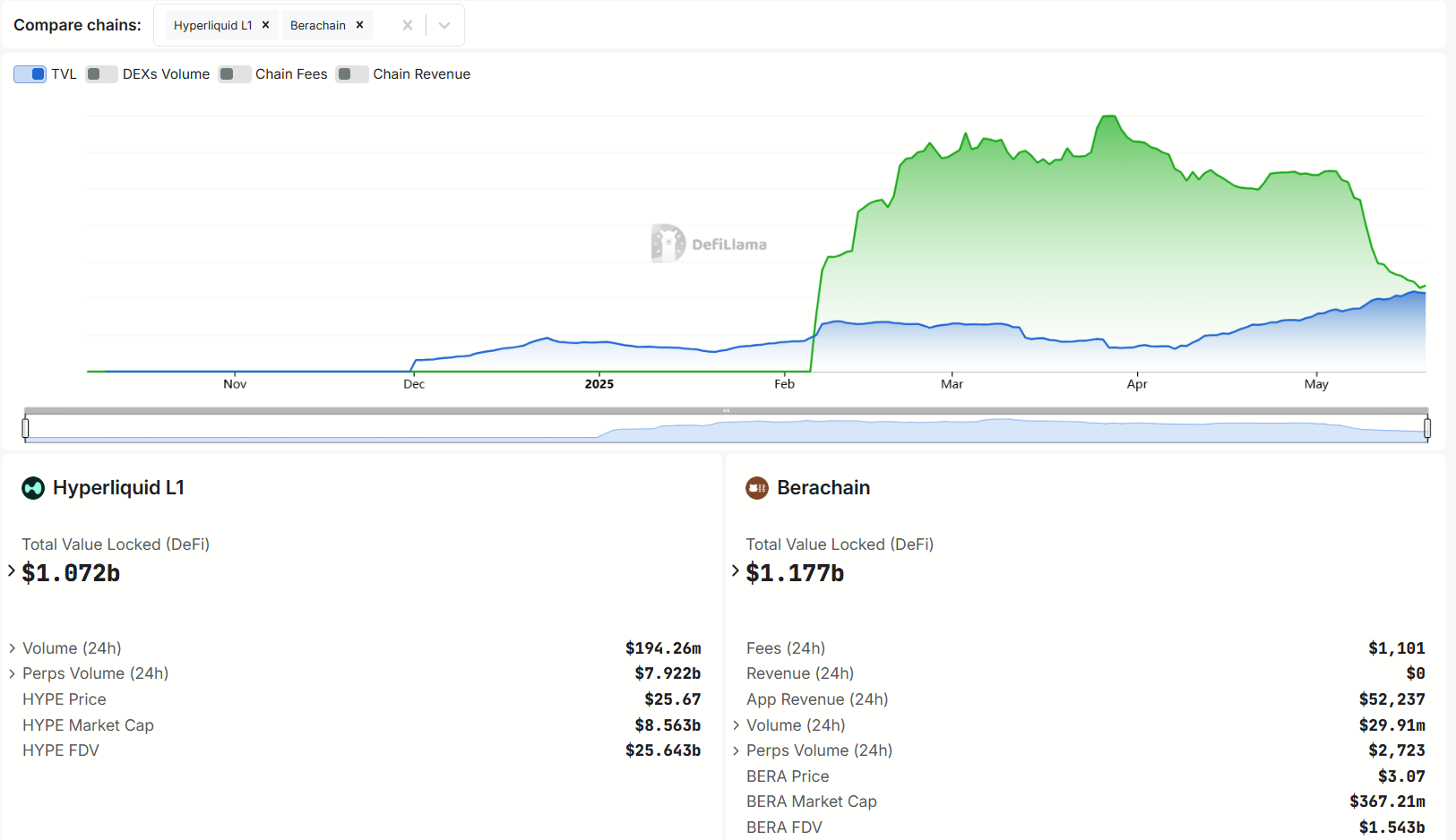

On Could 17, 2025, Hyperliquid L1’s Complete Worth Locked (TVL) is about to surpass Berachain’s, with on-chain knowledge exhibiting Berachain at $1.184 billion and Hyperliquid at $1.085 billion, reflecting a aggressive DeFi panorama marked by natural progress and market fluctuations.

Hyperliquid Dominates Perp DEXes with Regular TVL Development

Hyperliquid emerges as a pacesetter in crypto derivatives buying and selling, with its TVL reaching $1.085 billion as of Could 19, 2025. Hyperliquid’s 24-hour quantity at $195.83 million and perps quantity at $7.92 billion, considerably outpacing Berachain’s $25.29 million.

Supply: DefiLlama

Hyperliquid’s progress is basically natural, as emphasised by an analyst, who contrasted it with Berachain’s reliance on a “massive farming campaign”.

HyperEVM about to flip Berachain for TVL

One had a large farming marketing campaign

One was fully organically bootstrapped

Hyperliquid.$HYPE vs $BERA pic.twitter.com/qYvY4Cu2ho

— 800.HL (@degennQuant) Could 17, 2025

Hyperliquid’s HYPE token, priced at $25.48 with a market cap of $8.57 billion as of Could 19, 2025, underscores its market energy, rating #18 globally.

Supply: TradingView

The platform’s give attention to natural exercise, evidenced by its rejection of VC funding and community-driven method, has fueled its rise.

Berachain’s TVL Decline Alerts Sustainability Considerations

Berachain, as soon as a DeFi chief, has seen its TVL drop quickly from its peak at $3.351 billion in March 2025 to simply $1.184 billion in the present day.

Supply: DefiLlama

Berachain has a Proof-of-Liquidity (PoL) mannequin and carried out a large farming marketing campaign launched after its February 2025 mainnet debut.

berachain pulled in $3.5B TVL with factors and incentives — and is now bleeding capital, customers, and doing

hyperliquid’s L1 simply crossed $1B TVL with out grants, ecosystem farming, or compelled liquidity video games.

no bribes — simply reflexive circulate from essentially the most… pic.twitter.com/pCv5q0LnmC

— Simon (@simononchain) Could 18, 2025

Berachain’s BERA token, buying and selling at $3.06 with a market cap of $364.6 million and a totally diluted valuation of $1.532 billion, has additionally struggled, down almost 80% from its ATH at $14.83 earlier within the yr.

The platform’s reliance on incentivized liquidity, together with personal LP offers, has raised considerations about sustainability. Berachain’s 24-hour quantity of $26.28 million pales compared to Hyperliquid’s, signaling a possible shift in DeFi consumer desire towards extra natural ecosystems.

The broader DeFi market is watching intently, as Hyperliquid’s regular progress challenges Berachain’s earlier dominance. This development might sign a desire for platforms with sustainable, user-driven progress over these reliant on short-term incentives.