Bitcoin miner Hut 8 elevated its hashrate by 79% within the first quarter of 2025. The corporate reported a $134.3 million web loss in its Might 8 earnings launch. Income for the quarter stood at $21.8 million.

CEO Asher Genoot mentioned the loss was as a consequence of large-scale investments.

“The first quarter was a deliberate and necessary phase of investment,”

he acknowledged. As of March 31, Hut 8’s whole power capability reached 1,020 megawatts, sufficient to energy over 800,000 properties in the US.

The corporate additionally holds rights to broaden by one other 2,600 megawatts. These capability upgrades had been a part of its technique to strengthen Bitcoin mining operations in North America.

American Bitcoin launch boosts enlargement plans

In late March, Hut 8 launched a brand new U.S.-based subsidiary referred to as American Bitcoin. The undertaking consists of members of former President Donald Trump’s household as companions. The corporate mentioned this new unit goals to be the most important “pure-play Bitcoin miner” and construct a strategic Bitcoin reserve.

The announcement was adopted by studies in April that American Bitcoin would increase funds by an preliminary public providing. Genoot acknowledged that the brand new construction permits extra environment friendly use of capital.

“The streamlined capital allocation framework made possible by the American Bitcoin launch reinforces our ability to scale lower-cost-of-capital businesses such as high-performance computing,”

he mentioned.

The main focus stays on increasing Bitcoin mining whereas reducing operational prices by new subsidiaries and infrastructure.

Bitcoin mining agency outlines 2025 infrastructure targets

Hut 8’s roadmap for 2025 consists of a number of infrastructure milestones. These embody powering up the Vega information middle, starting work on the River Bend website, and creating a utility-scale energy portfolio. Genoot mentioned these efforts goal to create “resilient near-term cash flows.”

The power portfolio helps high-performance Bitcoin mining and computing operations. The agency continues so as to add infrastructure throughout the U.S. to extend operational scale.

Whereas Hut 8 is pushing enlargement, additionally it is navigating a high-cost surroundings. The corporate’s quarterly submitting displays capital spending linked to mining fleet upgrades and energy plant improvement.

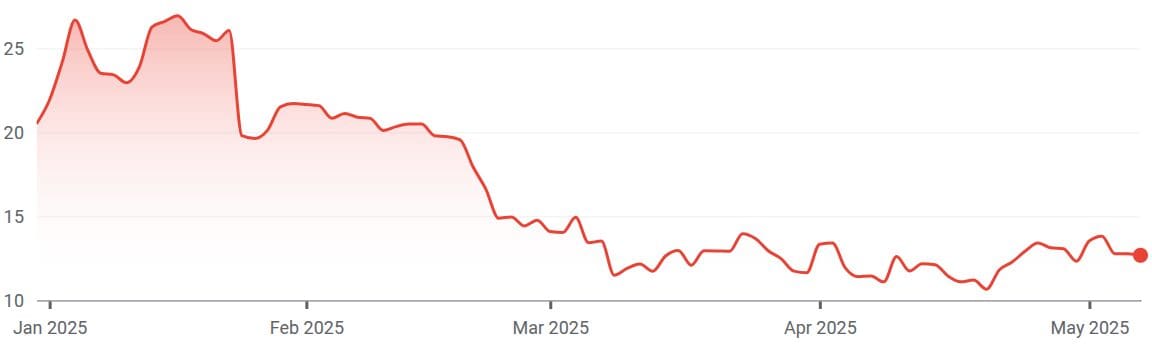

Hut 8 inventory falls 38% since begin of 2025

Hut 8’s inventory closed at $12.66 on Nasdaq on Might 8, up 2.2% for the day. Nonetheless, it has dropped 38% from $20.49 at the start of the yr. Buyers are watching the corporate’s excessive bills and delayed returns from ongoing tasks.

Against this, Bitcoin mining agency Core Scientific posted a $580 million revenue in the identical quarter. Nevertheless it missed analyst income forecasts as a consequence of decrease mining rewards.

The combined monetary outcomes amongst miners come throughout Bitcoin’s price restoration. Bitcoin traded above $101,000 on Might 8, rising from January ranges close to $97,000.