Oselote

HUT 8 Mining Corp. (NASDAQ:HUT) has been one of many mining corporations on my radar because the begin of this Bitcoin (BTC-USD) market cycle. In my protection of the inventory about ten months in the past, I advisable a “hold” – at a time once I gave friends like Marathon Digital (MARA) and Riot Platforms (RIOT) a “sell” ranking. The rising Bitcoin miner appealed to me then due to its sturdy money place (strengthened by its BTC holding) and the deliberate merger with USBTC at the moment, although the corporate confronted a number of downtime points in that interval.

My following protection of HUT 8 was a bit over six months in the past (in January). In that article, which I titled HUT 8: Diversified Enterprise Attraction, I highlighted how HUT’s rising high-performance computing (HPC) enterprise makes the corporate a sexy Bitcoin miner. I additionally talked about the miner’s low price-to-hash ratio in comparison with friends, and the extra reasonable price motion the inventory had seen in comparison with friends who had recorded triple-digit share beneficial properties. The inventory is up about 67% on that “buy” ranking. Contemplating the YTD acquire and the present inventory price, is there room for extra upside for HUT?

HUT’s Monetary and Operations Turnaround

Since Asher Genoot turned CEO of HUT, there was some turnaround within the firm’s operations. Within the CEO’s personal phrases: “We have centered Hut 8 on operating excellence and bottom-line economics.” A part of the required steps for the corporate has been the sunsetting of inefficient amenities and merchandise. HUT’s facility at Drumheller was shut down in Q1 for being inefficient.

In articles, I wrote final month masking CleanSpark (CLSK) and Marathon Digital, I talked about how vital it’s for a miner to instantly personal and management key facets of its operations at this stage of the Bitcoin market cycle. Because the fourth halving occasion, a miner’s direct management over such key variables has been one of the necessary qualitative elements I search for earlier than contemplating including a miner inventory to my portfolio. MARA now instantly owns and controls 54% of its electrical energy versus simply 3% beforehand, and runs largely proprietary software program and {hardware}. Bitdeer (BTDR) is transferring in direction of incorporating proprietary {hardware} and software program in its operations. Miners who nonetheless rely closely on third-party suppliers for sources like electrical energy and amenities may simply lag in operational effectivity.

HUT 8 has moved away from operating most of its miners at hosted amenities and now operates its personal amenities. Fleets from hosted amenities have been relocated to HUT’s personal amenities. HUT can also be implementing proprietary software program that can monitor its vitality utilization and assist the miner attain environment friendly vitality utilization. Transferring to its personal website has lowered HUT’s value to mine BTC resulting from its decrease all-in vitality value of lower than $275,000 per megawatt for 63 megawatts of recent capability the miner introduced on-line in Q1. Price to mine at HUT’s personal amenities is predicted to finally turn into 30% decrease in comparison with when the corporate primarily used hosted amenities. The miner is within the means of creating 1,100 MW of electrical energy and has ample dry powder to realize this.

HUT’s stability sheet stays very liquid. Its 9,102 BTC holding on the finish of Q1 resulted in a $276.4 million web earnings, resulting from a valuation of its BTC holdings to honest worth primarily based on the FASB honest worth accounting rule which Bitcoin miners have adopted. Web property (whole property minus whole liabilities) are about 3 times better than whole liabilities. Whole property are about $1 billion and whole liabilities are $258 million. Notice that HUT’s Q1 stability sheet contains property from its acquisition of 4 energy vegetation from entities managed by Validus Energy Corp., earlier this yr. What makes HUT’s stability sheet extra engaging and extremely liquid is that its 9,102 BTC holdings, marked at a good worth of round $650 million, make up over 50% of its whole property. The underside line is that for the time being HUT can comfortably cowl its debt obligation, spend money on development alternatives, and have a lot much less must tackle debt with unfavorable circumstances.

Backside Line

I like the truth that HUT is specializing in electrical energy capability enlargement to reinforce its self-mining. One of many drawbacks HUT has confronted prior to now has been energy surges at a few of its amenities, leading to operational inefficiencies. Challenges with mining operations are about to be a factor of the previous for HUT.

All indicators recommend that HUT’s AI vertical enterprise may begin producing gross sales quickly. HUT has hinted on the excessive chance of producing income from its AI vertical enterprise within the second half of this yr. In accordance with HUT’s June operations replace, 512 Nvidia H100 GPUs have been put in and configured at an HPC information heart in June as a part of outfitting the information facilities to accommodate the brand new AI infrastructure.

One of many perks of holding HUT in a Bitcoin inventory portfolio is its a lot lesser threat of dilution in comparison with a few of its mining friends. I do not see any want for HUT to lift funds via fairness within the foreseeable future. It is over 9,000 BTC stash, the latest $150 million Coatue funding to spice up its HPC line for its AI vertical enterprise, and its restated $65 million credit score facility from Coinbase present all of the dry powder the corporate could be needing. It’s value mentioning that whereas HUT does not face threat of quick dilution, there may be threat of dilution sooner or later sooner or later. The $150 million Coatue funding, for instance, was secured via convertible notes.

HUT Golden Cross (barchart.com)

From a technical standpoint, HUT’s MA50 crossed MA200, forming a Golden Cross final week. The final Golden Cross final yr despatched the inventory hovering 120% in a 60-day interval. There’s potential for HUT forming a powerful uptrend channel and see an analogous uptrend after the latest Golden Cross if the present Bitcoin sell-off FUD does not impede Bitcoin’s momentum for too lengthy.

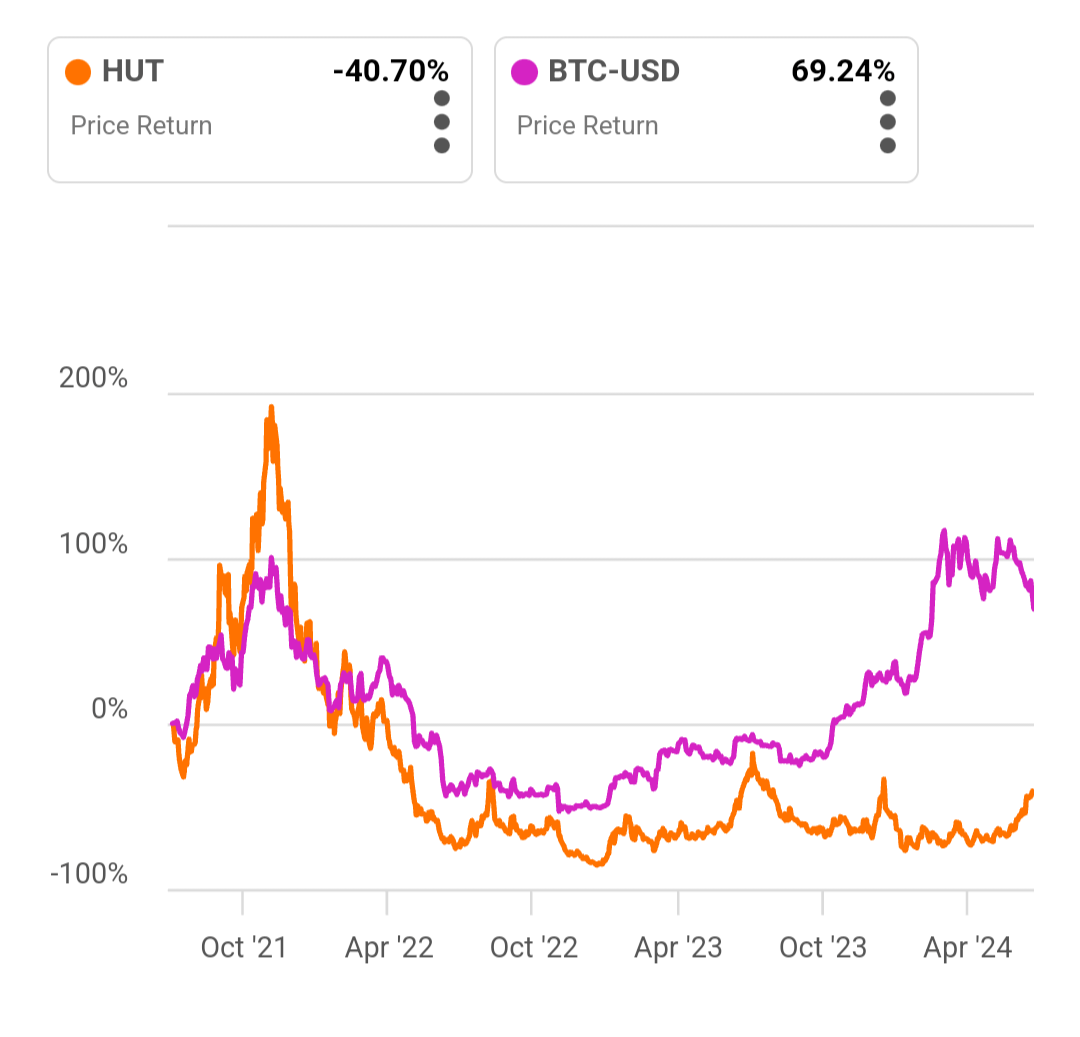

HUT vs BTC price motion 3Y (Searching for Alpha)

As seen within the chart above, HUT has majorly mirrored Bitcoin price actions; although there was some decoupling between HUT and BTC since Q3 final yr, HUT stays primarily thought to be a Bitcoin inventory and isn’t immune from the consequences of Bitcoin’s volatility. Nonetheless, I imagine that HUT is without doubt one of the Bitcoin shares that might see an additional price decoupling from Bitcoin quickly, when the AI vertical enterprise takes full form and income from that phase begins to contribute a big share to whole income.

Although the inventory is up over 60% because the final “buy” ranking in January, I see extra upside potential for HUT primarily based on easy, clear technical indicators and powerful qualitative elements.