As cryptocurrencies like Bitcoin and Ethereum collect momentum amongst traders desperate to trip the crypto-wave, Hut 8 (HUT), one of many main Bitcoin miners, stands out with a 175% achieve within the final 90 days, considerably outperforming Bitcoin and tech heavyweights like Nvidia (NVDA). As well as, the corporate not too long ago secured a $150M funding to energy its AI infrastructure and is primed for addition to the Russell 3000 Index.

The corporate is nicely positioned for future development, significantly if Bitcoin rallies greater. It’s an intriguing possibility for traders inquisitive about publicity to the rising cryptocurrency infrastructure trade.

Hut 8 Expands Its Amenities

Hut 8 is a vertically built-in operator of power infrastructure and Bitcoin mining. It operates in 4 important sectors: Digital Belongings Mining, Managed Providers, Excessive Efficiency Computing (HPC)- Colocation and Cloud, and Others.

In current information, Hut 8 secured a $150 million funding from Coatue Administration and boosted its Bitcoin manufacturing with upgrades at its Salt Creek website. The corporate has additionally transitioned away from utilizing hosted amenities for miners and now operates its personal websites, thus lowering the price of mining Bitcoin attributable to decrease power expenditure.

The corporate anticipates a 30% discount in mining prices in its amenities. The closure of an underperforming website, the motion of infrastructure from hosted to owned amenities, and the introduction of power curtailment software program are vital current developments for the agency.

Additional enlargement is anticipated, as Hut 8 has introduced definitive agreements for a website in West Texas. This website will present Hut 8 entry to 205 megawatts of instantly accessible energy capability.

Hut 8’s Latest Monetary Outcomes

The corporate reported Q1 2024 monetary outcomes, its first full quarter of operation since its merger with U.S. Bitcoin Corp in This autumn 2023. Income of $51.74 million fell wanting analysts’ expectations of $65.07 million, although it marked a substantial improve from $15.6 million year-over-year.

Internet revenue grew to $250.9 million from $17.3 million when put next towards Q1 2023. Adjusted EBITDA rose to $297.0 million from $11.1 million for a similar interval. Mining output grew with 716 Bitcoin mined in comparison with 524 Bitcoin in Q1 2023. The fee to mine Bitcoin elevated considerably, from $9,072 to $20,419 for owned amenities. Earnings per share of -$0.17, falling considerably wanting the analysts’ estimates of $0.59.

As of the top of Q1 2024, the corporate reported a steadiness sheet with $11.5 million in money and 9,102 Bitcoin, valued at $648.9 million, with 7,230 Bitcoin, equal to $515.4 million, unencumbered. The corporate additionally reported a complete debt of $177.6 million, of which $112.8 million is project-level debt with no minimal month-to-month reimbursement. This quarter additionally noticed Hut 8 draw an extra $50 million from its coin-based mortgage, rising the excellent complete to $64.8 million.

What Is the Worth Goal for HUT Inventory?

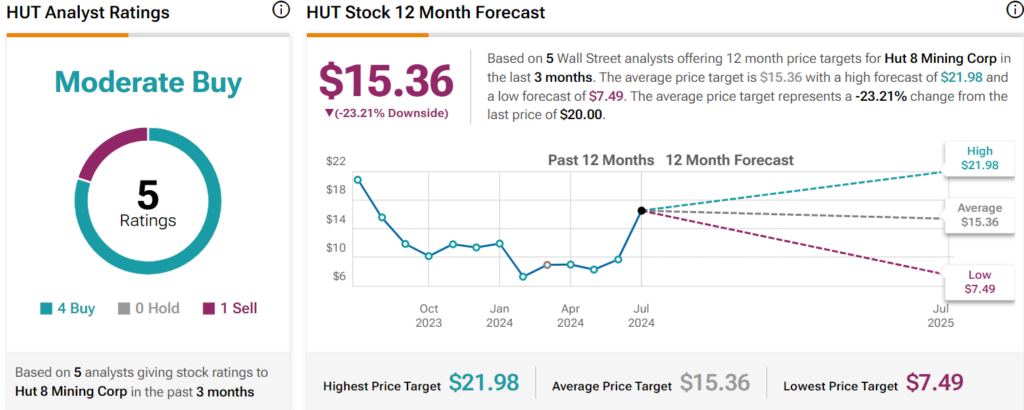

The inventory is extremely unstable, sporting a beta of two.95 and bouncing between $19 and $6.33 over the previous yr. It trades on the excessive finish of its 52-week price vary of $6.18 – $21.55 and exhibits ongoing optimistic price momentum, buying and selling above the 20-day (14.50) and 50-day (12.25) transferring averages. It trades at a relative low cost, with a P/E ratio of 6.92x, in comparison with the Capital Markets trade common of 18.36x.

Analysts following the corporate have been constructive on the inventory. For example, Canaccord analyst Joseph Vafi, a five-star analyst based on Tipranks scores, not too long ago raised the price goal from $14 to $22 whereas sustaining a Purchase score on the shares. He famous the significance of getting websites and energy to assist the rising demand for high-performance computing, with optimistic developments towards the corporate’s 1.1GW improvement alternative.

Total, Hut 8 is rated a Reasonable Purchase based mostly on 5 analysts’ suggestions and not too long ago assigned price targets. The common price goal for HUT inventory is $15.37, representing a possible draw back of 23.13% from present ranges.

Ultimate Evaluation on HUT Inventory

Hut 8 presents an attractive alternative for savvy traders. The corporate is poised for vital development, fueled by a current infusion of capital to bolster infrastructure and enlargement, as seen by its profitable procurement of a website with 205MW of available energy in West Texas. The corporate’s projected 30% discount in mining prices and transition to self-owned amenities are well-timed strategic strikes.

Though the inventory price tends to be unstable, it trades at a relative low cost, presenting an intriguing alternative for traders to achieve long-term publicity to this development section.

Disclosure