Picture supply: Getty Pictures

After spending a lifetime at work, all of us hope to benefit from the sit back and benefit from the fruits of our labours. However precisely how a lot passive earnings will we have to dwell comfortably? This will range considerably from individual to individual.

What is evident, nonetheless, is that the quantity required for an excellent way of life in retirement is rising steadily over time. It signifies that making the proper monetary selections when planning for later life is changing into more and more vital.

The excellent news is that buyers at the moment have extra alternatives than ever earlier than to hit their retirement objectives. Right here’s how I’m assured of attaining an opulent retirement.

The goal

As I discussed, the precise quantity an individual wants in later life will range, relying on elements like their retirement objectives, the place they dwell, and their relationship standing.

But it’s price contemplating what the Pensions and Lifetime Financial savings Affiliation (PLSA) says the typical particular person wants for a snug retirement to get a tough ball park estimate.

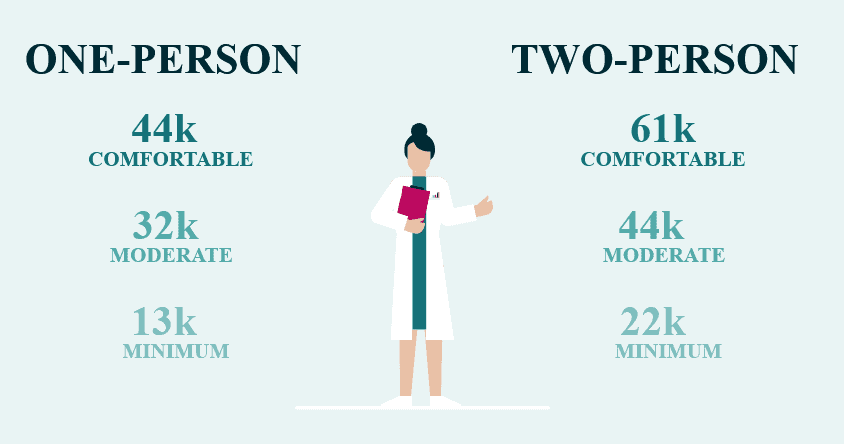

Its newest research exhibits that the typical one-person family requires a £43,900 yearly earnings for a snug life-style. This degree of earnings would supply for necessities and extras like a a wholesome finances for meals and garments, a substitute automobile each three years, and a two-week vacation within the Med and frequent journeys away every year.

The determine for a two-person family is £60,600.

A £38k+ earnings

There are numerous paths people can take to hit that objective. They’ll put money into property, develop a aspect hustle, or put cash in dividend- and capital gains-generating shares, for example.

I’ve personally chosen to prioritise investing in world shares to make a retirement earnings, with some cash additionally put apart in money accounts to handle threat. With an 80-20 cut up throughout these strains, I’m concentrating on a median annual return of not less than 9% on my share investments and 4% on my money over the interval.

Let me present you ways this works. With a month-to-month funding of £400 in shares and money, I may — if the whole lot goes to plan — have a £641,362 nest egg to retire on.

If I then invested this in 6%-yielding dividend shares, I’d have an annual passive earnings of £38,482. Added to the State Pension (at present at £11,975), I may simply obtain what I’ll must retire in consolation.

Taking the US route

After all, investing in shares is riskier than placing all my cash in a easy financial savings account. Nonetheless, funds and trusts just like the iShares Core S&P 500 UCITS ETF (LSE:CSPX) can considerably scale back my threat whereas nonetheless letting me goal the sturdy long-term returns the US inventory market can present.

Keep in mind, although, that efficiency might be bumpy throughout broader share market downturns.

This exchange-traded fund (ETF) has holdings in all the companies listed on the S&P 500 index. In addition to offering me with wonderful diversification by sector and area, it offers me publicity to world-class corporations with market-leading positions and robust stability sheets (like Nvidia and Apple).

Since 2015, this iShares fund has supplied a median annual return of 12.5%. If this continues, a daily funding right here may put me properly on the right track for a wholesome passive earnings in retirement. It’s why I already maintain it in my portfolio.