Nothing excites the market greater than a venture getting listed on Binance. It’s not only a stamp of product validation. It’s a liquidity catalyst that usually propels a venture into its subsequent part of development. This text explores the potential Binance listings of 5 tasks at present gaining robust consideration within the Web3 house: DeepBook, Hyperlane, Gomble, MegaETH, and Aster (Astherus).

Lately, Binance’s rollout of the “Vote to Delist” program has additional signaled a strategic shift: clearing out underperforming or fragmented tokens to make room for newer, high-potential tasks, lots of that are backed by Binance-affiliated entities like YZI Labs. This transfer not solely streamlines liquidity throughout the platform but additionally paves the best way for upcoming listings to launch with greater totally diluted valuations (FDVs).

Every venture will likely be assessed primarily based on 4 key pillars – ecosystem function, product maturity, tokenomics, and ties to Binance—to offer a complete outlook on their itemizing potential.

MegaETH

MegaETH is an rising Layer 2 answer optimized for ultra-fast transaction speeds, impressed by high-frequency buying and selling (HFT) methods in conventional finance. With sub-10ms processing instances, extraordinarily low latency, and the power to deal with up to 100,000 transactions per second, MegaETH goals to change into the go-to infrastructure layer for high-performance DeFi purposes.

As of early 2025, the venture has raised a complete of $57 million, together with a $20 million Sequence A led by Paradigm in June 2024 and a $10 million strategic spherical in December 2024.

First, Paradigm, one in all Binance’s closest enterprise capital allies, backs MegaETH, an element that carries appreciable weight. Traditionally, tasks like dYdX, Blur, and Blast — all backed by Paradigm, have been listed on Binance shortly after their token launches.

Moreover, MegaETH raised funds through Echo, much like how Ordinary and Initia did. Notably, each Ordinary and Initia secured Binance listings shortly after finishing their Echo-based fundraising rounds. This strengthens the case that Binance is at present monitoring community-driven tasks, particularly these supported by means of the Echo launch framework.

Learn extra: MegaETH Airdrop Information: Earn the Unique Airdrop Distribution

MegaETH was raised on Echo – Supply: Echo

Deepbook (DEEP)

DeepBook is a decentralized on-chain orderbook constructed immediately into the infrastructure of the Sui Community. Not like conventional standalone DEXs, DeepBook features as a shared liquidity layer for all the DeFi ecosystem on Sui.

A number of main exchanges – together with Gate.io, Bybit, KuCoin, Bithumb, and MEXC—already record DEEP.

DeepBook serves as a core infrastructure element for Sui — very similar to Raydium and Serum did for Solana or dYdX for Cosmos. Binance has traditionally prioritized tokens that function “core liquidity infra.” Since DEEP anchors liquidity throughout most DeFi protocols on Sui, it’s a pure candidate for Binance’s radar.

Second, utilization metrics are extremely constructive. In response to knowledge from the Sui Basis, over 85% of orderbook buying and selling quantity on Sui flows by means of DeepBook — notably through DEXs like Cetus and Turbos. By integrating natively into the Sui consensus, DeepBook affords ultra-fast matching speeds with out counting on standalone sensible contracts like most different DEXs. This provides it a technical edge in scalability and safety — two key itemizing elements for Binance.

DEEP additionally matches into Binance’s broader technique to broaden liquidity and record key Sui ecosystem tokens. Binance has already listed SUI, adopted by CETUS. By ecosystem logic, DEEP is the most certainly subsequent candidate.

Furthermore, DEEP’s token distribution is strongly community-driven, with the bulk allotted to customers and builders by means of airdrops, incentives, and liquidity mining – aligning carefully with Binance’s desire for decentralized distribution fashions.

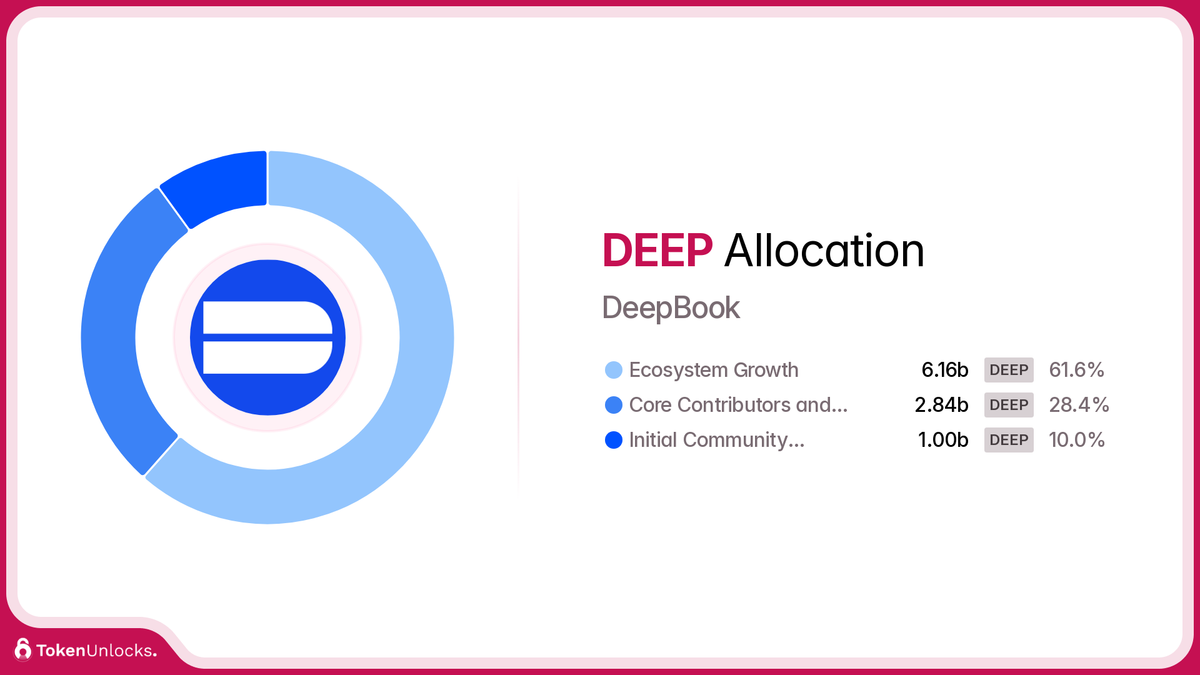

Token allocation breakdown:

- 61.57% to the group

- 10.93% to traders

- 10% to Mysten Labs

- 7.5% to early contributors

- 10% for the preliminary airdrop

DEEP Allocation – Supply: TokenUnlocks

Hyperlane (HYPER)

Hyperlane (HYPER) is a cross-chain messaging protocol that permits blockchains to ship and obtain knowledge securely and flexibly, much like LayerZero.

The venture performs a strategic function within the rising modular blockchain wave, alongside tasks like Celestia, Motion Labs, Eclipse, and Berachain. Binance has proven rising curiosity on this pattern, particularly after itemizing modular-focused tokens like ZRO. If ZRO helps bridge capital throughout EVM chains, then HYPER might function the messaging spine for modular and app-specific chains – a route Binance can be pursuing by means of the modularization of BNB Sensible Chain.

Like DEEP, HYPER encompasses a decentralized token distribution, with 57% allotted to the group through incentives, grants, staking, and liquidity mining. Non-public allocations are topic to long-term lockups, aligning with Binance’s desire for decentralization.

One other notable benefit is HYPER’s investor profile, which incorporates funds with robust historic ties to Binance listings. Corporations like CoinFund, Variant, and Galaxy Digital have beforehand backed tasks that later launched on Binance. With a funding spherical totaling over $18 million, HYPER stands out as a powerful itemizing candidate.

In response to ICO Drops, CoinFund has backed 93 tasks, with roughly 28.57% of them making it onto Binance – a comparatively excessive success price.

Learn extra: Examine Your Hyperlane Airdrop: HYPER Claimer has Opened

Gomble (GM)

Gomble (GM) is without doubt one of the few Web3 gaming studios that prioritize “fun-first” gameplay, fairly than focusing solely on the “play-to-earn” mannequin. With its flagship title, RumbyStars, and a broader ecosystem of interconnected minigames constructed round a social graph, the venture has attracted over 3.5 million customers, together with 2.8 million month-to-month lively gamers—a uncommon milestone within the Web3 gaming house at this time.

Gomble secured direct funding from Binance Labs, and Binance Alpha Highlight lately featured the venture — a sign that usually suggests a possible Launchpool inclusion or spot itemizing.

Moreover, Gomble has had early and significant integration with the Binance Pockets ecosystem, together with group campaigns, staking trials, and official mentions on Binance’s social channels. This aligns with a well-known sample noticed in previous Binance listings: media collaboration → person engagement marketing campaign → alternate itemizing. Notable examples embrace Renzo and Fusionist.

Lastly, Gomble’s token distribution construction aligns carefully with Binance’s emphasis on decentralized tokenomics – a key criterion for a lot of of its current listings.

Study extra: Binance Alpha Newly Launches DARK and GOMBLE

Gomble on Binance Alpha – Supply: Binance

Aster

Aster, previously often known as Astherus, operates as a decentralized perpetuals alternate (perpetual DEX) that goals to rival main platforms like dYdX, GMX, and Hyperliquid. The venture goals to ship excessive efficiency with a CEX-like person expertise whereas additionally constructing out a local rewards factors system and proprietary stablecoin to assist long-term development.

As of April 2025, Aster has surpassed $258 billion in cumulative buying and selling quantity, making it one of the vital lively perpetual DEXs but to launch a token.

Aster participated in Binance Labs’ Seed funding spherical, becoming a member of the ranks of tasks like Arkham (ARKM) and Ethena (ENA)—each of which later secured listings by means of Binance Launchpool or direct spot markets. Lately, practically 50% of Binance Labs’ seed-stage portfolio has made it to Binance, a sample that underscores the energy of inside assist and ecosystem alignment.

You’ll be able to be a part of Aster airdrop and ave 10% low cost at this hyperlink right here

Past funding ties, Aster additionally has technical integration with Binance infrastructure. Particularly, the venture has run staking incentive campaigns through Binance’s Keyless Pockets, showcasing actual traction throughout the Binance ecosystem.

There are such a lot of completely different variations of BNB rewards. asBNB, slisBNB, clisBNB… mix them? https://t.co/J5MLT44prt

— CZ 🔶 BNB (@cz_binance) April 18, 2025

The perp buying and selling narrative is clearly resurging following the surge of next-gen perpetual DEX tokens like Hyperliquid and Aevo. As Binance seems to be to diversify liquidity and foster wholesome competitors with CEX options, Aster stands out as a well-developed candidate for potential Launchpool inclusion or direct itemizing—very similar to Ethena (ENA) earlier than it.

Conclusion

Within the fierce competitors for a Binance itemizing, few tasks actually stand out, however these 5 carry distinctive strengths that give them a transparent edge.

Every venture aligns carefully with Binance’s recognized itemizing patterns: robust narrative match, lively person base, strategic investor alignment, and—maybe most significantly—credible involvement with Binance’s personal infrastructure or enterprise arms. Whereas nothing is ever assured in crypto, Binance could quickly flip its consideration to those 5 promising tasks.

Learn extra: High 5 Finest Airdrop Farming Initiatives on Solana (Half 1)