Picture supply: Vodafone Group plc

The Vodafone (LSE:VOD) share price is presently (14 August) round 74p. It was final above 80p in September 2023. Since August 2023, the shares have risen in worth by a meagre 2.5%.

The inventory seems to be going nowhere.

However I imagine there’s some proof to counsel that the corporate is considerably undervalued. Nonetheless, I feel will probably be some time earlier than a ample variety of buyers are persuaded to push the share price greater. Let me clarify.

The proof

Deutsche Telekom is Europe’s most beneficial telecoms firm. For the yr ending 31 December, the consensus forecast of analysts is for earnings per share (EPS) of €1.81. With a present (14 August) share price of €24.85, the price-to-earnings (P/E) ratio‘s 13.7.

Vodafone’s presently present process a restructuring train. Excluding the elements that the group is presently seeking to promote, analysts predict EPS of 9.22 euro cents (7.89p) for the yr ending 31 March 2025 (FY25). If right, this means a P/E ratio of 9.4.

If Vodafone had been to attain the identical valuation a number of as its German rival, its share price can be 46% greater (108p).

It’s the same story in the case of dividends. Deutsche Telekom’s forecast to pay 0.85 euro cents a share in 2024. This offers a present yield of three.4%.

Vodafone’s anticipated to return 4.50 euro cents (3.85p) to shareholders in FY25 — a yield of 5.2%.

As shareholders within the UK firm know all too nicely, dividends are by no means assured. Vodafone halved its payout in 2019 and introduced one other 50% discount — for FY25 — in Could.

An organization’s dividend is meant to compensate for the chance related to holding its shares. If Vodafone’s shareholders had been snug with a yield 3.4%, its share price can be 113p — a rise of 52% over its present degree.

Investor sentiment

As a shareholder in Vodafone, I’m tempted to assume that is unfair.

However it’s solely a part of the story. Deutsche Telekom’s lately reported its twenty sixth consecutive quarter of progress in EBITDAaL (earnings earlier than curiosity, tax, depreciation and amortisation, after leases) within the European Union. And it’s elevated its earnings in Germany for 31 successive quarters.

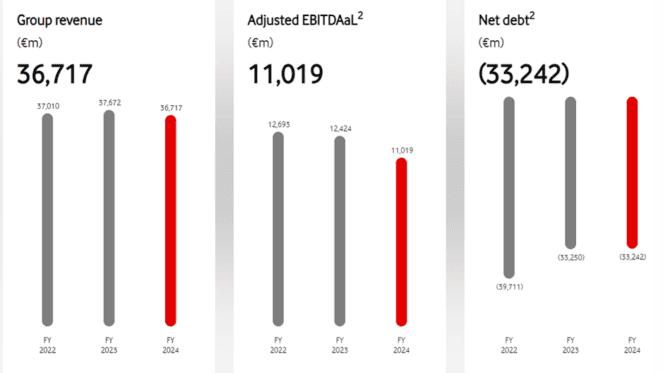

Throughout this time, Vodafone’ share price has fallen by round two thirds. Vodafone’s group income in FY24 was decrease than in FY22. And its EBITDAal — adjusted to keep in mind a slimmed down group — was €1.67bn much less.

I’m sure this explains the distinction within the valuations of the 2 firms. One’s rising whereas the opposite’s present process a radical restructuring.

However by exiting Spain and Italy, Vodafone’s attempting to take care of its enormous debt and enhance its return on capital which is lagging a few of its friends.

Wanting additional forward

And if Vodafone’s reorganisation proves to achieve success — and it may well reveal it’s rising as soon as extra — then I see no cause why its share price wouldn’t rise by round 50%.

However it’s going to take time. Its first quarter outcomes for FY25 confirmed some indicators of a restoration. Income was up 3.2%, in comparison with a yr earlier. And EBITDAaL was almost 2% greater.

Nonetheless, one swallow doesn’t a summer time make. A number of quarters of elevated income and earnings are wanted earlier than — I imagine — buyers will view the corporate as favourably as, for instance, Deutsche Telekom.