Picture supply: Getty Photographs

Demand for Barclays (LSE:BARC) shares hasn’t been dampened by alarm bells ringing for the UK financial system and uncertainty within the US.

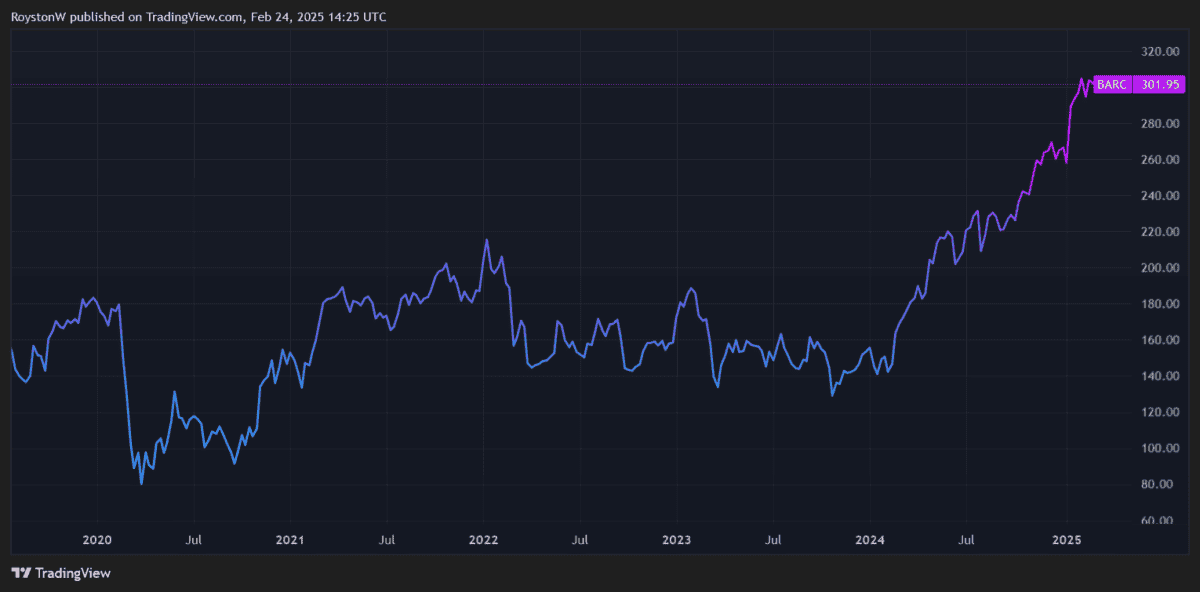

At 302p per share, the Barclays share price is up 14% because the begin of 2025. This takes complete beneficial properties for the previous yr to a whopping 83%.

Metropolis analysts don’t consider the FTSE 100‘s bull run is finished yet either. They’re tipping extra double-digit will increase over the following 12 months.

Ought to I think about snapping up Barclays shares?

11% extra to go?

First, it’s price noting that there are some giant variances throughout brokers’ present forecasts.

One significantly bullish analyst thinks Barclays’ share price will rise an additional 29% over the following yr, to 390p. On the different finish of the size, one pessimistic forecaster has set a 12-month price goal of 230p, down 24% from present ranges.

Having mentioned this, the general image painted by Metropolis brokers is fairly upbeat. The common price goal amongst 17 brokers is 335.20p per share. That represents an 11% premium to immediately’s price.

Low-cost on paper

One purpose why analysts suppose Barclays shares will rise might be due to its relative cheapness.

The quantity crunchers suppose the financial institution’s annual earnings will bounce 17% in 2025. This leaves it buying and selling on a price-to-earnings-to-growth (PEG) ratio of 0.4.

Any studying beneath one signifies {that a} share is undervalued.

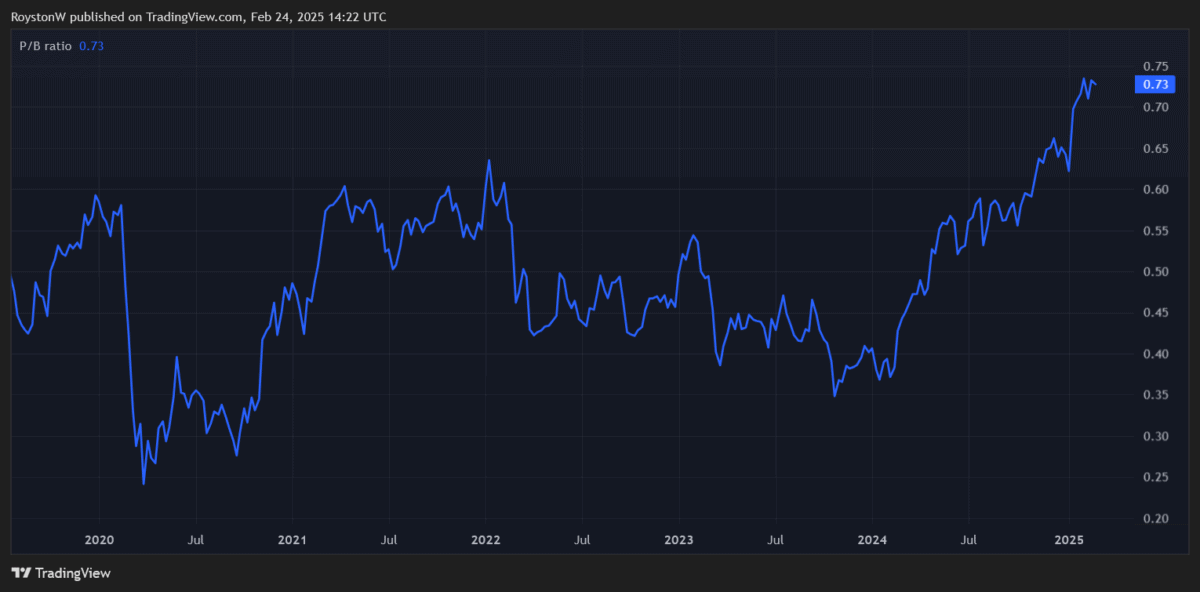

Moreover, Barclays’ price-to-book (P/B) worth can also be beneath one, indicating it trades at a reduction to the worth of its property.

Lastly, the agency’s price-to-earnings (P/E) ratio of seven.1 occasions for this monetary yr can also be extraordinarily low, together with relative to these of its friends.

Different UK-focused banks Lloyds and NatWest carry ahead earnings multiples of 9.9 occasions and eight occasions, respectively.

Reward vs threat

With brokers tipping an 11% price rise, and the Footsie financial institution additionally providing a 3% dividend yield, it’s simple to see why Barclays shares are so standard immediately.

The corporate’s forecast-beating outcomes for 2024 and revised medium-term targets have additionally boosted investor urge for food. The financial institution now expects to ship a return on tangible fairness (ROTE) of 11% and 12%-plus in 2025 and 2026, respectively, up from 10.5% final yr.

That is thanks largely to spectacular performances on the agency’s giant funding financial institution.

However with inflationary pressures growing, and different new hazards (like recent commerce tariffs) threatening the delicate financial system, buying and selling situations right here would possibly grow to be quite a bit harder from this level.

On the identical time, the threats to Barclays’ retail enterprise are additionally appreciable. Web curiosity margins (NIMs) may shrink sharply due to a double-whammy of rising competitors and falling rates of interest.

I’m additionally afraid of the prospect of weak mortgage development and rising impairments if financial situations stay powerful. Worryingly, the financial institution incurred a forecast-topping £2bn price of credit score impairment costs final yr, up 5% from 2023 ranges.

Lastly, Barclays dangers going through substantial monetary penalties if discovered responsible of mis-selling automobile finance. It’s put aside £90m to cowl doable prices, although consultants warn the precise determine might be far larger.

Whereas Metropolis brokers are bullish on Barclays’ share price, I don’t plan so as to add the financial institution to my very own portfolio. The dangers are too nice for my liking, even regardless of the cheapness of its shares.