Senator Elizabeth Warren has referred to as on regulators to analyze the Trump memecoins, citing issues about ethics, potential conflicts of curiosity, and nationwide safety dangers. Warren despatched a letter to companies just like the Securities and Trade Fee (SEC) and the Commodity Futures Trading Fee (CFTC), asking them to look at the Official Trump (TRUMP) and Melania Meme (MELANIA) tokens. In response to her, these tokens not solely elevate moral questions but additionally expose traders to vital dangers.

Why Warren Requested Regulators to Probe TRUMP Memecoins?

Warren’s letter outlined a number of main points. First, she highlighted the battle of curiosity created by Trump’s twin roles as a token promoter and the U.S. President. As President, Trump has the ability to nominate leaders of key regulatory companies accountable for overseeing cryptocurrencies. This raises questions on whether or not his coverage selections may favor his monetary pursuits within the memecoins.

One other concern is the potential of overseas interference. Warren warned that hostile nations may exploit the untraceable nature of cryptocurrencies to purchase these tokens and exert covert affect over U.S. politics. This risk, she argued, creates a critical danger to nationwide safety.

Warren additionally identified that the Trump Group and its associates management 80% of the TRUMP token’s provide. This stage of possession means smaller traders are left to bear the dangers of price volatility. In response to Warren, this case unfairly advantages the Trump household whereas leaving retail traders susceptible.

40 Wallets Holds 94% Of The Token — Retail Buyers Are At Threat

The TRUMP token noticed a meteoric rise shortly after its launch, reaching an all-time excessive of $73. Nonetheless, it shortly misplaced momentum, falling 57% to its present price of round $32. The MELANIA token adopted an analogous trajectory, peaking at $13 earlier than plummeting to $2.60. These steep price declines have left many small traders going through losses.

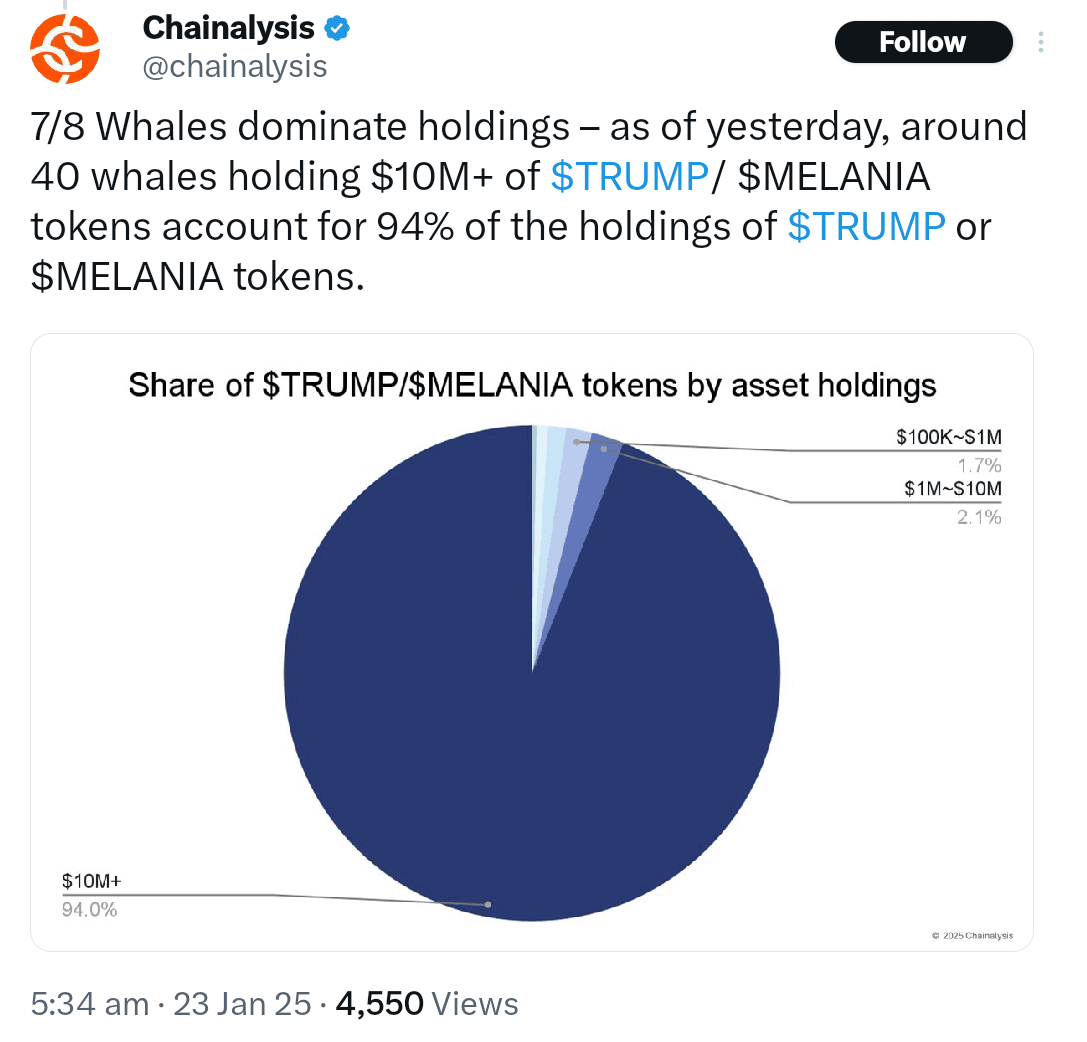

Blockchain analytics agency Chainalysis revealed that the overwhelming majority of those tokens are managed by a small group of traders. Roughly 94% of the mixed token provide is held by simply 40 wallets.Trump

This focus of possession makes the market extremely prone to manipulation. If even just a few of those massive holders determine to promote their tokens, it may set off a big price crash, leaving smaller traders with main losses.

TRUMP Token Has No Sensible Use

A significant criticism of the Trump memecoins is their lack of utility. Even Cathie Wooden, CEO of ARK Make investments, has dismissed the tokens as speculative property with no sensible use. In contrast to cryptocurrencies like Bitcoin and Ethereum, which facilitate transactions or energy decentralized purposes, the TRUMP and MELANIA tokens serve no sensible perform past hypothesis.

Wooden likened the present memecoin frenzy to the preliminary coin providing (ICO) growth of 2017, a interval marked by the rise of speculative and infrequently poorly designed tokens. She emphasised that ARK Make investments avoids memecoins as a consequence of their lack of significant contributions to the monetary ecosystem.

Who Actually Advantages?

Regardless of the dangers, the memecoins have attracted vital curiosity, significantly from first-time crypto customers. Chainalysis reported that just about half of the patrons created wallets particularly to buy TRUMP and MELANIA tokens. Nonetheless, most of those traders have seen little to no returns, with many shedding cash as a consequence of price volatility.

The first beneficiaries seem like the Trump Group and a small group of huge holders. Warren has accused the tokens of being a monetary software designed to personally enrich Trump and his associates, whereas smaller traders bear the dangers.

Is It Time to Dump Trump Memecoin?

If regulators determine to take authorized motion towards the Trump memecoins, it may have far-reaching penalties. Such motion may undermine investor confidence and result in a big sell-off, additional driving down the tokens’ costs. The opportunity of stricter rules on memecoins may additionally discourage potential traders and make it harder for these tokens to function successfully.

The controversy surrounding the tokens may additionally harm Trump’s public picture. Critics argue that the memecoins enrich the Trump household on the expense of retail traders, a notion that would hurt the tokens’ attraction. Some specialists have additionally raised issues a few potential “rug pull,” the place the Trump Group may dump its massive holdings, crashing the tokens’ worth and leaving small traders with heavy losses.