Liliya Filakhtova

Thesis Abstract

Ethereum (ETH-USD) ETFs have been permitted, and 9 ETFs can be out there for buy beginning Tuesday the twenty third of July.

Although all of those ETFs will observe the Ethereum price, there can be variations between these funds that traders ought to take note of earlier than investing.

Charges will, after all, be the most important issue to take a look at.

So which ETF has the bottom charges? Which ETF will appeal to probably the most capital? And what does the ETF approval imply for Ethereum and crypto?

Ethereum ETFs: Who’s Getting into the Race?

In whole, there can be 9 spot Ethereum ETFs that can start buying and selling on Tuesday twenty third of July.

These embody: Grayscale Ethereum Mini Belief (NYSEARCA:ETH), Franklin Ethereum ETF (BATS:EZET), VanEck Ethereum ETF (BATS:ETHV), Bitwise Ethereum ETF (NYSEARCA:ETHW), 21Shares Core Ethereum ETF (BATS:CETH), Constancy Ethereum Fund (BATS:FETH), iShares Ethereum Belief (NASDAQ:ETHA), and the Invesco Galaxy Ethereum ETF (BATS:QETH), and in addition the Grayscale Ethereum Belief (OTCQX:ETHE) which can be transformed to an ETF.

The wide range of ETFs will little doubt pave the way in which for elevated Ethereum adoption, permitting traders a neater solution to achieve publicity to this asset.

Nevertheless, with 9 choices to select from, we should be diligent about discovering out which the most suitable choice is. Since all of those will basically observe the efficiency of Ethereum, the principle consideration right here is charges.

Charges and Waivers

The checklist beneath exhibits us what the charges can be for every fund. Most of the funds can be waiving their charges, both fully, or partially, so that is one thing we should additionally take note of.

ETH ETFs charges and waivers (ccn.com)

As we will see, six of the funds will initially cost no charges in any respect. Nevertheless, these waivers are restricted when it comes to whole belongings and, most significantly, time. For probably the most half, charges will start to “normalize” after 6-12 months.

The one two funds to not supply any charge waiver can be QETH and ETHE. ETHE will truly go away its charge stage unchanged and with charges of two.5% will develop into the most costly ETH ETF.

Grayscale Ethereum Mini Belief: Aptly Named

Apparently, whereas Grayscale will seemingly see notable outflows from its ETHE fund, which can develop into the least aggressive of the ETFs, the corporate may stand to profit from the launch of its ETH Mini Belief.

That is, actually, a “spin-off” from its ETHE fund, and one thing the corporate can even do with its Grayscale Bitcoin Belief ETF (GBTC).

However how will this work?

Should you possess 1,000 shares of ETHE, you’ll be entitled to 1,000 shares of mini ETH. Though this originates from a share level, its worth is notably distinct.

A person holding $1,000 price of ETHE or GBTC could have $900 remaining within the unique fund and $100 allotted to the newly created mini ETFs following the spinoffs.

Supply: TokenPost

In different phrases, upon the launch of the mini fund 1/10 of the unique/giant fund can be transformed into the mini fund, which in flip has a worth per share of 1/10 relative to the unique/giant fund.

The Grayscale Ethereum Mini Belief could have a 0% charge for the primary $2 billion in belongings, second solely to iShares Ethereum Belief (ETHA), which could have 0% charges for the primary $2.5 billion in belongings.

Following this, nonetheless, ETH would be the fund with the bottom general charges, at solely 0.15%, with the Franklin Ethereum ETF (EZET) the subsequent most suitable choice at 0.19%

Cheaper is Higher

If the Ethereum launch is something just like the Bitcoin ETF launch, then we must always count on the funds with the bottom charges to do significantly better.

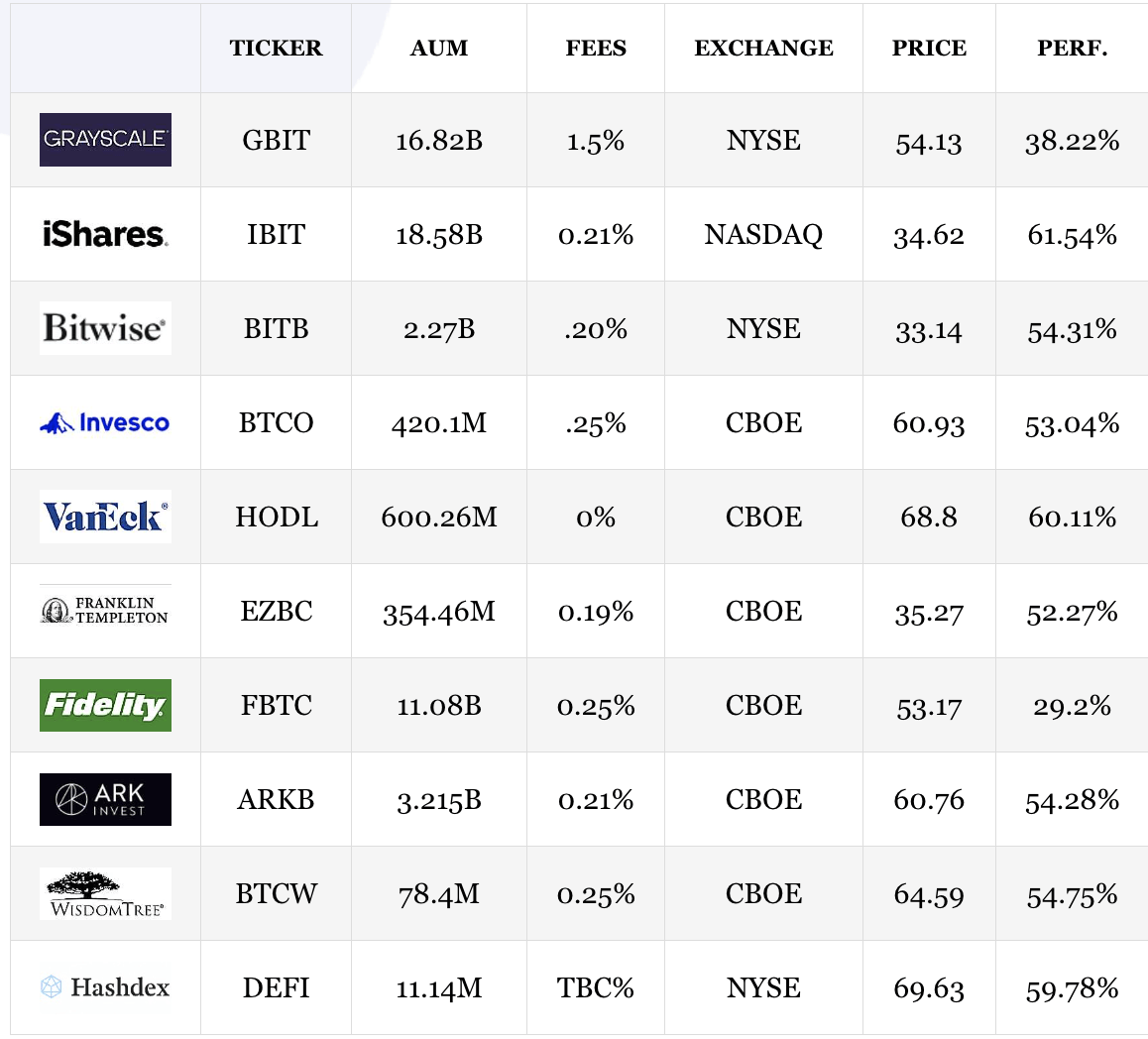

BTC ETF comparability (Mooloo)

Because it stands proper now, the VanEck Bitcoin Belief ETF (HODL) has the bottom charges, although they’ll enhance to 0.20% on April 1st, 2025. This fund has appreciated 60% since its launch and has 600 million in AUM.

The ETF with probably the most belongings and greatest efficiency is the iShares Bitcoin Belief ETF (IBIT), with $18.58 billion in AUM. There are a few funds with marginally decrease charges, however the iShares stands out as the most effective performer.

iShares is a really respected and standard ETF supplier, and this has seemingly additionally helped it safe a spot as the most well-liked BTC ETF.

Ethereum ETF Affect

The Ethereum ETF has been a much-awaited occasion, although it could truly pale compared to what we noticed through the Bitcoin ETF launch.

The crypto market maker Wintermute predicts that the Ethereum ETF will seemingly appeal to round $3.2-$4 billion in belongings.

With the agency anticipating Bitcoin ETFs to amass roughly $32 billion earlier than the top of the 12 months, which means Ethereum ETFs would get solely about 10% to 12.5% of the quantity of belongings that Bitcoin ETFs are projected to obtain.

Supply: DL Information, Wintermute report

The important thing difficulty right here is that Ethereum ETFs is not going to have a staking mechanism in place. Following Ethereum’s transition to Proof-Of-Stake, Ethereum holders with ample funds can stake their Ethereum and obtain a return on their funding (at present a 3.2% yield).

The ETFs is not going to have this characteristic in place, and can subsequently be much less engaging.

Nonetheless, Wintermute expects the Ethereum price may rise by 18%-24% as extra capital enters the asset via the ETFs.

Remaining Ideas

In conclusion, I consider that the Grayscale Ethereum Mini Belief fund may develop into the most well-liked Ethereum ETF. That is primarily based on three major causes:

-

It is going to have the bottom charges.

-

It is going to have a low share price (round $3).

-

Grayscale has a robust fame within the crypto world.

These three components ought to mix to make this a extremely popular choice. Everybody likes low charges, and the decreased share price can even assist appeal to smaller retail traders. Whereas Grayscale would not have as a lot of a fame as iShares, which can seemingly additionally do very nicely, I nonetheless assume that is the most suitable choice for traders.

Lastly, whereas this can be a nice step in the appropriate path for crypto, it might not be as important because the Bitcoin ETF.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.