Key Takeaways

- Grayscale’s Ethereum ETF noticed $346 million in internet outflows on its third day of buying and selling.

- BlackRock’s iShares Ethereum Belief led the pack with $71 million in inflows.

Share this text

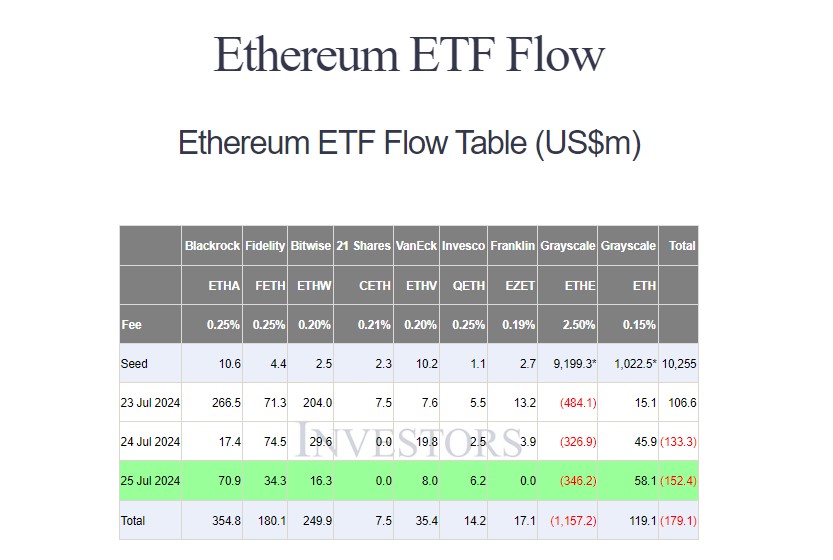

Grayscale’s Ethereum ETF (ETHE) ended Thursday with roughly $346 million in internet outflows, extending its losses to $1.1 billion inside three buying and selling days since its conversion, information from Farside Buyers reveals. After the third buying and selling day, ETHE’s property beneath administration plummeted from over $9 billion to $7.4 billion, a exceptional decline for the reason that launch of US spot Ethereum ETFs.

In distinction, BlackRock’s iShares Ethereum Belief (ETHA) led inflows on Thursday, attracting roughly $71 million. Grayscale’s Ethereum Mini Belief (ETH), a derivative of Grayscale’s Ethereum Belief, adopted with over $58 million in internet inflows.

Different funds, together with Constancy’s Ethereum Fund (FETH), Bitwise’s Ethereum ETF (ETHW), VanEck’s Ethereum ETF (ETHV), and Invesco/Galaxy’s Ethereum ETF (QETH), additionally reported inflows. The remaining ETFs noticed zero flows.

Regardless of inflows to eight Ethereum ETFs, the mixed internet outflow for all 9 funds on Wednesday reached $152 million, the biggest since their buying and selling debut on July 23. This outflow was largely pushed by Grayscale’s ETHE.

ETHE’s 2.5% price makes it a significantly costly possibility for traders who wish to get publicity to Ethereum. Buyers have been promoting their ETHE shares and transferring to lower-fee newcomers.

The scenario just isn’t solely sudden given the expertise of Grayscale’s Bitcoin ETF (GBTC). The fund’s outflows topped $5 billion after the primary buying and selling month, in line with information from Bloomberg.

Nonetheless, this time, Grayscale’s Ethereum Mini Belief may assist it do away with the deja vu. ETH’s 0.15% price makes it one of many lowest-cost spot Ethereum funds within the US market, and the fund’s inflows have persistently grown because it was transformed into an ETF.

Share this text

![]()