Dennis Diatel Images

Grayscale Ethereum Belief Overview

Grayscale Ethereum Belief (OTCQX:ETHE) is an funding belief designed to carry Ether (ETH-USD). As such, it’s distinctly not an ETF or different type of open-end fund. It is extra like Berkshire Hathaway (BRK.A) and makes use of a closed-end strategy to take a position its shareholders’ capital.

Crypto ETFs are a more recent asset class, and the primary Ethereum ETFs are set to launch this week on July 23. By taking an alternate route, Grayscale was forward of the curve right here, and it is fascinating to think about simply how the launch will have an effect on them. Individually, I feel it is not a lot of a catalyst, and ETHE was a significantly better Purchase when it had a big low cost to NAV. No matter non permanent surge in ETH will happen right here, I feel it is higher to deal with ETHE as a Maintain for now.

Quick Impression

When an ETF launches, the open-end nature of the fund implies that capital will circulate into it. Since these ETFs are designed maintain ETH for buyers (bypassing the necessity to have crypto wallets), the primary they may do is use the capital to purchase ETH. Like every open-end fund, cash flowing in will lead to extra purchases of its portfolio belongings, and cash flowing out will lead to gross sales. These can have bullish and bearish impacts, respectively.

I feel it is subsequently possible that the launches this week will lead to a rise within the price of ETH and something uncovered to it, like ETHE for a brief time period.

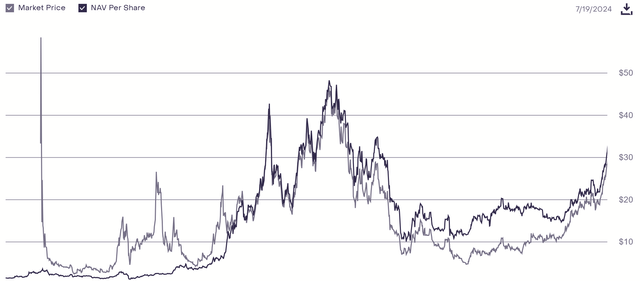

ETHE Value vs. NAV Historical past (Grayscale Official Web site)

All through its life (since 2019), ETHE’s price actions have adopted these of ETH, albeit not completely. For almost all of 2023 and far of this yr, the shares have even traded at a reduction to NAV. Nonetheless, an increase in ETH has often been met with an increase in ETHE, so there’s that potential right here.

Lengthy-Time period View

What’s extra necessary for buyers, these within the long-term view of their belongings, is what occurs if one invests in ETHE at this time with intention of holding on to it, and that in some ways is a judgment name about ETH and crypto broadly.

Ether

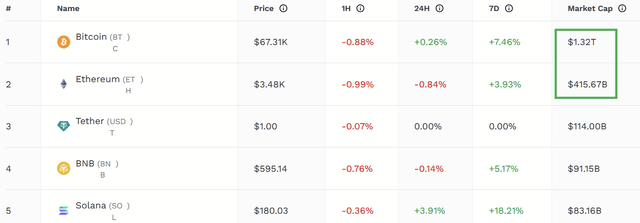

Why is Ether thought-about engaging sufficient to deserve its personal ETFs and funding trusts like Grayscale’s? Nicely, I feel the large cause is that it is the #2 cryptocurrency after BTC.

coinmarketcap.com

There should not many different main contenders within the crypto house fairly like them. After all, for its personal value, one has to think about that ETH can be used as a foreign money in some unspecified time in the future. The selection between having one’s wealth in USD or in ETH ought to actually be the identical as the selection of getting one’s wealth in USD or CAD. The first threat must be some type of trade fee threat. It comes down to what worth we expect we get by being in one other foreign money.

I’ve all the time mentioned to of us who requested me that in the event you want a cryptocurrency to finish a transaction, then purchase it, and perhaps hold a sure cushion of it readily available if the necessity for an additional such transaction arises. By proudly owning shares of ETHE, nonetheless, this benefit is misplaced, and that is one thing I dislike about funds that particularly orient themselves towards crypto.

Furthermore, as ETFs and related funding funds purchase and maintain ETH, I feel it turns into extra possible that cryptocurrencies have a tougher time really taking off as currencies. In spite of everything, they are not getting used to facilitate transactions at that time. Of their 2023 Type 10K, Grayscale reported having about 2.5% of all ETH in circulation. Whereas a while has handed, one has to understand how giant of a share that’s for one entity. If too little ETH is ever used for transactions, I’ve a tough time seeing what sort of demand would exist to make one thing like ETHE a very good funding to supply engaging, long-term returns.

Demand is not created by undersupply. Demand is created by folks wanting and needing one thing, and the case that rather more demand for ETH will exist sooner or later, to the advantage of ETHE, nonetheless must be made.

Bitcoin

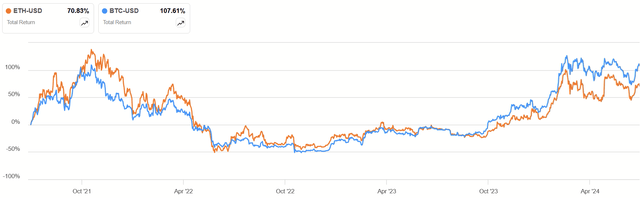

One other issue value contemplating is ETH’s relationship to BTC. Simply check out the three-year efficiency of every.

ETH vs. BTC 3Y Efficiency (Searching for Alpha)

Whereas it isn’t excellent, we do see a really shut relationship. As BTC’s personal halving this spring appeared to immediate a rally, ETH apparently adopted go well with. I feel the most effective clarification for that is that crypto buyers are sometimes invested in each BTC and ETH, and so they have a tendency so as to add and trim positions concurrently as a part of their diversification technique.

Within the present surroundings, it is also possible that long-term actions in BTC will have an effect on ETHE as effectively, maybe much less instantly than ETH. So long as crypto buyers imagine in each as strongly as they do, I count on this to be the case. Excellent news for BTC might additionally spell excellent news for ETH.

Low cost To NAV

The very last thing to think about with an funding like ETHE is whether or not or not a reduction to NAV exists. I feel giant reductions, which have occurred earlier than, signify probably the most compelling purchase case, as primarily a type of arbitrage. Presently, the market price is sort of precisely the NAV. Because of this of us shopping for ETHE due to the launch of those ETFs will rely completely on a horny sufficient enhance in ETH, one thing I think about to be dangerous.

Not solely do I feel a reduction is required however a pretty big one at that due to the long-term friction attributable to the belief’s bills, that are at the moment 2.5% of the fund’s belongings. That is a really vital drag over time, greater than the standard fee of inflation, so primarily we’ve got to hope that ETH beats inflation for ETHE to be breakeven over time. In any other case, an investor has to fabricate that end result with a greater entry price and resisting temptation to get in when the low cost narrows.

Conclusion

Whether or not it is crypto or funds that particularly spend money on them, they’re difficult as a result of they’re non-productive belongings. Warren Buffett himself is long-quoted saying the next about gold as an funding asset:

Gold will get dug out of the bottom in Africa, or someplace. Then we soften it down, dig one other gap, bury it once more and pay folks to face round guarding it. It has no utility. Anybody watching from Mars can be scratching their head.

Believers in gold naturally really feel it’s a hedge in opposition to inflation, however as Buffett identified, there’s nothing to it that has a compounding impact, and cryptocurrencies are related on this regard. Of us who purchase crypto as an funding want a compelling cause to imagine they will later promote it for a significantly better price. Proudly owning ETH not directly by way of a belief like ETHE comes with the identical dangers however none of the benefits of having a foreign money readily available to transact. There’s additionally the two.5% expense ratio.

As such, the one purchase case that exists is when ETHE, with its closed-end nature, trades considerably under NAV. At the least then there’s some intrinsic distinction. That hole closed in latest months, and whereas we now have solely simply gotten affirmation that Ether ETFs will launch, we nonetheless want good costs to get good returns. Till a significant low cost to NAV seems once more, I think about ETHE simply be a Maintain.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.