Picture supply: Getty Photos

FTSE shares typically entice worth traders as a result of UK inventory market’s relative underperformance and appealingly low valuations. In comparison with the US, many British firms commerce at a price considerably under their honest worth.

For traders focusing on undervalued firms with robust development potential, the UK market is rife with alternatives.

In search of worth

On common, UK shares are inclined to have low costs in comparison with their reported earnings. There could also be a couple of causes for this however the principle one is the lure of American shares. The speedy features of massive tech firms have proved irresistible to British traders for a few years now.

However earlier than we get forward of ourselves, there are actually some extremely valued shares on the Footsie. Since Brexit – and much more so, Covid – a number of top-quality firms have loved spectacular price development. Rolls-Royce being a primary instance, however let’s not overlook Video games Workshop and 3i Group.

So, when looking for worth, we have to think about a couple of components.

The dividend angle

Among the finest methods to extract worth from low-priced shares is thru dividends. As costs fall, yields rise and plenty of FTSE shares are actually over 10%. Investing in an undervalued inventory with a excessive yield could be an effective way to safe profitable passive revenue for a small price.

But when the price retains falling, it’s all for nothing. Particularly if that cash may have been directed to a development inventory providing higher returns in the long run.

So how can I uncover a high-yield dividend inventory that isn’t going to tank?

Why is it low cost?

Asky why a share is reasonable is a very powerful query to ask. It might appear illogical, however many FTSE shares are low cost for no good purpose. That is the place worth lies.

Contemplate the favored UK pub and hospitality chain, JD Wetherspoon (LSE: JDW). Throughout Covid, it was hit laborious, reporting its first loss in 36 years in 2020. It’s had a tricky time since, with the inventory down 55% in 5 years.

But it surely’s not doing badly, financially.

Its price-to-sales (P/S) ratio of 0.36 suggests it’s bringing in additional income than its share price displays. Equally, its price-to-earnings (P/E) ratio of 14.8 is much under the UK Hospitality common of 33.7.

What’s extra, it not too long ago reintroduced dividends at 12p per share.

So why is the inventory undervalued?

There are some dangers that may very well be giving traders causes for warning.

Alcohol consumption is trending down amongst youthful generations, bringing the way forward for pubs into query. Wetherspoons should adapt to those altering habits if it hopes to stay related.

On high of that, will increase within the nationwide residing wage and nationwide insurance coverage contributions may ramp up operational bills. If it passes these prices to customers, it dangers shedding its predominant promoting level: low costs.

Does that negate its worth proposition?

I don’t assume so. At the very least, not but.

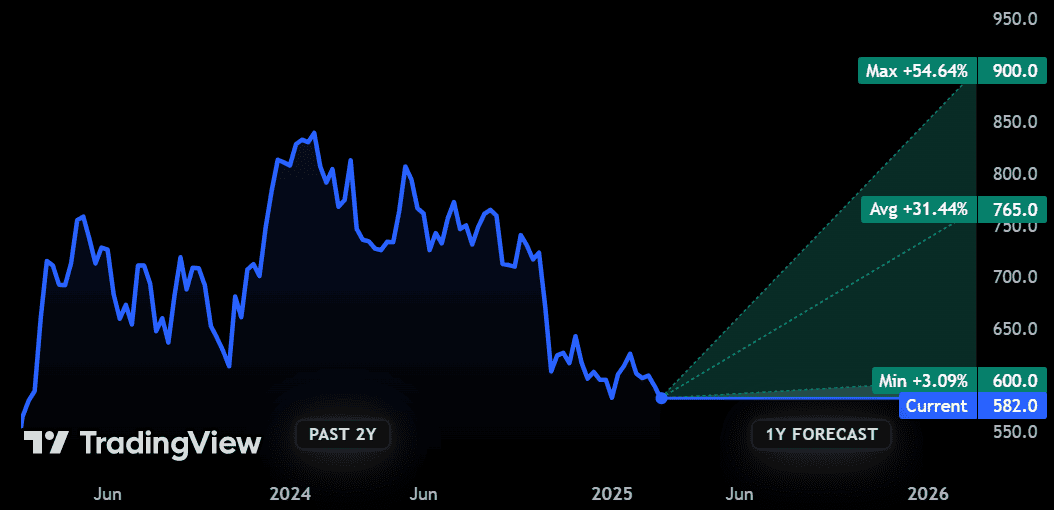

Wetherspoon not solely has a thriving meals and beverage enterprise but in addition a rising portfolio of resorts. Whereas many pubs could undergo within the coming years, I feel ‘Spoons is nicely positioned to stay worthwhile. And so do analysts – the common 12-month goal of 765p is 31.44% increased than the present price.

That seems like a inventory price contemplating should you ask me.