- TD Sequential alerts FLOKI development exhaustion, hinting at doable short-term rebound.

- Derivatives knowledge exhibits rising open curiosity regardless of falling quantity, suggesting cautious optimism.

- RSI and MACD on each day chart replicate weak momentum however point out early indicators of stabilization.

Ali, a crypto analyst, not too long ago shared on his X account that FLOKI could also be gearing up for a short-term rebound. His analysis pointed to a contemporary purchase sign triggered by the TD Sequential indicator on the weekly chart, suggesting that promoting stress could also be fading.

The chart additionally displayed a bullish arrow and a “9” countdown marker, alerts usually related to development exhaustion. Ali famous that this improvement might construct bullish momentum if help holds and follow-through shopping for happens.

Nonetheless, FLOKI’s weekly chart reveals the preliminary indicators that it could expertise a reversal of the downtrend after some consecutive weekly losses. The FLOKI/USDT weekly shut on Binance was at $0.00005017, up by 2.37% when it comes to weekly price. This upturn occurred after many candles confirmed bearish alerts in the midst of March, indicating heavy promoting pressures.

The latest white-bodied candle, showing after a pointy price drop, displays early shopping for curiosity. The TD Sequential’s “9” marker underneath the most recent candle and the presence of a bullish arrow level to a doable reversal. FLOKI is now within the strategy of experimenting with a essential stage of round $0.00004500. If this stage stays intact, the token might rebound again to the $0.00006000 area within the brief time period.

Market Positioning Reveals Cautious Optimism

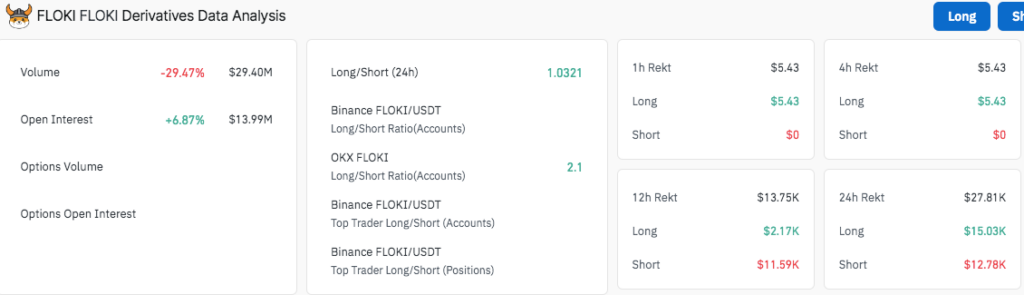

The information signifies optimistic indicators concerning FLOKI’s efficiency expectations. This declined the buying and selling quantity by 29.47% whereas $29.40 million was transacted. Nonetheless, open curiosity elevated 6.87% to $13.99 million, which indicated that merchants each churned over their positions and entered new positions in the course of the interval.

The lengthy/brief ratio stands at 1.0321, reflecting a slight majority of lengthy positions. OKX knowledge reveals a stronger bullish development with a ratio of two.1. Equally, Binance prime dealer metrics point out lengthy positions dominating account rely and measurement.

Liquidation knowledge during the last 24 hours totaled $27.81K, with lengthy liquidations at $15.03K and shorts at $12.78K. The near-even distribution suggests reasonable leverage clearing however no large-scale unwinding of positions, aligning with a market making ready for potential upward motion.

Each day Technicals Point out Weak Momentum, Potential Stabilization

On the identical time, each total indicator within the each day timeframe suggests a bearish bias, however the outlook would possibly change quickly. As of April 9, FLOKI’s RSI is at 34.15, approaching oversold territory. This studying exhibits that downward stress could also be easing, and consumers might step in close to present ranges.

Moreover, the MACD line is positioned at -0.00000548 whereas the sign line is barely above -0.00000495. Nonetheless, the indicator remains to be within the destructive territory whose histogram is changing into much less extensive, indicating lowering bearish stress.