Cryptocurrency adoption could also be gaining momentum, however getting crypto-friendly banks isn’t a stroll within the park. Many customers discover that finding a pleasant monetary establishment is full of hurdles, and giving up on the search is simple. Furthermore, it’s straightforward to outline crypto-friendliness as a result of areas have diverse digital asset regulatory and acceptance ranges.

Whereas banking guidelines and laws concerning crypto vary from detached to supportive to restrictive, some banks permit customers to purchase crypto instantly utilizing their banking apps, others prohibit the follow altogether.

So, how do you, as a crypto fanatic, know the perfect crypto financial institution?

Our information examines the basics of discovering the perfect crypto banks worldwide and their stage of assist for cryptocurrencies. Welcome on board!

What Is a Crypto-Pleasant Financial institution?

The query of what banks are crypto-friendly is a typical one inside crypto communities, and customers, each new and skilled, search solutions. We, subsequently, outline crypto-friendly banks as establishments that supply a mix of conventional and revolutionary crypto-based monetary companies. Such banks turn into a one-stop-shop for corporations or people providing cryptocurrency administration, buying and selling platforms, pockets companies, and crypto-backed loans.

Crypto-friendly banks allow digital asset customers to purchase, promote, and safeguard their cryptocurrencies simply and securely. These banks additionally transcend simply providing companies by facilitating advantages exceeding your conventional cryptocurrency pockets, together with pay as you go debit playing cards and federally insured accounts. Utilizing state-of-the-art know-how, crypto banks are making it potential for individuals to interact with cryptocurrencies effectively.

In addition to providing the companies talked about, these banks assure consumer funds’ safety by adhering to stringent KYC and AML procedures throughout the cryptocurrency trade. By appearing as a bridge between the normal banking and crypto worlds, they improve cost-effectiveness in transitioning between fiat and cryptocurrencies.

Select the Proper Crypto-Pleasant Financial institution

Selecting banks that assist crypto requires rigorously assessing a number of options and your particular person wants. You need to find a financial institution providing a variety of companies that combine crypto and fiat currencies since having each sorts of currencies beneath one roof is a recreation changer. As you begin researching and making an attempt to find banks that supply crypto-friendly companies, create a shortlist of potential candidates based mostly on the next elements to extend your possibilities of succeeding.

1. Regulatory Compliance and Threat Administration

Since cryptocurrencies function exterior the regulatory controls that govern conventional banking programs, in search of a financial institution that complies with the obtainable regulatory requirements is critical. Affirm that the financial institution has regulatory authority to deal with digital property. This can safeguard your funds as you may make sure that the establishment adheres to know-your-customer (KYC) and anti-money-laundering (AML) laws. Examine additionally whether or not the financial institution insures your fiat deposits with a good authorities company.

Coping with a non-compliant financial institution may expose you to severe dangers, equivalent to restricted entry to companies, frozen accounts, and several other different transactional delays. Furthermore, there could possibly be authorized problems related to regulated jurisdictions, all of which you’ll keep away from by checking on compliance points.

2. Companies, Charges, and Accessibility

There are various transaction charges related to cryptocurrency transactions, and each financial institution has its charge construction for withdrawals, deposits, and transfers or different charges related to utilizing crypto wallets. Perform a cautious analysis by evaluating the free schedules of the banks in your shortlist. Select a financial institution that provides clear and aggressive charges to make sure your transactions won’t value you an arm and a leg.

Since you can’t plan and price range except you perceive the financial institution’s charge construction, some important inquiries to ask embody whether or not there are month-to-month account upkeep charges, change charges, limits on crypto-related accounts, whether or not the pricing mannequin is clear, or if there are hidden prices or extreme financial institution fees for crypto.

Moreover, determine the quantity and kind of cryptocurrencies the financial institution helps since not all banks assist the identical digital property. Different important options to contemplate embody:

- Fiat and Crypto Assist: Discover out if the financial institution means that you can handle fiat and cryptocurrencies in the identical account.

- Crypto Playing cards: A financial institution that points crypto playing cards will allow you to spend your cryptocurrencies simply and conveniently.

- Integration with Exchanges and Wallets: Affirm whether or not the financial institution seamlessly integrates with digital wallets and crypto exchanges to facilitate a seamless switch of funds. Confirm that the financial institution seamlessly integrates with common cryptocurrency exchanges and digital wallets to facilitate straightforward transfers of funds.

- Crypto-Powered Banking Options: Some banks supply specialty companies like yield farming, crypto-backed loans, and different companies that would profit you.

Since a user-friendly expertise will improve your crypto funding journey, search for a financial institution that gives cell apps or an easy-to-use interface, portfolio monitoring, and integration with different related platforms.

3. Safety Options

Fund safety is a vital issue when coping with cryptocurrencies. Prioritize a financial institution that provides high-grade safety measures, together with encryption, multi-factor authentication (MFA), biometric logins, insurance coverage protection, a clear incident response coverage, chilly storage for custody, and insurance coverage in opposition to hacking incidents or thefts. Select a financial institution with a confirmed monitor file for safeguarding its purchasers’ crypto property.

High World Crypto-Pleasant Banks

In the event you’re asking your self what banks are crypto-friendly globally, the next is a listing of the highest 5 crypto-friendly banks you may take into account on your funding.

1. Revolut

Revolut is a famend crypto financial institution working from the UK. The agency facilitates fiat forex custody, transfers, and exchanges along with crypto buying and selling on the 30+ supported cryptocurrencies. The financial institution additionally gives quite a few crypto storage vaults, enabling passive revenue from idle property. Revolut facilitates shopping for and promoting crypto, buying and selling, and fiat withdrawals throughout the UK, USA, Singapore, Australia, Switzerland, and Japan, with over 30 million registered customers. The financial institution features a safe built-in cryptocurrency change, and purchasers can use enterprise and private debit playing cards.

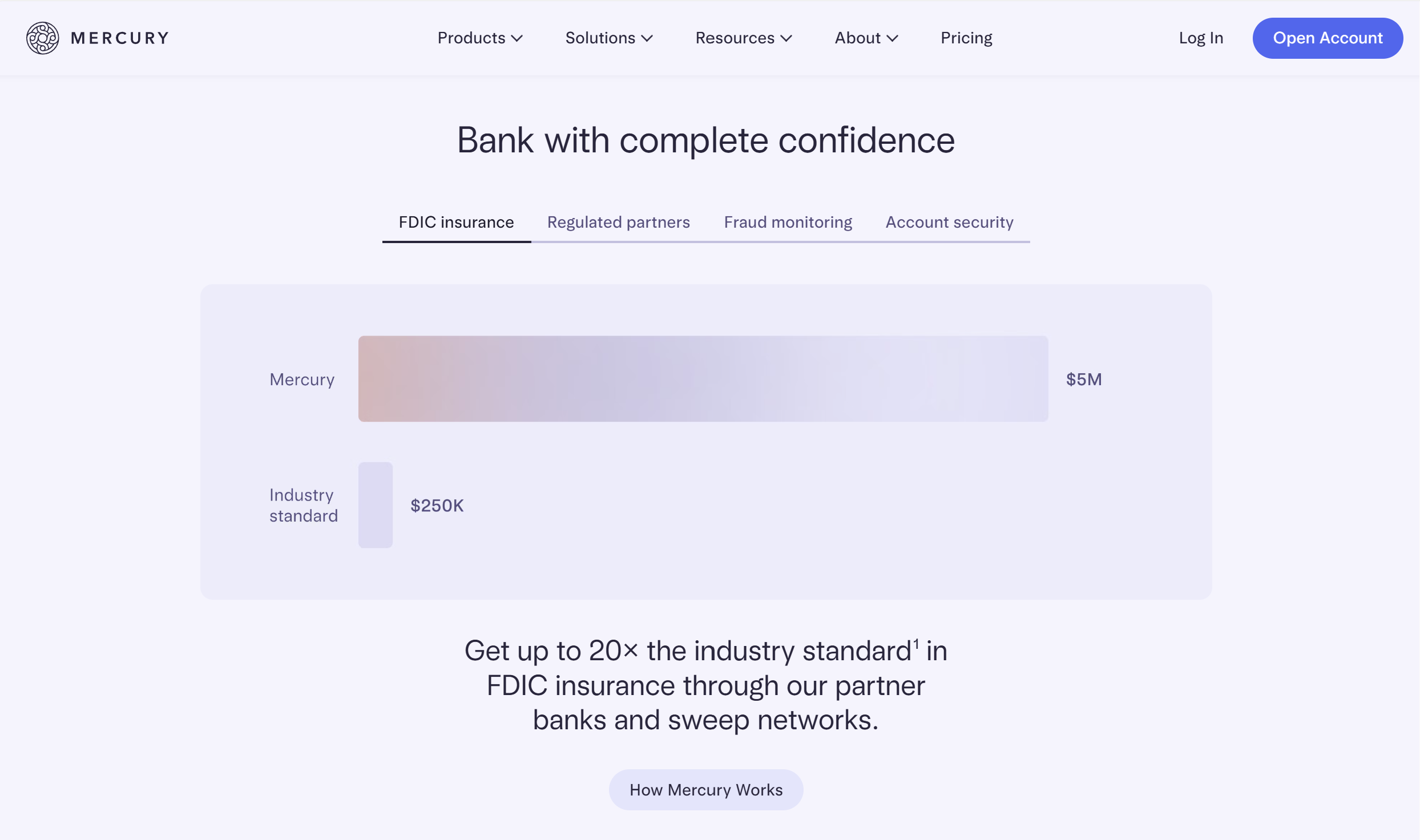

2. Mercury

Mercury is a well known US-based crypto-friendly financial institution. The Federal Deposit Insurance coverage Company (FDIC) absolutely regulates the establishment; guaranteeing customers’ funds are absolutely secured and insured. Companies are charged with a minimal annual value of $500, however no minimal account steadiness necessities exist. The agency covers a large geographical space aside from a number of African nations. The perfect options of Mercury embody crypto buying and selling and custody companies, crypto funds for establishments, digital asset lending, API connectivity, and sub-accounts for digital IBANs, and a crypto-to-fiat change. The financial institution adheres to all safety and regulatory necessities and has a devoted crypto buying and selling platform for establishments and insurance coverage protection of up to $250,000.

3. Wirex

Whereas it could not technically be a crypto financial institution, Wirex gives a variety of crypto and fiat forex companies, together with deposits and shopping for crypto to Wirex accounts to be used in funds through Mastercard-supported debit playing cards. Wirex’s companies can be found globally, with a 5 million consumer base in a minimum of 130 nations. Companies supplied primarily embody crypto transactions, ATM withdrawals, Wirex debit playing cards, and forex change. For true crypto fanatics, notice that Wirex has a local cryptocurrency, WXT, that can be utilized for DeFi actions. Customers can take part in crypto staking and yield farming and luxuriate in free fiat forex withdrawals at partnering ATMs.

4. Juno

Juno Financial institution gives crypto-friendly companies to particular person and company crypto customers. The highlights embody enabling clients to function separate accounts, stake their crypto, apply for crypto loans, and take part in different crypto buying and selling actions. A crypto-backed debit card permits clients to make versatile funds utilizing fiat or cryptocurrencies for services and products in numerous currencies. The companies supplied embody crypto accounts, financial institution accounts, cryptocurrency staking choices, cash switch, change, digital asset buying and selling, and crypto borrowing and lending options. The financial institution is modernizing its companies and now makes use of synthetic intelligence (AI) and machine studying (ML) fashions for service personalization.

High Crypto-Pleasant Banks within the USA

Whether or not you’re simply beginning or have an skilled hand in crypto buying and selling, finding the perfect crypto-friendly banks within the USA could imply the distinction between your success and failure. Since your alternative makes a giant distinction, the next are the highest banks within the USA supporting cryptocurrencies:

1. JPMorgan Chase

JPMorgan Chase is likely one of the main crypto-friendly banks providing companies to a number of digital assert companies and cryptocurrency exchanges. The agency prioritizes regulatory compliance and threat administration and supplies institutional-grade research on crypto markets, which helps its customers make knowledgeable funding selections. In addition to serving main cryptocurrency exchanges and crypto-focused companies, the financial institution excels in compliance and threat administration and supplies detailed research knowledge on crypto markets. Nonetheless, notice that it solely gives restricted crypto-related companies.

2. Clients Financial institution

The Pennsylvania-based Clients Financial institution gives a blockchain-based platform that permits clients to make USD funds 24/7. Clients Financial institution Immediate Token (CBIT) platform has attracted numerous crypto asset companies, primarily stablecoin issuers and cryptocurrency exchanges. The CBIT system facilitates 24/7 USD transfers and immediate settlements with no switch limits for cryptocurrency exchanges. The financial institution primarily serves institutional clients and gives restricted companies to retail crypto buyers.

3. Ally Financial institution

Established in 2009, Ally Financial institution focuses on providing on-line banking and funding companies. Whereas the agency doesn’t assist direct crypto shopping for, it supplies oblique crypto publicity through particular crypto merchandise like Bitcoin futures ETFs, crypto trusts, and crypto-related shares. Customers of Ally Financial institution can profit from transfers between financial institution accounts and exterior exchanges, which may facilitate entry to crypto buying and selling. Ally Financial institution is licensed as a safe, dependable, and insured establishment however doesn’t supply direct publicity to crypto buying and selling, DeFi, or staking companies.

4. Evolve Financial institution & Belief

Evolve Financial institution & Belief was based in 2015 and primarily gives enterprise and private banking ending companies and mortgage options. The financial institution partnered with MasterCard in 2021 and began a program to facilitate hassle-free cryptocurrency card transactions in america utilizing a US dollar-backed stablecoin. The financial institution’s clients can ship and obtain USD from FinCEN-regulated crypto exchanges and luxuriate in sturdy infrastructure for stablecoin-backed funds designed for crypto-focused companies. Nonetheless, the agency doesn’t present crypto custody, buying and selling, or pockets companies.

5. Capital One

Capital One Financial institution gives a big selection of banking companies in america, from company banking to auto loans, bank cards, and present and financial savings accounts. A subsidiary of Capital One Monetary Company, the financial institution is likely one of the USA’s largest crypto-friendly banks. This crypto-friendly financial institution gives a highly-rated cell app apart from being served by an intensive ATM community; over 70,000 fee-free Capital One, MoneyPass, and Allpoint ATMs, and 450 branches and 50 Capital One Cafes. Customers are allowed face-to-face banking and recommendation, however there’s potential for hidden charges for particular accounts or companies.

High Crypto-Pleasant Banks in Europe

1. AMINA Financial institution (Switzerland)

AMINA Financial institution (previously SEBA Financial institution) gives a variety of companies, beginning with conventional companies like loans and financial savings accounts. Nonetheless, the group strongly focuses on integrating cryptocurrencies into all its different choices. The financial institution’s companies intention to bridge the hole between conventional and rising crypto property and can be found to institutional and particular person purchasers. AMINA Financial institution is absolutely licensed by Switzerland’s Monetary Market Supervisory Authority (FINMA), which suggests it operates as a crypto financial institution inside regulatory requirements.

2. SolarisBank (Germany)

The German Fintech agency gives banking-as-a-service options by enabling corporations to combine its companies into their merchandise with no license. SolarisBank is listed as a crypto-friendly financial institution providing cost processing, financial institution accounts, and lending, permitting purchasers to include crypto options. German monetary authorities license the financial institution.

3. Financial institution Frick (Liechtenstein)

Financial institution Frick is a privately owned common financial institution that made historical past by changing into Europe’s first financial institution to provoke blockchain banking. The financial institution regulated by Liechtenstein’s Monetary Market Authority (FMA) gives personalised and revolutionary banking options and grants them managed entry to crypto property like cryptocurrencies or tokenized property. Financial institution Frick’s companies embody regulated blockchain banking, crypto asset custody supporting preliminary coin choices (ICOs) and tokenization of property. Different companies embody traditional banking, blockchain banking, fund and capital markets, cost companies, and enterprise loans.

4. Clear Junction (UK-based, Europe-wide)

Clear Junction is headquartered within the UK however has a Europe-wide attain. It facilitates cross-border funds for remittance operators, cryptocurrency exchanges, and different crypto companies corporations. The corporate focuses on serving to corporations combine fiat gateways by eliminating bureaucratic overheads. Clear Junction has its wings unfold over 180 nations, and it focuses on monitoring transactions and threat evaluation for companies that search immediate settlement in a number of jurisdictions.

5. Januar (Denmark)

Januar is Denmark’s pioneering establishment integrating conventional fiat banking and cryptocurrencies, specializing in threat administration and regulatory compliance. The agency grew to become the primary crypto-focused establishment to obtain a cost institute license from the Danish authorities, highlighting its functionality to navigate the crypto market’s advanced areas. Januar gives custom-made companies that mix conventional finance programs with cryptocurrencies and is pioneering in reshaping the way forward for finance.

High Crypto-Pleasant Banks in the UK

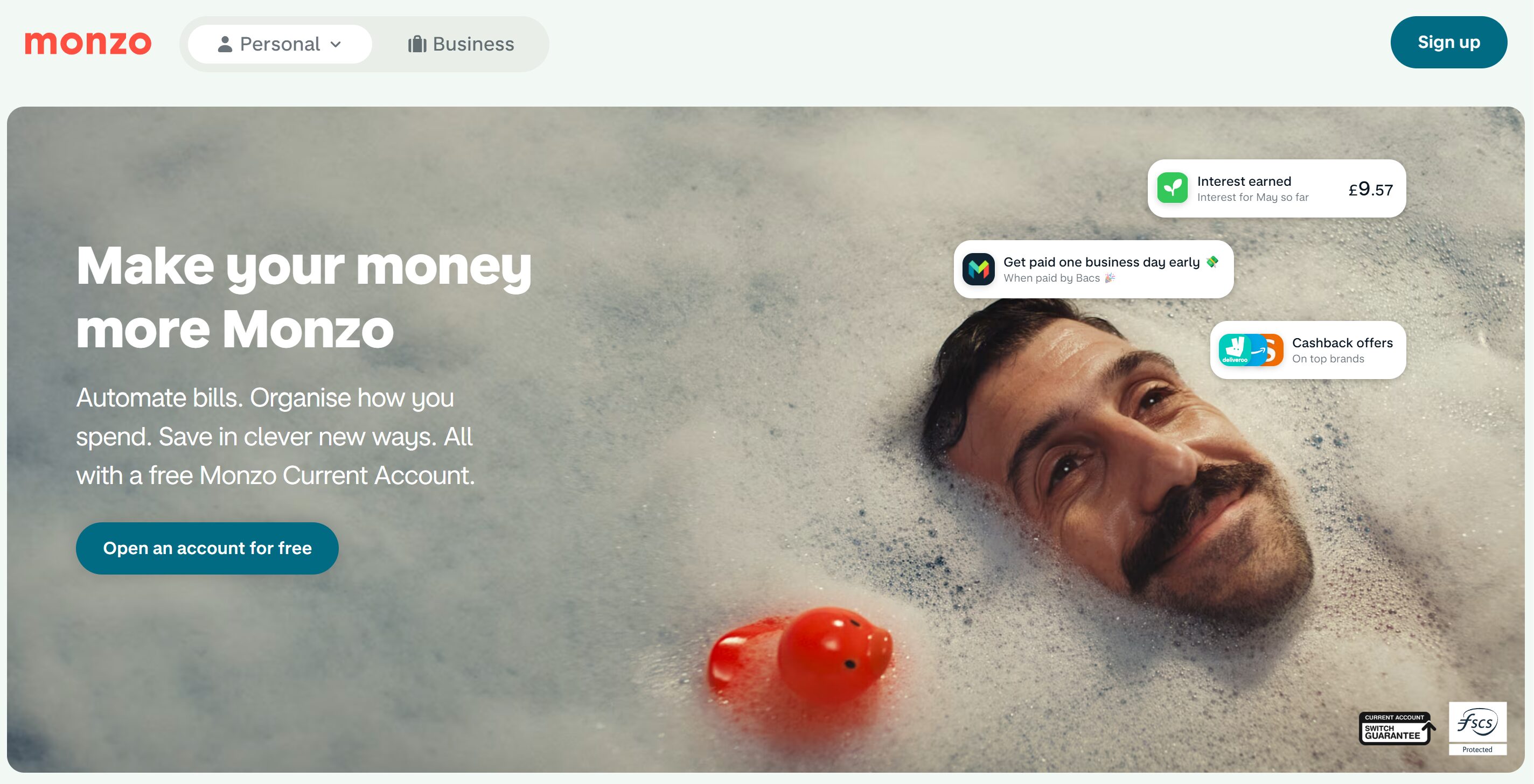

1. Monzo

Based in 2015, Monzo Financial institution prioritizes a mobile-first method with a powerful buyer engagement tradition. The financial institution doesn’t present crypto buying and selling or pockets companies however as an alternative helps transfers to and from cryptocurrency exchanges, which suggests its companies are crypto-integrated and never crypto-compatible. Customers can switch funds from exchanges, enabling them to make crypto investments throughout the UK regulatory boundaries. The agency helps immediate transaction notifications utilizing superior safety controls equivalent to card freezing to present customers who must make crypto transfers an added layer of safety.

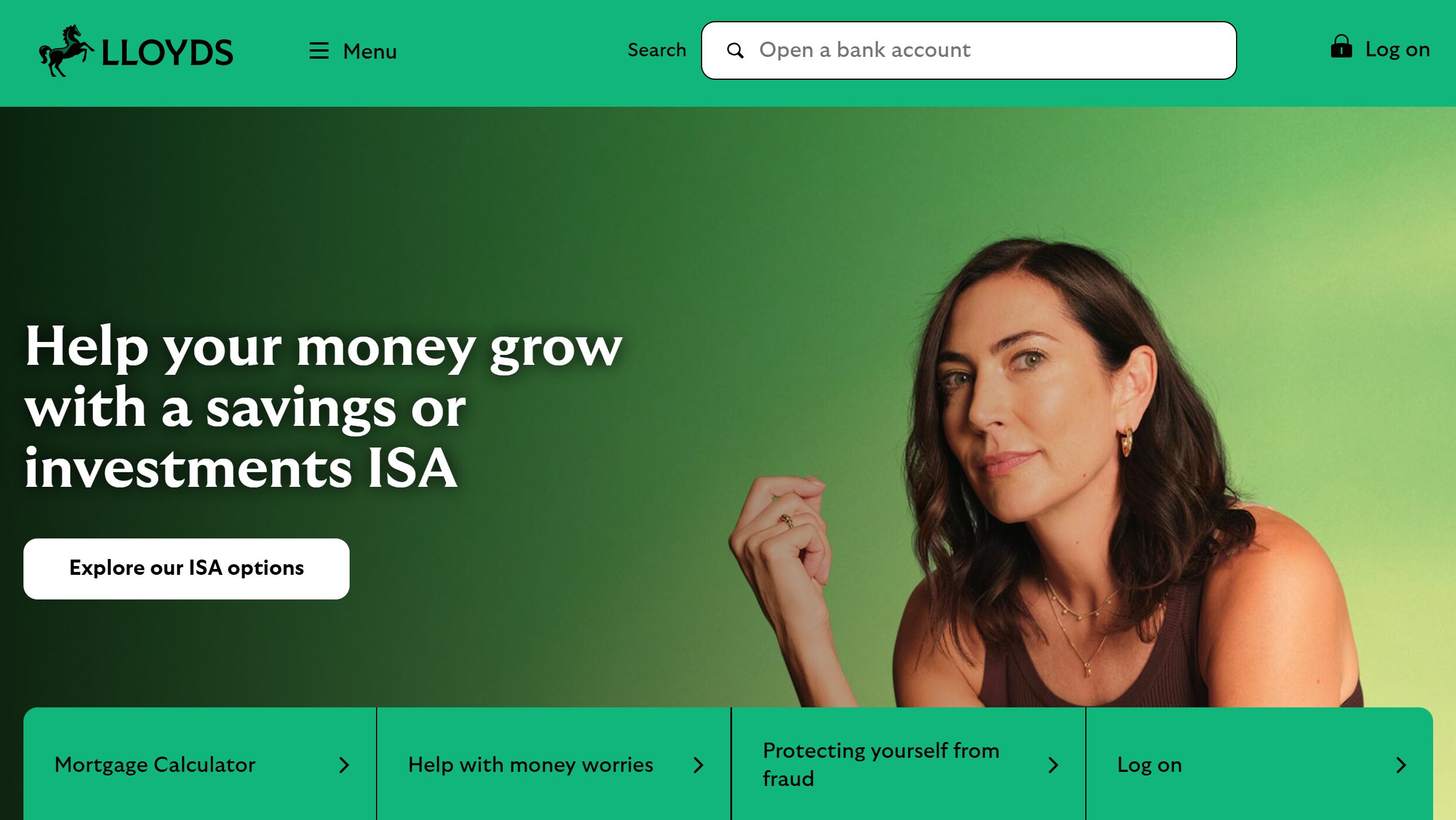

2. Lloyds Banking Group

Lloyds Banking Group has been in enterprise since 1765 and has a powerful presence throughout the UL retail and business banking sector. The financial institution could not essentially supply direct entry to digital property however is taken into account among the many finest crypto banks for enabling clients to switch funds to FCA-registered crypto exchanges seamlessly. It covers them by taking purchasers via an entire verification upon transaction request—the financial institution’s clients to entry regulated crypto exchanges with zero restrictions whereas sustaining oversight for safety. Lengthy-standing repute and regulatory compliance give crypto clients the boldness to maintain their fiat banking with a trusted establishment whereas exploring crypto alternatives externally.

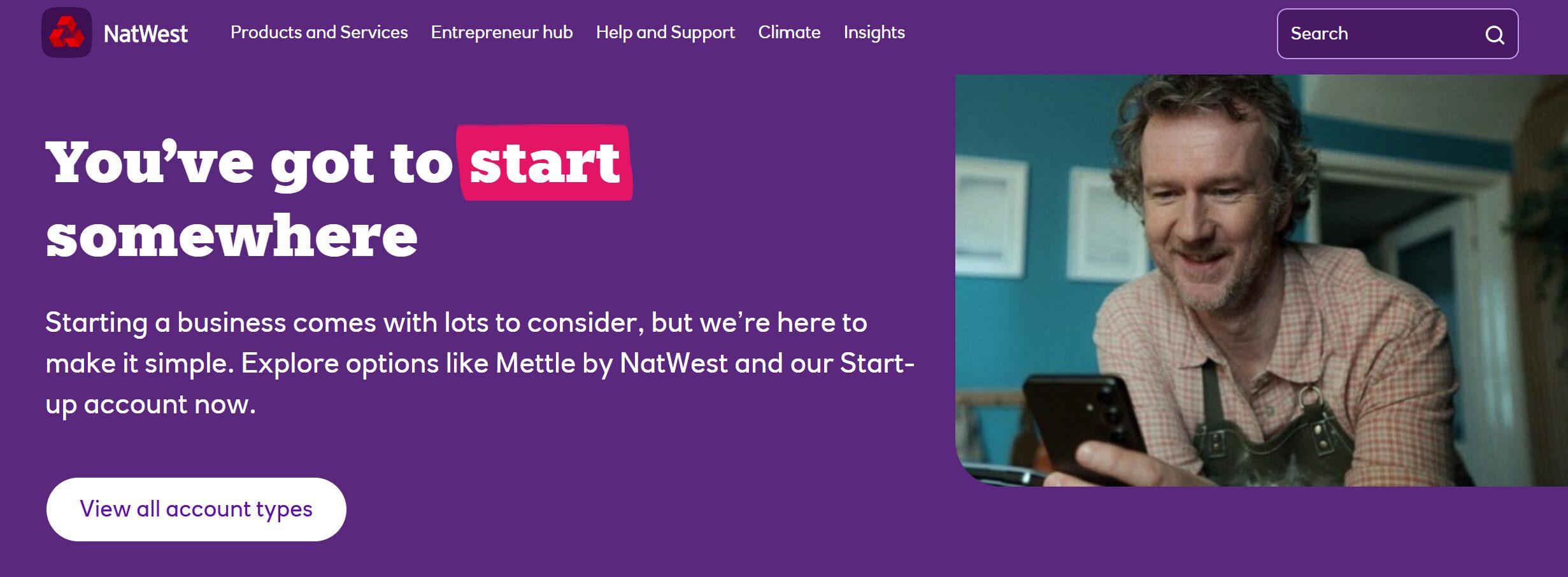

3. NatWest

NatWest is amongst banks that assist crypto within the UK however takes a comparatively conservative method, which incorporates inserting a number of restrictions on transactions to and from cryptocurrency exchanges. The financial institution facilitates transfers to regulated cryptocurrency exchanges beneath strict supervision, guaranteeing clients know the safety dangers of crypto-related transactions. NatWest clients have the privilege of safely partaking in cryptocurrency buying and selling however inside regulated limits. The agency is famend for using top-grade safety measures to safeguard buyer funds. Nonetheless, crypto-customers can’t use bank cards to make purchases, lowering the variety of obtainable cost choices.

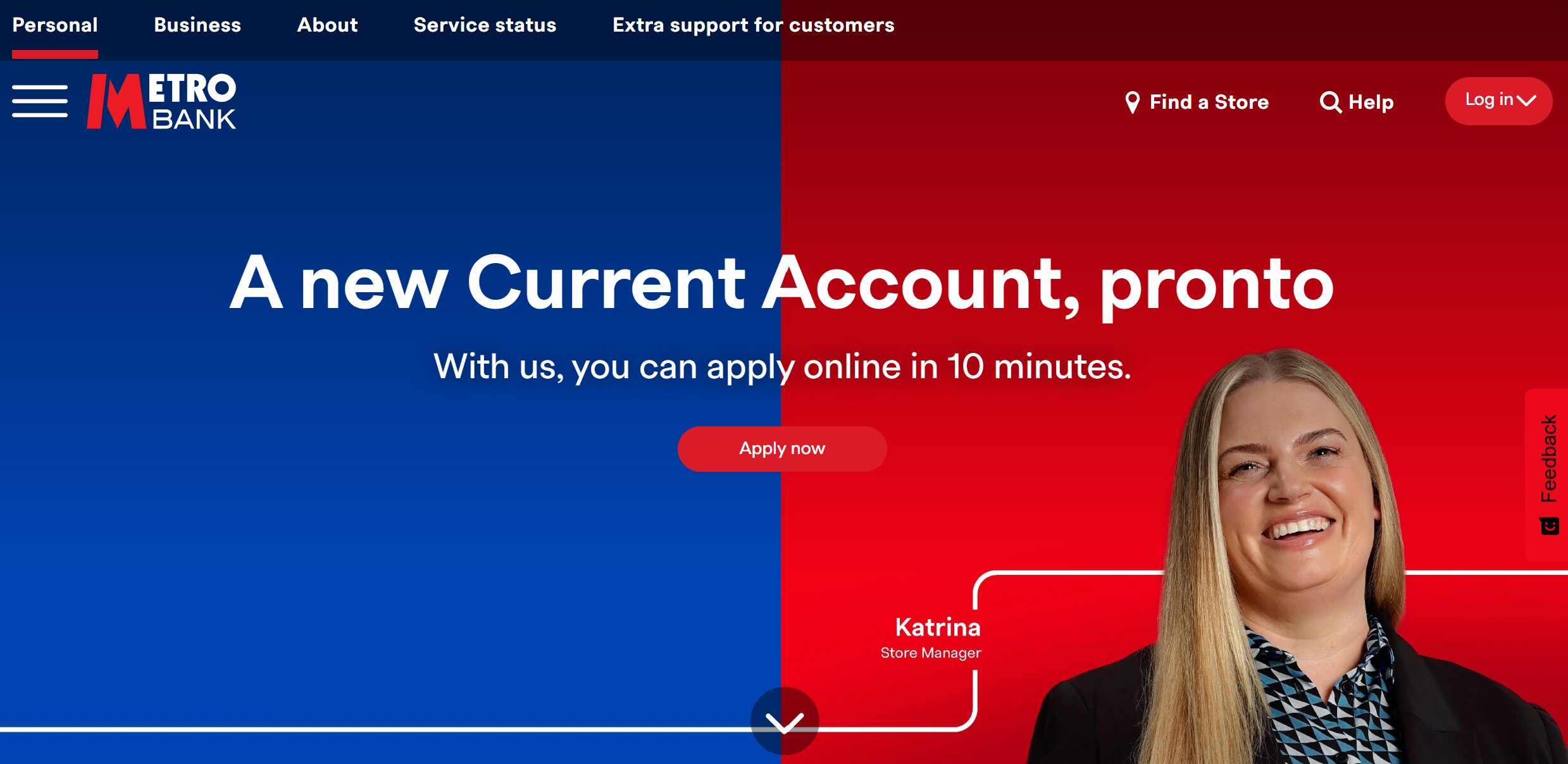

4. Metro Financial institution

Metro Financial institution is a UK-based monetary establishment that provides restricted choices for patrons to obtain however not ship cryptocurrencies. The financial institution’s clients used to ship crypto property, however the financial institution has since discontinued the service, citing safety issues and fraud dangers. Which means that customers can solely obtain crypto transfers from exchanges however can’t deposit such funds via Metro Financial institution.

High Crypto-Pleasant Banks in Asia-Pacific

1. DBS Financial institution (Singapore)

In addition to being a number one financial institution in Singapore, DBS Financial institution additionally holds the slot of the crypto-pioneer establishment amongst banks throughout the Asia-Pacific area. DBS launched its personal DBS Digital Trade (DDEx) in 2020 to facilitate buying and selling cryptocurrencies and different digital property. It helps six main cryptocurrencies, together with Bitcoin, Ethereum, XRP, and others, alongside 4 fiat currencies. Moreover, the financial institution gives accredited crypto companies for each particular person and institutional buyers, allocating a minimum of $600 million yearly to discover rising applied sciences equivalent to blockchain and digital property.

2. SBI Sumishin Internet Financial institution (Japan)

The SBI Sumishin Internet Financial institution is a number one mild amongst banks that assist crypto in Japan. It combines conventional and blockchain-based banking. The companies supplied embody digital banking for loans, deposits, and settlements utilizing cutting-edge applied sciences like blockchain and AI. By specializing in technological innovation, SBI Sumishin Internet Financial institution has turn into the purpose of reference for Japan’s tech-savvy buyers who need to handle conventional and crypto property in a regulated banking setting.

3. Mizuho Financial institution (Japan)

A member of the Mizuho Monetary Group, Mizuho Financial institution is a Japanese establishment that provides a variety of crypto-asset companies utilizing third-party custody. The financial institution primarily serves Asia-based institutional crypto buyers, asset managers, and hedge funds with company funding wants. With an asset base of 24 million customers and supporting main cryptocurrencies and stablecoins USDT, USDC, and GUSD, the corporate additionally supplies tokenization, lending, and asset administration companies for institutional digital asset holders. Mizuho Financial institution is a totally registered member of the Monetary Companies Company (FSA) and the Federation of Bankers Associations of Japan (FBAJ).

World and Cross-Border Banking Options for Crypto

Fiat Republic

The Fiat Republic bridges crypto-focused companies and their conventional banking companions. The agency connects quite a few banking service suppliers, which means customers don’t should cope with particular person establishments. The financial institution goals to deal with the de-banking concern, guaranteeing that crypto ventures take pleasure in a predictable circulate of fiat currencies when wanted. Fiat Republic supplies a unified threat administration and compliance cowl, which means corporations simply getting into the crypto house can escape numerous pink tape. The financial institution is very really useful for corporations searching for clean fiat-to-crypto cross-border transactions between america, the UK, and the Eurozone.

BCB Group

BCB Group is a monetary establishment licensed and controlled by the UK’s Monetary Conduct Authority (FCA) and hyperlinks crypto-focused companies with established banking networks. The agency caters primarily to cryptocurrency exchanges and enormous institutional purchasers, providing then an energetic OTC desk along with liquidity, settlement networks, and specialised cost companies utilizing the a number of fiat currencies it helps. Crypto companies favor utilizing the BLINC community to allow real-time settlement, particularly for purchasers coping with high-volume merchants.

Professionals and Cons of Crypto-Pleasant Banks

Professionals

There are quite a few crypto pleasant banks professionals about establishments that settle for cryptocurrency deposits, together with:

- Simplicity: Crypto banks simplify the method of utilizing cryptocurrency funds, particularly for inexperienced persons, guaranteeing their purchasers take pleasure in hassle-free companies.

- Effectivity: Crypto-friendly banks lack withdrawal restrictions which might be widespread with conventional banks that serve crypto exchanges via streamlined companies.

- Assist Crypto Enterprise: Crypto banks assist the event of crypto companies by enabling them to entry conventional banking companies in a regulated setting.

- Accessibility: Most banks that settle for crypto supply cell purposes that allow customers to entry their companies 24/7 through iOS/Android smartphones and tablets.

Cons

With all the good things that we get from crypto-friendly banks, there are a number of crypto pleasant financial institution cons of concern to notice, together with:

- Excessive charges: In comparison with conventional banks, most banks that settle for cryptocurrency deposits cost comparatively increased prices for his or her companies.

- Restricted performance: Totally different crypto banks supply solely a small phase of crypto-focused companies, and it isn’t straightforward to seek out one financial institution providing all of those companies beneath one roof.

- Work in progress: Crypto-friendly banks function in a dynamic and ever-evolving setting, which means they’re additionally looking out for regulatory developments globally, which may create some instability within the phase.

Future Traits for Crypto-Pleasant Banking

The crypto banking sector continues to make nice strides, with new, greater gamers exhibiting curiosity in becoming a member of in 2025 following the regulatory developments happening, particularly beneath the Trump administration within the US. As conventional actors be part of the rising checklist of banks that assist crypto, they may introduce a brand new vary of companies and make the market extra aggressive.

Furthermore, consultants consider banks may strengthen their market attain and affect once they introduce {hardware} wallets with inbuilt apps that allow purchasers to have easy entry to crypto storage and switch capabilities. The continued curiosity by worldwide banks will quickly imply that it’ll quickly be potential to function worldwide crypto accounts the place digital asset transfers might be executed seamlessly.

At the moment, there’s nice potential to introduce superior buying and selling instruments that allow refined cryptocurrency merchants and buyers to make use of algorithmic buying and selling bots alongside margin buying and selling for both choices or futures and crypto ETFs via crypto-friendly banks. Integrating further functionalities like real-time market knowledge and analytics will significantly enhance consumer expertise and improve adoption.

As crypto banking turns into safer and user-friendly, it is going to be capable of cater to a broader consumer base, particularly with the rising transparency and the anticipated clear regulatory frameworks that may improve transparency and client safety.

Conclusion

As digital property proceed to mainstream, you may anticipate the checklist of banks that settle for cryptocurrency deposits to develop as they need to catch up with their purchasers who’ve already received over the crypto neighborhood. Whereas some banks could not mean you can purchase crypto via your account, there’s quickly going to be an opportunity that they could possibly be linked to a crypto-related service come what may.

If you’re a agency crypto believer, you may relaxation assured that very quickly, there will likely be a proper crypto pleasant financial institution close to you that may undertake crypto-related issues since it’s nearly apparent now that digital property will turn into a giant a part of the way forward for finance. Eric Trump, the son of US President Donald Trump, is on file telling banks that they threat changing into out of date in 10 years in the event that they fail to undertake cryptocurrencies. That signifies that if his prediction is correct, banks that assist crypto have a vibrant future, whereas people who refuse to vary may discover it arduous to outlive.

FAQs

Why is selecting the best crypto-friendly financial institution necessary?

You have to be cautious when in search of a monetary associate like a crypto-friendly financial institution as a result of not all crypto banks are created equal. Vital variations exist between the charges and charges supplied for accessible accounts and companies and whether or not they have an easy-to-use interface. You additionally must search for particular options and whether or not you may transfer your funds between crypto and fiat currencies with none restrictions.

Which banks settle for cryptocurrency deposits?

Quite a few banks now facilitate cryptocurrency transactions, however solely a restricted quantity settle for deposits. Most crypto-friendly banks permit clients to purchase, promote, or maintain crypto of their accounts by integrating with main exchanges, whereas others supply tailored crypto companies. Among the many banks that settle for crypto deposits are Revolut, Ally Financial institution, and Monzo, which permit clients to make use of their accounts with exterior crypto exchanges. Different banks, like Xapo Financial institution and Cashaa, dedicate their banking companies to crypto companies.

Are crypto-friendly banks secure to make use of?

Crypto-friendly banks are comparatively secure to make use of as they provide a safe method for his or her clients to work together with cryptocurrencies. Nonetheless, customers have to be cautious as there are at all times dangers and limitations related to crypto banks, which provide a bridge between conventional banking and the rising digital world of crypto currencies.

Are crypto transactions with these banks taxable?

As with all crypto-based transactions, revenue tax turns into relevant whenever you promote the asset and obtain both money or models of one other cryptocurrency. At this level, you’re counted to have realized the positive aspects and have a taxable occasion. Nonetheless, the finer particulars will range from one nation to a different.