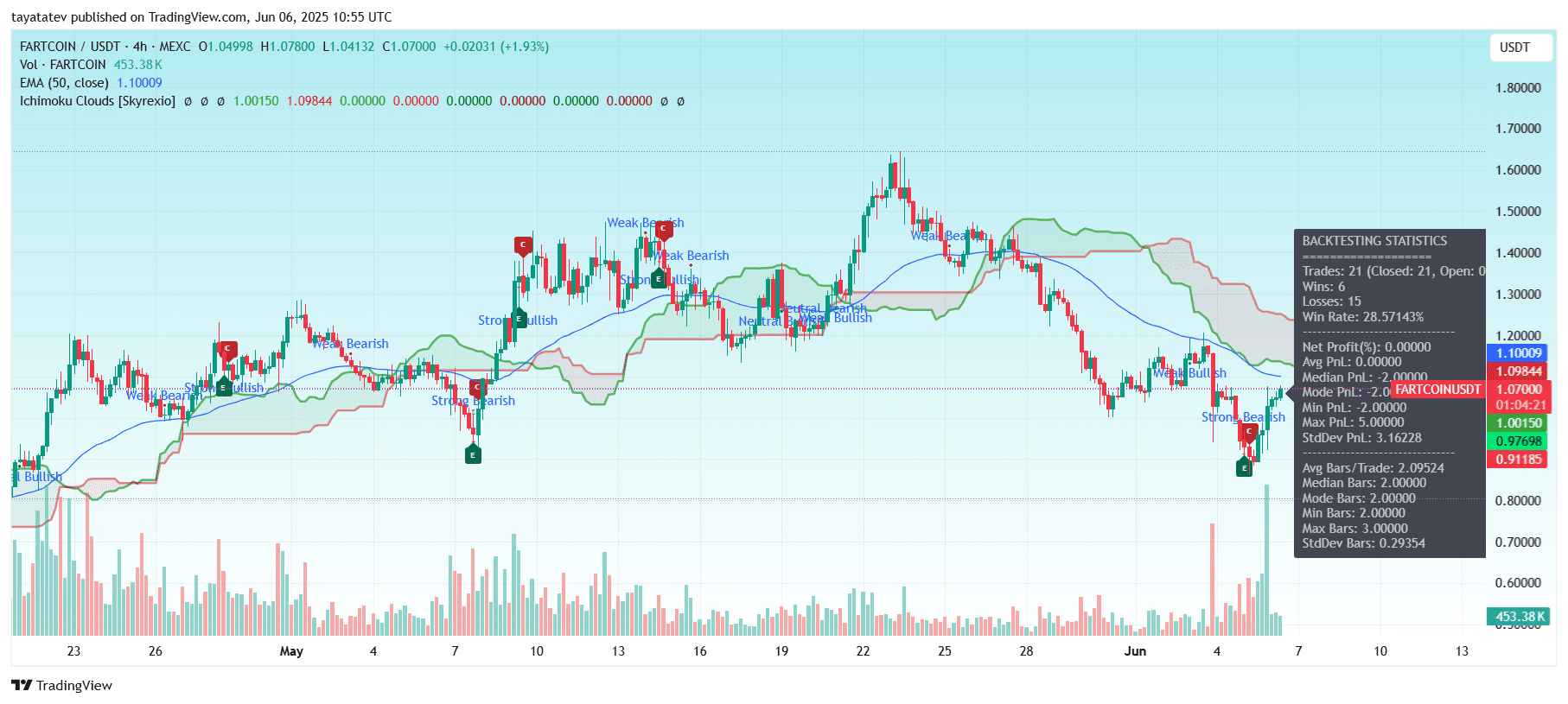

On June 6, 2025, the FARTCOIN to Tether (USDT) buying and selling pair on the 4-hour chart fashioned a falling flag sample.

A falling flag sample seems when the price drops inside a downward-sloping channel after a robust upward transfer. It usually indicators a bullish continuation as soon as the price breaks above the flag’s higher resistance line.

If this breakout confirms, the price can rise 38% from the present stage of $1.06390 to the projected goal of roughly $1.47062.

The chart exhibits a transparent breakout try above the flag’s resistance. On the identical time, buying and selling quantity has surged, which helps the power of the transfer. Quantity enlargement throughout breakout typically validates the bullish sample.

As well as, the price is now testing the 50-period Exponential Transferring Common (EMA), at the moment at $1.09985. A decisive shut above this dynamic resistance stage would strengthen the case for a continued uptrend.

The earlier sturdy rally fashioned the flagpole. The consolidation part inside parallel descending trendlines formed the flag. This construction aligns with the basic bullish flag setup.

If bulls preserve stress and push above the EMA, the price could rally towards the $1.47 goal within the coming classes.

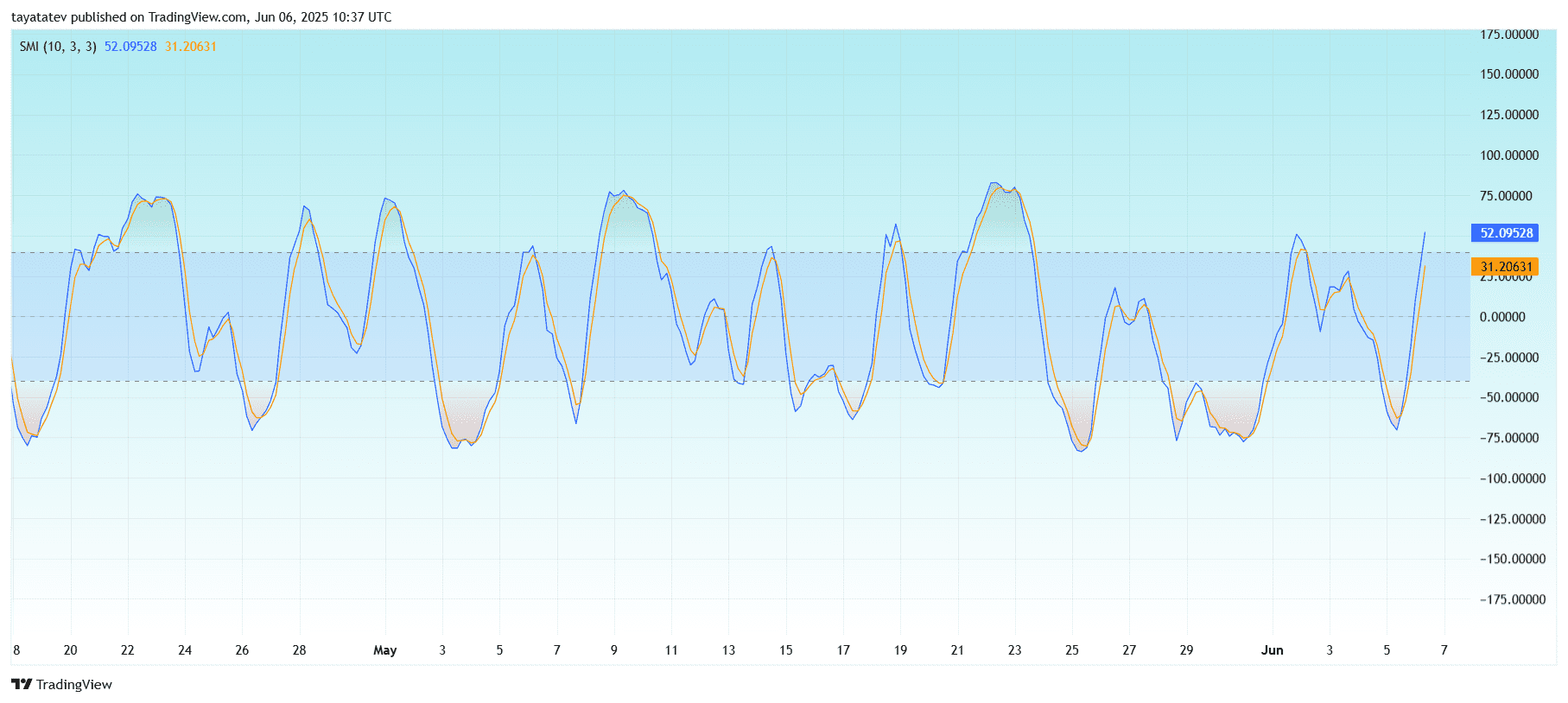

FARTCOIN SMI Indicator Surges, Confirms Bullish Momentum

On June 6, 2025, the FARTCOIN to Tether (USDT) 4-hour chart confirmed a robust upward transfer on the Stochastic Momentum Index (SMI), with the blue line (SMI) rising to 52.09 and the orange sign line reaching 31.20.

The Stochastic Momentum Index (SMI) is a refined model of the standard stochastic oscillator. It measures the closing price relative to the midpoint of the current high-low vary and indicators overbought or oversold circumstances.

On this chart, the SMI line has sharply crossed above the sign line from under the -40 zone. This crossover from a low stage usually signifies a bullish reversal. The indicator has additionally entered the constructive territory above the zero line, which reinforces upward momentum.

If the SMI continues rising and stays above the +40 zone, it could verify sustained shopping for stress. The final crossover and upward spike coincide with the breakout from the falling flag sample seen on the primary price chart, aligning technical indicators throughout indicators.

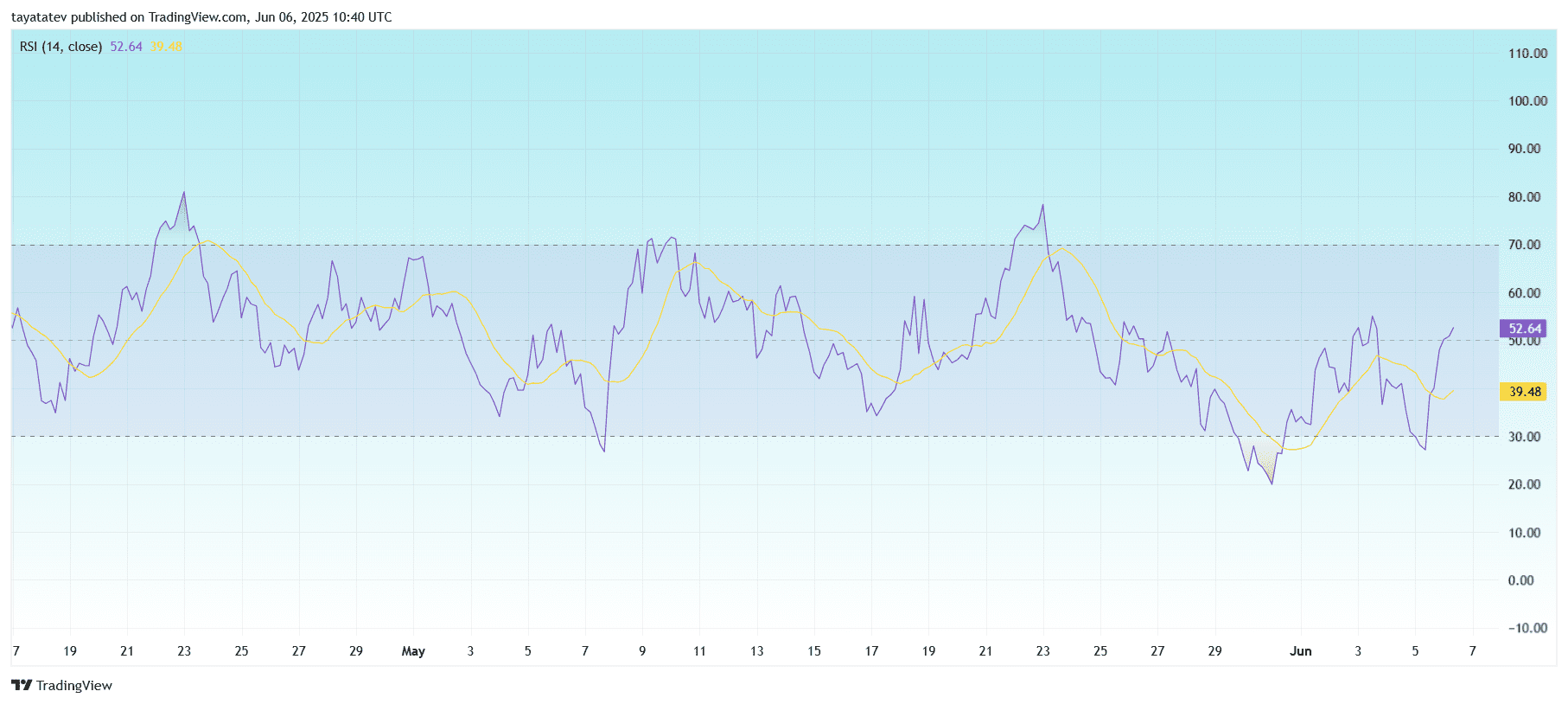

FARTCOIN RSI Breaks Above 50, Alerts Rising Power

On June 6, 2025, the Relative Power Index (RSI) for the FARTCOIN to Tether (USDT) pair on the 4-hour chart rose to 52.64, shifting above its sign line at 39.48.

The Relative Power Index (RSI) measures the pace and alter of price actions on a scale from 0 to 100. Values above 50 counsel bullish momentum, whereas ranges under 50 point out bearish stress.

This crossover into bullish territory marks the primary clear break above the 50 stage because the finish of Could. The RSI line has additionally crossed above the sign line (yellow), which is usually learn as a bullish affirmation.

The RSI beforehand hovered close to the oversold space (under 30), then bounced again sharply. This rebound provides affirmation to the breakout seen within the price chart and aligns with the bullish sign from the Stochastic Momentum Index.

If RSI continues to rise and stays above 50, it could assist additional upward motion within the FARTCOIN price.

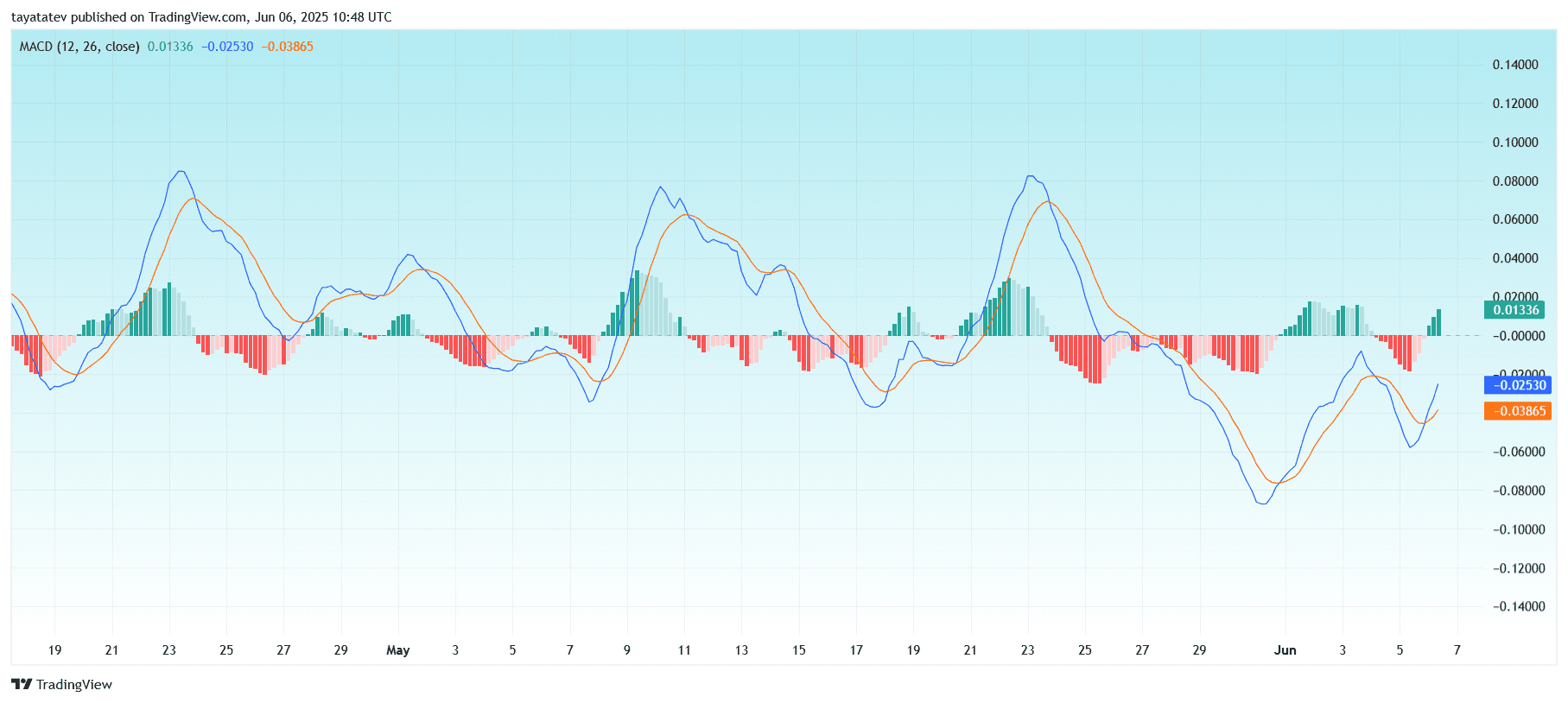

MACD Flips Bullish as Histogram Turns Inexperienced

On June 6, 2025, the Transferring Common Convergence Divergence (MACD) indicator for the FARTCOIN to Tether (USDT) 4-hour chart signaled a bullish crossover. The MACD line (blue) crossed above the sign line (orange), with values at –0.02530 and –0.03865, respectively. The histogram has additionally turned constructive at 0.01336, indicating rising bullish momentum.

The MACD makes use of two exponential shifting averages — usually 12-period and 26-period — to detect pattern modifications. A bullish crossover happens when the MACD line rises above the sign line, suggesting a possible upward price motion.

The histogram turning inexperienced reinforces this sign, displaying that bullish momentum is accelerating. The MACD is approaching the zero line from under, which, if crossed, would additional verify a pattern reversal to the upside.

This MACD breakout aligns with the bullish indicators seen within the RSI and SMI indicators, including extra weight to the case for continued upward price motion.

FARTCOIN Enters Cloud Resistance Zone, Ichimoku Alerts Early Reversal

The FARTCOIN to Tether (USDT) 4-hour chart confirmed the price climbing again towards the Ichimoku Cloud, testing early resistance from under.

The Ichimoku Cloud, often known as Ichimoku Kinko Hyo, is a complete indicator that exhibits pattern route, assist and resistance ranges, and momentum in a single view.

Presently, FARTCOIN trades at $1.07000, slightly below the 50-period Exponential Transferring Common (EMA), now at $1.10009. The cloud’s decrease boundary sits close to $1.00150, and the higher boundary is round $1.09844. The price has entered this vary, signaling the beginning of a check towards resistance.

The chart additionally exhibits a current “Weak Bullish” sign printed under the present candle, adopted by a “Strong Bearish” sign from earlier in June. Whereas the cloud continues to be purple, suggesting ongoing bearish construction, price shifting into the cloud and approaching the EMA hints at a doable short-term reversal.

Backtesting knowledge on the chart confirms restricted historic edge:

This implies the setup has traditionally had restricted reliability underneath present technique circumstances, however the price breakout and momentum must be watched together with quantity and different indicators.