Listed below are the newest updates on the U.S. President Donald Trump’s ongoing tariffs coverage.

June 11, 2025 — Trump Claims Authorized Victory as Appeals Court docket Permits Tariffs to Stand Quickly

President Donald Trump welcomed a federal appeals court docket resolution on Tuesday that enables his administration’s tariffs to stay in impact whereas litigation continues. Calling it “a great and important win for the US,” Trump praised the ruling from the U.S. Court docket of Appeals for the Federal Circuit, which briefly upholds the tariffs, together with the extensively mentioned “Liberation Day” duties imposed on a spread of imported items.

The ruling permits the continuation of Trump’s tariff regime, regardless of a decrease court docket ruling final month that declared most of the measures unlawful. The administration had argued that lifting the tariffs would hurt U.S. international coverage pursuits and weaken its negotiating leverage.

Trump Says Uncommon Earths Cope with China Reached in Commerce Talks

Individually, Trump introduced that the U.S. and China have reached a provisional settlement on uncommon earth mineral exports following two days of negotiations in London. He mentioned China has agreed to provide “magnets, and any necessary rare earths,” resolving one of many key points within the ongoing commerce dispute.

In return, Trump mentioned the U.S. would enable Chinese language college students to stay at American universities — a degree of concern for Beijing following latest visa restrictions. The deal stays topic to ultimate approval by each Trump and Chinese language President Xi Jinping.

June 6, 2025 — Elon Musk Warns Trump Tariffs Could Result in Recession; Tesla Shares Drop $150 Billion

Tesla CEO Elon Musk mentioned that U.S. President Donald Trump’s new tariffs may result in a recession within the second half of 2025. “The Trump tariffs will cause a recession,” Musk posted on X. The assertion comes amid rising disagreements between Musk and the Trump administration over latest coverage adjustments.

Following Musk’s remark, Tesla’s inventory declined greater than 14%, leading to a lack of almost $150 billion in market worth. The drop occurred shortly after President Trump informed reporters he was “very disappointed in Elon,” claiming the CEO had beforehand expressed assist for a brand new tax and spending invoice.

Musk denied the declare, stating on X that he had by no means seen the invoice and had not been consulted. “This bill was never shown to me even once and was passed in the dead of night,” Musk wrote. He additionally posted, “Without me, Trump would have lost the election,” referring to his earlier assist throughout the marketing campaign.

June 4, 2025: Trump Doubles Metal and Aluminum Tariffs to 50%, Deepening World Financial Pressure

U.S. President Donald Trump formally raised metal and aluminum tariffs to 50% on Tuesday, doubling down on his “reciprocal” commerce technique amid ongoing negotiations with a number of nations forward of a July 9 deadline. The brand new charges, regardless of pending court docket challenges over the legality of Trump’s broader tariff powers, stay in power for now.

The tariff escalation comes as world financial indicators proceed to weaken. Market analysts warn that Trump’s tariff-driven brinkmanship is accelerating a broader downturn, with the U.S. itself dealing with heightened dangers. Although merchants usually anticipate reversals in Trump’s commerce techniques—a sample dubbed “Trump Always Chickens Out” (TACO)—the uncertainty is already disrupting world commerce flows and investor sentiment.

June 3, 2025: Trump-Xi Telephone Name Anticipated This Week Amid Renewed Tariff Disputes, Says White Home

The White Home has confirmed that President Donald Trump and Chinese language President Xi Jinping are prone to maintain a cellphone name this week to deal with rising commerce tensions. Press Secretary Karoline Leavitt mentioned the dialogue would come amid rising disputes over tariff enforcement and commerce restrictions, although Beijing has not but confirmed any plans for a name. Treasury Secretary Scott Bessent additionally said {that a} dialog was anticipated quickly, with matters to incorporate disagreements on key mineral entry and China’s export guidelines.

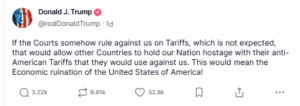

In the meantime, Trump issued a pointy warning on Reality Social, saying a court docket ruling blocking his tariff authority would trigger “economic ruination.” He argued that limiting the president’s potential to impose tariffs would weaken the U.S. towards international financial threats.

June 2, 2025: China Accuses U.S. of Violating Commerce Deal; Trump Doubles Tariffs on Metal and Aluminum

China’s Ministry of Commerce rebuked President Donald Trump’s administration for imposing new restrictions that it claims violate the phrases of their latest commerce understanding.

Beijing cited a number of U.S. actions, together with new export controls on AI chips, restrictions on chip design software program, and the revocation of pupil visas for Chinese language nationals, as examples of unilateral coverage adjustments. These measures, China mentioned, undermine belief and violate the spirit of the tariff de-escalation deal signed in Geneva in Could.

Markets reacted sharply to the information. Asian shares slid, with Chinese language shares listed in Hong Kong dropping as a lot as 2.9%, the steepest decline in almost two months. U.S. inventory futures additionally fell, as renewed commerce tensions threatened world investor sentiment.

Trump Hikes Metal and Aluminum Tariffs to 50%; India Expects Minor Affect

In the meantime, President Trump introduced a doubling of tariffs on imported metal and aluminum, elevating charges from 25% to 50%, efficient Wednesday, June 4.

India’s Metal Minister HD Kumaraswamy mentioned the influence on India would probably be “minor”, since Indian metal exports to the U.S. stay restricted. Nonetheless, steel shares nonetheless reacted negatively on Monday. Shares of JSW Metal, SAIL, Jindal Metal, Vedanta, Tata Metal, NMDC, and Nationwide Aluminium fell by as a lot as 2% in early buying and selling.

The BSE Steel Index declined by 467 factors to 30,293, making it the worst-performing sector of the day. The Nifty Steel Index additionally dropped 146 factors to 9,047.

Could 19, 2025: Trump to Reinstate Tariffs on Non-Compliant Nations; Tells Walmart to “Eat the Tariffs”

President Donald Trump will transfer ahead with greater tariffs on nations that fail to negotiate commerce offers “in good faith,” U.S. Treasury Secretary Scott Bessent mentioned in tv interviews on Sunday. Bessent did not specify what qualifies as “good faith” or present a clear timeline for when new tariff choices would be made.

This comes weeks after Trump initially imposed aggressive tariff charges on April 2, adopted by a partial reversal on April 9, when he introduced a 90-day tariff pause, decreasing most charges to 10%, and setting Chinese language import duties at 30%. On Friday, Trump had warned that his administration would quickly ship letters to U.S. buying and selling companions, informing them of their ultimate tariff charges.

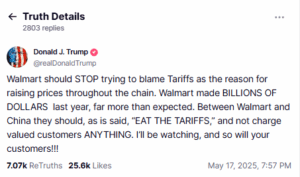

Over the weekend, Trump additionally criticized Walmart after the retailer warned that tariffs may quickly lead to greater costs. He added that the firm ought to “EAT THE TARIFFS” and keep away from passing prices on to prospects.

Walmart had said that some product costs could improve in the coming weeks due to Trump’s commerce measures. CEO Doug McMillon mentioned the retailer is monitoring the influence carefully. Walmart, which earned $29.3 billion in working revenue on $674.5 billion in income final yr, serves 90% of American households by means of its 4,000+ shops. A massive portion of its earnings come from groceries, which are primarily sourced domestically.

Different main manufacturers, together with Adidas and McDonald’s, have additionally expressed issues about the commerce battle, warning that greater tariffs may disrupt provide chains, increase costs, and worsen situations for already strained shoppers dealing with persistent inflation.

Could 16, 2025: Trump Warns 150 Nations of Imminent Tariff Hikes; Says India Has Provided “Zero Tariffs” Deal

U.S. President Donald Trump mentioned that nations ready to strike commerce offers with the US have only some weeks left earlier than they face greater tariffs. Talking at a enterprise roundtable in Abu Dhabi, Trump mentioned the U.S. can’t accommodate all 150 nations at the moment engaged in commerce discussions, and would quickly start assigning tariffs unilaterally.

Trump mentioned the method could be “very fair” however emphasised that delays in negotiations wouldn’t forestall his administration from appearing. The message is a warning to a lot of America’s buying and selling companions that point is operating out to finalize particular person offers earlier than they’re hit with new tariffs.

India Has Proposed “Zero Tariffs” on U.S. Items

Throughout a separate occasion with enterprise leaders in Doha, Trump additionally revealed that India has proposed a “zero tariffs” commerce supply as a part of efforts to finalize an settlement with Washington. Trump mentioned Indian authorities have been now prepared to eradicate import duties on American merchandise, in what he described as a significant shift.

This follows India’s latest transfer to cut back its common tariff hole with the U.S. from almost 13% to under 4%, as a part of ongoing negotiations. A deal between the 2 nations is predicted to be introduced within the coming weeks.

Could 13, 2025: India Proposes Tariffs on U.S. Items in First Retaliation

India has formally proposed retaliatory tariffs on choose U.S. items in response to Washington’s duties on metal and aluminum, in accordance to a submitting with the World Commerce Group (WTO). This marks India’s first formal transfer to counter President Donald Trump’s tariff insurance policies, even as each nations work to finalize a broader commerce settlement.

The WTO doc, dated Could 12, said that “the proposed suspension of concessions or other obligations takes the form of an increase in tariffs on selected products originating in the United States.” The discover did not title particular merchandise that would be affected.

Could 12, 2025: U.S. and China Agree to Slash Tariffs, Start 90-Day Truce

The United States and China have reached a breakthrough settlement to slash tariffs and pause new commerce measures for 90 days, in accordance to U.S. officers. The deal was introduced Monday following high-stage talks in Geneva between Treasury Secretary Scott Bessent, U.S. Commerce Consultant Jamieson Greer, and Chinese language financial chief He Lifeng.

Talking to reporters after the assembly, Bessent mentioned the two nations had agreed to scale back reciprocal tariffs by over 100 proportion factors, bringing charges down from 145% to 10%.

Could 9, 2025: Trump Says “80% Tariff on China Seems Right” Forward of Weekend Talks

In the present day, Donald Trump mentioned that an 80% tariff on Chinese language items “seems right”, simply as his prime commerce representatives ready to satisfy Chinese language officers for essential weekend talks.

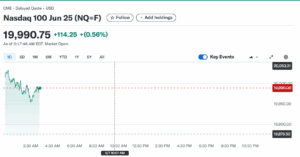

Dow Jones Industrial Common futures, which had risen earlier in the day, turned flat following Trump’s remarks. S&P 500 futures rose 0.1%, whereas Nasdaq-100 futures edged up 0.2%.

In the meantime, India has provided to scale back its common tariff hole with the United States to beneath 4%, down from almost 13%, in a bid to safe exemptions from present and future U.S. tariffs. This represents a 9-level drop in the unweighted common tariff differential throughout all product classes.

Could 8, 2025: Fed Warns Tariffs Could Elevate Inflation; Trump Refuses to Lower China Tariffs Forward of Talks

U.S. Federal Reserve Chair Jerome Powell warned on Wednesday that President Donald Trump’s tariff coverage may result in greater inflation, slower financial progress, and rising unemployment. Talking at a press convention, Powell mentioned there’s a risk that inflation will stay persistent if tariff ranges keep elevated.

Powell acknowledged that it’s nonetheless too early to totally perceive the long-term influence of the commerce measures. The Fed has chosen to increase its wait-and-watch method, stating that the most effective plan of action for now could be to be affected person and observe how tariff developments unfold earlier than making any financial coverage changes.

In the meantime, President Trump confirmed that the 145% tariffs on most Chinese language imports will stay in place “for now”, at the same time as U.S. and Chinese language officers put together to satisfy for commerce talks this weekend in Geneva. The president made his feedback throughout the swearing-in ceremony of David Perdue as the brand new U.S. Ambassador to China.

When requested instantly on the White Home whether or not he would take into account decreasing tariffs to assist the negotiations, Trump answered with a agency “No.” He added that China was the one requesting the talks, not the US, and criticized Chinese language officers for misunderstanding the commerce relationship. “I think they ought to go back and study their files,” Trump mentioned.

Could 7, 2025: U.S. and China to Maintain First Commerce Talks Since Tariff Battle Started

The United States and China will maintain their first official commerce talks later this week since President Donald Trump started imposing sweeping tariffs on Chinese language items. U.S. Treasury Secretary Scott Bessent and chief commerce negotiator Jamieson Greer will meet with China’s prime financial official, He Lifeng, in Switzerland to start talks aimed at easing tensions between the world’s two largest economies.

The assembly, set to take place in Geneva, was first introduced by Washington and later confirmed by Beijing. The information triggered a sharp rise in Asian inventory markets and boosted investor sentiment in after-hours buying and selling in New York. Futures for the Dow Jones Industrial Common opened with 0.5% achieve, or about 280 factors. S&P 500 futures gained 0.6%, or 50 factors, whereas Nasdaq 100 contracts jumped 0.7%, including 200 factors.

In accordance to Reuters, the talks are anticipated to cowl potential reductions in the tariffs that have disrupted world commerce flows.

Simply hours earlier than confirming the upcoming assembly, China introduced new steps to assist its financial system, which has been beneath stress due to the commerce battle. The Folks’s Financial institution of China (PBOC) reduce its key seven-day reverse repurchase fee to 1.4% from 1.5%, marking a transfer to ease borrowing prices. In addition, the central financial institution mentioned it would decrease the reserve requirement ratio (RRR) for banks by 0.5 proportion factors to free up extra funds for lending.

PBOC Governor Pan Gongsheng introduced the adjustments at a briefing on Could 8, alongside China Securities Regulatory Fee Chairman Wu Qing and Nationwide Monetary Regulatory Administration head Li Yunze. In accordance to the PBOC, the repo fee reduce will take impact on Thursday, and the RRR reduce will be applied subsequent week.

Could 6, 2025: Trump to Announce New Tariffs on Pharmaceutical Imports

U.S. President Donald Trump’s administration will announce new tariffs on pharmaceutical imports inside the subsequent two weeks. The announcement got here shortly after Trump signed an government order aimed at boosting home medical manufacturing and lowering America’s dependence on international drug producers.

Since returning to workplace in January, Trump has launched broad tariffs on almost all U.S. buying and selling companions. Initially, the pharmaceutical business had been exempt from these measures, which introduced aid to many in the healthcare sector. Nonetheless, Trump later steered that this exemption may not final.

The president did not make clear which nations or merchandise will be affected by the new tariffs. The United States at the moment imports over $200 billion in prescription medication each yr, with a massive share coming from nations in Europe and Asia. India, in specific, is one of the largest exporters of prescribed drugs to the U.S., making it a doubtlessly vital participant in any upcoming adjustments.

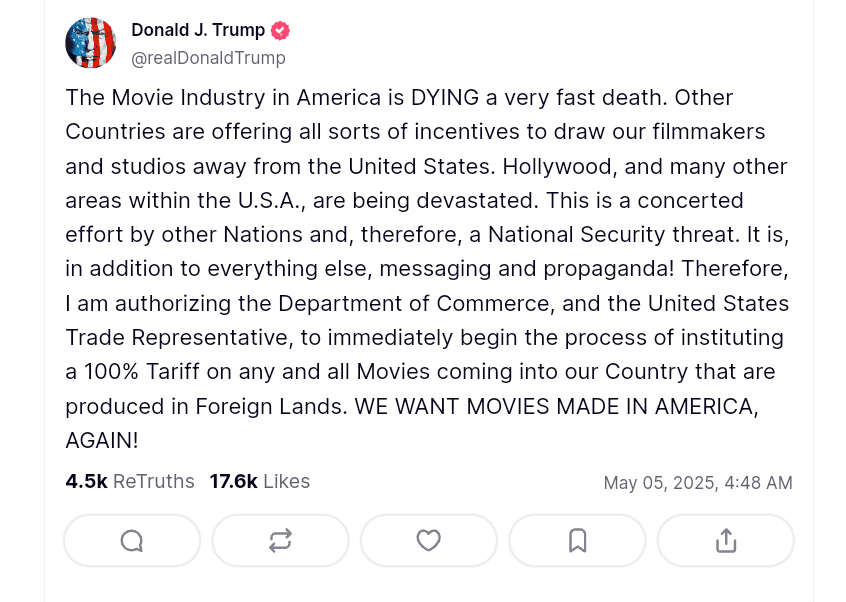

Could 5, 2025: Trump Threatens 100% Tariffs on Overseas-Made Motion pictures

U.S. President Donald Trump has introduced that he’ll impose a 100% tariff on movies made outdoors the US, as a part of his increasing commerce battle towards nations he accuses of undermining American industries. Trump mentioned the transfer is meant to guard the U.S. movie business, which he claims is “dying a very fast death” as a consequence of aggressive incentives provided by different nations to lure filmmakers overseas. Trump known as international movie manufacturing a nationwide safety risk, saying that it impacts not simply the financial system, but in addition public messaging and cultural affect.

U.S. Commerce Secretary Howard Lutnick responded to the announcement, saying the administration is engaged on the difficulty, although no formal coverage particulars have but been launched. Trump didn’t make clear whether or not the tariffs would apply to American studios that movie overseas or how the brand new levies could be calculated and enforced. It additionally stays unsure whether or not the tariffs will apply to movies distributed through streaming platforms like Netflix, or solely to theatrical releases.

In response to Trump’s feedback, the governments of Australia and New Zealand issued public statements defending their nationwide movie industries. Each nations emphasised their contributions to world cinema and voiced assist for the worldwide artistic collaborations which have helped their economies and cultural sectors thrive.

Could 2, 2025: Employee Protests Sweep China as Trump Tariffs Hit; Beijing Considers U.S. Talks

Mass protests have erupted throughout China as U.S. tariffs imposed by President Donald Trump trigger widespread financial disruption. Employees in industrial hubs from Shanghai to Inside Mongolia are demonstrating towards manufacturing unit closures, wage delays, and plummeting export demand.

In Tongliao, building staff climbed buildings and threatened self-harm after months of unpaid wages. Close to Shanghai, 1000’s from an LED manufacturing unit protested over again pay owed since January. Related unrest was reported in Dao County, the place a sports activities tools firm shut down with out compensating its employees.

In response, China’s Ministry of Commerce introduced on Friday that it’s assessing latest messages from the US in search of to reopen talks on tariffs. The ministry confirmed that Washington had made a number of outreach efforts expressing curiosity in restarting negotiations.

World Markets Climb on Hope of Renewed Talks

Markets reacted positively to indicators of potential U.S.-China engagement. S&P 500 futures rose 0.5%, and Dow Jones futures gained 0.6%. European indexes additionally superior, with Germany’s DAX up 1.5%, France’s CAC 40 up 1.3%, and the UK’s FTSE 100 rising 0.7%. In Asia, Hong Kong’s Grasp Seng jumped 1.7%, whereas Taiwan’s index surged 2.7%. Shanghai markets have been closed for a public vacation.

India’s U.S. Oil Imports Set to Hit Report Excessive as Commerce Talks Progress

As India and the U.S. proceed to barter a commerce settlement, India is predicted to import over 1 million barrels per day of U.S. crude oil throughout April–June 2025 — the best stage on report.

In line with Kpler, imports from the U.S. rose 17% month-over-month and 68% year-over-year in April. The U.S. Power Data Administration (EIA) reported comparable figures, noting that India’s vitality imports from the U.S. are on tempo to greater than double in comparison with Q2 2023.

April 30, 2025: China’s Manufacturing facility Exercise Drops as Tariffs Take Impact; Trump Targets Amazon Over Value Transparency

China’s manufacturing unit exercise fell sharply in April, displaying early indicators of financial stress attributable to President Donald Trump’s sweeping tariffs. In line with the Nationwide Bureau of Statistics, China’s official manufacturing PMI dropped to 49.0, down from 50.5 in March. This was the bottom studying in 16 months and effectively under expectations.

A PMI under 50 indicators contraction. The April studying means that China’s factories are scuffling with weak demand, each at house and abroad. Many producers had rushed shipments out earlier than the tariffs took impact, however that technique not works now that Trump’s “Liberation Day” tariffs are in place.

The non-manufacturing PMI, which incorporates building and providers, additionally slipped barely from 50.8 to 50.4, staying simply above the growth-contraction line.

Trump Criticizes Amazon Over Tariff Pricing

President Trump criticized Amazon after studies claimed the corporate deliberate to show tariff-related prices subsequent to product costs. A information story mentioned Amazon may begin displaying how a lot of every merchandise’s price is because of U.S. import duties.

Trump reportedly known as Amazon founder Jeff Bezos on to complain. He was sad that the e-commerce big was highlighting the impact of tariffs, which he believes may harm public assist for his commerce coverage.

Trump Says U.S.-India Tariff Talks Are “Going Great”

Trump additionally expressed confidence in his administration’s tariff talks with India. Chatting with reporters outdoors the White Home, he mentioned he expects a cope with India quickly and that the discussions are “going great.”

Trump added that he plans to go to Africa and maintain talks with Australian officers within the coming weeks as a part of his world commerce outreach.

April 29, 2025: Trump Strikes to Ease Auto Tariffs; Temu Hikes Costs Resulting from 145% Tariffs

The Trump administration introduced it should scale back the influence of automotive tariffs beginning April 29. In line with officers, President Donald Trump’s crew plans to alleviate some duties on international automobile components utilized in domestically manufactured autos. On the identical time, the administration will be sure that tariffs on imported automobiles don’t stack on prime of present levies, like these already imposed on metal and aluminum.

Commerce Secretary Howard Lutnick mentioned in a press release that Trump is constructing a partnership with home automakers and American staff. Lutnick described the transfer as a significant win for Trump’s commerce coverage as a result of it rewards corporations that manufacture automobiles contained in the U.S., whereas additionally giving time to different producers who’ve promised to spend money on American manufacturing.

Temu Raises Costs After New Import Costs

In the meantime, Chinese language on-line retailer Temu has reacted to Trump’s tariffs by including new “import charges” of about 145% on many merchandise shipped to the US.

These charges started showing over the weekend after Trump’s tariffs formally went into impact on Friday. In lots of instances, the brand new import prices price greater than the unique price of the product, which means {that a} typical Temu order now greater than doubles in price for U.S. buyers.

April 28, 2025: China Stays Assured on 2025 Progress Regardless of U.S. Tariffs

Chinese language officers on Monday tried to calm fears that heavy U.S. tariffs may derail China’s financial restoration. Analysts have warned that the continued commerce battle between the U.S. and China may badly harm progress by disrupting provide chains and affecting many industries.

Nonetheless, Zhao Chenxin, the vice head of China’s Nationwide Growth and Reform Fee (NDRC), mentioned he was ”totally assured” that China would nonetheless meet its financial progress goal of round 5% for 2025.

Talking at a press convention, Zhao mentioned that China’s sturdy first-quarter outcomes had constructed a stable basis for the remainder of the yr. He added that new assist insurance policies could possibly be launched within the second quarter if wanted, relying on how the financial system performs.

Zhao additionally emphasised that China would keep targeted by itself improvement plans, no matter how the worldwide state of affairs adjustments.

April 25, 2025: China Calls for Full Tariff Elimination Earlier than Commerce Talks Start

China has informed the US that if President Donald Trump is critical about ending the commerce battle, he should first cancel all U.S. tariffs on Chinese language items. Chinese language officers mentioned there have been no formal commerce talks between the 2 nations, regardless that Trump claimed that discussions had taken place.

Earlier this week, Trump mentioned the U.S. and China had held conferences and have been negotiating. He additionally steered that the 145% tariff on Chinese language imports could possibly be “substantially” diminished, although not eradicated completely. That assertion helped carry market sentiment and gave buyers hope that tensions may ease.

However China shortly pushed again. A spokesperson for the Chinese language commerce ministry mentioned there are at the moment no commerce negotiations between the 2 nations. Later, at a international ministry press briefing, one other official known as studies of commerce progress “baseless rumours.” He mentioned if the U.S. needs peace, it should “completely cancel all unilateral tariff measures.”

China Sends Boeing Planes Again as Retaliation

In one among its strongest responses but, China despatched again Boeing planes it had beforehand ordered from the U.S. This marks one other direct blow within the ongoing tariff battle and an indication that relations stay tense.

Earlier this month, China additionally responded to U.S. tariffs with a 125% tariff on American items. U.S. Treasury Secretary Scott Bessent has mentioned the present state of affairs is unsustainable and in contrast it to a commerce embargo.

IMF Requires Speedy Commerce Truce

The Worldwide Financial Fund (IMF) has joined the requires an finish to the commerce battle. IMF Director Kristalina Georgieva mentioned that world financial uncertainty has “spiked off the charts” as a result of battle. Talking at a press convention in Washington, she mentioned a fast decision is important to keep away from additional harm to the worldwide financial system.

Georgieva warned that uncertainty is stopping companies from investing and main households to avoid wasting as a substitute of spend. This, she mentioned, is making already weak financial progress even worse.

She didn’t criticize the U.S. instantly however mentioned the world’s main economies should settle their commerce variations shortly to revive confidence.

April 24, 2025: 12 U.S. States Sue Trump Over Tariffs; Trump Says China Reduction Relies on Negotiations

A coalition of 12 U.S. states has filed a lawsuit within the U.S. Court docket of Worldwide Commerce, difficult President Donald Trump’s tariff coverage. The states argue that Trump has overstepped his authority by utilizing emergency powers to impose broad commerce tariffs with out approval from Congress. The lawsuit accuses the president of misusing the 1977 Worldwide Emergency Financial Powers Act (IEEPA), which is barely meant for actual emergencies, not common commerce actions.

The lawsuit says Trump’s actions have disrupted the U.S. financial system and upset the stability of energy between the chief department and Congress. The 12 states—Oregon, Arizona, Colorado, Connecticut, Delaware, Illinois, Maine, Minnesota, Nevada, New Mexico, New York, and Vermont—are asking the court docket to declare the tariffs illegal and forestall federal companies from imposing them.

In the meantime, President Trump spoke to reporters on the White Home and mentioned he could decrease the 145% tariff on Chinese language items, however provided that Beijing agrees to new commerce phrases. Trump mentioned the U.S. had been “ripped off for years” and would solely scale back tariffs as a part of a good deal.

He additionally talked about that extra tariff adjustments may come within the subsequent few weeks, relying on negotiations. Trump mentioned he continues to have an excellent relationship with Chinese language President Xi Jinping and nonetheless hopes a deal may be reached. However he added, “If we don’t have a deal… we’re going to set the tariff.”

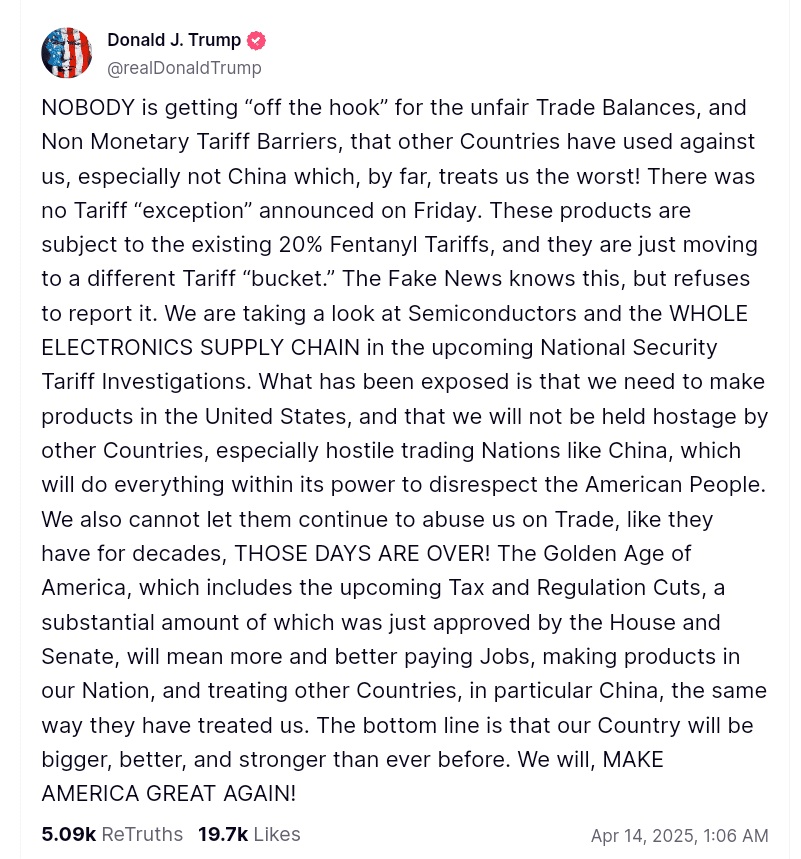

April 14, 2025: Trump Denies Tariff Exemptions, Says No Nation Is ”Off the Hook”

President Donald Trump denied that any nation could be exempt from his tariff program, pushing again towards studies of commerce aid for tech merchandise. His remarks adopted a U.S. Customs and Border Safety steerage issued on April 11, which appeared to exempt smartphones, computer systems, and different electronics from the brand new tariffs.

In a Reality Social put up, Trump wrote, “NOBODY is getting ‘off the hook’ for the unfair Trade Balances… especially not China which, by far, treats us the worst!” He added that there was no official tariff exemption and claimed that these merchandise stay topic to the prevailing 20% fentanyl-linked tariffs, although they could now fall beneath a distinct tariff classification.

Trump additionally accused the media of misreporting the state of affairs, saying, “The Fake News knows this, but refuses to report it.”

Later, chatting with reporters on April 13, Trump clarified that any aid for electronics from China was non permanent. He added that his administration remains to be reviewing tariffs on semiconductors, and mentioned an official announcement could be made quickly.

April 11, 2025: U.S. Raises China Tariffs to 145%, China Targets Hollywood, Markets Slide

The White Home confirmed on April 10 that the whole U.S. tariff fee on Chinese language imports has reached 145%, after including collectively previous and up to date levies. This features a 20% obligation imposed earlier this yr, a 34% tariff launched final week, and a brand new 91% improve utilized this week. The White Home clarified the up to date determine after President Trump incorrectly cited 125% on Reality Social.

In response, China’s Nationwide Movie Administration introduced it could scale back the variety of Hollywood movies launched in its home market. The company linked this resolution on to the brand new U.S. tariff hike, calling it a defensive transfer within the ongoing commerce battle.

Asian markets fell sharply as we speak on April 11 following the White Home’s clarification. Japan’s Nikkei 225 misplaced almost 4%, and China’s CSI 300 dropped 1.2%. Hong Kong’s Grasp Seng index fell 3.1%, whereas MSCI’s Asia-Pacific index outdoors Japan slid 1.7%.

Trump can also be dealing with accusations of market manipulation. On Wednesday morning, he posted “THIS IS A GREAT TIME TO BUY!!! DJT” on Reality Social. Hours later, he introduced the 90-day tariff pause for many nations, triggering a historic inventory market rally. Critics now query the timing of his message.

April 10, 2025: Trump Pauses Tariffs for Most Nations, However Will increase Them on China

U.S. President Donald Trump introduced a 90-day pause on tariffs for many U.S. buying and selling companions. Because of this nations aside from China is not going to face new U.S. tariffs for the following three months. Trump made the announcement on April 9, simply someday after new tariffs have been put in place. Whereas most nations bought a break, China didn’t. As an alternative, Trump elevated the tariff on all Chinese language items to 125%. This fee is greater than any earlier tariff throughout his presidency. Trump mentioned China had refused to again down and take away its personal tariffs on U.S. merchandise. So, the U.S. was elevating stress. On the identical time, the White Home warned different nations to not retaliate. An announcement from the administration mentioned: “Do not retaliate and you will be rewarded.”

China Responds With Extra Tariffs

China didn’t settle for Trump’s calls for. Inside hours of the U.S. announcement, China responded. It imposed a brand new 84% tariff on all American imports. These new Chinese language tariffs took impact as we speak on April 10. Following the tariff pause information, U.S. inventory markets had one among their strongest days on April 10. The S&P 500 rose by 9.5%, which is a achieve usually seen over a complete yr.

The Nasdaq Composite jumped 12%, gaining greater than 1,857 factors to achieve 17,124.97. The Dow Jones Industrial Common climbed 7.9%, ending a stretch of market losses attributable to tariff fears.

April 9, 2025: U.S. Hits China with 104% Tariff

The US formally imposed a large 104% tariff on Chinese language imports on April 9. The transfer follows President Donald Trump’s ultimatum to China earlier this week, the place he warned of steep new duties if Beijing refused to roll again its 34% counter-tariff on American items. China didn’t comply, prompting the White Home to proceed with its tariff escalation. The brand new 104% tariff is the results of three cumulative will increase:

- A 20% tariff introduced in March.

- A 34% tariff applied as a part of the “Liberation Day” coverage.

- A further 50% penalty was confirmed this week.

Following the announcement, the Asian inventory market tumbled. On April 9, Japan’s Nikkei 225 index dropped almost 4%. Markets in South Korea, New Zealand, and Australia additionally posted losses over the deepening U.S.-China commerce battle. China’s main inventory indexes fell in response. The CSI 300, which tracks China’s prime blue-chip shares, slipped 1.2%, whereas Hong Kong’s Grasp Seng index plunged 3.1%.

April 8, 2025: Trump Threatens China with 50% Tariff; Markets Swing Wildly

Tensions between the US and China escalated additional on April 8 after President Donald Trump threatened to impose an extra 50% tariff on Chinese language items. The warning got here in response to China’s resolution to retaliate towards Trump’s earlier 34% tariff by inserting an identical counter-tariff on American imports. President Trump gave China a 24-hour deadline to take away its 34% countermeasure. He mentioned that if China refused to again down, the US would reply with a 50% import tariff on all Chinese language items. The Chinese language embassy in Washington shortly responded by accusing the U.S. of “economic bullying.” It additionally said that Beijing would “firmly safeguard its legitimate rights and interests.” The rising uncertainty over commerce coverage led to unstable actions throughout monetary markets all through the day. Inventory futures initially rose in after-hours buying and selling late Monday. Contracts tied to the Dow Jones Industrial Common, the S&P 500, and the Nasdaq-100 all gained greater than 1%.

April 7, 2025: China Plans Stimulus as World Markets Wrestle; Trump Dismisses Recession Fears

Chinese language leaders held emergency conferences over the weekend to debate how to reply to President Trump’s rising checklist of tariffs. In line with individuals conversant in the matter, prime Chinese language policymakers and monetary regulators thought-about fast-tracking stimulus plans to assist stabilize the financial system and increase home consumption.

A few of these stimulus measures have been already in improvement earlier than the U.S. tariffs however could now be accelerated to counter the financial shock. No ultimate choices have been introduced publicly.

Trump Dismisses Market Considerations, Calls for Commerce Deficit Elimination

President Trump, talking aboard Air Pressure One on Sunday, pushed again towards fears that the tariffs would result in inflation or a recession. He insisted that the market volatility was solely non permanent and claimed the U.S. would enter a brand new financial “boom.”

Trump additionally made it clear that he wouldn’t decrease the best tariffs except the U.S. utterly eradicated its commerce deficit with particular nations.

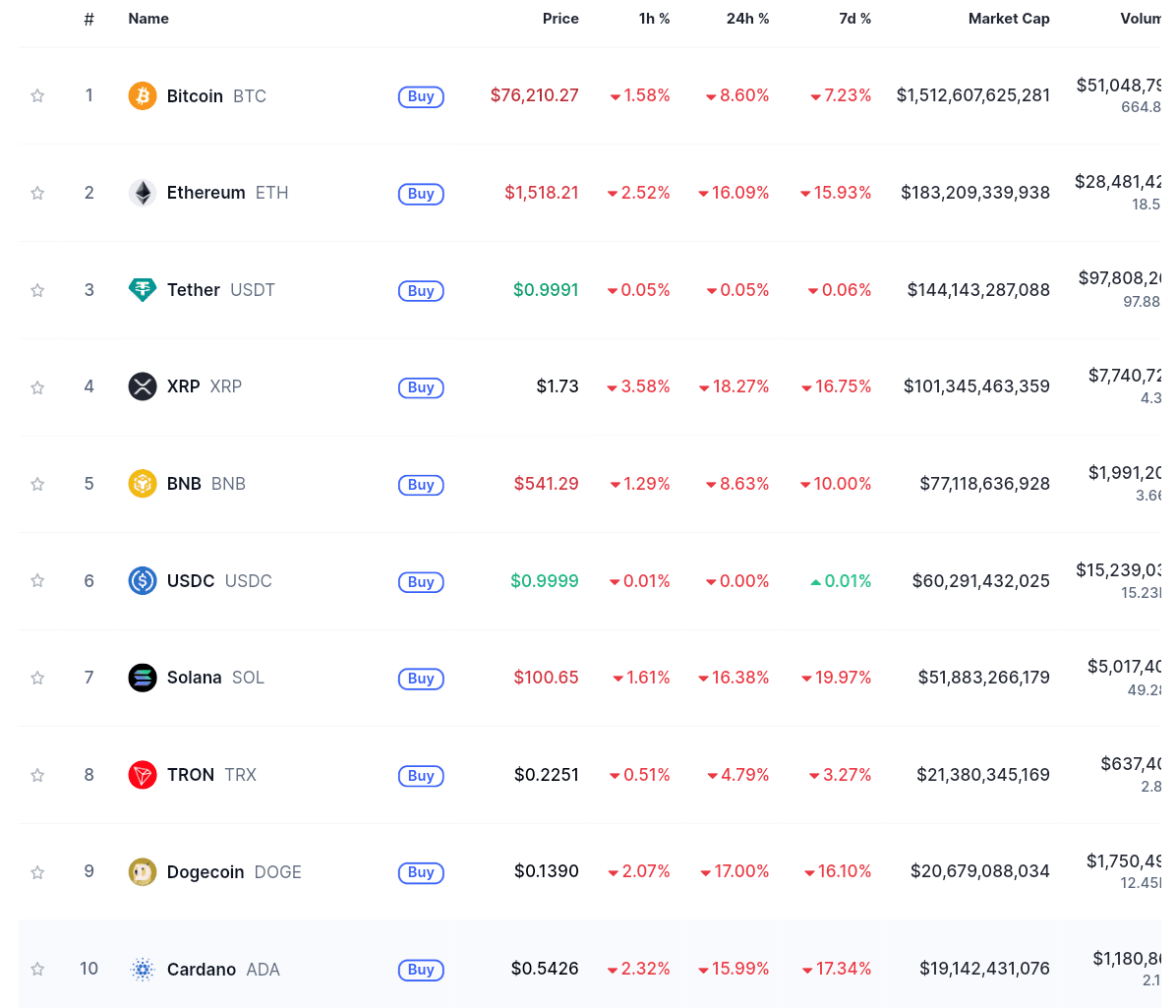

Crypto and Inventory Futures Drop Once more

The worldwide monetary fallout continued as U.S. inventory futures opened decrease and cryptocurrencies noticed one other sharp drop. In the present day, all prime 10 Cryptocurrencies by market cap are down. Bitcoin misplaced over 8% of its worth, falling to round $76,210. Ether declined greater than 16%, buying and selling at $1,518. The whole crypto market capitalization dropped over 8%, hitting $2.5 trillion.

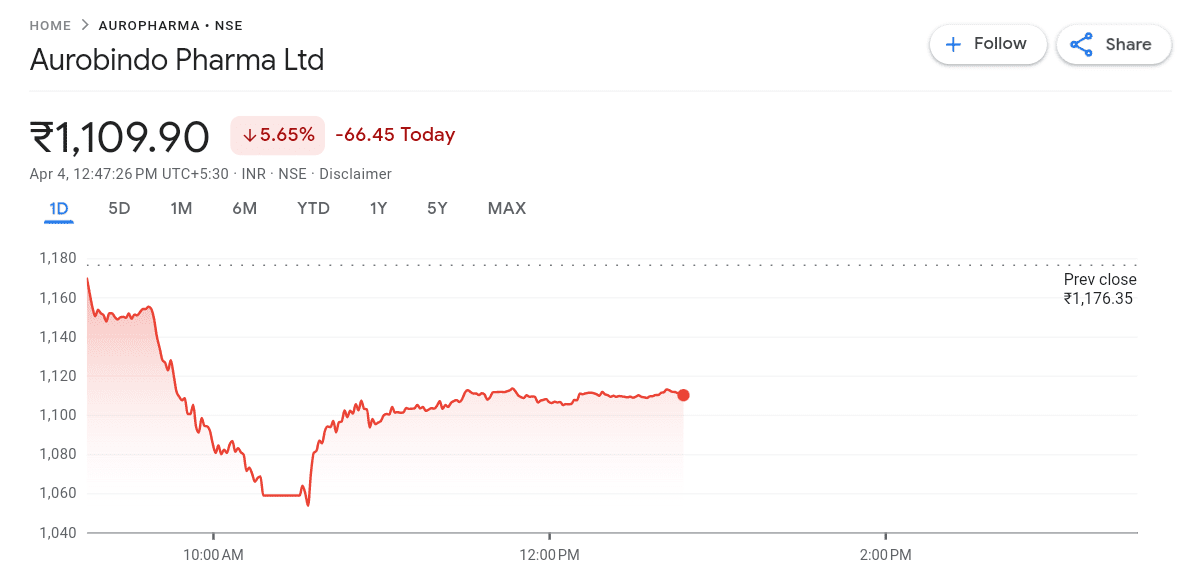

April 4, 2025: Trump Revises Tariffs, India Focused; Pharma Shares Crash

A brand new White Home doc launched on April 4 reveals that Trump’s tariff charges have been revised for no less than 14 nations, together with India. India’s tariff fee was first talked about by Trump as 26%, however the brand new annex initially listed it at 27%. The ultimate doc confirms it has been revised again down to 26%.

Trump’s administration additionally introduced that prescribed drugs and semiconductors at the moment are beneath overview for potential new tariffs beneath Part 232 of the Commerce Growth Act of 1962. This part permits the U.S. President to impose tariffs if imports are seen as a risk to nationwide safety.

Following this information, Indian pharmaceutical shares took a tough hit:

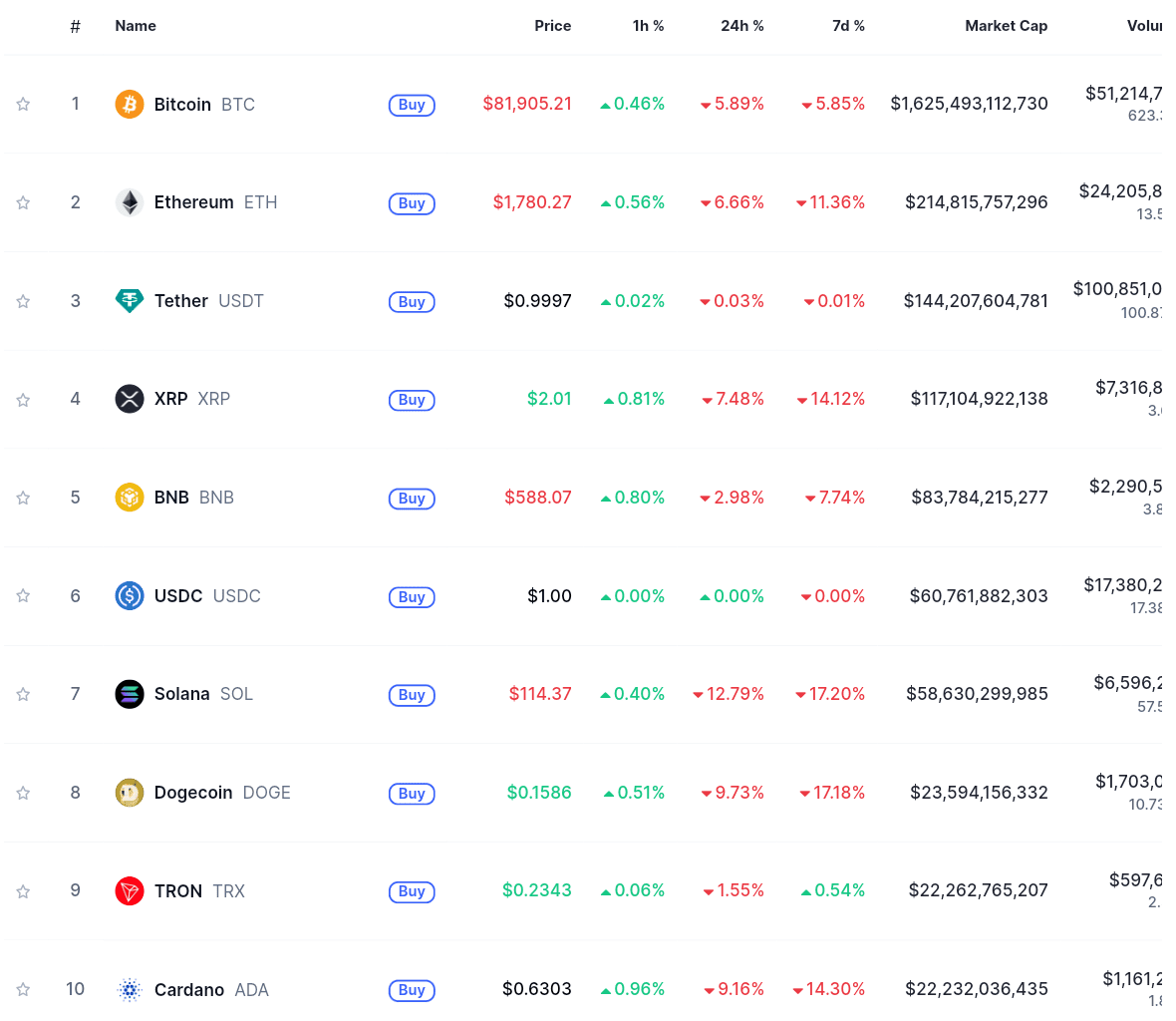

April 3, 2025: U.S. and Crypto Markets Dump After Tariff Shock

World monetary markets reacted negatively to Trump’s newly introduced tariffs. Key monetary indexes noticed steep declines:

- The Dow Jones Industrial Common fell by over 1,500 factors (3.6%).

- The S&P 500 declined round 4%.

- The Nasdaq Composite dropped almost 5%.

Bitcoin and different main cryptocurrencies skilled notable declines. Bitcoin fell as a lot as 4%, reaching roughly $82,000 on Thursday morning in Singapore. Different cryptocurrencies, together with Ether and XRP, additionally noticed declines, with Solana dropping over 9% at one level.

April 2, 2025: Trump Formally Launches ”Liberation Day” Tariffs

President Trump formally introduced the ”Liberation Day” tariffs on this date. He known as it a nationwide emergency to guard American business. The main points of the brand new tariffs have been:

- A 10% baseline tariff on all imports.

- A 34% tariff on items from China.

- A 46% tariff on items from Vietnam.

- A 20% tariff on items from the European Union.

- A 10% tariff on imports from the UK, Australia, and different allied nations.

Trump mentioned these tariffs would rebuild the American financial system, convey again jobs, and decrease taxes. However many nations criticized the transfer. The European Union and Australia expressed sturdy issues, saying the tariffs would harm world commerce.

Trump’s Commerce Battle 2.0: The Background of Imposed Tariffs Defined

After profitable the U.S. presidential election in November 2024, Donald Trump returned to the White Home with a transparent message: he wished to repair America’s commerce deficit and scale back dependency on international items. Moreover, he promised to convey again American manufacturing jobs and make the nation much less reliant on nations like China. On February 1, 2025, just some weeks after taking workplace for his second time period, Trump signed his first main commerce motion. He imposed new tariffs on imports from China, Canada, and Mexico. The tariffs included:

- A 25% tariff on items from Canada and Mexico,

- A ten% tariff on items imported from China.

These tariffs formally took impact on Feb. 4. Trump mentioned that these tariffs would shield U.S. industries, safe jobs, and stability commerce. Nonetheless, this resolution instantly created stress with America’s prime buying and selling companions. Canada, Mexico, and China all expressed issues and warned that they could retaliate. Notably, all through February and March 2025, the state of affairs worsened. Extra tariffs adopted, concentrating on particular nations. Particularly, China and Vietnam have been accused of manipulating their currencies and giving unfair subsidies to their exporters. Trump and his crew used this to justify even greater tariffs on these nations. Because the tariff battle heated up, monetary markets additionally started to react. Specifically, companies, particularly those who depend on imports or promote to worldwide markets, began to endure. Above all, buyers are involved that the tariff struggle may result in a commerce battle or perhaps a recession.