Ethereum (ETH), the world’s second-largest cryptocurrency, is having a tough begin to 2025. After a brutal market-wide correction, ETH has suffered vital losses, with price motion wanting fragile. The actual query is: Is Ethereum setting up for a significant restoration, or is that this the start of an extended downward spiral? Buyers are actively looking for an Ethereum price prediction 2025 that clarifies its subsequent transfer.

Let’s break down Ethereum’s present state, controversies, on-chain information, derivatives market, and technical setup to find out whether or not ETH is a stable purchase or a godforsaken promote.

The Elephant within the Room: Ethereum Value Is Crashing, and It’s Not Simply the Market

Ethereum price is down large, however it’s not alone. The broader crypto market has been hit by a number of macroeconomic headwinds, together with:

- Commerce Struggle & Market Reactions – The U.S. administration imposed a ten% tariff on all Chinese language items, triggering retaliatory tariffs and financial uncertainty. Crypto markets have traditionally reacted negatively to commerce tensions, and this time isn’t any completely different.

-

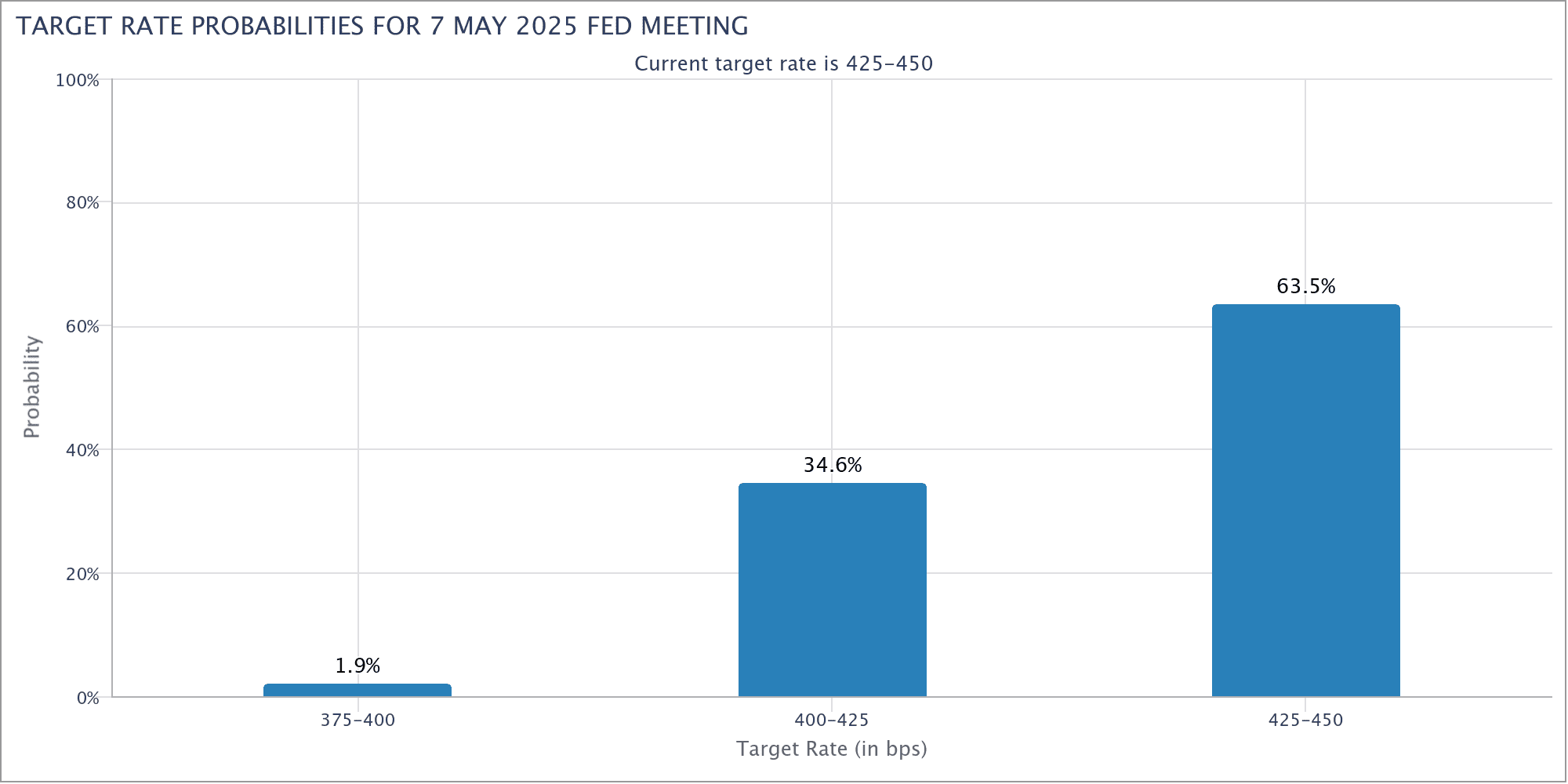

Federal Reserve Price Lower Pause – Expectations of additional price cuts have been placed on maintain, resulting in tighter liquidity. Threat belongings like crypto thrive in easy-money situations, and a hawkish Fed doesn’t assist.

-

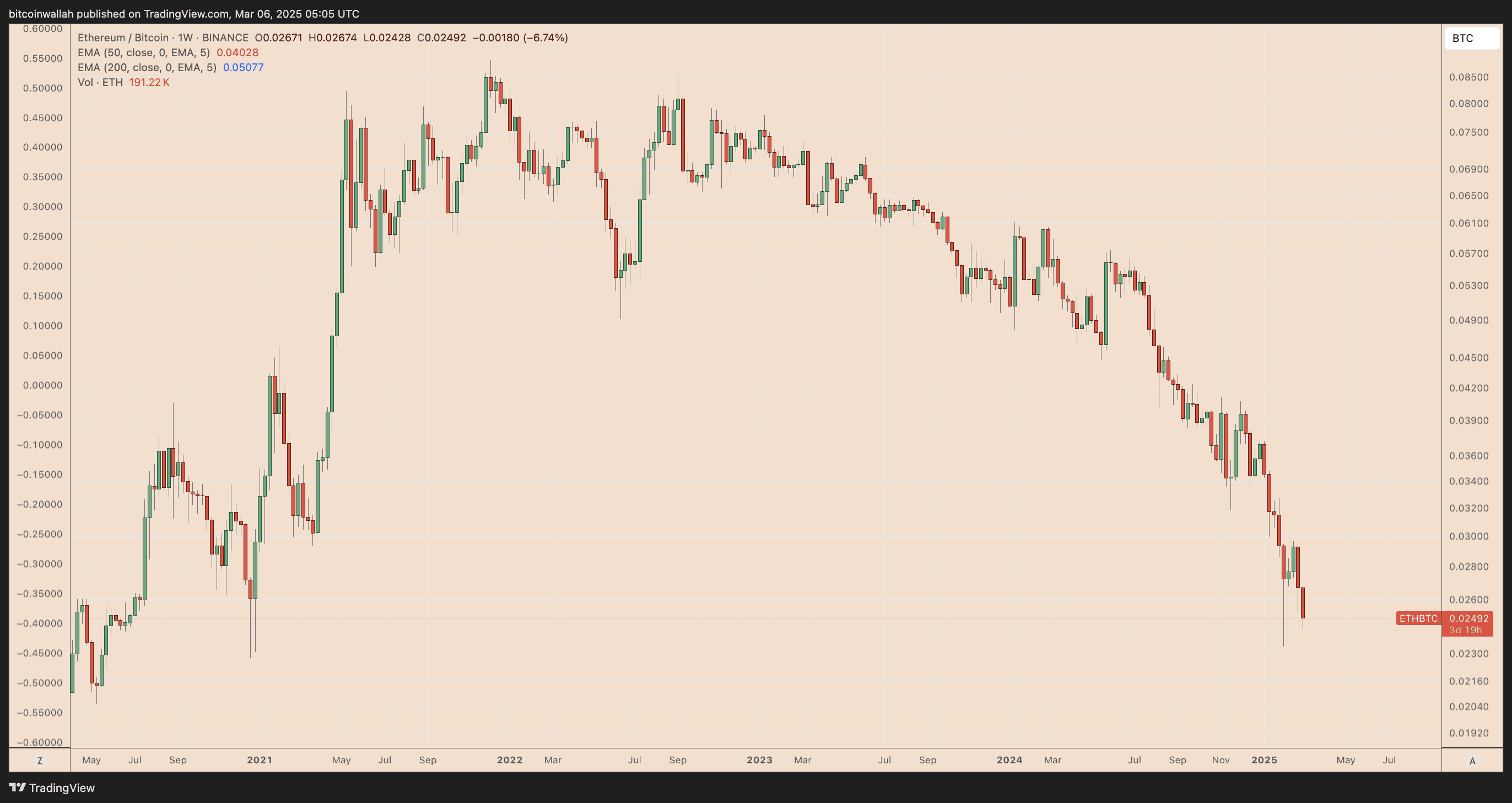

Market Dominance Decline – Ethereum’s relative weak spot is regarding. The ETH/BTC ratio has dropped to ~0.025, and ETH/SOL can be declining, suggesting that capital is rotating out of Ethereum into Bitcoin and Solana.

These macro elements are pressuring ETH, however inner points inside Ethereum are making issues worse. Analysts monitoring Ethereum price prediction 2025 fashions notice that its efficiency relative to opponents might decide its future trajectory.

How Do These Catalysts Affect Our ETH Value Prediction?

- Greater tariffs enhance financial uncertainty, main traders to shift capital away from dangerous belongings like crypto.

- A pause in price cuts means borrowing prices stay excessive, limiting liquidity and lowering funding in speculative markets.

- ETH’s declining market share reveals that traders might desire various blockchains, which might have an effect on Ethereum’s long-term dominance and progress potential.

A key Ethereum price prediction in 2025 pattern means that except ETH can regain market dominance, it might wrestle to outperform its friends.

Ethereum Upgrades: Previous and Future

Ethereum has had an eventful previous yr, crammed with technological upgrades and institutional adoption, but in addition main issues:

- Dencun Improve (March 2024) – Launched proto-danksharding (EIP-4844) to scale back Layer-2 gasoline charges and improve scalability.

- Spot ETH ETFs Permitted (July 2024) – 9 Ethereum ETFs have been authorised, rising institutional publicity.

Ethereum Basis 2025 Roadmap

- Pectra Improve (Q1 2025) – Introduces EIP-7702 for native account abstraction.

- Osaka-Fulu Improve (Late 2025) – Implements PeerDAS for improved information availability.

- DevCon 8 (October 2025) – Anticipated to concentrate on Layer-2 scaling options and interoperability.

Regardless of these developments, Ethereum has been suffering from controversies and inner struggles. Ethereum price prediction in 2025 discussions now revolve round whether or not these upgrades can offset bearish market developments.

Ethereum’s Rising Record of Controversies

Ethereum has confronted rising scrutiny over a number of key points:

- Ethereum Basis Promoting ETH – Merchants have accused the Ethereum Basis of dumping ETH holdings at market peaks, elevating issues about insider promoting.

BREAKING:

ETH FOUNDATION SOLD AGAIN.

CAN YOU GUYS TAKE A BREAK FOR

ONE FUCKING DAY ?? pic.twitter.com/1FyE8JJRxk— Ash Crypto (@Ashcryptoreal) January 27, 2025

How Do These Controversies Affect Our Ethereum Value Prediction?

- Basis sell-offs create worry that insiders are cashing out, resulting in short-term price volatility.

- Rising competitors reduces Ethereum’s market share, probably impacting its valuation and adoption.

For these assessing Ethereum price prediction 2025 developments, these elements elevate issues about ETH’s capability to keep up its long-term dominance.

Ethereum’s Inflation Drawback: From Deflationary to Inflationary

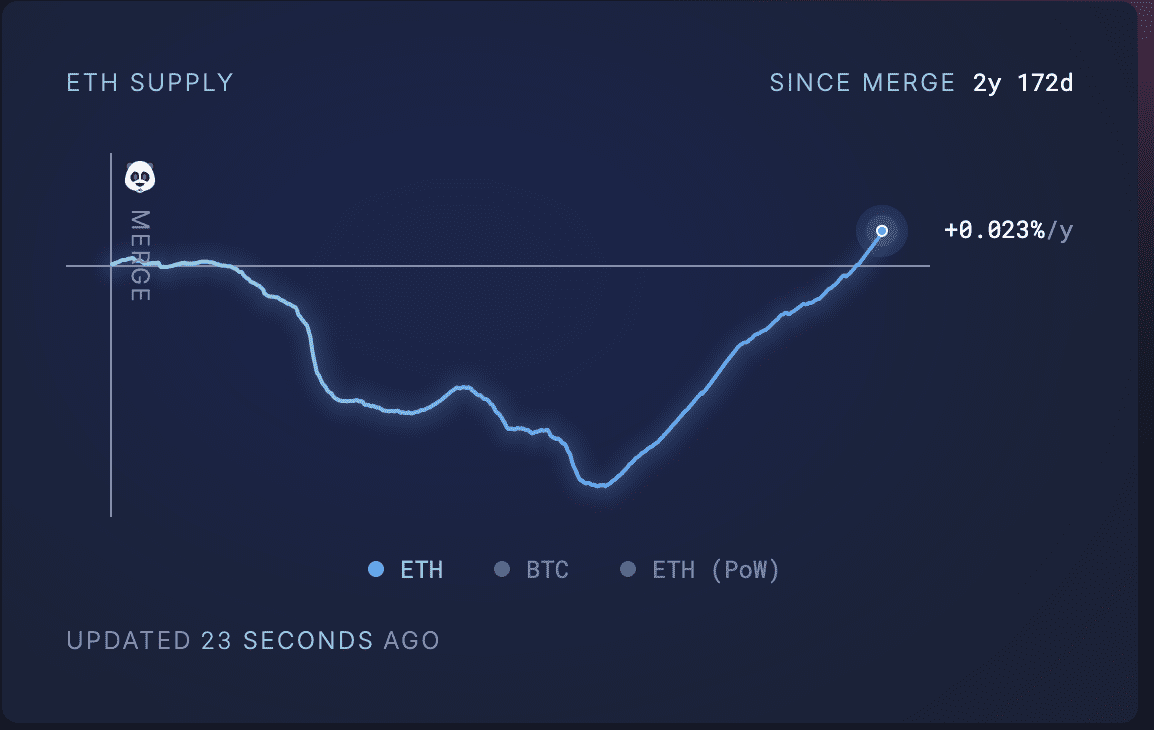

One in every of Ethereum’s greatest narratives post-Merge was its deflationary standing. Nonetheless, that narrative is now fading:

- Ethereum’s Provide Progress Price is Now +0.023% per Yr – As a substitute of being deflationary, ETH is now barely inflationary as a result of decrease gasoline charges and elevated staking rewards.

- Decrease Gasoline Charges = Decrease ETH Burn – With fewer transactions taking place on Ethereum, much less ETH is being burned beneath EIP-1559.

- Staking Rewards Including Extra ETH to Provide – Elevated staking participation means extra ETH is being issued, additional offsetting the burn price.

How Does Ethereum’s Inflation Have an effect on Buyers?

- Greater provide progress places downward stress on ETH’s price if demand doesn’t enhance proportionally.

- Decrease ETH burn price means ETH is not functioning as “ultrasound money,” which might weaken its long-term funding thesis.

- Extra staking rewards might appeal to yield-seeking traders, however it additionally means extra ETH getting into circulation.

Analysts weighing in on Ethereum price prediction 2025 developments recommend that inflationary pressures might cap ETH’s potential upside except demand will increase considerably.

On-Chain Knowledge: What Are the Whales Doing?

Analyzing Ethereum’s on-chain information offers useful insights:

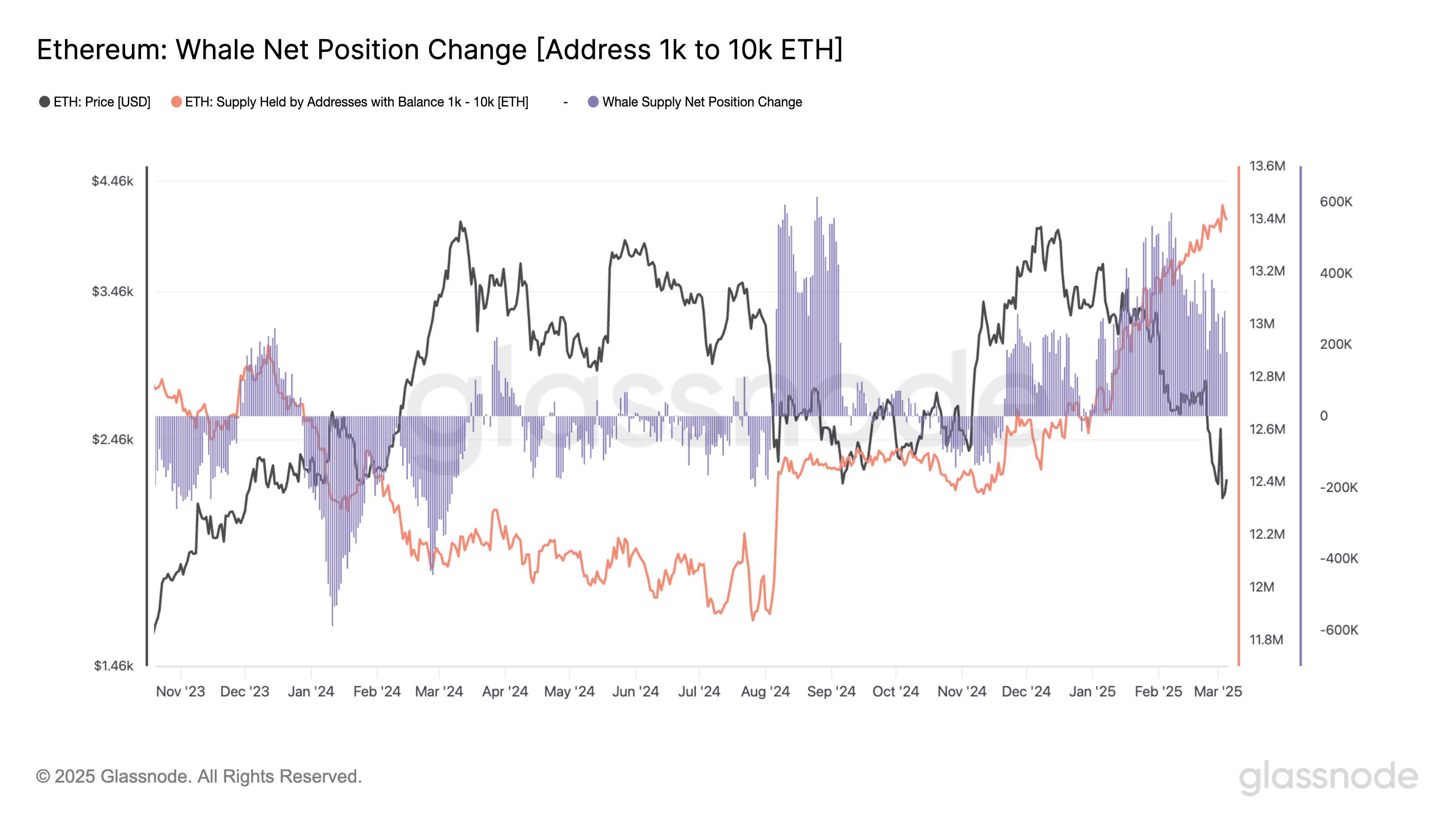

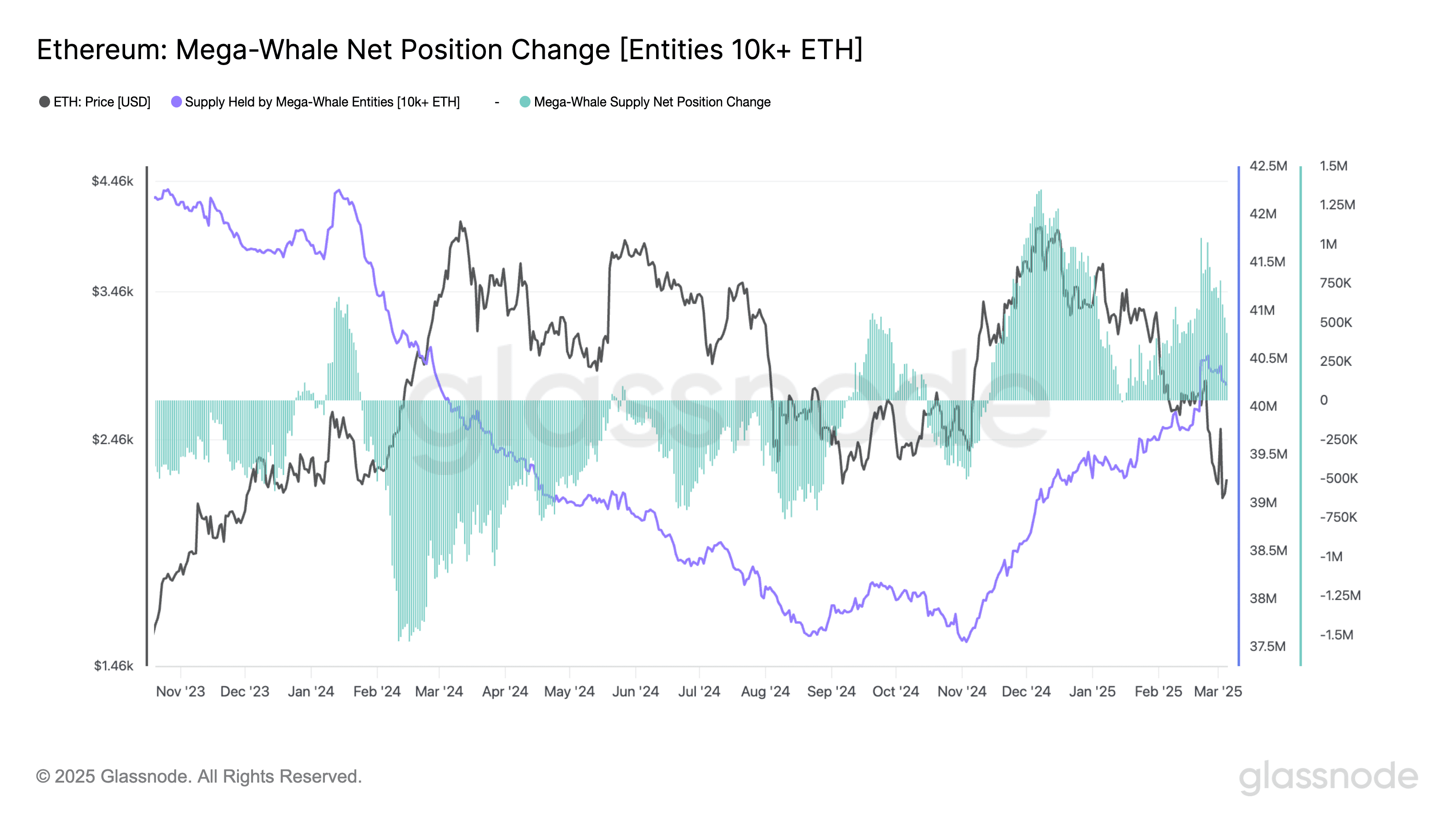

- Whale Accumulation – Addresses holding 1k-10k ETH have been steadily rising their holdings, displaying confidence in Ethereum’s long-term potential.

- Mega-Whales (10k+ ETH) Are Nonetheless Accumulating – Regardless of price declines, the most important ETH holders proceed so as to add to their positions.

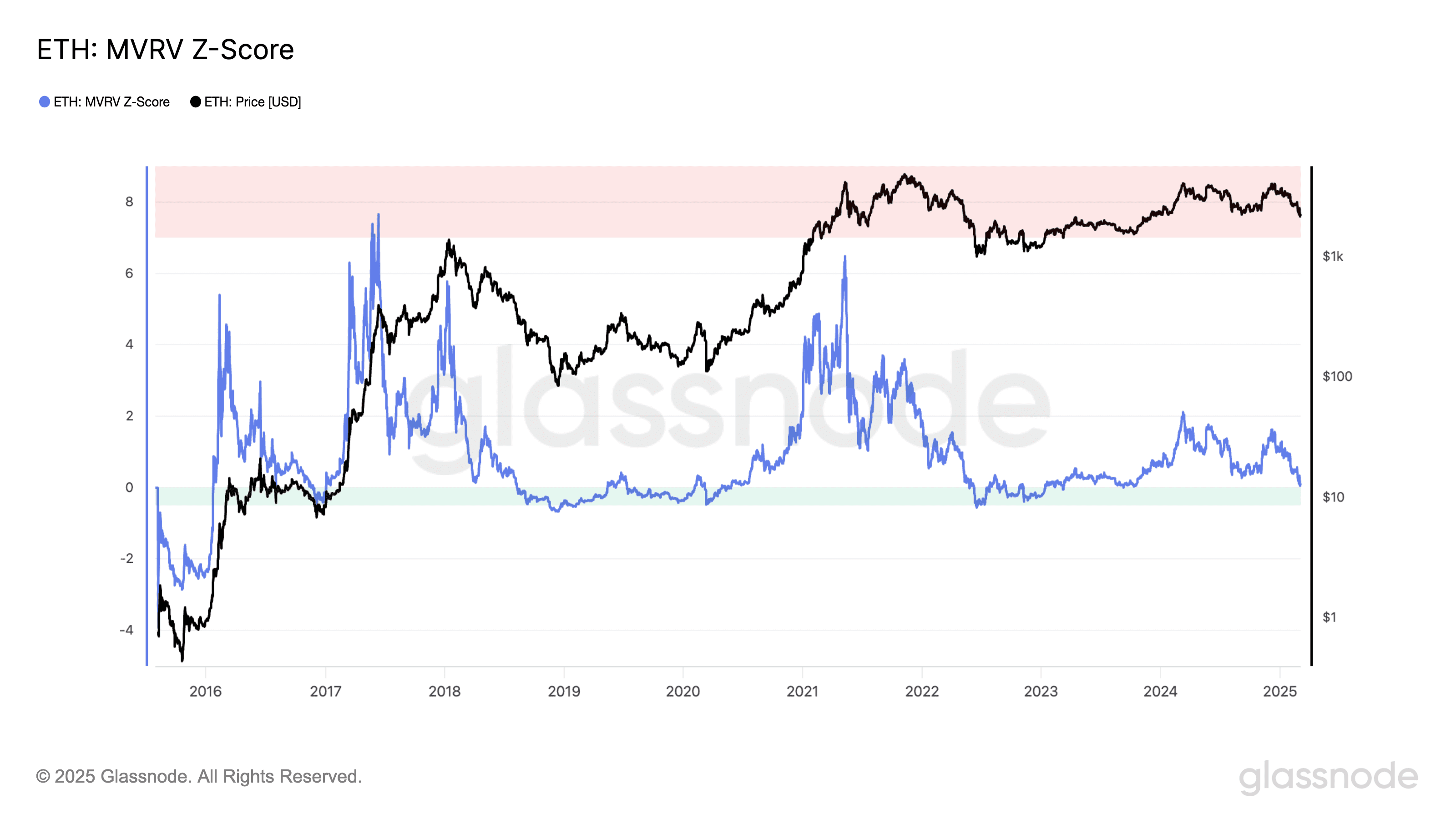

- MVRV Z-Rating Close to Accumulation Zone – This metric suggests ETH is approaching undervaluation territory, traditionally a robust purchase sign.

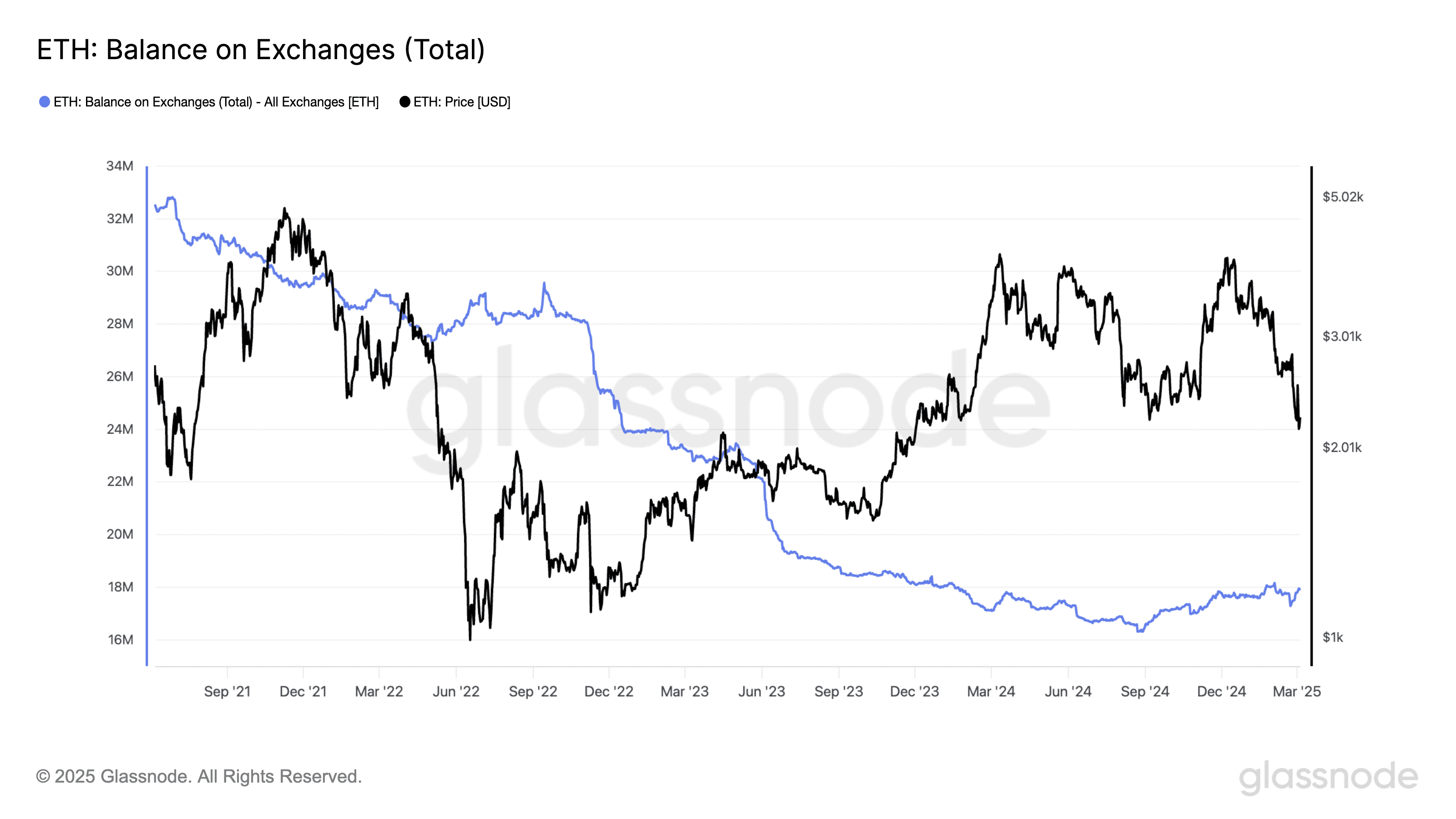

- U.S. Alternate Reserves Lowering – ETH held on U.S. exchanges has been rising, suggesting that traders are depositing ETH into chilly storage, rising sell-side stress.

- Trump’s Crypto Strikes – President Donald Trump’s monetary arm, World Liberty Monetary (WLFI), has been accumulating ETH, including over $47 million value of ETH on inauguration day. This institutional shopping for might present long-term price assist.

- The Upcoming US Crypto Strategic Reserve – Trump has introduced the creation of a nationwide strategic reserve, which would come with Ethereum alongside Bitcoin, Solana, Cardano, and XRP.

Ethereum price prediction 2025 fashions might shift to a extra bullish stance if whale accumulation continues within the coming months.

Ethereum Derivatives: Indicators of Deleveraging

Ethereum’s futures market:

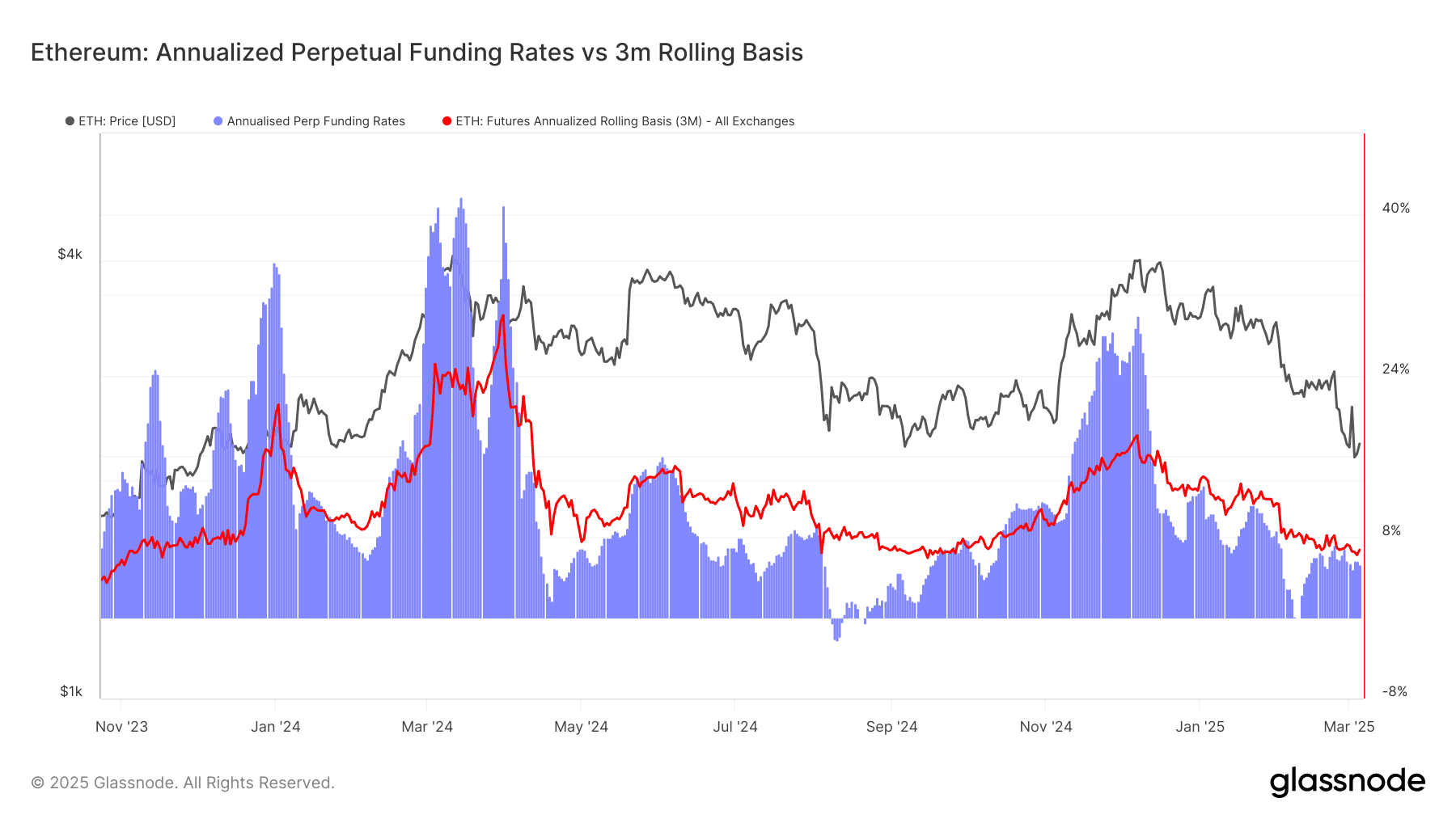

- Perpetual Funding Charges Have Cooled – Leverage demand has dropped, suggesting merchants have been de-risking. Decrease funding charges imply merchants are much less desperate to tackle leveraged lengthy positions, resulting in a extra balanced market with decreased volatility.

- 3M Futures Foundation is Nonetheless Elevated – Institutional merchants see mid-term worth in ETH, as evidenced by the secure premium in 3-month futures contracts. This means that giant traders are nonetheless positioning for long-term features, despite the fact that speculative curiosity in perpetual futures has declined.

- If Funding Charges Rebound, It May Point out a Value Reversal – Traditionally, a pointy enhance in perpetual funding charges after a cooling interval indicators renewed bullish momentum. Many Ethereum price prediction fashions incorporate derivatives information to anticipate market turnarounds, as rising funding charges point out merchants are prepared to pay a premium to carry lengthy positions.

Many Ethereum price prediction 2025 fashions have a look at derivatives information to anticipate market turnarounds.

Ethereum Value Prediction in 2025: Watching A Hazard Zone?

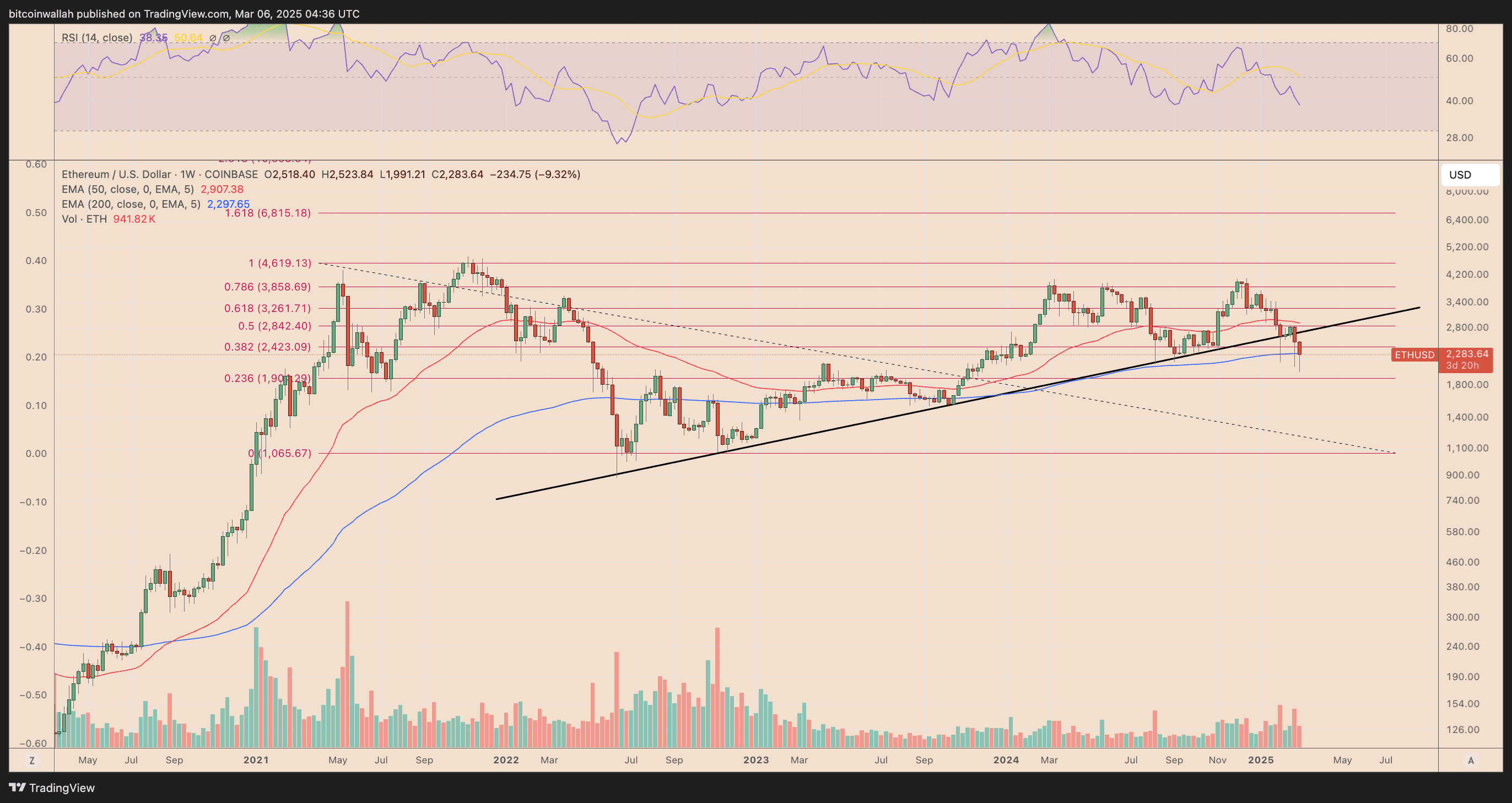

ETH’s chart is flashing warning indicators:

- Broke Beneath Lengthy-Time period Uptrend – ETH has misplaced a key trendline assist that had held since 2022, signaling a possible shift from bullish to bearish construction.

- Testing 200-Week EMA (~$2,297) – The 200-week exponential shifting common has traditionally acted as a significant assist stage for ETH. If ETH fails to carry this stage, it might result in a pointy decline towards the following assist zone.

- Fibonacci Assist at $1,900 – The subsequent main Fibonacci retracement stage sits at $1,900, a important space the place bulls will possible try to defend the price. If this stage fails, ETH might spiral towards deeper assist zones close to $1,500-$1,600.

- RSI Close to Oversold Ranges (~38.5) – The Relative Energy Index (RSI) suggests ETH is nearing oversold situations. Whereas this might trace at a possible reduction bounce, a failure to reclaim key resistance ranges might hold promoting stress intact.

- Bearish Quantity Spike – Current buying and selling volumes point out a rise in sell-side stress, reinforcing the bearish pattern. Nonetheless, a shift in quantity towards shopping for might point out a possible reversal.

What Merchants Ought to Watch For in This ETH Value Prediction 2025

- Reclaiming the $2,423 stage – ETH must bounce above this stage to sign a restoration.

- Failing to Maintain $2,297 – A drop under the 200-week EMA might set off a extra prolonged bearish transfer.

- Value Motion at $1,900 – If this Fibonacci stage holds, ETH might stage a robust rebound. If it breaks, anticipate additional draw back.

- RSI Restoration Above 50 – A push above 50 on the RSI would point out renewed bullish momentum.

Ethereum price prediction 2025 fashions typically depend on key assist and resistance ranges—dropping $2,297 might speed up draw back dangers.

Closing Verdict: Purchase, Promote, or Wait?

Bear Case:

- ETH’s declining market dominance is worrisome, particularly with Solana gaining floor.

- Inflationary provide progress contradicts its “ultrasound money” thesis.

- The technical breakdown under trendline assist is a significant crimson flag.

Bull Case:

- Whale accumulation reveals good cash continues to be shopping for.

- ETH is nearing historic accumulation zones, per MVRV Z-Rating.

- U.S. reserves are lowering, and Trump’s WLFI is shopping for ETH, including long-term demand.

Whether or not ETH is a purchase or a promote is dependent upon its capability to reclaim misplaced floor. If whales proceed accumulating and market situations enhance, Ethereum price prediction 2025 fashions might quickly flip bullish. Watch these assist ranges intently!