Key Takeaways

- Spot ETH ETFs launch July 23 with diversified payment constructions and waivers.

- ETH price could also be delicate to preliminary influx knowledge from new ETFs.

Share this text

Spot Ethereum exchange-traded funds (ETFs) are set to launch on July twenty third, and the preliminary inflows to those merchandise would possibly have an effect on the crypto price, in keeping with a report by Kaiko. Following SEC approval of trade rule adjustments for these funds, ETF issuers have finalized particulars with the SEC, together with payment constructions revealed in current S-1 filings.

“The launch of the futures-based ETH ETFs in the US late last year was met with underwhelming demand, all eyes are on the spot ETFs’ launch with high hopes on quick asset accumulation,” said Will Cai, head of indices at Kaiko. “Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days.”

Grayscale plans to transform its ETHE belief right into a spot ETF and launch a mini belief seeded with $1 billion from the previous fund. ETHE’s payment stays at 2.5%, larger than opponents.

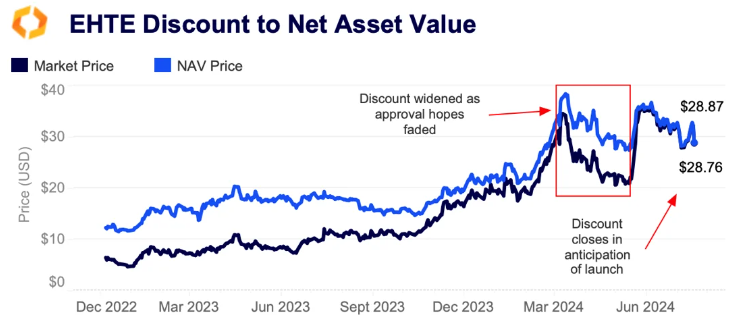

ETHE’s low cost to web asset worth (NAV) has narrowed lately, suggesting merchants could redeem shares at NAV price upon conversion for income.

Most issuers are providing payment waivers, starting from no charges for six months to a 12 months or till belongings attain between $500 million to $2.5 billion. This aggressive panorama led Ark Make investments to withdraw from the ETH ETF race.

ETH price briefly spiked in Might following the 19b-4 Kinds approval however has since trended decrease. ETH implied volatility elevated over the weekend, with the July twenty sixth contract rising from 59% to 67%, indicating uncertainty across the ETH launch.

Share this text

![]()