Torsten Asmus

Introduction

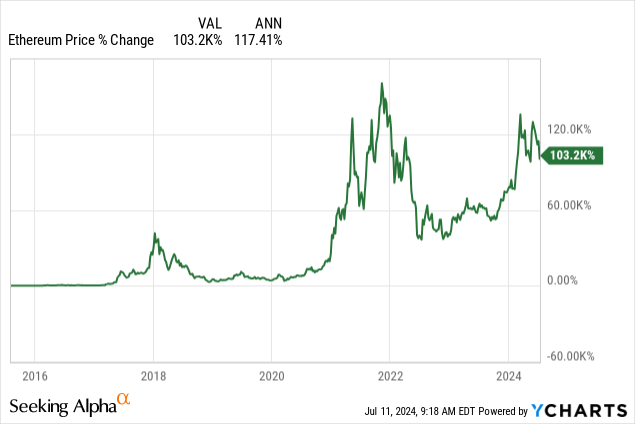

Since its inception in 2015, Ethereum (ETH-USD) has emerged as probably the most highly effective contender to Bitcoin, securing the place of second-largest cryptocurrency on the planet.

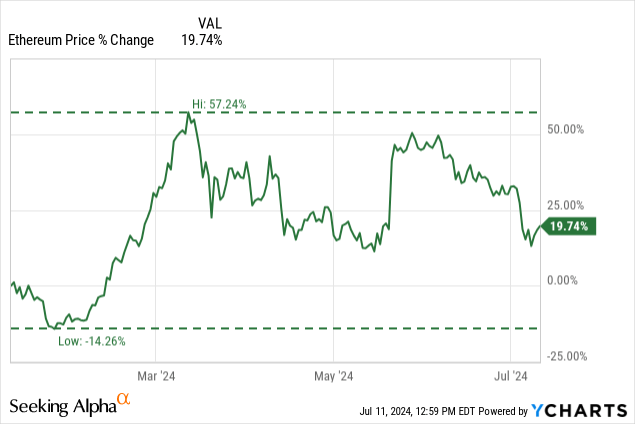

Just lately, Ethereum has been upgraded and is displaying enhancements, but the price has lately fallen from 6-month highs.

Ethereum’s all-time chart nonetheless seems to be monstrous, for reference. We aren’t solely under these 6-month highs by a good bit, however we’re additionally nonetheless far under the 2022 highs.

We’ve got an extended option to go too if ETH is to return to these dizzying highs again in 2022.

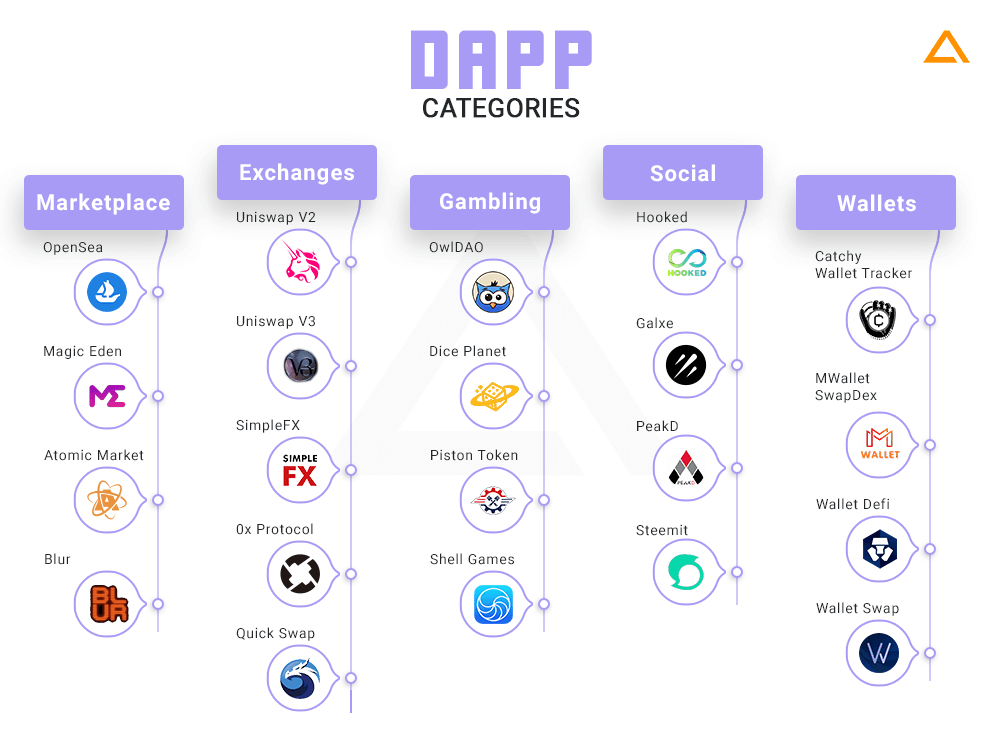

ETH is not only a cryptocurrency; it’s a decentralized platform that helps builders construct and deploy good contracts and decentralized purposes (“dApps”). This makes Ethereum totally different than what most individuals consider as a forex, and expands its use case past easy fee transactions.

There’s a “dApp” for all the pieces, and the biggest names are all monetary providers and marketplaces. I say “largest names,” however that is relative to cryptocurrency. There aren’t any decentralized banks with a status the dimensions of Financial institution of America (BAC). Very famously, many of the dApps that enable people to personal and commerce NFTs are additionally hosted on the Ethereum community.

Determine 1 (Glowid IT)

The Final Improve Was a Success

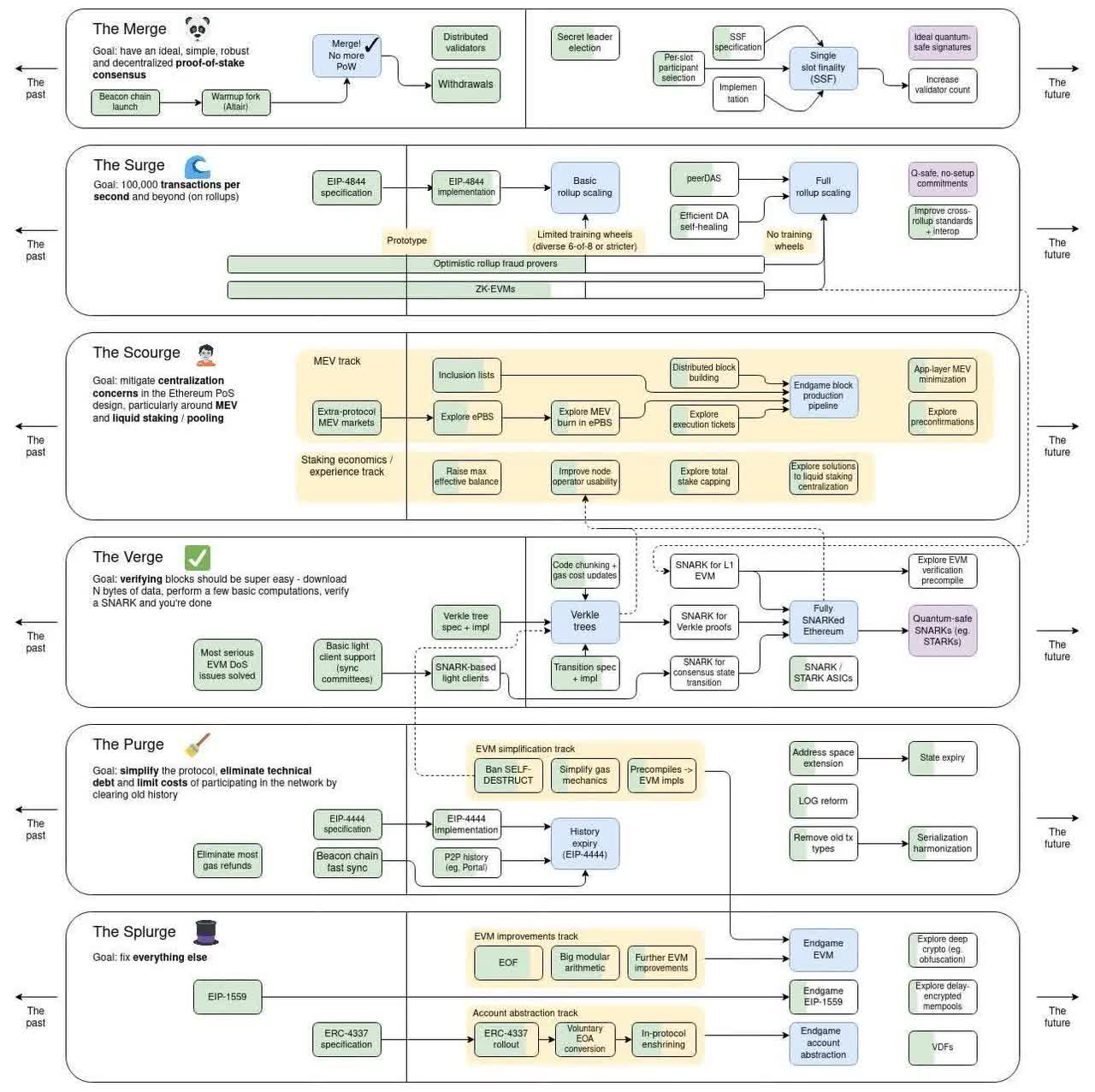

Vitalik Buterin, one of many key builders and the face of Ethereum, revealed this roadmap earlier this 12 months to his X account, displaying the trajectory for Ethereum transferring ahead. Observe that it’s a little technical, so do not dwell on it an excessive amount of if you happen to’re lacking some context. The purpose right here is that lively growth continues to be ongoing and the founder continues to be very actively concerned within the venture.

Determine 2 (Vitalik Buterin)

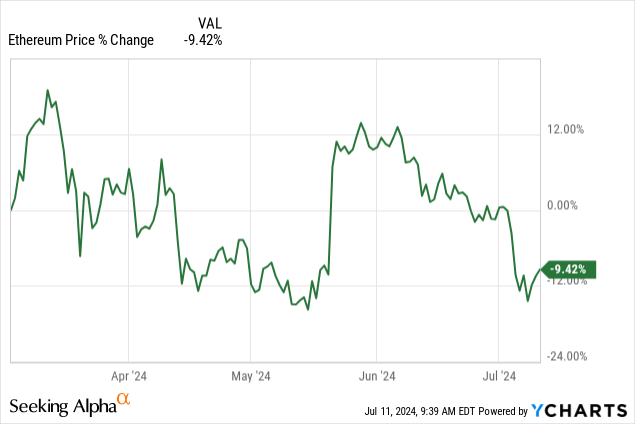

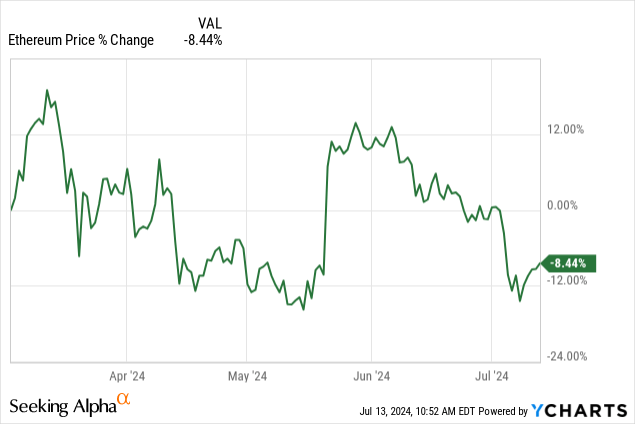

Again in March, we started “The Surge” a part of Vitalik’s plan, with a brand new improve to the community, Cancun-Deneb (“Dencun”). That replace launched this new section, and Ethereum has been pretty flat since, with an nearly 10% decline since then. Though in traditional cryptocurrency trend, ETH has been to +12% and -12% in that very same timeframe.

Gasoline Charges are Down

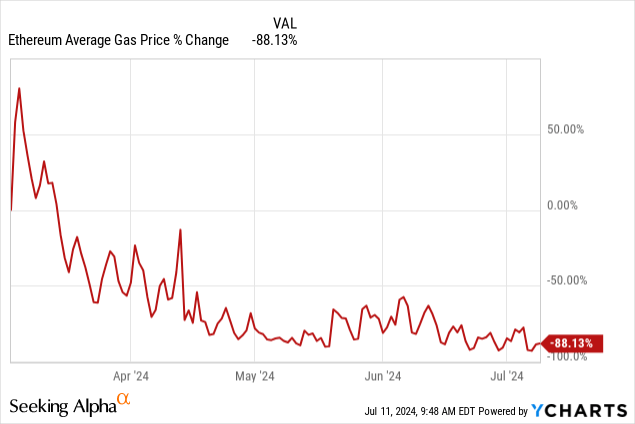

Dencun was supposed to repair one of many core issues with Ethereum, its use bills, colloquially referred to as “gas.” It labored wonders, with ETH’s gasoline charges now down 88% since Dencun’s launch.

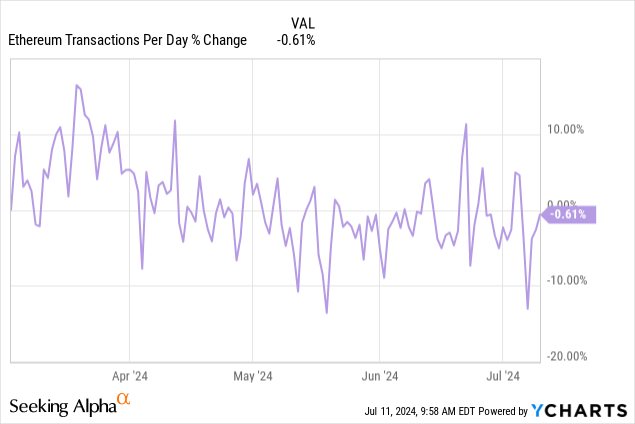

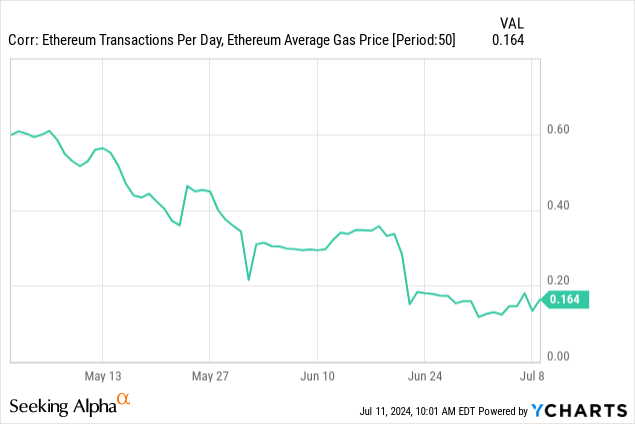

We have seen the gasoline costs fall, even when the typical transaction quantity stays the identical. It is a excellent signal for the community.

Over the previous few months, we have seen a de-coupling of the correlation between these two figures, which is a really bullish signal to me. One of many main points with cryptocurrency adoption is dynamic, excessive utilization charges. Addressing this, and maintaining charges depressed even during times of extraordinarily excessive utilization, shall be an enormous boon for Ethereum that can assist drive broader adoption.

Gasoline could also be leaving all collectively for some transactions, with information about gas-free stablecoin transactions coming to the Ethereum chain later this 12 months to problem centralized techniques like PayPal Holdings, Inc. (PYPL) PayPal USD (PYUSD-USD) and Coinbase World, Inc. (COIN)’s settlement with Circle to have fee-less USDC (USDC-USD) transfers.

This may be an enormous boon for Ethereum, as one of many components that majorly hinders adoption is the related charges with making transfers and funds.

The Market Disagrees With Me on Dencun

Since Dencun, the price has really fallen.

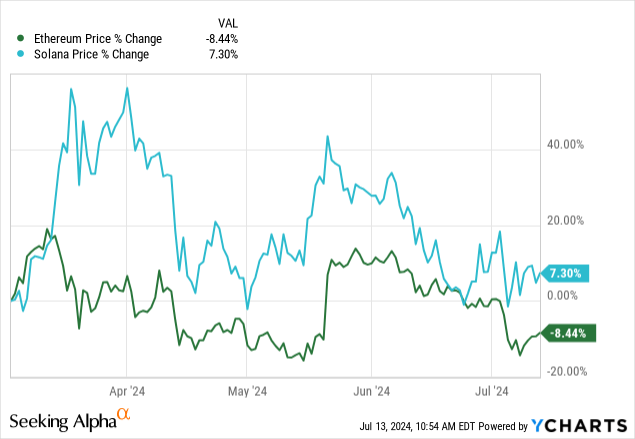

I consider there are a number of causes for this. Probably the most main is that Ethereum’s market share was eroded by the rise of different competing currencies like Solana (SOL-USD), which is being billed by some analysts as an “Ethereum Killer”.

In the identical timeframe, since Dencun’s launch, SOL has remained optimistic and outperformed Ethereum at each step.

SOL, nonetheless, is getting into overvalued territory in comparison with Ethereum, because it has additionally outperformed Bitcoin and the broader market on this timeframe. Its outperformance is a part of a broader correction in SOL for the reason that FTX collapse, the place SOL was significantly impacted as the autumn of FTX took down one in all its largest dApps.

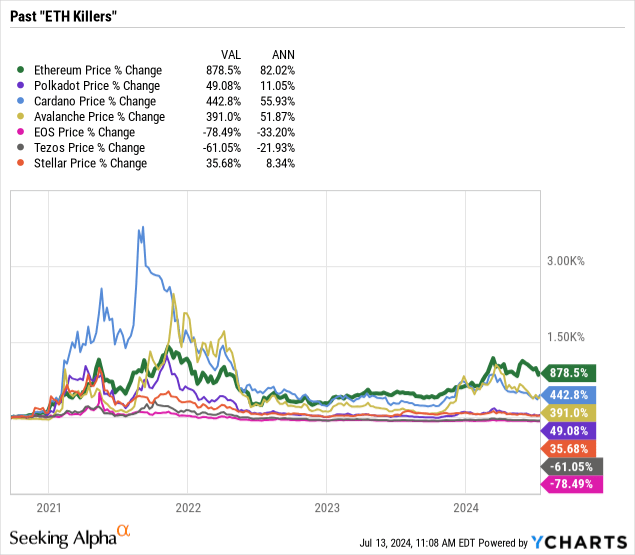

Be cautious of currencies marked as “Ethereum killers” like SOL. Within the final ten years of following the crypto business, I’ve realized to not belief any cryptocurrency on condition that title. It is a curse.

DeFi Continues to Develop and Dominate

DeFi is the platform fulfilling one in all cryptocurrency’s best guarantees: banking the unbanked. DeFi is designed to offer monetary providers over the blockchain. This enables nameless utilization of those providers, in addition to a option to curtail governmental or centralized energy over finance.

How properly that truly works is a narrative for an additional article. For now, all that is necessary is that we see how giant a few of these establishments are and how briskly they’re rising. There are at present six DeFi protocols with over $30B in property constructed on the Ethereum community, with the biggest, Synthetix, having over $370B in property. Of these, $205M are locked in contracts and should not liquid.

Protocols like Balancer (BAL-USD), which is used to facilitate market making in forex pairs (i.e. forex exchanged referred to as “liquidity pools”), churned by a quantity of $80B within the final 30 days.

To be clear, Synthetix has a bigger quantity of deposits than Goldman Sachs Financial institution (GS), which sits at $363B as of the tip of March.

Observe: this comparability is somewhat unfair as Synthetix’s AUM is calculated utilizing all property, together with speculative property, whereas Goldman’s AUM is simply money deposits and doesn’t embrace the investments they handle.

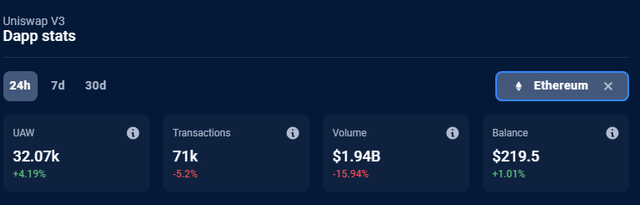

The most important decentralized change by variety of lively customers, Uniswap V3, transacts about $2B Ethereum day-after-day throughout tens of hundreds of customers.

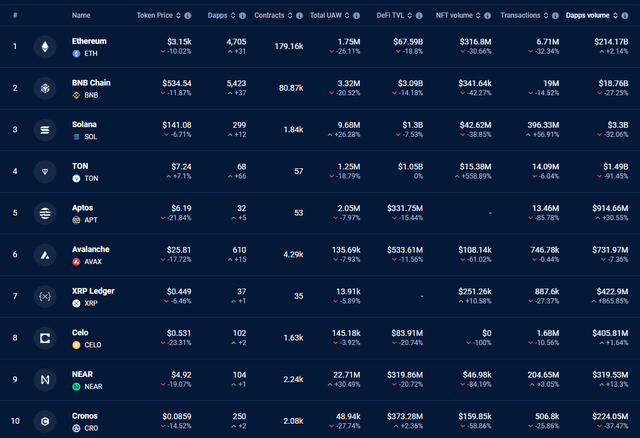

Determine 2 (DappRadar)

It is a main promoting level for Ethereum, because it reveals simply how necessary DeFi is to its ecosystem and the way a lot cash really flows by it. Its 30 day dApp quantity exceeded ten occasions that of the next-closest “layer one” (“L1”) cryptocurrencies.

We will additionally see how far and away ETH is in relation to NFT quantity and variety of contracts (i.e. number of providers) when in comparison with different main cryptocurrencies like BNB (BNB-USD) and Solana (SOL-USD).

Determine 3 (DappRadar)

What’s Subsequent?

“The Merge” occurred in 2022, which was when Ethereum modified their protocol from proof-of-work (the best way Bitcoin validates blocks) to proof-of-stake, which was alleged to decrease the vitality enter required to run the Ethereum Digital Machine and make the whole system cheaper, whereas rewarding those that held very giant quantities of Ethereum moderately than those that managed probably the most computing energy. This was alleged to be a really optimistic catalyst for Ethereum, and whereas I consider this transfer was good for the entire community, this has shifted the ETH/BTC ratio down, and because the down shaded areas present, BTC has outperformed since.

Determine 4 (Glassnode)

However as we have seen previously, following BTC outperformance is usually intervals of Ethereum outperformance (and they’re usually longer). This might come from a number of different catalysts that I consider buyers ought to be careful for and will very positively influence Ethereum’s price and assist it catch again up once more, again to the pre-merge ratio with BTC.

- Spot ETFs for Ethereum are within the works, with Constancy already having launched a fund in Canadian markets, the Constancy Benefit Ether ETF (FETH:CA) and submitting to launch one within the US again in Could

- This was a really optimistic catalyst for Bitcoin, which outperformed Ethereum since its spot ETFs launched

- Many speculators may even see these spot Ether ETFs as a proxy for investing in Web3 with out idiosyncratic firm danger

- Ethereum was lately given tacit authorities approval when the SEC closed its investigation with out submitting any prices final month

- This has established the present authorized standing of Ethereum. Its standing as a safety continues to be contested, which is a optimistic catalyst for the inventory transferring ahead because it signifies that the SEC would possibly keep extra hands-off

- It’s to notice that the SEC makes use of the controversial Howey Take a look at for figuring out what’s and isn’t a safety, and so they haven’t dominated definitively on Ethereum

- New upgrades nonetheless being added and utilized by dApps such because the recently-added restaking, which permits smaller blockchains to make the most of the Ethereum Digital Machine and leverage its energy (whereas having to purchase Ether to make use of as gasoline for this operation to work)

- It is a optimistic catalyst transferring ahead as that is nonetheless very new and under-utilized by the broader cryptocurrency market at present and will trigger loads of shopping for of Ether as soon as providers that streamline the method for smaller chains are capable of scale, akin to EigenLayer

- Market sentiment has lately trended towards non-Layer 2 options like Solana (SOL-USD), however these currencies at the moment are getting into overvalued territory. Regardless of their outperformance, they weren’t capable of seize equal market share of good contracts utilization regardless of their price rises

Suitability

I’ve introduced a bull case for Ethereum, banking on the truth that it’s at a relative low in price in comparison with earlier highs, regardless of its efficiency and usefulness having a lot improved since these highs. Nevertheless, this doesn’t essentially imply that buyers ought to be leaping into ETH head first.

All cryptocurrencies are extremely risky, or not less than have the potential to be, and black swans that might trigger systemic shocks and shatters within the cryptocurrency neighborhood may go completely unnoticed in the remainder of the investing world. It is necessary for buyers to do not forget that their allocations to cryptocurrencies ought to be very small and purely speculative.

I consider that merchants and speculators ought to restrict their complete publicity to cryptocurrencies to five% and beneath. Threat-seeking buyers ought to think about a 1-2% allocation. Conservative and risk-adverse buyers mustn’t put money into any cryptocurrencies.

Conclusion

Ethereum is ready to, regardless of its 35% YTD efficiency, doubtlessly run again towards its earlier highs as long as the present market euphoria continues. Its personal fundamentals have improved, and its usability is healthier in comparison with 2022 and its older variations. Now that the system has improved and more cash is flowing by it, I consider that Ethereum nonetheless has room to go.

That being stated, watch out for volatility and speculate properly. I might not suggest locking up your cryptocurrency with third-party exchanges exterior of publicly traded Coinbase (COIN). I additionally wouldn’t suggest interacting with any of the protocols I discussed on this article until you may have a strong understanding of cryptocurrencies past investments.

I’m contemplating an allocation to Ethereum, probably by an change or my very own custodianship, whereas I anticipate Constancy (my main dealer) to launch its spot Ethereum ETF.

Thanks for studying.