Ethereum’s DEX ecosystem is prospering with a 73% surge in dealer exercise, Aave’s TVL doubling to $12 billion, and rising consumer engagement, marking a robust DeFi comeback as of Could 2025.

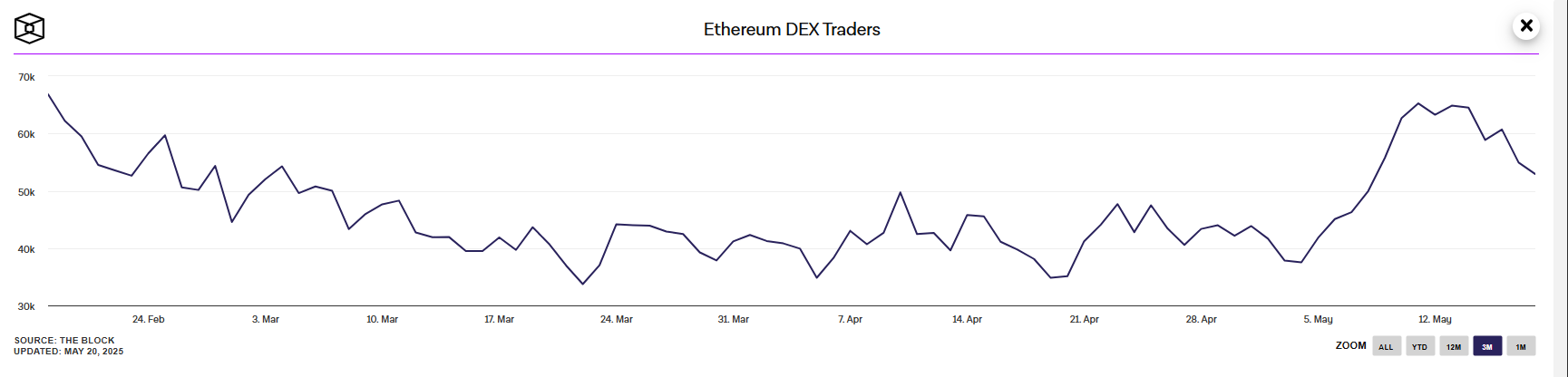

Ethereum DEX Exercise Reaches 3-Month Excessive with 64,000 Customers

On Could 20, 2025, Ethereum’s DEX dealer exercise has surged by 73% this month, with every day lively customers reaching 64,000, a three-month excessive from a Could 4 low of 37,000.

Supply: The Block

Regardless of this, month-to-month DEX buying and selling quantity stays flat at $15 billion, with Uniswap UNI capturing 97% of merchants ($13 billion of the amount), highlighting its dominance and the prevalence of smaller retail trades driving the uptick.

Traditionally, such retail-driven exercise has preceded broader market participation, hinting at potential development within the coming weeks.

Moreover, Aave’s TVL reached $40 billion as of Could 2025, up from $20 billion in late 2024, pushed by renewed curiosity in yield farming and lending.

Study extra: Aave TVL Doubles Put up-Downturn, Signaling Ethereum DeFi’s Comeback?

This development displays rising confidence in Ethereum’s DeFi infrastructure, bolstered by its dominance in real-world asset tokenization and decentralized finance functions.

Past Uniswap and AAVE, different metrics and protocols illustrate Ethereum DeFi’s upward momentum.

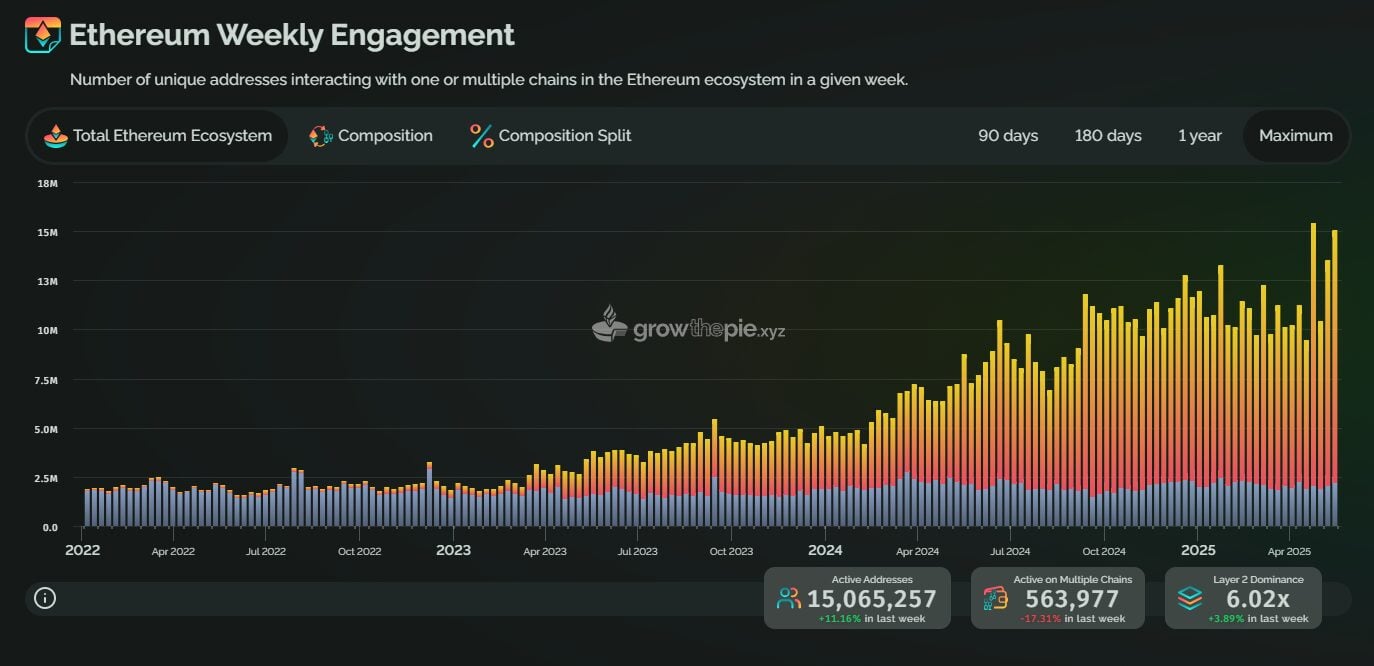

In keeping with Develop The Pie, the variety of distinctive addresses interacting with Ethereum DeFi protocols is reaching an all-time excessive of round 15 million. This surge in consumer exercise signifies rising adoption and engagement.

Supply: Develop The Pie

Moreover, Curve Finance, a significant decentralized change for stablecoins, reported a 30% enhance in its Ethereum-based TVL, climbing to $2.4 billion as of Could 20, 2025, per DefiLlama.

Supply: DefiLlama

Pectra Improve and Market Restoration Gas Ethereum DeFi Development

A number of components are driving Ethereum DeFi’s comeback. The Pectra improve has considerably enhanced Ethereum’s scalability and consumer expertise.

11 Ethereum Enchancment Proposals (EIPs) applied in Pectra assist enhance staking effectivity, pockets usability, and fuel effectivity. A key function is EIP-3074, which simplifies DeFi interactions by enabling account abstraction, decreasing transaction steps, and decreasing prices for customers participating with protocols like Uniswap and Aave. This has made Ethereum ETH DeFi extra accessible, contributing to the 73% surge in dealer exercise.

A broader market restoration additionally performs a task. After a downturn in late 2024, the crypto market has bounced again, with Ethereum’s price rising practically 50% post-Pectra to $2,700.

Moreover, Ethereum’s ecosystem enlargement by way of Layer-2 options like Arbitrum ARB, whose DeFi TVL hit $2.5 billion, has lowered fuel charges and attracted extra customers, as proven in 3 million every day transactions.

Little question @Arbitrum is the highest L2 on the market

– Stablecoin Mcap: $2.6B

– TVL: $2.5B

– 3M txns every day

– Weekly DEX Quantity: $6B+

– Weekly app income: $1M+

– @l2beat STAGE-1$ARB ecosystem is seeing huge development beating all different L2s. pic.twitter.com/gO58FRKdkk— Immortal 💥 (@BitImmortal) Could 18, 2025