Ethereum has traded beneath the $2,681 resistance degree for over a month. Regardless of this, its price has remained steady, exhibiting little volatility.

Massive Buyers Begin Accumulating Ethereum

Since early June, investor curiosity in Ethereum has elevated. Knowledge exhibits that traders purchased greater than 300,000 ETH, price about $778 million. This marks a transparent shift from the constant promoting seen on the finish of Could.

A serious contributor to this development is Consensys, which reportedly bought over $300 million price of ETH from Galaxy Digital, in accordance with information from Arkham. This transfer indicators sturdy confidence in Ethereum’s long-term worth. As extra massive traders like Consensys enter the market, it boosts general belief in ETH.

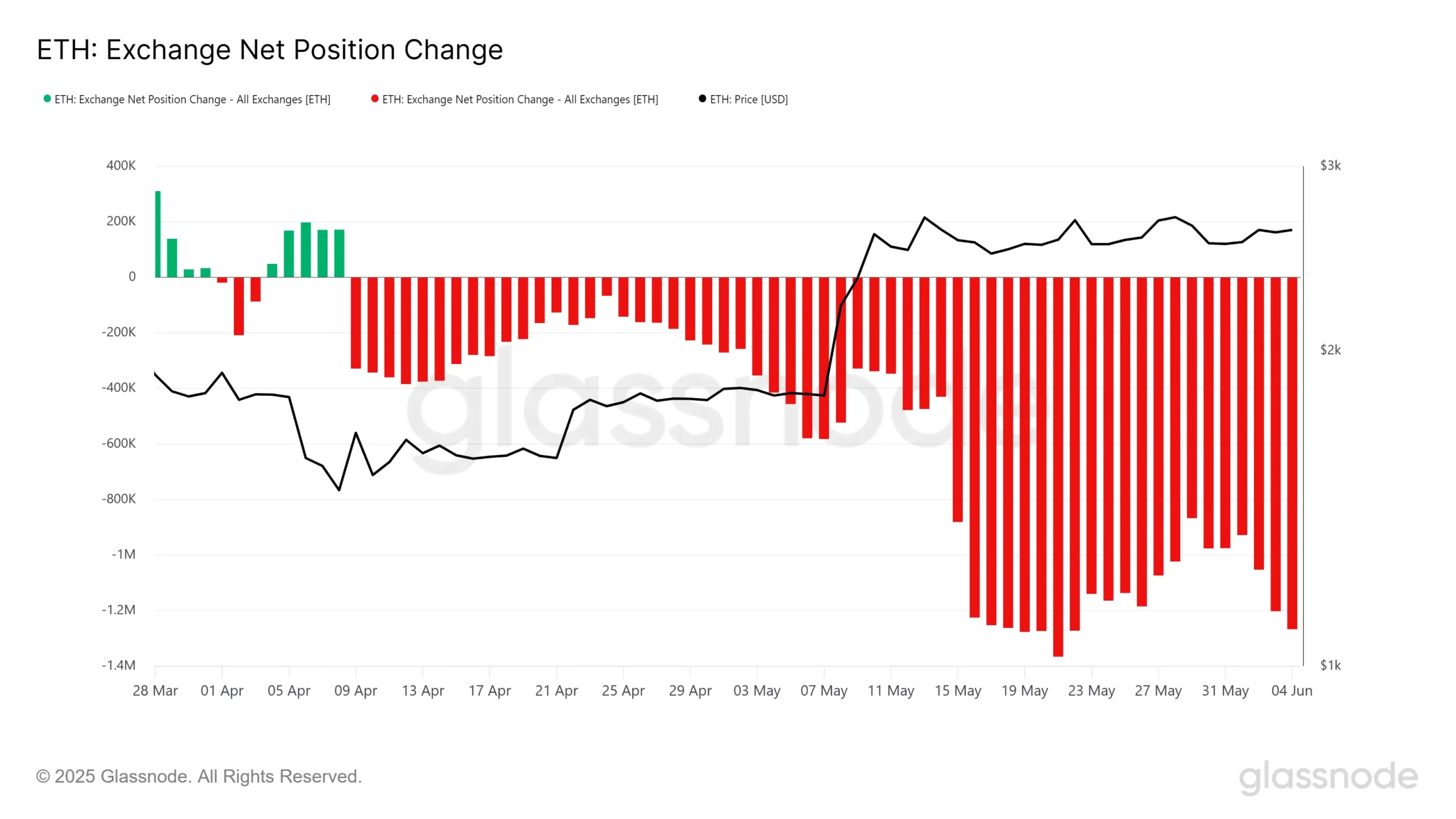

Trade Knowledge Confirms Rising Demand

In line with Glassnode, Ethereum’s Trade Web Place Change has turned constructive in early June after an extended interval of damaging readings. This implies extra ETH is leaving exchanges than coming into. The purple bars in Could present sturdy outflows, signaling sustained accumulation by traders.

The return to constructive values in June means that the promoting stress could have eased. As ETH strikes into non-public wallets, it turns into much less prone to be offered shortly, lowering provide on exchanges. This conduct sometimes displays long-term holding methods and rising investor confidence in Ethereum’s price outlook.

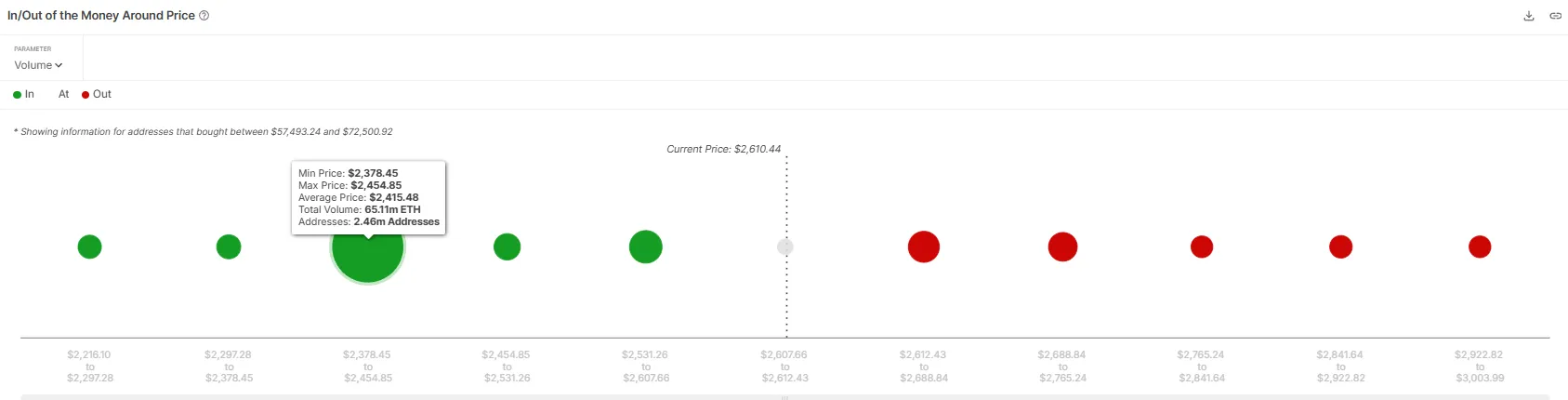

On-chain information from IntoTheBlock exhibits a powerful demand zone between $2,378.45 and $2,454.85. On this price vary, over 65.11 million ETH is held by round 2.46 million addresses. This cluster varieties a heavy assist degree beneath the present price of $2,610.44. The big inexperienced bubble on the chart confirms sturdy investor positioning on this space.

Since a lot ETH was purchased on this zone, many holders are nonetheless in revenue. This reduces the probabilities of panic promoting if the price drops barely. In consequence, this demand zone acts as a buffer towards downward stress, serving to stabilize Ethereum’s price motion.

The IOMAP chart exhibits that only a few holders on this demand zone are prone to promote. Due to this, Ethereum faces restricted draw back stress. So long as accumulation continues and sellers stay inactive, Ethereum’s price could quickly escape of its consolidation vary.

In abstract, Ethereum’s steady price, sturdy assist zone, and elevated accumulation by main gamers sign a shift towards bullish momentum.

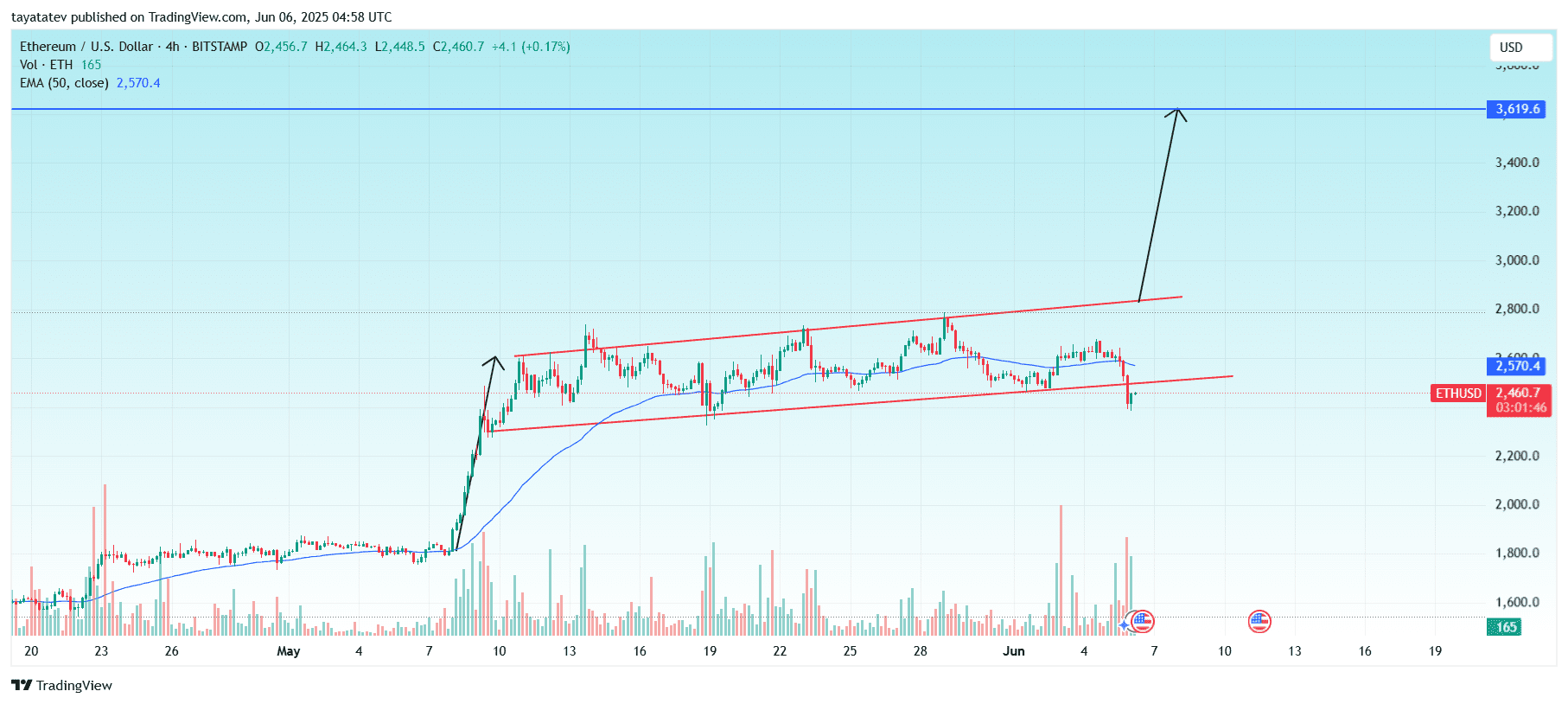

On June 6, 2025, the Ethereum to U.S. Greenback (ETH/USD) pair on the 4-hour chart shaped an ascending channel sample. An ascending channel seems when the price strikes between two upward-sloping parallel trendlines, often signaling a bullish continuation.

If the sample confirms, Ethereum’s price may rally 47 % from the present degree of $2,460 to the projected goal of $3,619. This goal matches the horizontal resistance marked in blue on the chart.

Earlier in the present day, ETH briefly dropped 5 % beneath the decrease channel boundary however shortly recovered 3 %. The sudden dip possible adopted the Trump–Musk battle, after Donald Trump threatened to chop Elon Musk’s authorities subsidies. The assertion spooked markets and triggered sharp draw back strikes in main crypto property, together with Bitcoin.

Nonetheless, Ethereum rebounded quick, exhibiting sturdy shopping for curiosity. It now trades just below the 50-period Exponential Transferring Common (EMA) at $2,570.4. If bulls push the price above this line with larger quantity, it may affirm the breakout setup.

Trading quantity has already picked up through the bounce, pointing to renewed accumulation. If ETH breaks above the higher purple trendline of the channel, the price could intention for $3,619 within the coming periods.

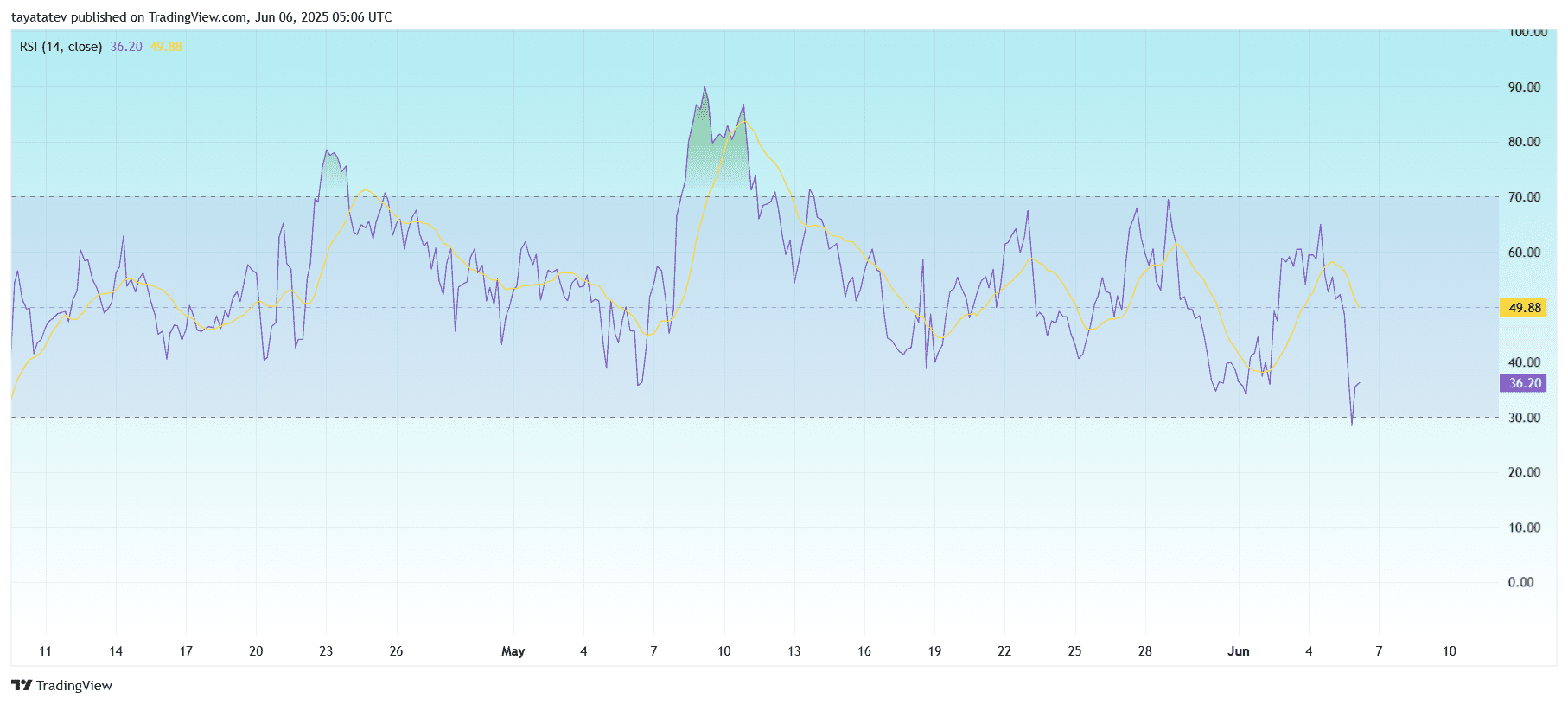

Presently, the RSI worth is 36.20, which locations it within the oversold zone. Any RSI studying beneath 40 usually indicators weakening momentum and promoting stress. It means that Ethereum not too long ago skilled a pointy drop in shopping for energy.

Earlier, the RSI crossed underneath the shifting common line (49.88), confirming the bearish momentum. Nonetheless, the curve exhibits a slight upward bend, hinting that patrons could also be returning after the panic dip—possible tied to exterior occasions such because the Trump–Musk pressure affecting market sentiment.

If the RSI climbs again above 40 and finally crosses the typical line, it might sign a possible shift again to bullish energy. Till then, the RSI exhibits that ETH is in restoration mode from oversold circumstances.