Ethereum (ETH) has lately reclaimed the $1,800 mark after weeks of buying and selling between $1,500 and $1,700. This price surge, coupled with robust on-chain exercise and rising whale curiosity, raises the query: Is that this motion a real bullish sign for ETH, or only a short-term spike? Let’s dive into the small print.

ETH Exhibits Indicators of a Bullish Comeback

After a difficult two-week interval the place ETH lingered between $1,500 and $1,700, the cryptocurrency has notably recovered, hitting $1,800 on April 23. This price motion aligns with a number of optimistic indicators for Ethereum’s ecosystem. Ethereum’s ecosystem’s complete worth locked (TVL) has reached $46.719 billion, reflecting rising confidence in its decentralized purposes (dApps) and general community exercise.

Learn extra: Simply In: Ethereum Precipitously Fell to the Lowest of 2024-2025

Supply: DefilLama

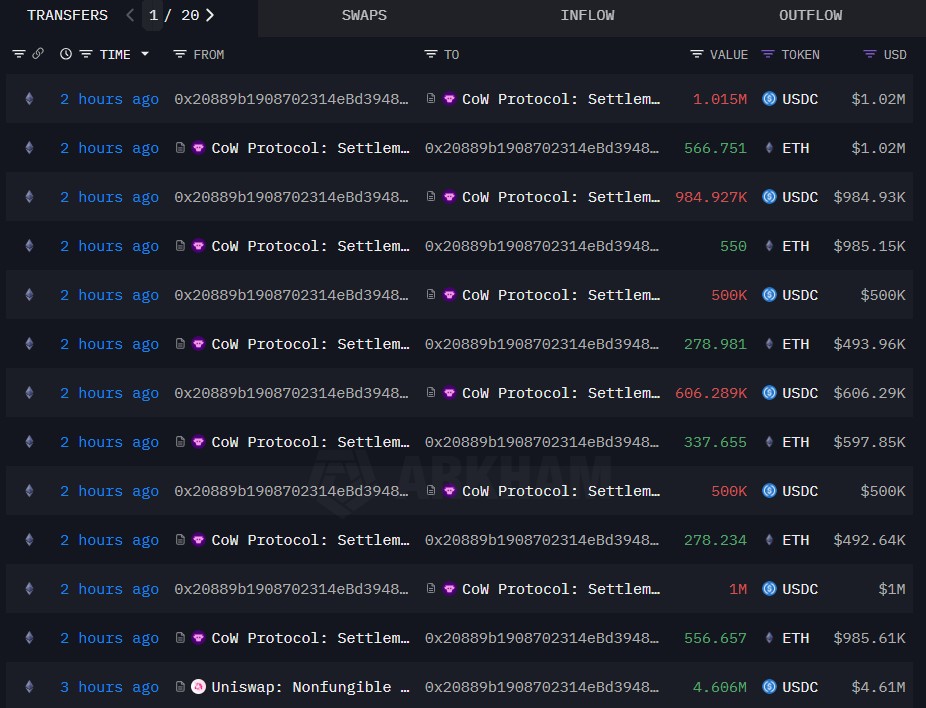

On-chain information additional helps this optimism. In response to Lookonchain, two outstanding whales have proven robust shopping for curiosity in ETH. Whale 0xD20E withdrew 5,531 ETH (valued at $9.8M) from Binance, whereas whale 0x2088 spent 4.61M USDC to buy 2,568 ETH at $1,794 at this time. Moreover, one other whale, who beforehand incurred a $40M loss on ETH, borrowed 34.75M USDT from Aave to purchase 19,973 ETH at $1,740 following the current price rise, signaling a daring transfer to capitalize on the uptrend.

Supply: Arkham Intelligence

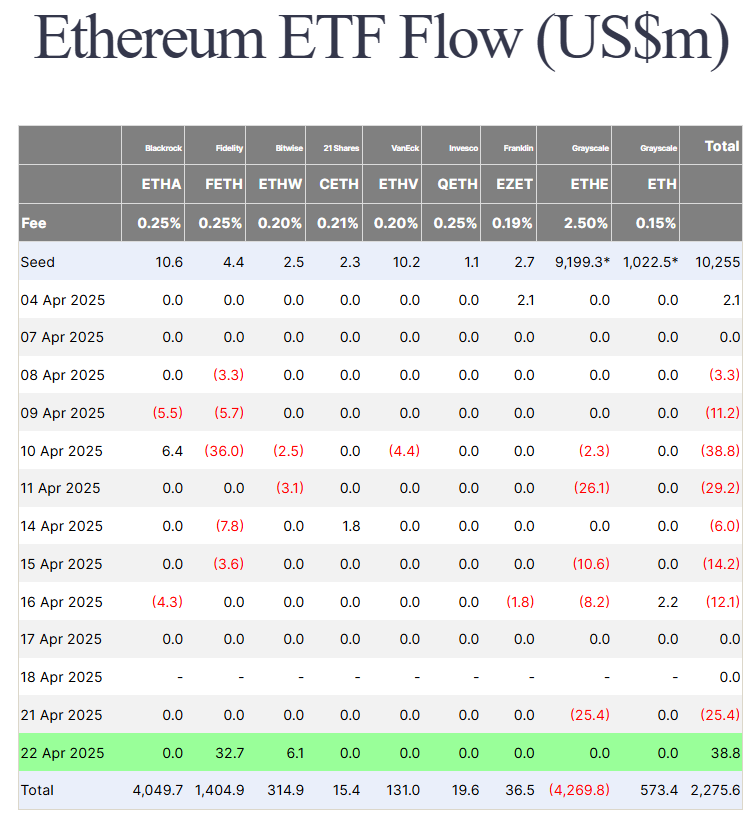

The ETH ETF market additionally paints a promising image. On April 22, ETH ETFs recorded a internet influx of $38.8M, pushed by shopping for exercise from main gamers like Constancy and Bitwise. Notably, this marked the primary optimistic netflow in over three weeks, a shift that would sign a brighter future for ETH.

Supply: Farside Traders

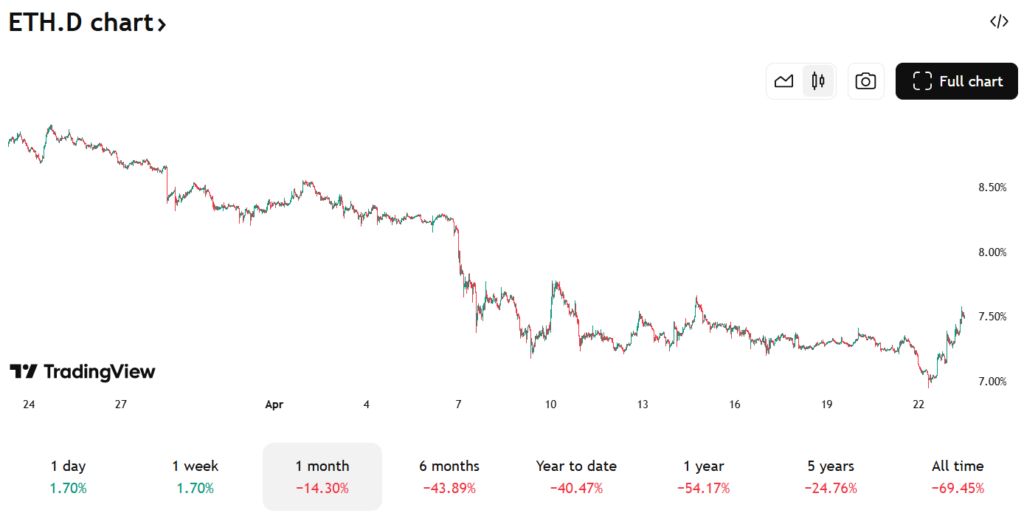

Moreover, Ethereum’s market dominance (ETH.D) surged by almost 8% within the final 24 hours, rebounding from an prolonged interval of low efficiency.

Supply: TradingView

Including to the optimism, Ethereum co-founder Vitalik Buterin lately proposed transitioning from the Ethereum Digital Machine (EVM) to RISC-V structure to boost the community’s efficiency. This potential improve has sparked hypothesis that it might drive ETH’s price greater by addressing scalability and effectivity considerations, additional fueling bullish sentiment amongst long-term buyers.

Is This a Bullish Breakout or Simply Hype?

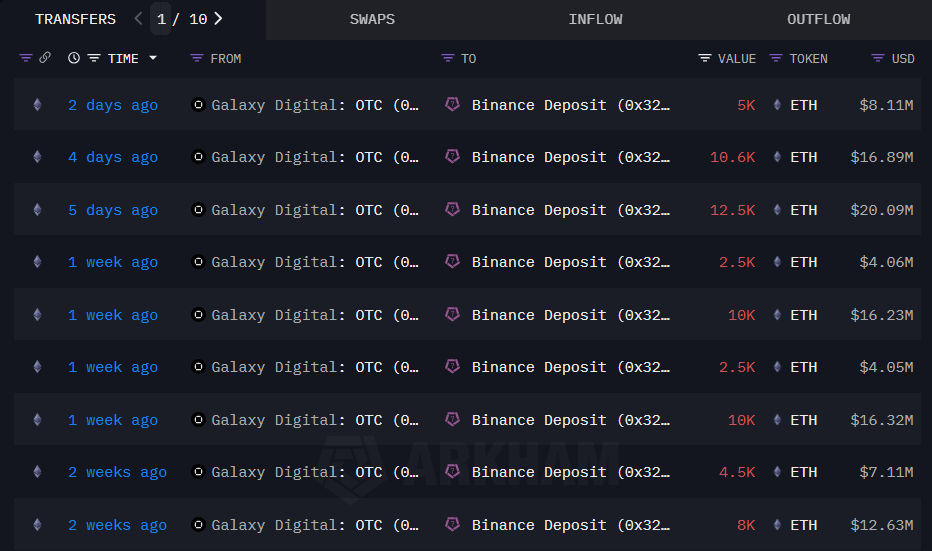

Regardless of these encouraging indicators, the highway to a sustained bullish development for ETH is way from sure. A big counterpoint comes from Galaxy Digital’s current transfer to swap $105M value of ETH for Solana (SOL). In response to Lookonchain, Galaxy Digital transferred 65,600 ETH (roughly $105M) to Binance over the previous two weeks whereas withdrawing 752,240 SOL (valued at $98.37M) from the alternate.

Supply: Arkham Intelligence

This ETH-to-SOL swap suggests a doable insecurity in Ethereum’s short-term prospects. The transfer aligns with broader bearish sentiment round ETH, which has confronted a 20% month-to-month decline and ongoing institutional outflows, as famous in current stories. Galaxy Digital’s shift to Solana, a competitor of Ethereum, might point out that some institutional gamers are hedging their bets in opposition to ETH’s present challenges.

ETH’s rise to $1,800 is a optimistic sign, however buyers want to attend for BTC.D to drop, indicating capital shifting from Bitcoin to altcoins. In the meantime, BTC’s price has to stay steady or increase; if it declines, it might drag ETH and altcoins down, given Bitcoin’s important market affect. This interaction highlights the necessity for Bitcoin’s stability to unlock a broader altcoin rally, together with ETH’s potential progress.

Furthermore, the current price surge seems to be a 24-hour phenomenon pushed largely by whale exercise fairly than a transparent indicator of long-term, sustainable progress. Whereas whale accumulation and ETF inflows are optimistic, they don’t but present concrete proof of a long-lasting uptrend. The crypto market stays extremely risky, and ETH’s year-to-date efficiency, down 46%, underscores the dangers concerned.

Traders should train warning when making selections, not solely with ETH however throughout the broader cryptocurrency market. The competitors from Solana, coupled with Ethereum’s declining burn charge and institutional sell-offs, provides layers of uncertainty to ETH’s speedy future.