For some time, Nvidia (NASDAQ: NVDA) seemed like one of many hottest issues on Wall Avenue. Currently, it has misplaced a few of its shine. The Nvidia inventory price has fallen 28% since January.

Nonetheless, over 5 years, the chipmaker’s inventory has soared 1,370%. Sure, 1,370%.

That’s the kind of efficiency that might thrill me as an investor!

So given the latest fall in Nvidia inventory, might now be the time so as to add some to my portfolio? Or is the autumn an indication of a change in fortunes that must put me off shopping for now?

A potential long-term discount

Let’s begin by wanting on the discount aspect of the argument. Presently, Nvidia is buying and selling on 36 occasions earnings. I don’t see that as low-cost, though it’s markedly decrease than it has been at some factors just lately.

Created utilizing TradingView

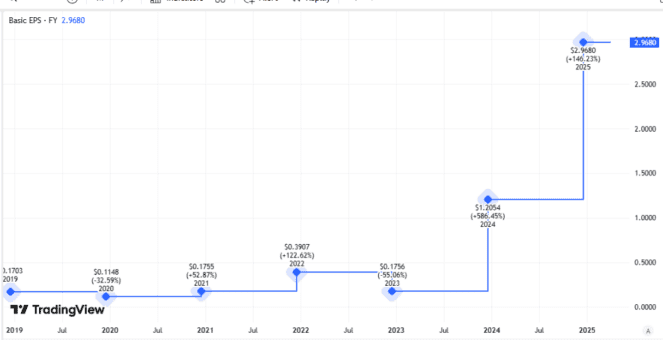

In recent times, earnings per share have grown sharply.

Created utilizing TradingView

That largely displays the most important funding firms have been making as they scale up their synthetic intelligence (AI) supply. It might be that there’s a lot extra the place that got here from, as actually what we’ve seen to this point is actually simply the primary wave of massive funds expenditure on AI.

If that’s the case, it might be good news for Nvidia’s earnings, making the present share price look a possible discount from a long-term perspective.

In any case, with proprietary expertise, a big consumer base and robust model, Nvidia is a transparent chief on this house and I reckon it might keep that manner.

Potential worth lure?

Why then, the autumn of near 30% in a matter of months? For one factor, commerce battle is a major danger to a multinational firm whose purchasers straddle each the US and China. It might damage revenues and earnings critically.

Even past that although, Nvidia’s AI windfall has additionally uncovered different potential future dangers. What if AI is developed that requires much less computing energy than presently? That has been an enormous concern for the reason that launch of the Deepseek AI mannequin.

What if the preliminary ramp-up spending on AI chips shouldn’t be the primary wave, however actually the one and solely wave? In any case, in lots of instances the enterprise case for AI stays to be made.

With a market capitalisation of $2.6tn, there’s a variety of optimism concerning the AI chip outlook mirrored in Nvidia’s inventory price, even after its latest fall.

Glass half-full, or half-empty?

It might change into a price lure, however I might be shocked. Whereas the longer term scale of AI chip demand stays unsure, my guess is that will probably be substantial.

Let’s not neglect too that Nvidia already had a roaring enterprise even earlier than companies beginning shelling out to construct AI functionality at scale.

Nonetheless, the dangers right here look substantial to me and whereas the P/E ratio is decrease than earlier than, I’m not comfy that it provides me adequate margin of security.

For now, I’ll maintain Nvidia inventory on my watchlist. However I cannot be shopping for but.