As of Might 16, 2025, the DOGEUSD 4-hour chart exhibits that Dogecoin has created a bullish pennant sample.

A bullish pennant is a continuation sample that types after a powerful price rise, adopted by a brief interval of consolidation between converging trendlines, earlier than a doable breakout upward.

If this sample is confirmed, Dogecoin may rise about 46%, which might convey the price goal close to $0.33 from the breakout level round $0.227.

The price surged from roughly $0.16 to $0.27 between Might 7 and Might 10, forming the flagpole of the pennant. Since then, DOGE has been consolidating in a triangle sample with declining quantity, a typical signal of a bullish pennant setup.

The 50-period EMA (Exponential Transferring Common) on the 4-hour chart sits close to $0.22042, at present performing as dynamic assist. Dogecoin continues to carry above this shifting common, which helps a bullish bias.

The RSI (Relative Power Index) is flat close to 50.15, indicating impartial momentum. Nevertheless, a breakout above the higher pennant trendline may shift momentum in favor of consumers.

The breakout degree seems close to $0.238, simply above the triangle resistance. If DOGE closes above this price with growing quantity, the sample can be confirmed. Based mostly on the flagpole peak, the goal is ready round $0.33, marking a projected 46% enhance.

Briefly, if quantity will increase and price breaks above the pennant resistance, Dogecoin may enter a powerful upward transfer towards $0.33. If it fails to interrupt out, the price might retest the 50 EMA or drop to the bottom of the triangle close to $0.22.

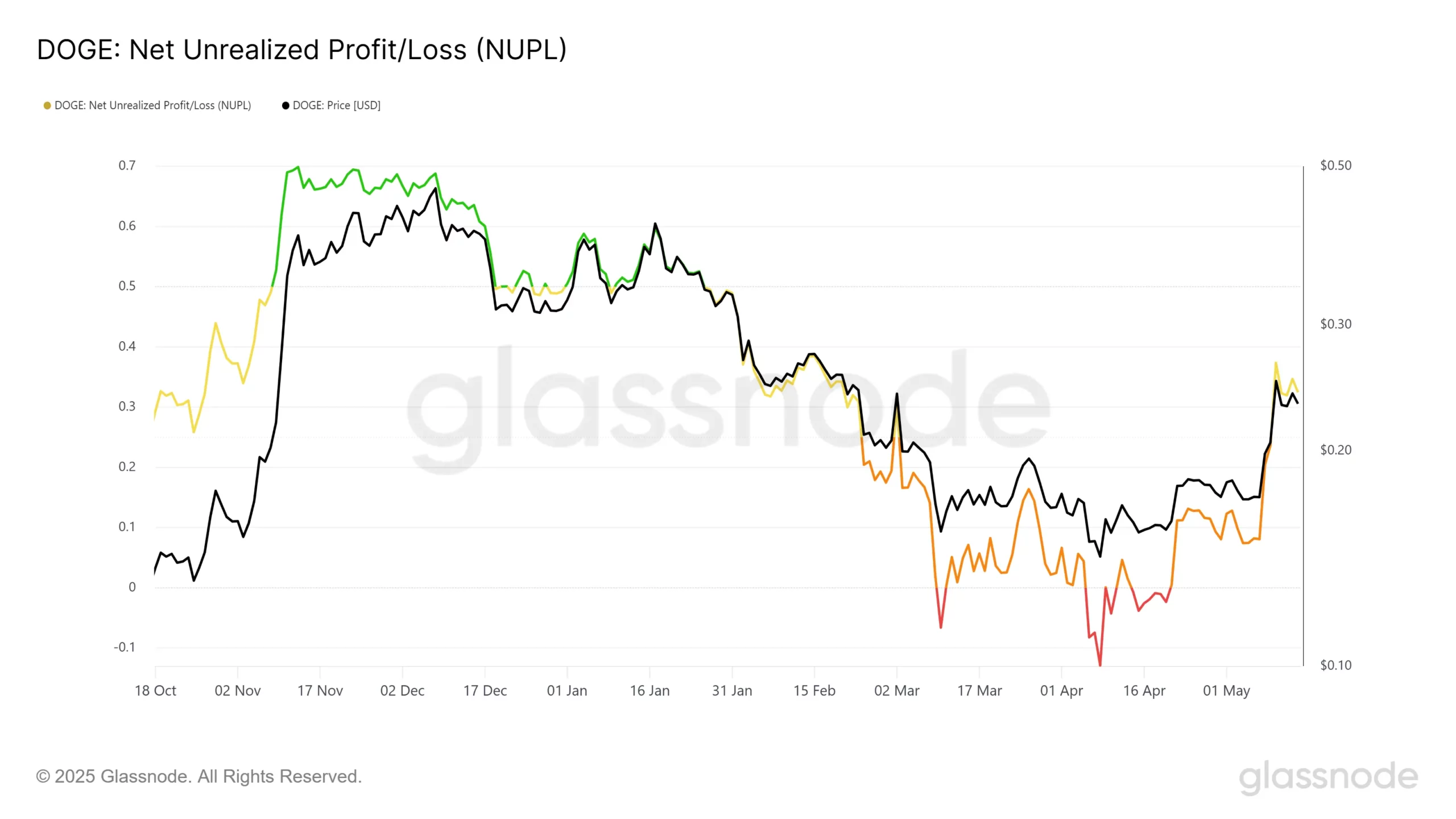

Dogecoin’s Internet Unrealized Revenue/Loss (NUPL) has surged to its highest degree in three months, in line with Glassnode knowledge. This metric exhibits the distinction between unrealized features and losses throughout all DOGE holders. Proper now, it signifies that almost all buyers are sitting on earnings, not losses.

This sharp rise locations Dogecoin firmly within the “optimism” zone, a section that always displays rising perception in future price development. When the market enters this zone, it means that members count on costs to maintain climbing. Confidence is rising, and fewer holders really feel stress to promote at present ranges.

As extra buyers maintain DOGE at a revenue, the motivation to promote weakens. This reduces promoting stress, helps price stability, and creates the circumstances for sustained upward momentum. The upper the revenue margin throughout the community, the extra assured holders are likely to turn into.

Mixed with current price features, the sturdy NUPL studying paints a bullish image. If this pattern continues, Dogecoin may see stronger assist on any dips and extra participation throughout rallies.

On the similar time, Dogecoin’s variety of lively addresses has surged to its highest degree in six months, in line with knowledge from Santiment. This rise in 24-hour exercise displays rising participation from customers who’re both transacting with or holding DOGE.

This enhance in community engagement suggests renewed curiosity and belief within the asset. As extra wallets work together with the community, Dogecoin features traction amongst each new and current holders.

Rising exercise additionally helps higher liquidity and deeper market depth. With extra customers concerned, DOGE can deal with bigger trades and reply extra easily to price modifications. This development in lively utilization provides to the general bullish momentum seen in current weeks.

Dogecoin ETF Evaluate Course of Begins After SEC Submitting

On April 9, 2025, the U.S. Securities and Change Fee (SEC) formally accepted 21Shares’ software to launch a Dogecoin exchange-traded fund (ETF). This motion marks the beginning of a proper assessment interval that might prolong up to 240 days.

Following the announcement, Dogecoin’s price surged greater than 6%, as investor sentiment turned bullish. The Dogecoin neighborhood welcomed the information, expressing optimism about elevated institutional entry to the cryptocurrency.

Though the ETF remains to be beneath assessment, the regulatory course of alerts rising acceptance of meme cash in mainstream monetary merchandise. Supporters hope the continued assessment will transfer quicker beneath the present pro-crypto U.S. administration.

Whales Accumulate 1 Billion DOGE as Community Exercise Surges

Analysts on X stay optimistic as Dogecoin’s on-chain momentum strengthens. In accordance with Santiment knowledge, three key metrics—day by day lively addresses, transaction quantity, and whale transactions—have all spiked alongside current price actions.

The chart exhibits a transparent enhance in day by day lively addresses (orange bars), indicating larger person participation. On the similar time, transaction quantity in USD (crimson line) surged, reflecting rising capital circulate throughout the community. Most notably, whale transaction depend (blue line), which tracks transfers above $100,000, jumped sharply in early Might, coinciding with DOGE’s price rally.

These synchronized rises in person exercise, transaction measurement, and quantity assist bullish sentiment. They present that each retail and enormous holders are participating extra actively with the community. This uptick in utilization means that confidence is constructing, and the market is making ready for an additional doable transfer.

Up to now 30 days, Dogecoin has seen sturdy accumulation by massive buyers, with over 1 billion DOGE added to wallets holding between 100 million and 1 billion tokens. This accumulation, valued at greater than $223 million, marks a pointy enhance in whale demand.

The Santiment chart exhibits a transparent rise in holdings from this massive cohort beginning in early Might 2025, aligning intently with the upward breakout in DOGE’s price. As accumulation intensified, the market capitalization of Dogecoin jumped by $11 billion, reaching roughly $33.37 billion.

This habits alerts rising confidence amongst whales, who typically act forward of broader market strikes. Their accumulation tends to cut back circulating provide, assist price power, and sign long-term conviction. Mixed with bullish on-chain metrics, the sustained shopping for from these massive holders provides weight to expectations of additional upside within the close to time period.